Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Demand was hardly current behind Cardano regardless of the heavy losses in latest months

- One other drop in costs may arrive within the weeks to return

The value motion of Cardano has been closely bearish in latest months. A number of necessary ranges have been misplaced to the bears since April. The variety of Cardano wallets soared over the previous month.

Moreover, 66,000 transactions had been accomplished on the Cardano community in response to Adaverse simply a few days in the past.

Learn Cardano’s [ADA] Worth Prediction 2023-2024

They did nothing so as to add conviction to decrease timeframe bulls. The value noticed little or no volatility up to now three days. Larger timeframe merchants can watch for a transfer greater earlier than assessing the chances of one other bearish transfer.

The $0.315, $0.34 ranges stand agency and bulls shouldn’t have a lot energy within the markets

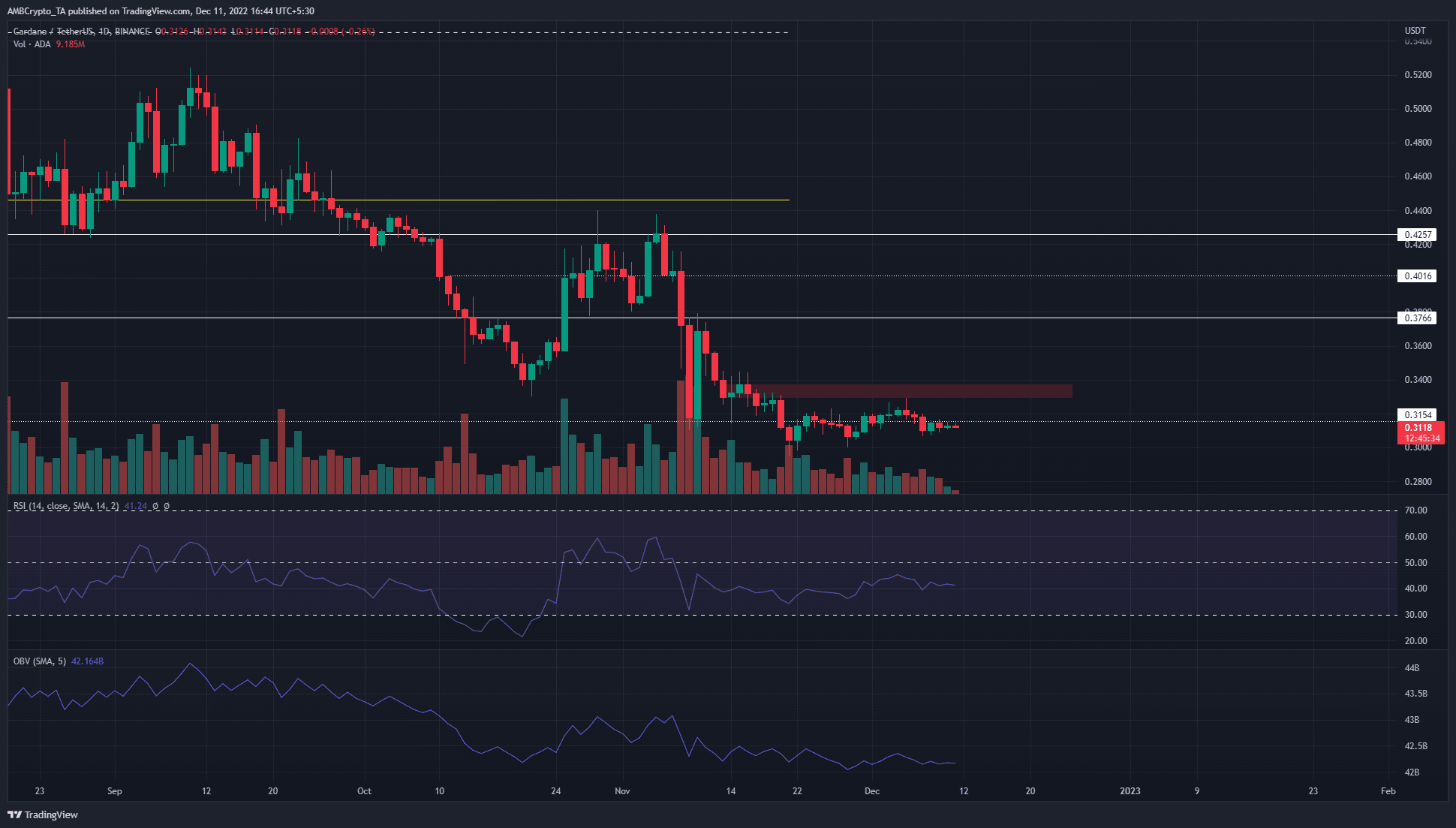

Supply: ADA/USDT on TradingView

On the day by day timeframe, the downtrend was evident. This meant that long-term buyers can watch for a change within the pattern earlier than shopping for. Any shopping for alternatives will seemingly be confined to decrease timeframes as short-term performs.

