- MakerDAO has a brand new proposal to introduce a debt ceiling breaker.

- MKR has commenced a brand new bear run.

In a brand new emergency govt proposal, main DeFi platform MakerDAO [MKR] has sought neighborhood approval to introduce a debt ceiling breaker for collateral belongings used to mint its DAI stablecoin.

Learn MakerDAO’s [MKR] Worth Prediction 2023-2024

This motion grew to become vital after USD Coin [USDC] misplaced its parity with the U.S. greenback final weekend because of the disclosure that Circle, the issuer, held deposits at Silicon Valley Financial institution (SVIB). As USDC was a big collateral backing for DAI, its de-pegging occasion resulted in a brief lack of greenback parity for DAI.

With this new proposal, the DeFi protocol goals to implement a mechanism to set the debt ceiling of any collateral kind to zero on the Maker protocol.

MakerDAO’s debt ceiling refers back to the most variety of DAI tokens that may be generated in opposition to the worth of the collateral belongings locked within the Maker protocol. The debt ceiling is ready individually for every kind of collateral the protocol accepts. The aim of the debt ceiling is to take care of the steadiness of the MakerDAO system by limiting the variety of DAI that may be issued,

By introducing a debt ceiling breaker, MakerDAO goals to deal with situations the place the underlying collateral asset is experiencing substantial volatility. This mechanism would allow MakerDAO to safeguard its liquidity and forestall losses in such conditions.

MKR demand falters, costs undergo

Due to its statistically vital constructive correlation with Bitcoin [BTC], the expansion within the king coin’s worth following Federal Regulators’ decision to make all SVIB depositors entire resulted in a brief worth rally for MKR.

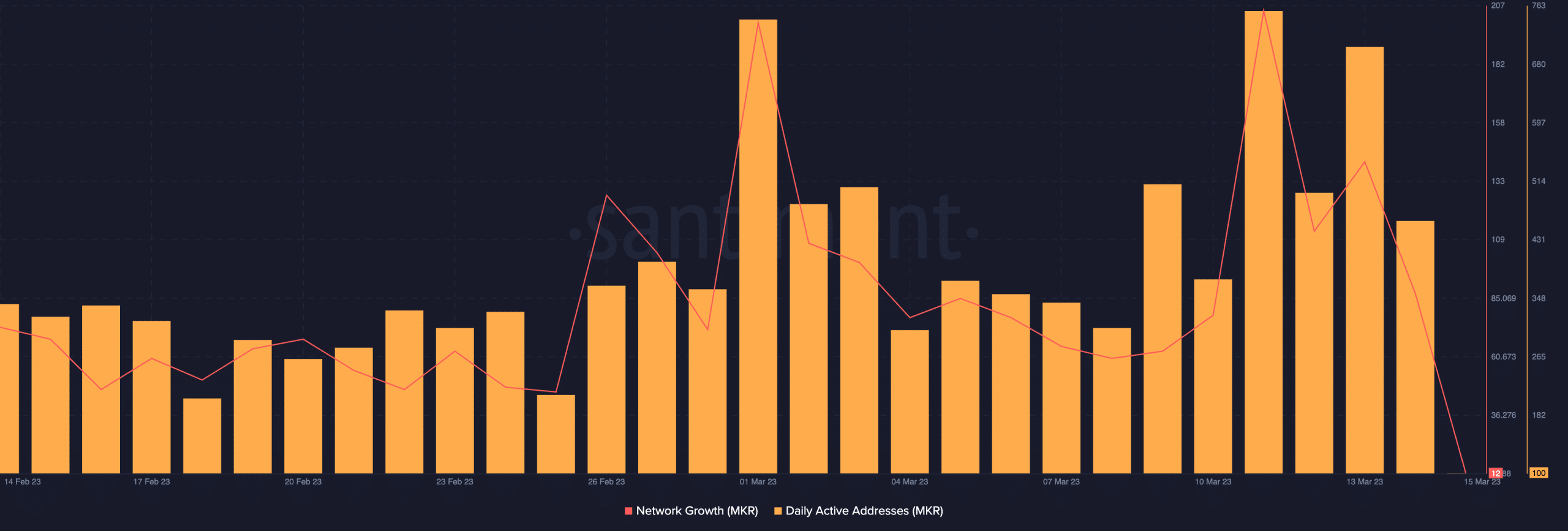

Nevertheless, the shortage of latest liquidity brought about MKR’s worth to say no, and stagnated the uptick. Based on knowledge from Santiment, the alt has skilled a lower in community exercise because the starting of the week. For instance, the rely of day by day lively addresses buying and selling MKR has since fallen by 86%. Likewise, new demand which may assist worth development has additionally dropped by 95% within the final 4 days.

