- Bitmain’s mining rigs promote out in below 27 seconds, nonetheless, volatility persists when it comes to mining income.

- Retail buyers present religion in Bitcoin, as merchants take lengthy positions.

Main Bitcoin mining rig firm, Bitmain, managed to sell out their new mining servers in 27 seconds. Regardless of the FUD surrounding Bitcoin mining and the immense promoting stress being confronted by miners, it appeared that there have been some individuals who nonetheless had hope for the way forward for mining.

Learn Bitcoin’s Worth Prediction 2023-2024

Mine your enterprise

The mining rig value its prospects $2092. In line with the Bitmain web site, solely 5 items had been out there per buyer.

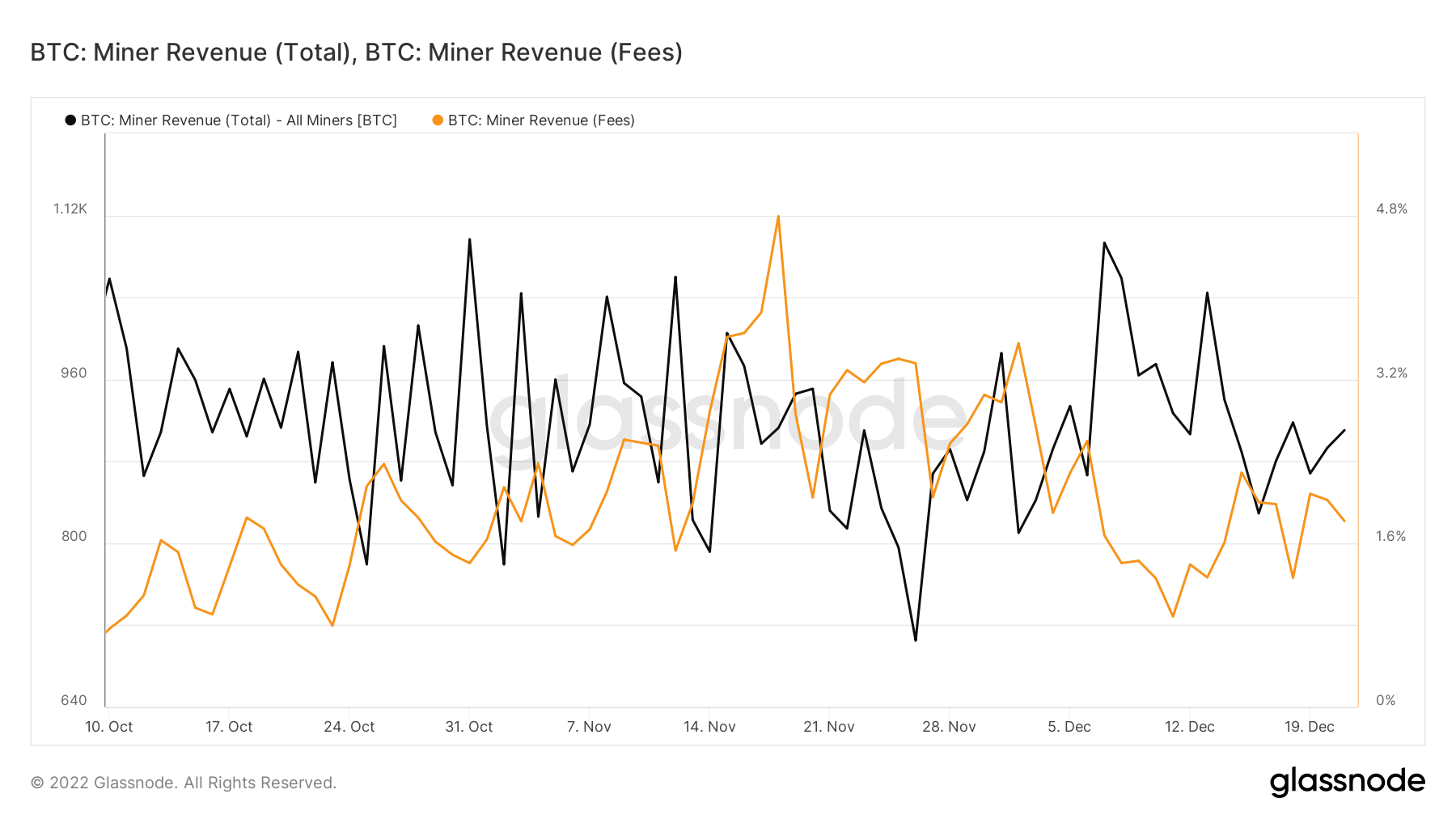

Although mining rigs have been flying off the cabinets, uncertainty across the income generated by mining nonetheless persists. From observing information supplied by glassnode, it may be seen that the charges being generated by Bitcoin miners declined materially over the previous few weeks.

Even when it comes to the income generated by the Bitcoin miners, it appeared that the quantity of income collected by miners on a given day fluctuated massively over the previous few months.

