- Chainlink reached fairly a number of milestones this week

- Stochastic was oversold, which was bullish, however different metrics have been bearish

Chainlink’s [LINK] current value motion was not what the buyers anticipated, as its weekly chart was painted crimson. In keeping with CoinMarketCap, LINK registered almost 10% detrimental weekly features and was trading at $6.63 with a market capitalization of over $3.3 billion at press time.

Nonetheless, CryptoQuant’s data revealed a significant bullish sign which may change Chainlink’s value trajectory through the closing weeks of this 12 months.

Learn Chainlink’s [LINK] Value Prediction 2023-24

Chainlink additionally reached fairly a number of milestones this week, which have been optimistic for the blockchain.

Right here is the excellent news

CryptoQuant’s information identified that LINK’s stochastic was in an oversold place, which gave hope for a development reversal quickly. Moreover, Chainlink introduced that there have been 16 integrations of 4 Chainlink providers throughout three totally different chains – together with Ethereum, Fantom, and Polygon – this week, which too was a optimistic sign for the community.

One other important achievement was that, by resolving the Oracle concern, Chainlink had enabled $6 trillion or extra in whole worth by 2022.

4/ By fixing the oracle drawback Chainlink has already reached $6T+ whole worth enabled in 2022 alone.

Self-repaying loans? ☑️

Dynamic NFTs? ☑️

Provably truthful video games? ☑️They’re all made doable by the Chainlink Community.

Get the total story: https://t.co/cjraX64pQ8 pic.twitter.com/t261PHSYDp

— Chainlink (@chainlink) December 11, 2022

The extra excellent news was ready from the on-chain metrics, as a number of of them supported a value hike. For example, LINK’s alternate reserve decreased, which was a optimistic signal because it represented much less promoting strain.

The entire variety of transactions and lively addresses additionally registered an increment, additional portray an optimistic image for Chainlink.

Chainlink has some trigger for concern

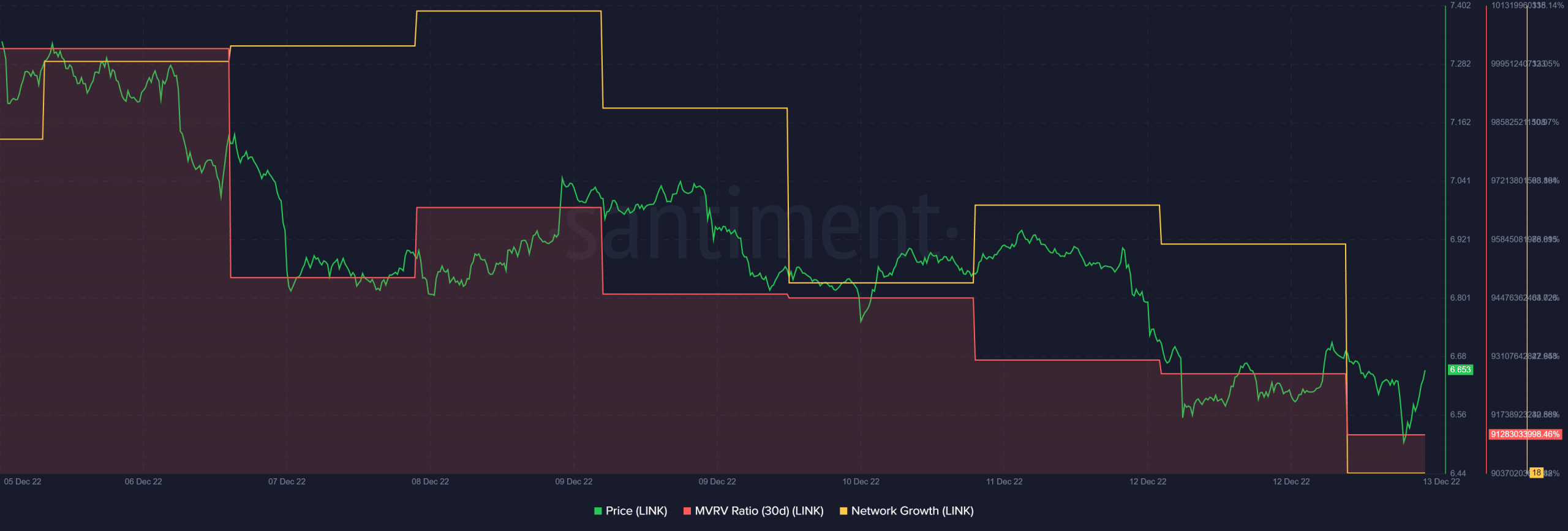

Nonetheless, Santiment’s chart seemed a bit regarding. LINK’s MVRV Ratio steadily declined over the past week, which was a bearish sign. LINK’s community development additionally adopted the identical path.

