Ever been curious about the inner workings of Ethereum, the renowned cryptocurrency? Central to Ethereum’s operations is the Ethereum Virtual Machine (EVM), the engine driving its unique capabilities.

In recent times, Ethereum has captured global interest due to its support for smart contracts and decentralized applications (dApps). But how does the EVM fit into this groundbreaking platform?

To truly grasp Ethereum’s potential and its applications, one must understand the EVM. This article will guide you through the intricacies of the Ethereum Virtual Machine, shedding light on its objectives, functionalities, and its pivotal role in smart contract execution. Whether you’re a crypto aficionado or just keen to understand the tech behind Ethereum, this piece will offer a thorough insight into the EVM.

Hello! I’m Zifa. I’ve been delving into the world of cryptocurrency and sharing my insights through writing for the past three years. Join me as we embark on this enlightening journey into the heart of Ethereum.

What Is an EVM in Crypto?

Imagine a magical box, the Ethereum Virtual Machine (EVM), where you can insert a recipe known as a smart contract. When you close this box and initiate the process, akin to executing a transaction, the box meticulously follows the recipe’s steps, delivering a consistent result. This consistency ensures that no matter where or who uses the box, the outcome remains unchanged. In the Ethereum realm, this consistency instills trust, ensuring digital agreements are executed as intended without interference.

What Is an EVM (Ethereum Virtual Machine)?

The EVM is akin to the operating systems we use on our computers, but it’s designed for the decentralized world of Ethereum. It’s a special state machine that provides a runtime environment for executing smart contracts and decentralized applications (dApps). Acting as the heart of Ethereum’s computational engine, the EVM allows for the execution of code, specifically machine-level instructions, ensuring smart contract functionality. Unlike a physical machine, this Turing-complete virtual machine can execute any mathematical function or algorithm. Its decentralized nature means there’s no central authority overseeing transactions or validating data.

Every transaction within the EVM consumes “gas,” representing the computational effort needed. This gas, priced in Ethereum’s native cryptocurrency, Ether (ETH), determines the transaction fees. As the EVM processes these transactions, it moves from one block to another within the Ethereum network, using a structure called the Merkle Patricia Trie to manage its state. This ensures that applications, whether they’re decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), or decentralized exchanges, run smoothly. The vibrant open-source community around the EVM has birthed a plethora of tools and frameworks, further enhancing the ecosystem and facilitating the development of EVM-compatible blockchains and dApps.

History of Ethereum Virtual Machine

The Ethereum Virtual Machine (EVM) has a rich history, its origins intertwined with BitTorrent, one of the earliest examples of decentralized applications (dApps).

The EVM was initially conceived to power the decentralized network of Ethereum, a blockchain platform that enables the execution of smart contracts and the development of dApps. Inspired by BitTorrent’s peer-to-peer file-sharing protocol, Ethereum founder Vitalik Buterin recognized the need for a runtime environment that could facilitate the execution of smart contract code.

The EVM serves as the computation engine of the Ethereum blockchain, enabling the execution of smart contracts and decentralized applications. It operates on a stack-based architecture and employs a transition function to process valid transactions within the decentralized network.

Similar to BitTorrent, the EVM operates without any physical limits and is not controlled by any central authority. It offers a decentralized platform that allows developers to write and deploy smart contract code, define gas costs, and execute transactions across an EVM-compatible blockchain network.

How Do EVMs Work?

The Ethereum Virtual Machine (EVM) is the runtime environment for executing smart contracts on the Ethereum blockchain. Since it offers developers a platform to deploy and interact with smart contracts, it’s pivotal in processing decentralized applications (dApps).

What Are EVM Opcodes?

Opcodes determine the operations the EVM can perform. Each opcode is a byte of data signifying a specific instruction, and collectively, they form the bytecode — the EVM’s low-level programming language.

The EVM operates on a stack-based architecture. Operands are pushed onto the stack, and operations are executed using these operands. Opcodes fall into categories like stack manipulation, arithmetic, logical operations, control flow, memory access, and storage.

The allocation of opcodes considers the operation’s necessity, complexity, and potential use in dApps. The EVM’s opcodes ensure Turing completeness, allowing it to perform any computational task with sufficient time and memory.

A notable opcode is “PUSH,” which pushes variable-sized data onto the stack, enhancing data management within smart contracts. Through opcodes, the EVM executes smart contract bytecode, making Ethereum adaptable for diverse applications.

Smart Contracts

Smart contracts automate transactions without intermediaries: they have set rules and conditions that are automatically enforced. Therefore, they are integral to the EVM.

