- After a fast push up the charts, CHZ whales withdrew about $3 million from Binance.

- CHZ path might commerce sideways within the quick time period as merchants rush to lengthy the token.

The primary week of the brand new yr introduced some respite as altcoins together with Chiliz [CHZ] registered worth will increase. Between 4 January and the early hours of 5 January, the sports activities fan token was up 10%. This surge set whale motion in movement as a number of traders took to take out a few of their holdings, Lookonchain revealed.

What number of CHZ tokens are you able to get for $1?

In line with the “smartmoney” on-chain analyst, a complete of $ 3 million price of CHZ left the Binance alternate in two separate transactions.

After Upbit introduced the addition of seven new fan tokens and solely helps Chiliz chain recharge, the worth of $CHZ rose by 10%.

Whales start to withdraw $CHZ from #Binance.

Deal with “0xb88e” withdrew 8,899,972 $CHZ($1.02M) and deal with “0x1c3a” withdrew 9,435,590 $CHZ($1.08M). pic.twitter.com/xoH9i8JRqF

— Lookonchain (@lookonchain) January 5, 2023

As robust as a bull

Opposite to what may need been anticipated, the alternate outflow didn’t end in a downtrend for CHZ. At press time, CoinMarketCap data confirmed that the CHZ value maintained the greens, placing up a 7.53% enhance.

Nevertheless, the CHZ pattern didn’t cease with its value rise. The amount additionally elevated by over 196% to $223 million. Regular circumstances would imply that it was nonetheless a great interval to lengthy CHZ. However what’s the viewpoint of technical indicators?

In line with the day by day chart, CHZ was contracting in volatility. Round 15 December, the token volatility had risen primarily based on the indications from the Bollinger Bands (BB).

A steady value lower additionally adopted this extraordinarily risky spike. The contraction, nevertheless, started because the CHZ value elevated. Notably, the worth approached the higher band. In a situation the place it follows by means of with the motion, CHZ may turn into overbought. So, a value reversal could possibly be seemingly.

Are your holdings flashing inexperienced? Examine the CHZ Revenue Calculator

The Directional Motion Index [DMI] benchmarked an additional motion within the bullish path. This was because of the constructive DMI (inexperienced) rising to twenty.54.

The damaging DMI (pink), stumbled downwards to 23.86. Though the -DMI worth was extra, the Common Directional Index (ADX) indicated higher directional power in favor of the +DMI. 41.20 was a degree excessive sufficient to assist CHZ preserve its uptick.

Supply: TradingView

No hesitation out there as a result of…

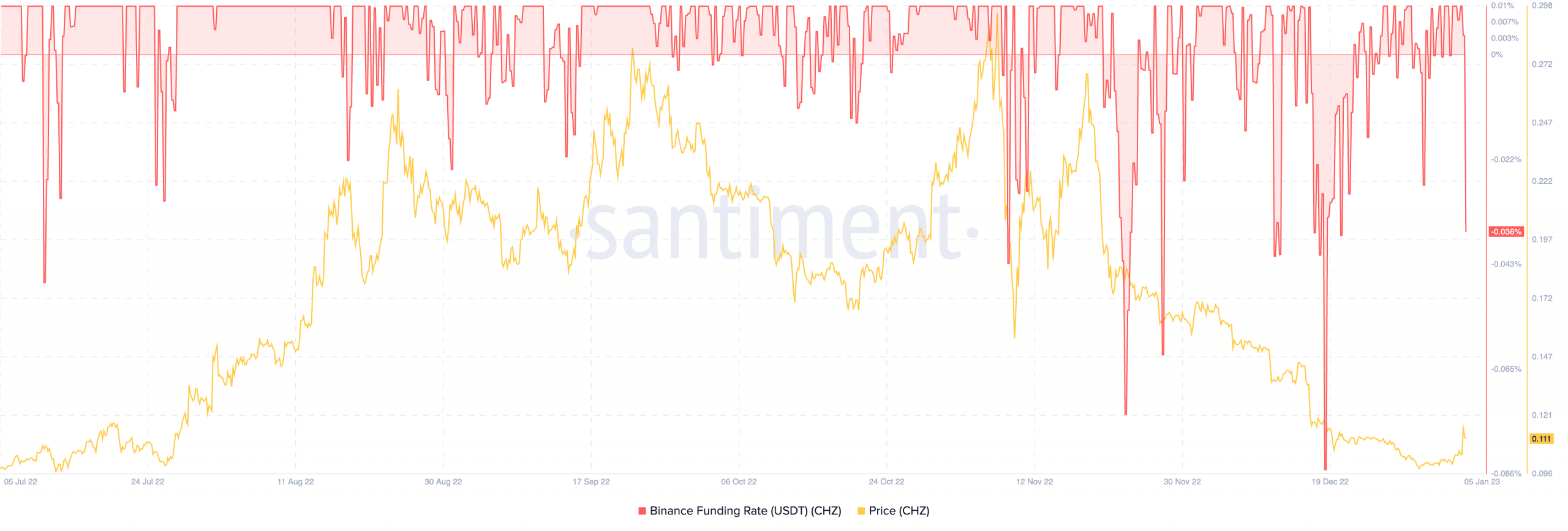

In the meantime, the uptick has not pushed merchants to the derivatives market with the mission to open CHZ futures contract positions. This was as a result of the Binance funding rate had dropped -0.0036% whereas CHZ traded at $0.11.

Supply: Santiment

The explanation could possibly be because of the inconsistent swing in path and momentum revealed by the indications.

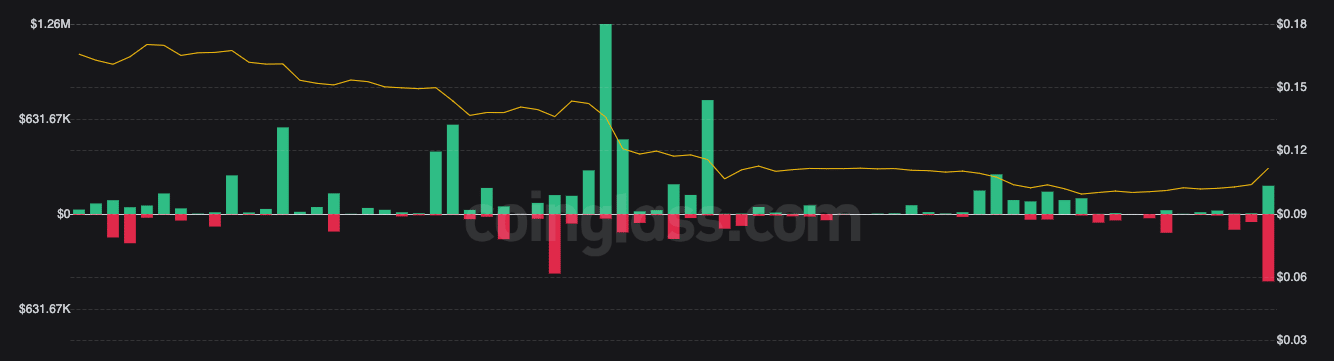

Nevertheless, info from Coinglass confirmed that the CHZ futures open interest was in double-digits enhance throughout the highest exchanges within the final 24 hours.

This implied {that a} excessive variety of contracts had been opened by contributors through the intraday buying and selling. As anticipated, shorts had been largely victims of liquidations, accounting for $447,620 out of a doable $693,210.

Supply: Coinglass