Ever felt like you’ve stepped into a whole new universe when you hear about cryptocurrencies? Yeah, I’ve been there too. But once you get the hang of it, it’s not as daunting as it seems.

Hi, I’m Zifa. I’ve spent the last three years diving deep into the crypto world, writing, learning, and sometimes, getting a tad bit lost. But that’s the fun part, right? I believe in breaking things down and keeping it simple. So, if you’ve ever scratched your head over ‘altcoins,’ you’re in the right place. Let’s chat about it!

What Is Altcoin?

Altcoins, short for “alternative coins,” are digital currencies distinct from Bitcoin, the market leader. While Bitcoin remains the most recognized cryptocurrency by market cap, altcoins cater to diverse needs within the crypto realm, each offering unique purposes and capabilities.

Unlike Bitcoin, which primarily serves as a decentralized digital currency, altcoins often have specific functions and operate on various blockchain networks. They can be grouped into categories like native cryptocurrencies (e.g., Ethereum and Ripple), utility tokens (e.g., Chainlink), stablecoins (e.g., USD Coin), and forks (e.g., Bitcoin Cash). Among these, Ethereum, Chainlink, XRP, and Cardano are some of the popular cryptocurrencies.

Each altcoin category serves a distinct purpose. For instance, Ethereum facilitates decentralized applications and smart contracts, while utility tokens like Chainlink provide specific services within their respective ecosystems. Stablecoins maintain value by pegging to traditional currencies, and forks are alternate versions of existing blockchains, often created to address specific concerns or improvements.

Altcoins vs. Bitcoin

Even though Bitcoin, being the pioneering crypto coin, maintains its position as the market leader, altcoins emerged to address its perceived limitations or introduce new features. Bitcoin’s established reputation and dominance in the cryptocurrency market make it a preferred choice for many long-term investors. In contrast, altcoins, with their varied functionalities, offer a broader spectrum of opportunities in the crypto landscape.

Both Bitcoin and altcoins aim to serve as mediums of exchange, leveraging blockchain technology for secure financial transactions. However, altcoins provide a platform for experimentation with different consensus mechanisms and transaction efficiencies.

Categories of Altcoins

Altcoins can be classified based on their features and underlying technology. For instance:

- Stablecoins maintain a consistent value by pegging to fiat currencies or commodities, offering a predictable store of value.

- Utility tokens grant access to specific products or services within a blockchain network.

- Security tokens represent ownership in traditional assets, like real estate or company stocks, and adhere to regulatory standards.

- Governance tokens allow holders to influence decisions within a decentralized network.

This diversity underscores the versatility of altcoins, expanding cryptocurrency use cases beyond mere financial transactions.