These elements coupled with the growing vitality prices and declining BTC costs may improve the promoting stress on miners even additional.

Supply: glassnode

One of many methods during which miners may generate regular income and income could be if BTC’s worth elevated.

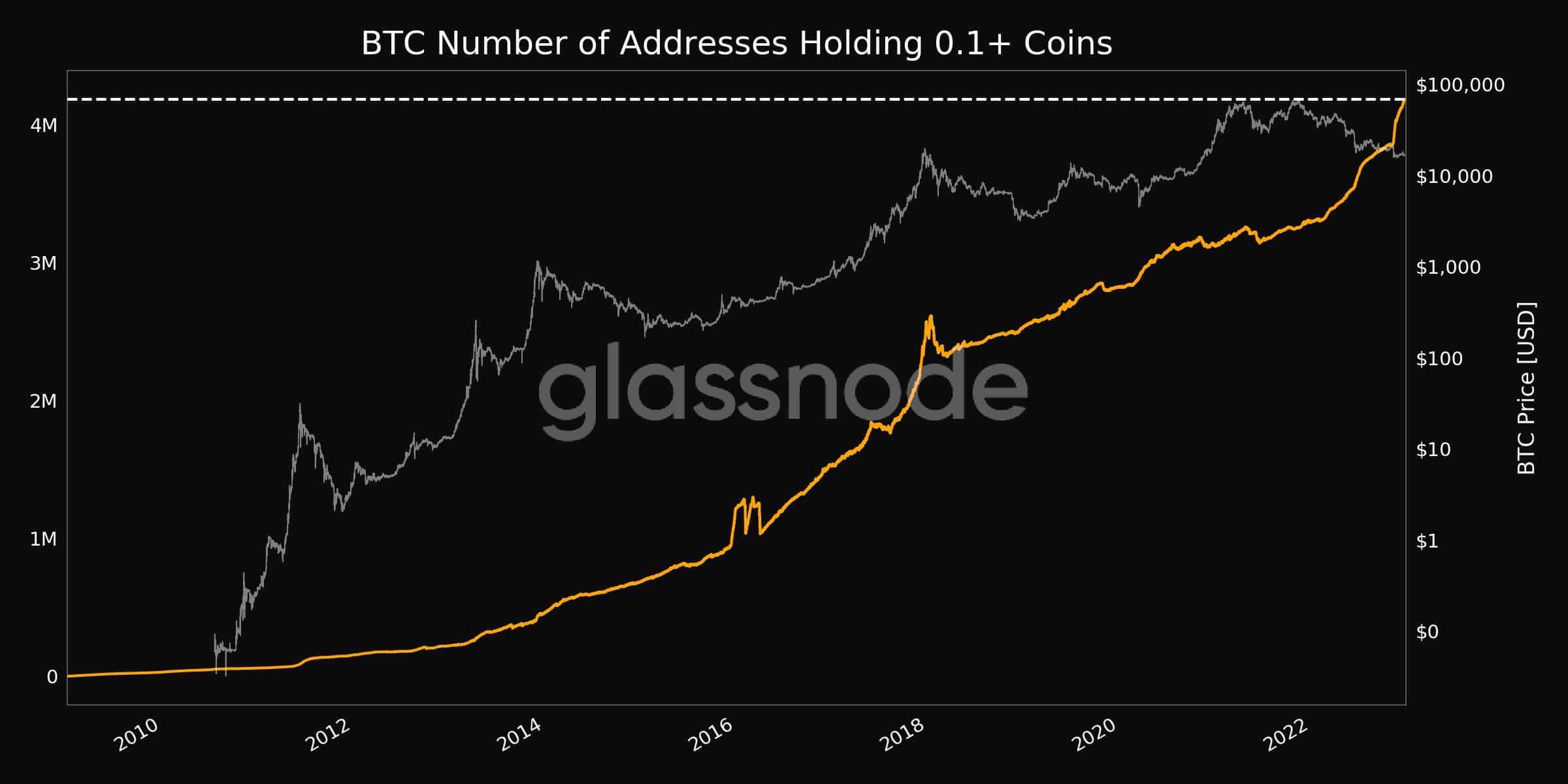

Although a spike in BTC’s costs on this bearish market seems to be a far-fetched dream, the resurgence of curiosity from retail buyers within the king coin may assist make that dream a actuality.

In line with information supplied by glassnode, the variety of addresses holding greater than 0.1 cash grew considerably over the previous few months. On the time of writing, the variety of addresses holding a couple of coin had reached an all-time excessive of 4.1 million addresses.

Supply: glassnode

Lengthy or Quick?