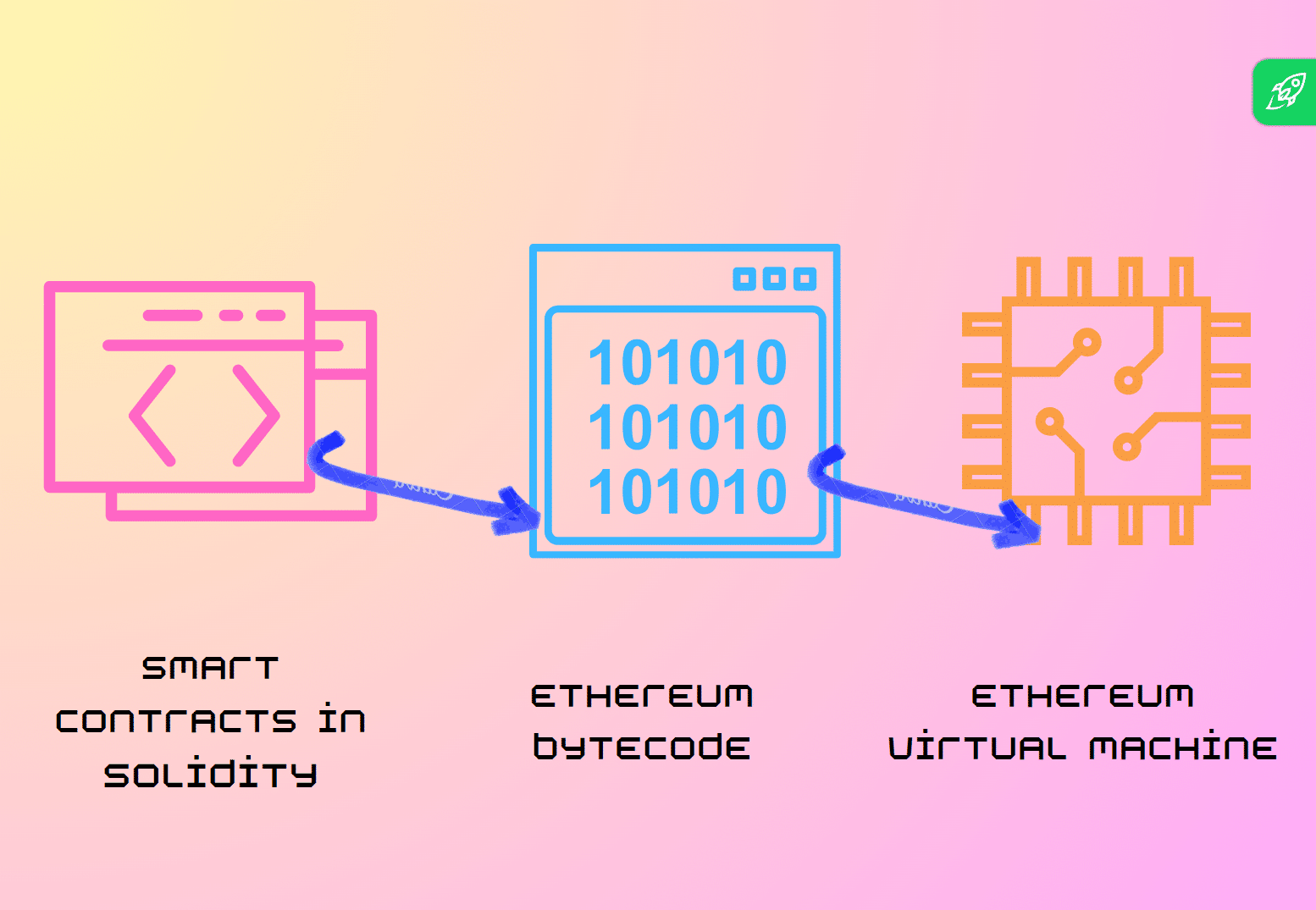

Developers use languages like Solidity and Vyper for smart contracts. Solidity, the predominant language, facilitates expressing contract logic. These contracts are then translated into opcodes for the EVM to execute.

Solidity contracts resemble languages like JavaScript, allowing variable, structure, and function definitions. Vyper prioritizes simplicity and security. After drafting, the contract is converted to bytecode, which the EVM interprets and runs.

In essence, smart contracts, written in languages such as Solidity and Vyper, are transformed into opcodes for the EVM, enabling decentralized transactions and rule enforcement without intermediaries.

Gas

Gas is vital in the EVM, for it determines computational costs and transaction fees. It’s a unit that quantifies the cost of operations, like running smart contracts.

Operations have varied gas costs based on their complexity. For instance, cryptographic tasks consume more gas than basic arithmetic due to their computational demands.

When initiating a transaction, senders define a gas limit and gas price. The gas limit caps the gas for a transaction, preventing excessive resource use. Conversely, the gas price is the Ether (ETH) amount the sender pays per gas unit. Transactions with higher gas prices are prioritized by miners, encouraging users to pay more for quicker processing.