Native Cryptocurrencies

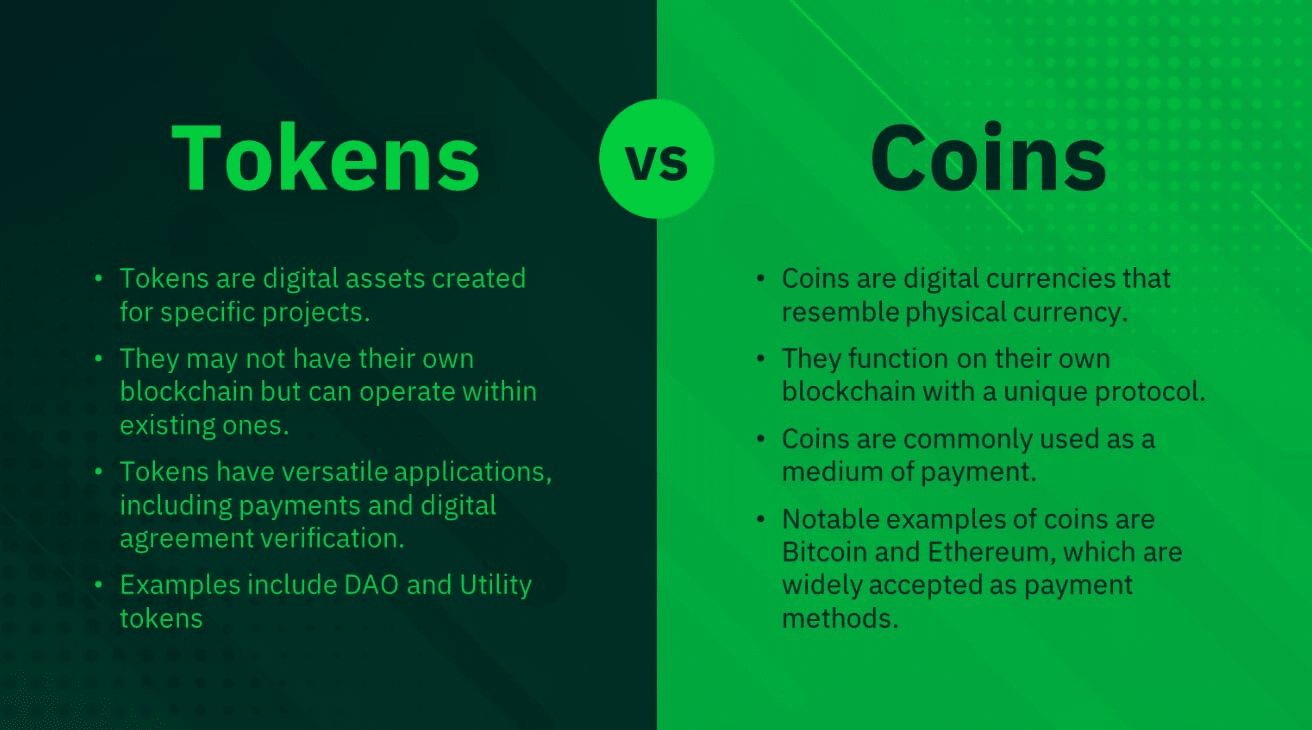

Native cryptocurrencies, or native coins, are integral to specific blockchain ecosystems. For example, Bitcoin operates on its blockchain, serving as a medium of exchange. Similarly, Ethereum’s native coin, Ether, powers decentralized applications and smart contracts on its platform. Holding native coins often reduces transaction fees and facilitates faster transactions within their networks.

Tokens

Tokens, digital assets on already existing blockchains like Ethereum, function via smart contracts. These contracts autonomously execute agreements when conditions are met. Tokens can be utility-based, like Chainlink, offering services within a blockchain network, or governance tokens, like Uniswap, allowing holders to influence platform decisions.

Stablecoins

Stablecoins aim to provide a stable cryptocurrency value by pegging to assets like the U.S. dollar. They offer a predictable digital currency for daily transactions or investments. However, while they promise stability, events like the TerraUSD collapse highlight potential challenges and uncertainties. It’s vital to understand a stablecoin’s mechanisms and backing before investing.

Forks

Forks arise when a blockchain network undergoes rule changes, leading to two separate blockchain versions. Notable forks include Bitcoin Cash, which increased block size for faster transactions, and Ethereum Classic, a result of a split in the Ethereum blockchain. Forks can introduce innovations but may also lead to community disagreements. Staying informed about fork implications is a must-do for informed decision-making.

Best Altcoins to Buy in 2023

Now that we’ve clarified what altcoins are, let’s delve into those which I personally view as the most promising. In curating this list, I’ve placed a strong emphasis on the fundamental value and the longevity of each project. These aren’t just fleeting trends; they represent solid investments with a vision for the future. Moreover, based on my observations and market analysis, I believe these altcoins are currently underpriced, making them some of the best options to consider buying right now.

- Ethereum (ETH)

- Ethereum, the second-largest blockchain platform after Bitcoin, is more than just a digital currency. It’s a launch pad for smart contracts and decentralized applications (dApps).

- Its native coin, ether (ETH), powers transactions and finds its use as collateral in the decentralized finance (DeFi) sector.

- Ethereum’s vision extends beyond just a currency, pushing the boundaries of blockchain technology.

- Curious about Ethereum’s future? Check out our price prediction here.

- Chainlink (LINK)

- Chainlink bridges the gap between smart contracts and real-world data.

- It ensures smart contracts access accurate and timely data, expanding their potential use cases.

- Wondering where Chainlink might head next? Dive into our price forecast here.

- XRP (XRP)

- XRP facilitates currency exchanges, especially for cross-border transactions.

- Despite its utility, XRP faces legal challenges that impact its market sentiment and price.