Supply: Santiment

Is your portfolio inexperienced? Try the Maker Revenue Calculator

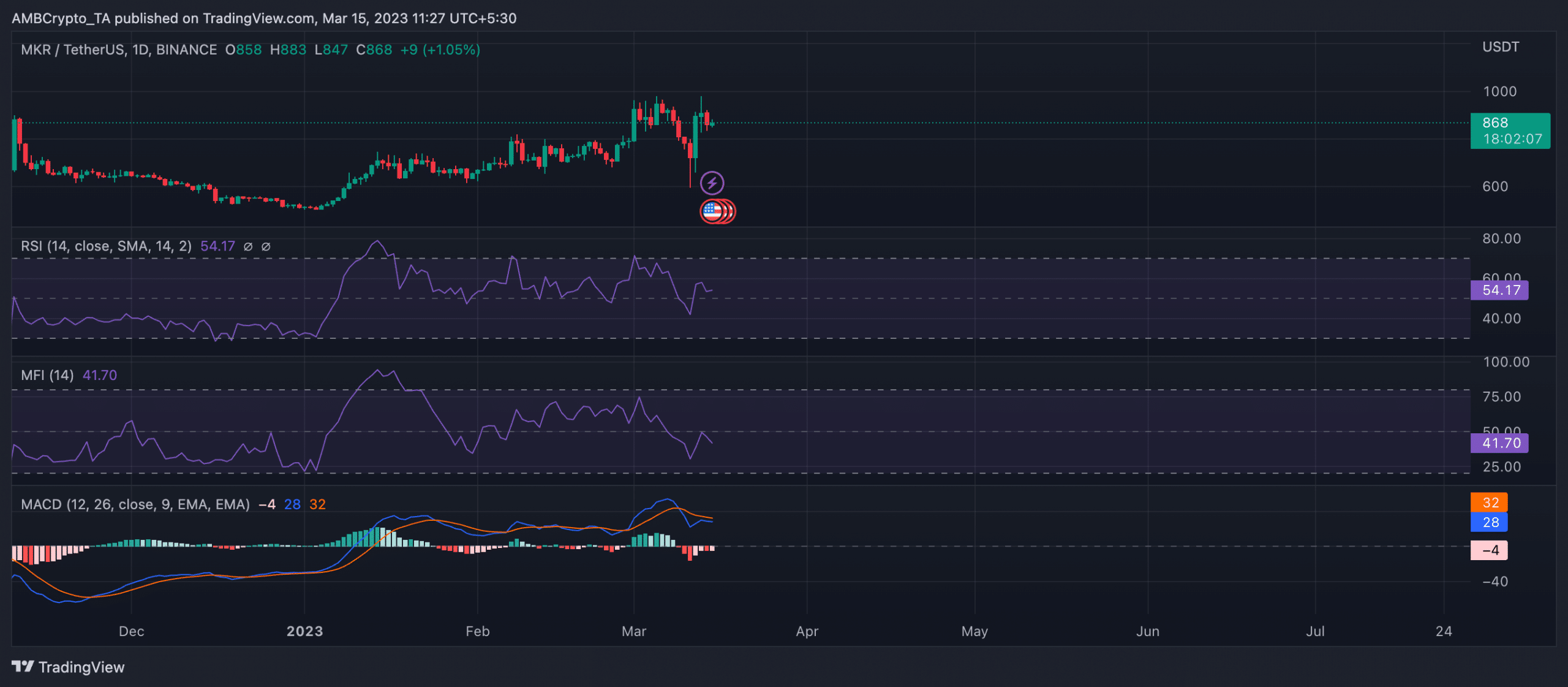

The token accumulation was evident on the day by day chart at press time. Nevertheless, it was not sufficient to provoke any vital worth development. As of this writing, MKR’s RSI rested above its centerline at 54.17, whereas its MFI, on an uptrend, was pegged at 41.

A better have a look at the asset’s MACD indicator revealed why there had been a worth decline because the week began. The MACD line intersected with the development line on 11 March, ushering in a brand new bear run, therefore the downtrend.

Supply: MKR/USDT on TradingView