The block gas limit sets a cap on gas usage per block, determining the transaction capacity of a block. If exceeded, transactions might be postponed or declined until a new block is formed.

To conclude, gas measures computational effort in the EVM and determines transaction fees. Specified gas limits and prices influence transaction priority and cost in the Ethereum network.

What Is the Purpose of the Ethereum Virtual Machine (EVM)?

The Ethereum Virtual Machine (EVM) is the runtime environment for smart contract deployment and execution on the Ethereum blockchain.

Think of the EVM as a unique state machine adept at processing smart contracts. It interprets code written in Ethereum’s primary language, Solidity, paving the way for decentralized applications (dApps) and programmable, self-executing contracts.

The EVM’s execution of smart contracts enables secure and trustless asset transfers, including ERC-20 tokens and non-fungible tokens (NFTs). It guarantees deterministic contract execution, free from centralized interference.

The EVM serves as a decentralized computing environment that allows for the execution of smart contracts.

Operating on a stack-based architecture, the EVM uses a transition function to process smart contract bytecode. It also manages gas costs, transaction fees, and gas limits, ensuring efficient and secure contract execution.

Basically, the EVM is the heart of the Ethereum ecosystem, offering a robust, Turing-complete system of virtual machines for smart contract execution and dApp development.

EVM Use Cases

The Ethereum Virtual Machine (EVM) offers a platform for executing smart contracts and developing decentralized applications (dApps). Its capabilities extend to various sectors, including decentralized finance (DeFi), supply chain management, identity verification, and personal data storage. The EVM’s adaptability, combined with a robust developer community, positions it as a transformative tool in multiple industries.

ERC-20 Tokens

ERC-20 tokens are standardized digital assets on the Ethereum blockchain. They’re fungible, meaning each token is identical and interchangeable. These tokens have become integral to the cryptocurrency landscape, facilitating functions within dApps. Projects like Uniswap and Nexus Mutual utilize ERC-20 tokens for liquidity and governance.

AMMs and DEXs

Automated Market Makers (AMMs) and Decentralized Exchanges (DEXs) enable direct token exchanges without intermediaries, which solidifies their pivotal role in the EVM. Platforms like SushiSwap and Uniswap exemplify the decentralized AMM model, allowing users to contribute to liquidity pools and earn fees.

NFT Minting

NFT minting on Ethereum allows creators to tokenize unique assets. These non-fungible tokens (NFTs) have diverse applications, from digital art to virtual real estate. Through Ethereum smart contracts, NFTs offer verifiable ownership and authenticity, ushering in a new digital economy.

DeFi Lending

DeFi lending on the EVM decentralizes traditional financial instruments. Platforms like MakerDAO and Compound offer decentralized lending and borrowing systems. Transactions within DeFi lending are transparent and automated, making financial services more accessible.

DAOs

Decentralized Autonomous Organizations (DAOs) redefine governance on the EVM. Operating via transparent smart contracts, DAOs allow decentralized communities to make collective decisions. This model promotes trust, transparency, and inclusivity, transforming organizational governance.

What Are EVM-Compatible Blockchains?

EVM-compatible blockchains are networks designed to interoperate with the Ethereum Virtual Machine (EVM). The EVM serves as a runtime environment for executing smart contracts — self-executing contracts with terms directly coded into them. By being EVM-compatible, these blockchains can run Ethereum-based smart contracts and engage with the broader Ethereum ecosystem.

The significance of EVM-compatible blockchains lies in their promotion of interoperability within the blockchain world. Smart contracts and decentralized applications (dApps) crafted for Ethereum can be deployed on these compatible blockchains. This interoperability allows developers to utilize the established Ethereum infrastructure, promoting their applications’ broader adoption.

These compatible blockchains offer advantages like faster transaction speeds due to higher capacity and throughput, enhancing application scalability. They also typically feature lower transaction costs, encouraging more extensive ecosystem participation.

The bottom line is that EVM-compatible blockchains fortify the Ethereum ecosystem’s reach and functionality. They grant developers and users increased flexibility and options, improving the scalability and user experience of dApps.

Which Chains Are EVM-Compatible?

Ethereum’s prominence in the smart contract domain has inspired other networks to ensure compatibility. These EVM-compatible chains let developers harness the EVM’s capabilities while also benefiting from each network’s distinct features.

Prominent EVM-compatible chains include Binance Smart Chain (BSC), Avalanche, Cardano, Solana, Polygon (previously Matic Network), Fantom, Optimism, Boba Network, and HECO (Huobi Eco Chain).

To maintain compatibility, these chains have their EVM versions, supporting Ethereum’s primary programming language, Solidity. These implementations come in various languages, such as Rust for Avalanche, Go for Fantom, and C++ for HECO.