- Interested in XRP’s potential? Explore our price prediction here.

- Litecoin

- Litecoin, an early Bitcoin alternative, boasts faster transaction processing and a more decentralized mining approach.

- Thinking of Litecoin’s prospects? Read our price outlook here.

- Dogecoin

- Originally a “joke currency,” Dogecoin has found its niche as an internet tipping currency. Its community-driven nature has fueled its unexpected rise in the crypto world.

- Pondering Dogecoin’s trajectory? Delve into our price prediction here.

- Cardano (ADA)

- Cardano introduced an innovative proof-of-stake consensus mechanism, offering faster transactions and reduced energy consumption.

- It promises high security and low fees, though its pace of development has drawn some criticism.

- Keen on Cardano’s future? Discover our price forecast here.

- Binance Coin (BNB)

- BNB offers various benefits within the Binance ecosystem, including trading fee discounts.

- Its close ties to the Binance exchange have raised decentralization concerns.

- Eager to know more about BNB’s path? See our price prediction here.

- Tron (TRX)

- Tron envisions becoming a fully decentralized organization, emphasizing community decision-making.

- Its rapid growth and value increase have made it one of the fastest-growing cryptocurrencies.

- Intrigued by Tron’s potential? Check out our price outlook here.

- Polygon (MATIC)

- An Ethereum-based platform, Polygon addresses Ethereum’s scalability issues, offering faster and cheaper transactions.

- It’s a go-to for developers needing efficient dApp solutions.

- Considering Polygon’s prospects? Dive into our price forecast here.

- Polkadot (DOT)

- Polkadot allows multiple blockchains to interoperate, fostering innovation.

- Its security model and active developer community make it a standout, though some projects’ slow progress has been a point of contention.

- Curious about Polkadot’s trajectory? Explore our price prediction here.

These are the altcoins that both I and industry experts believe hold the most promise. Remember, further research is always essential when it comes to crypto. And if you’re feeling inspired to add one of these shining stars to your portfolio, don’t forget that Changelly is right here to assist! Buying crypto and exchanging altcoins has never been this straightforward and hassle-free.

What Is the Altcoin Season?

The term “altcoin season” describes a time in the cryptocurrency market when altcoins — cryptocurrencies other than Bitcoin — see significant price gains.

- Historical Context: Historically, the altcoin season spans about 3 months. In this period, many altcoins undergo notable growth.

- Market Cap Dynamics: Market capitalization is a vital concept. It helps us understand price movement potential. High market cap assets need more capital to shift their prices. On the other hand, assets with a lower market cap move more easily. For instance, an asset valued at $10 with a $1 million market cap has a better chance to rise to $50. In contrast, an asset worth $15,000 with a $1.5 billion market cap faces challenges to reach $75,000.

- The Altcoin Season Index: This is a special index that monitors how Bitcoin fares against the top 50 altcoins over 90 days. The index excludes stablecoins and tokens like wrapped BTC. This exclusion gives a clearer market picture. The chosen 90-day window reduces the effects of short-term market changes and provides a longer-term view.

- Bitcoin Dominance: This is a crucial metric for understanding the altcoin season. It calculates Bitcoin’s market cap percentage against the entire cryptocurrency market cap. When Bitcoin’s dominance is high, it means Bitcoin has a major market share. If this dominance drops, it can hint at a move towards altcoins. This shift can signal the start of the altcoin season.

To sum it up, the altcoin season is a very important time. During this period, altcoins perform exceptionally well in the market. That’s why experienced crypto traders and investors look forward to it.

Are Altcoins a Good Investment?

When maneuvering in the world of altcoin investments, there’s a lot to unpack. I think that it’s absolutely vital to really get to know the specific altcoin you’re eyeing. What problem does it aim to solve? How robust is its technology? Who’s behind it? And what’s their game plan for the future? These are all questions that can give you a clearer picture of its potential.

Now, based on my observations, market demand and adoption are like the heartbeat of any altcoin. If there’s a buzzing community around it and it’s being widely used, chances are it might just be a good investment. And don’t forget to check out its liquidity and trading volume on exchanges. It’s all about ensuring you can hop in and out with ease.