The Relative Power Index (RSI) was constantly beneath the impartial 50 mark since September. Early November noticed bulls hope for a transfer above 60 on the RSI however these hopes had been swiftly put to the sword. The On-Stability Quantity (OBV), alongside the value, was additionally in a downtrend.

On 15 November, the value of ADA tried to bounce nevertheless it solely turned out to be the formation of a bearish order block on the day by day timeframe. A retest of this zone on 5 December noticed ADA shortly reverse and plunge from $0.329 to $0.306 a few days later.

The $0.315 stage has been necessary for years now and served as resistance again in January 2021 and Might 2018. This was the extent that Cardano bulls wrestled with on the time of writing. A plunge beneath $0.3 may see ADA sink towards $0.245. In the meantime, a retest of the aforementioned bearish order block at $0.33-$0.338 can provide a shorting alternative.

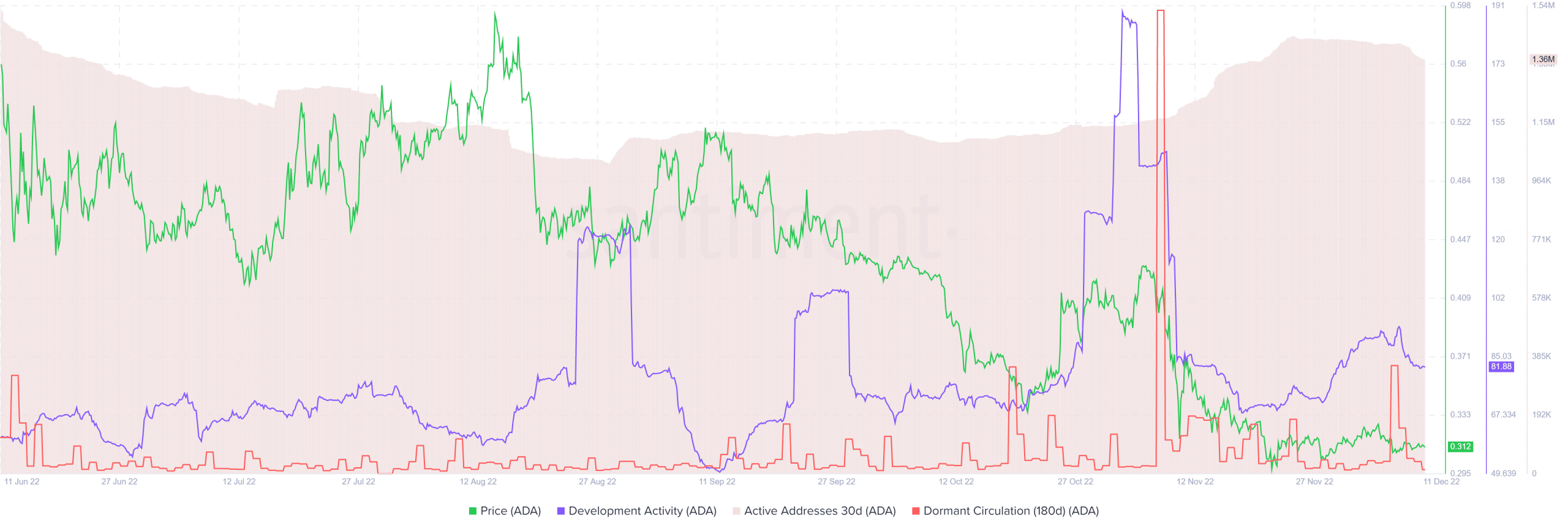

Lively addresses plateau whereas dormant circulation noticed a spike throughout the November sell-off

Supply: Santiment

Regardless of the sharp drop in costs early in November, the event exercise took a dramatic upswing. This was an encouraging signal for longer-term buyers, because it signaled that worth traits didn’t matter on the event facet.

The dormant circulation (180-day) noticed an enormous spike in early November, which confirmed a considerable amount of beforehand dormant ADA altering arms. This strengthened the concept there was sturdy promoting strain throughout that week of concern and panic.

Within the coming week or two, the $0.33-$0.34 space will likely be an necessary resistance zone. A retest of this space as assist on the again of fine demand can sign a rally towards $0.36-$0.375