- TRON’s stablecoin, USDD, depegged from the greenback

- TRX worth motion held out within the unfavorable as Justin Solar calmed the group

USDD, the decentralized stablecoin of TRON [TRX], misplaced its peg to the greenback on 11 December, Eliosa Marchesoni revealed. The stablecoin, a product of Justin Solar’s ambition to have a widespread affect out there, declined to get well.

In accordance with Marchesoni, a tokenomics knowledgeable and advisor, the dip affected TRON’s obtain collateral and Curve Finance [CRV] pool.

4/

👉🏻 $USDD (@justinsuntron‘s Terra/LUNA clone) simply dipped under the $0.97 depeg threshold they set, whereas the reserve collateral and Curve swimming pools are being drained. pic.twitter.com/qeM3ZbvHSo— Eloisa Marchesoni (@eloisamarcheson) December 11, 2022

Learn TRON’s [TRX] Value Prediction 2023-24

Is TRON taking the Kwon route?

Evidently, this was not the primary time {that a} stablecoin depegged from the greenback. There have been a couple of cases the place Tether [USDT] did the identical. For USDD, this was the primary depeg since June 2022. The distinction was, nonetheless, that USDT’s restoration was swift, because it did wait virtually 24 hours. With the rocks hitting the market, it was regular for buyers to fret.

In response to the depegging, TRON’s founder, Justin Solar, stated that USDD’s collateralization was 200%, and the group might entry the data by way of a hyperlink he connected to the tweet.

In case anybody ask about #USDD, it’s 200% collateralized ratio on https://t.co/bQwdLAEw0B. You may test all dwell knowledge on blockchain 24*7. 😎 pic.twitter.com/whbJrKpMoh

— H.E. Justin Solar🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 12, 2022

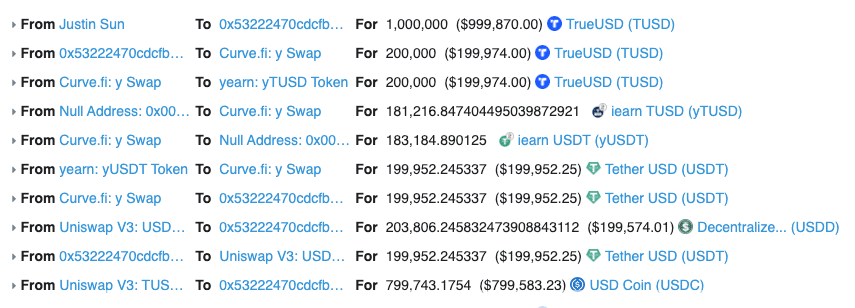

The founder went on to emulate Terra Luna [LUNA] founder Do Kwon’s tweet of “deploying extra capital’’ to show that each one was nicely with USDD. Nonetheless, he connected proof of including extra liquid belongings to the reserves. Particulars from Etherscan‘s transaction confirmed that Solar personally added about $1 million to the pool.

Supply: Etherscan

Following the enter, CoinMarketCap confirmed that USDD’s volume surged 80% within the final 24 hours. Nonetheless, regardless of the rise, the stablecoin continued to hold round $0.97.

Feedback underneath Solar’s tweet revealed that fairly quite a lot of buyers didn’t discover the humor within the “joke,” particularly because it was one thing related that influenced the market capitulation in June.

TRX: Oblivious of no matter is going on

Regardless, TRX continued to drift round $0.05. At press time, TRON had lost 3.58% of its earlier day’s worth. Per its worth motion, TRX had the potential to be negatively impacted by USDD’s shenanigans, as indicated by the Directional Motion Index (DMI).

Based mostly on the four-hour chart, the DMI revealed that sellers had the higher hand. This was as a result of the -DMI (purple), at 26.16, dominated the +DMI (inexperienced), which was far under at 8.99. Furthermore, the Common Directional Index (ADX) supported an prolonged run of vendor management.

On the time of writing, the ADX (yellow) was 27.33. A simplification of the projection was as a result of indicator being above 25. In a scenario like this, the ADX signaled sturdy directional motion. In addition to, the Cash Move Index (MFI) prompt restricted liquidity stream in current occasions.

![Tron [TRX] price action showing that price would remain negative](https://ambcrypto.com/wp-content/uploads/2022/12/TRXUSD_2022-12-12_12-05-26.png)

Supply: TradingView