But here’s the thing: the crypto world is a roller coaster. Prices can skyrocket, but they can also plummet. And altcoins, being the new kids on the block, can be especially volatile. They’re also navigating a world of potential regulatory changes, security threats, and stiff competition.

However, I second the experts who say that altcoins can be a goldmine. If you strike gold with the right altcoin early on, you could see growth that mirrors the success stories of Bitcoin and Ethereum. Plus, they’re a great way to diversify your crypto portfolio.

But, and it’s a big but, always tread with caution. There are some shady projects out there. I can’t stress enough how important it is to do your homework. Study the altcoin’s tokenomics, see how strong the community backing is, and get a feel for its place in the market.

To wrap this section up, altcoins can be a tantalizing investment option. But, as with all investments, it’s all about doing your research, understanding the market, and weighing up the risks and rewards.

Is It Better to Invest in Bitcoin or Altcoins?

Ah, the age-old debate: Bitcoin or altcoins? Which is the better investment? I’ve seen this question pop up time and time again. The answer? Well, it’s not so black and white. It really boils down to individual factors like your financial health, what you’re intending to achieve with your investment, how much risk you’re willing to stomach, and your personal beliefs about the future of crypto.

Bitcoin, the original crypto heavyweight, has certainly made its mark. Its impressive track record and dominant position in the market make it a favorite for many. But on the flip side, altcoins offer a world of possibilities beyond just Bitcoin.

If you’re on the fence, take a moment to reflect on your financial situation. How much can you invest? What are your financial goals? And how do you handle the ups and downs of the market? I’ve observed that some folks are drawn to Bitcoin because they see it as a long-term store of value. Others are more intrigued by the potential rapid growth of altcoins.

Regardless of where you land, consulting with a financial expert is recommended. They can offer insights tailored to your unique situation and help you navigate the often complex world of crypto.

In my opinion, whether you opt for Bitcoin or altcoins really hinges on your personal circumstances and what you’re hoping to achieve. But always remember: the crypto market is volatile, so arm yourself with as much knowledge as possible and consider seeking expert advice.

What to Consider Before Buying Altcoins

If you’re thinking about dipping your toes into the altcoin waters, there are a few things you should keep in mind. First and foremost, altcoins come with their own set of risks. They’re the underdogs compared to Bitcoin, and that can mean they’re a bit more unpredictable. And, as my observations suggest, there are some less-than-legit ventures out there, so always be on your guard.

Investing in altcoins isn’t something you should rush into. Take the time to really get to know the technology behind it and the team steering the ship. And always have an ear to the ground for market demand and potential growth.

When it comes to your investment strategy, diversification is your friend. Altcoins can be a wild ride, so it’s wise to spread your investments around. This can help cushion any potential blows.

Moving Forward: The Future of Altcoins

Altcoins have truly carved out their own space in the crypto world. They offer a tantalizing array of options beyond the big players like Bitcoin and Ethereum. And as the crypto landscape evolves, I genuinely believe the future is bright for altcoins. Their real-world applications are becoming more evident by the day. Some might be the digital currencies of the future, while others could revolutionize industries from the ground up.

But, as with all things crypto, there are challenges ahead. Regulatory hurdles and the need to build trust with traditional financial institutions are just a couple of the obstacles altcoins face. But with innovations in blockchain technology coming thick and fast, I’m optimistic about the growth and adoption of altcoins.

Can Altcoins “Die”?

The short answer? Yes, altcoins can “die” or fade into obscurity. There are a few reasons why this might happen. Some altcoins, despite their best intentions, just don’t manage to gain traction. Without a clear purpose or value proposition, they can struggle to drum up demand.

Reputation is everything in the crypto world. And, unfortunately, the industry has seen its fair share of scams and shady dealings. That’s why it’s so important to be cautious and do your due diligence.

There are also challenges around market access. Some altcoins might face regulatory roadblocks or struggle to get listed on the big exchanges. And then there’s the tech side of things. Glitches, security issues, or scalability problems can all spell disaster for an altcoin.

To navigate these choppy waters, arm yourself with knowledge. Scrutinize the project’s code, get to know the team behind it, and always have their roadmap in your sights.

In conclusion, while altcoins can offer a world of exciting investment opportunities, they’re not without their risks. Yet, with careful research and a bit of savvy, you can navigate the world of altcoins with confidence.