Supply: Santiment

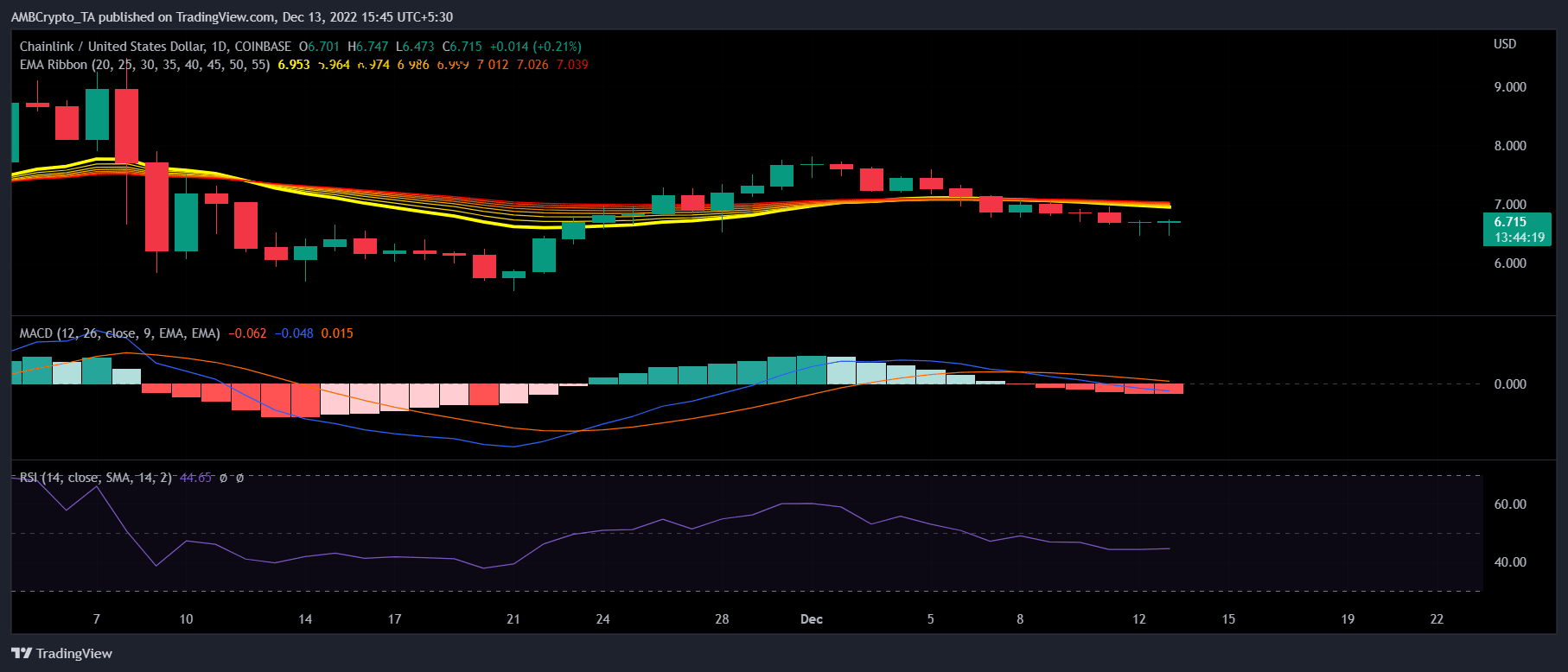

The market indicators have been additionally not supportive of a value surge, because the bears gained a bonus. This was exacerbated by the Exponential Shifting Common (EMA) Ribbon, which displayed a bearish crossover. The MACD instructed the same story, suggesting that the sellers had the higher hand out there.

Chainlink’s Relative Energy Index (RSI) was resting under the impartial mark, which could prohibit LINK’s value from rising within the quick time period.

Supply: TradingView

![What are the odds of Chainlink [LINK] crossing its near-term high this week?](https://cryptonitenews.io/wp-content/uploads/2022/12/LINK-1-1000x600-768x461.png)