- U.S. authorities involves the rescue of failed banks. Nevertheless, BUSD and USDC proceed to endure.

- The crypto neighborhood, normally, criticized the federal government’s bailout.

Over the previous few days, the collapse of Signature and the Silicon Valley Financial institution has impacted the monetary and crypto markets fairly considerably.

A much-awaited response by the U.S. authorities was issued on 12 March, which aimed toward tackling the challenges being confronted by the banks and their depositors.

The White Home breaks its silence

The federal government’s response was communicated via a joint assertion from the Treasury, Federal Reserve, and FDIC (Federal Deposit Insurance coverage Company).

It confirmed that the Silicon Valley Financial institution difficulty shall be efficiently resolved with the approval of the U.S. Treasury Secretary, Janet Yellen.

The assertion additionally assured depositors of the financial institution that they might be absolutely safeguarded and would have the ability to entry their funds after 13 March.

An equal threat exception was declared for Signature Financial institution, with a affirmation that each one depositors of the financial institution can be absolutely reimbursed.

Moreover, it was talked about that there can be no monetary burden on taxpayers for resolving these banks.

The President of america additionally took to Twitter to share his perspective, emphasizing the federal government’s intention to bolster oversight and regulation of main monetary establishments.

Moreover, he made it clear that the authorities are decided to carry those that are accountable for such occurrences accountable.

At my route, @SecYellen and my Nationwide Financial Council Director labored with banking regulators to handle issues at Silicon Valley Financial institution and Signature Financial institution.

I’m happy they reached an answer that protects staff, small companies, taxpayers, and our monetary system. https://t.co/CxcdvLVP6l

— President Biden (@POTUS) March 13, 2023

Paxos and Circle reply

Following the federal government’s announcement of resolving points at each banks, the Paxos crew confirmed that their stablecoin reserves have been utterly collateralized. And, it could possibly be redeemed by clients at a 1:1 ratio with the U.S. greenback.

The crew additional clarified that 90% of Paxos’ reserves have been held in U.S. treasury payments and in a single day repos and that there was no actual menace to their stablecoins.

The crew at Circle adopted go well with, as cofounder Jeremy Allen took to Twitter to make sure holders that their property have been completely secured.

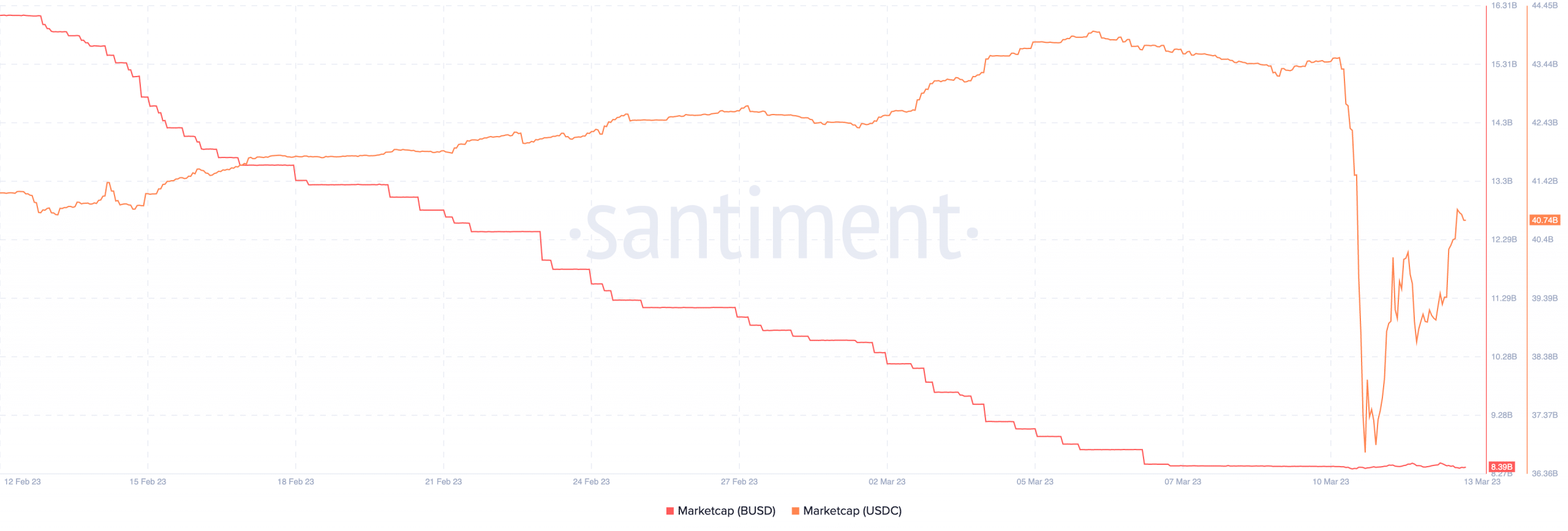

However, regardless of Paxos’ efforts to dampen the FUD surrounding its stablecoin BUSD, its market cap continued to say no.

The identical, nevertheless, couldn’t be stated about USDC’s market cap, which witnessed some enhancements in its marketcap owing to the religion proven within the stablecoin by whales and fund managers alike.

Supply: Santiment

Deja Vu

Whereas authorities bailouts could present short-term safety for traders, members of the cryptocurrency neighborhood argue that such bailouts can truly encourage dangerous habits.

Many influential figures have drawn parallels between the present scenario and the 2008 banking disaster.

CZ and different distinguished leaders expressed considerations that authorities bailouts could lead banks to prioritize their very own pursuits over the protection and well-being of their depositors.