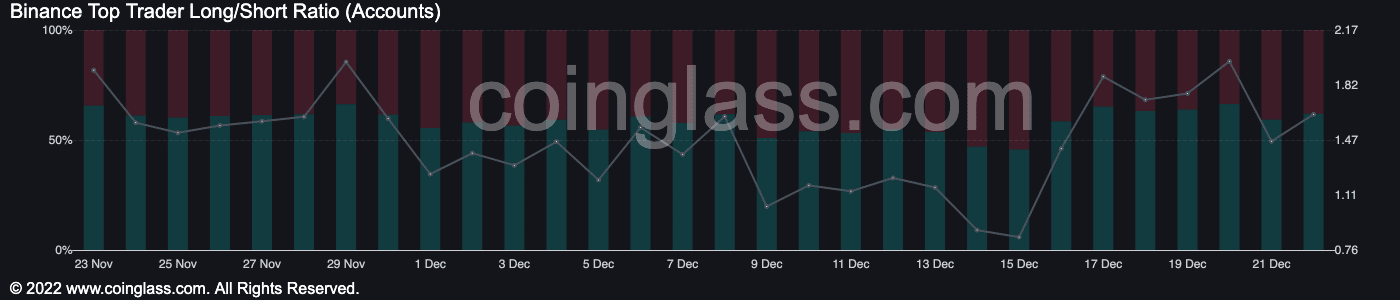

However it wasn’t simply retail buyers who had been optimistic about the way forward for Bitcoin, large merchants on Binance additionally confirmed curiosity within the king coin.

From coinglass’ information, it was noticed that after 15 December, the variety of merchants who had lengthy positions on BTC elevated considerably. At press time, 61.97% of dealer accounts had been holding lengthy positions for BTC, whereas the opposite 38.03% of the merchants had been shorting Bitcoin.

Supply:coinglass

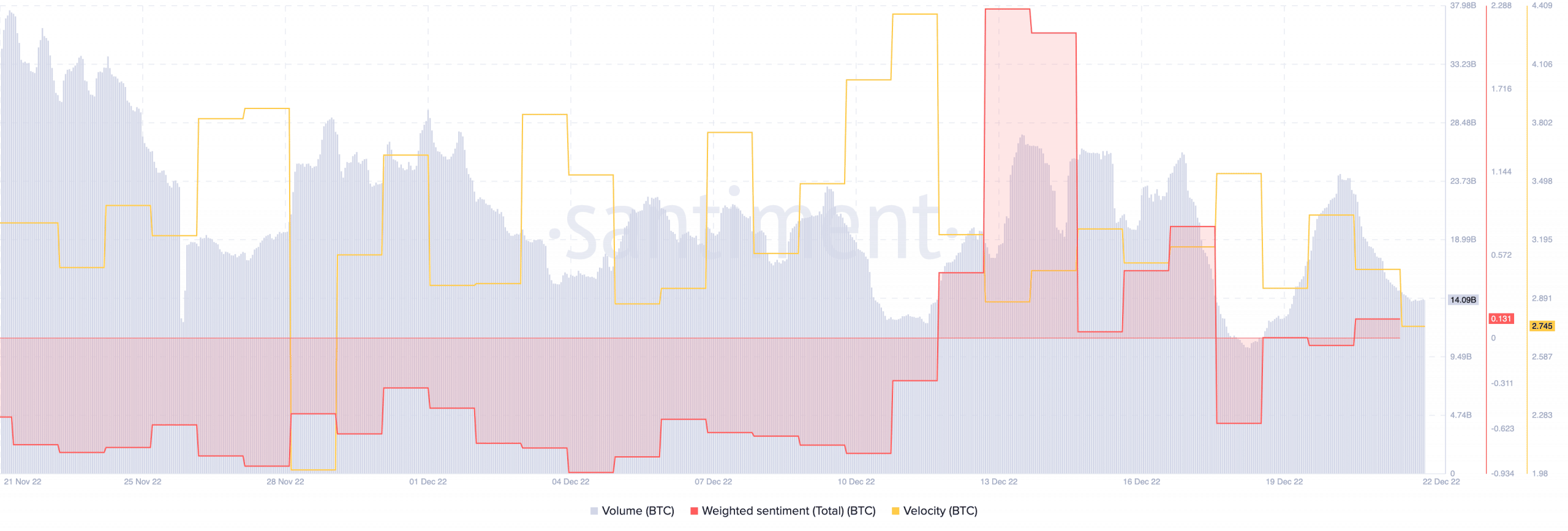

One of many causes for betting in opposition to Bitcoin might be its declining exercise.

One indicator of reducing exercise could be Bitcoin’s velocity, which lowered dramatically over the previous couple of days. This indicated that the frequency with which BTC was being exchanged amongst addresses had decreased.

Including to that, Bitcoin’s quantity declined too. Over the previous month, the quantity fell from 37.18 billion to 14.1 billion.

Supply: Santiment

Regardless of the continued crypto winter, the sentiment in direction of Bitcoin remained constructive. On the time of writing, the weighted sentiment for BTC was 0.131.

![Will Bitcoin [BTC] mining see a resurgence? This new data suggests…](https://cryptonitenews.io/wp-content/uploads/2022/12/andre-francois-mckenzie-JrjhtBJ-pGU-unsplash-5-1000x600-768x461.jpg)