By adopting EVM compatibility, these chains amplify the potential of Ethereum’s smart contracts and dApps. They offer alternatives with quicker transaction speeds, reduced costs, and features tailored to diverse requirements. Ultimately, the presence of EVM-compatible chains bolsters the decentralized finance (DeFi) landscape, spurring innovation across multiple blockchain platforms.

EVM Limitations

The Ethereum Virtual Machine (EVM) brings to the table many advantages. However, it also has limitations. A major concern is scalability. As Ethereum’s user base grows, the EVM faces congestion and delays. This happens because every transaction and computation on the EVM gets copied across all network nodes, slowing down the process.

High gas fees are another issue with the EVM. Gas fees are the costs to run smart contracts on Ethereum. More complex smart contracts need more gas, making them costly to use.

The EVM also isn’t fully decentralized. The blockchain is decentralized, but the EVM depends on miners and nodes to validate transactions. This setup gives miners significant influence, introducing some centralization.

Working with the EVM demands technical skills. Deploying smart contracts requires knowledge of Solidity (Ethereum’s main programming language) and an understanding of the EVM structure.

Another limitation is the rigidity of smart contracts. Once deployed on the EVM, they can’t be altered. This is a challenge if there are code errors or if updates are needed.

In summary, the EVM has reshaped smart contracts and decentralized applications. But it grapples with scalability, high costs, partial centralization, and technical demands. The Ethereum community is working hard to overcome these challenges and boost the EVM.

The Future of EVMs

Ethereum Virtual Machines (EVMs) are set for exciting changes.

The Ethereum Optimism Full Compatibility (EOF) upgrade, expected in 2023, is one such development.

EOF, which stands for EVM Object Format, is a significant upgrade focusing on enhancing the Ethereum Virtual Machine (EVM) — the core component responsible for executing smart contracts on the Ethereum distributed ledger. This upgrade is the first major enhancement to the EVM since its launch in 2015.

The EOF upgrade comprises five Ethereum Improvement Proposals (EIPs). These proposals aim to streamline EVM execution, making it more efficient and upgradeable. A notable feature of the upgrade is the introduction of a new binary format for smart contracts. This change will simplify the process of creating, executing, and updating smart contracts, leading to better performance and a more resource-efficient Ethereum network.

However, it’s worth noting that the EOF upgrade’s release has been postponed and is now expected to roll out a few months after the Shanghai Upgrade.

There’s also a move towards Ethereum WebAssembly (eWASM). This new environment for running smart contracts promises better efficiency, speed, and compatibility. eWASM lets developers use various coding languages, attracting more developers to Ethereum.

The Ethereum community is keen on improving network speed and throughput. Cutting the rate of executing smart contracts is vital for the broader acceptance of Ethereum’s decentralized applications (dApps). Solutions like sharding, which lets Ethereum handle many transactions at once, are being explored to reduce network congestion.

In conclusion, the EVM’s future is bright. With upgrades like EOF and the transition to eWASM, the focus is on better scalability, compatibility, and speed. Continuous efforts from the Ethereum community will further establish Ethereum as the top blockchain platform.

FAQ

Does Bitcoin use EVM?

No, Bitcoin does not use the Ethereum Virtual Machine (EVM). The EVM, specific to the Ethereum blockchain, is designed to execute smart contracts on the Ethereum platform.

Bitcoin operates on a different system and uses a scripting language for its transactions, which is not Turing-complete like the EVM. This scripting system in Bitcoin is more limited in its capabilities compared to Ethereum’s EVM, since Bitcoin was primarily designed as a digital currency, while Ethereum was designed as a platform for decentralized applications and smart contracts.

However, if you’re looking to hold BTC on an EVM-compatible chain, you can do so through the use of what is called a wrapped token. Essentially, a wrapped token is BTC’s value represented on an EVM chain, bundled within an EVM-compliant token wrapper, usually in the form of an ERC-20 token. This allows for Bitcoin’s value to be integrated and utilized within the Ethereum ecosystem and other EVM-compatible chains.

Is MetaMask an EVM wallet?

Yes, MetaMask is compatible with the Ethereum Virtual Machine (EVM). MetaMask is primarily designed as a wallet and browser extension for the Ethereum protocol, which operates on the EVM. This compatibility allows users to interact with Ethereum-based decentralized applications (dApps) and manage Ethereum-based assets directly from their browsers.

Additionally, MetaMask can be configured to connect to other EVM-compatible blockchains, enabling users to interact with dApps and manage assets on those networks using the same MetaMask interface.

Is EVM an ERC20?

No. These are two distinct concepts within the Ethereum ecosystem. The Ethereum Virtual Machine (EVM) is a decentralized environment that enables smart contract deployment and ensures Ethereum smart contracts run consistently across the network. Meanwhile, ERC-20 is a widely adopted standard for creating tokens on Ethereum. While the EVM ensures smart contracts operate smoothly, ERC-20 provides guidelines for token creation within that system.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.