- Based on new information by CryptoQuant, the upcoming Bitcoin halving might set off a reduction rally for Bitcoin.

- Miner income declined as holders bought their BTC for a loss.

Bitcoin [BTC] holders could have one thing to sit up for within the coming 12 months. Based on new information offered by CryptoQuant, the subsequent Bitcoin halving, which is predicted to happen in Could 2024, might be a reduction rally for BTC’s value.

2-1/ Market backside?

– Provide in Revenue & Loss

A excessive risk of getting an honest reduction rally within the crypto market is predicted earlier than the subsequent $BTC halving.– Delta Value

The Delta Value (Delta Cap divided by the entire coin provide) at the moment sits round 12.5k. pic.twitter.com/LP9356sQif— CryptoQuant.com (@cryptoquant_com) December 29, 2022

What number of BTCs are you able to get for $1?

Glass “halve” full

Over the previous few years, each Bitcoin halving was preceded by a reduction rally. The UTXO (unspent transaction output) for Bitcoin additionally witnessed a short lived spike throughout the identical interval. UTXO is the technical time period for the quantity of digital forex that continues to be after a cryptocurrency transaction.

If merchants are banking on historical past repeating itself, then it could be secure to say that there can be loads of curiosity in accumulating BTC simply earlier than the reduction rally.

Nevertheless, the upcoming halving might not be excellent news for Bitcoin miners. After the Bitcoin halving, the block reward generated by miners can be significantly decreased.

Regardless of the potential for declining income, the miners’ conduct didn’t replicate any signal of promoting stress. Based on information offered by Glassnode, miner outflow quantity reached a one-year low of 475.47 BTC and continued to say no over the previous few months till press time.

📉 #Bitcoin $BTC Miners’ Outflow Quantity (7d MA) simply reached a 1-year low of 47.457 BTC

Earlier 1-year low of 47.612 BTC was noticed on 10 January 2022

View metric:https://t.co/DvHJapToPY pic.twitter.com/9bIwg5xmA9

— glassnode alerts (@glassnodealerts) December 29, 2022

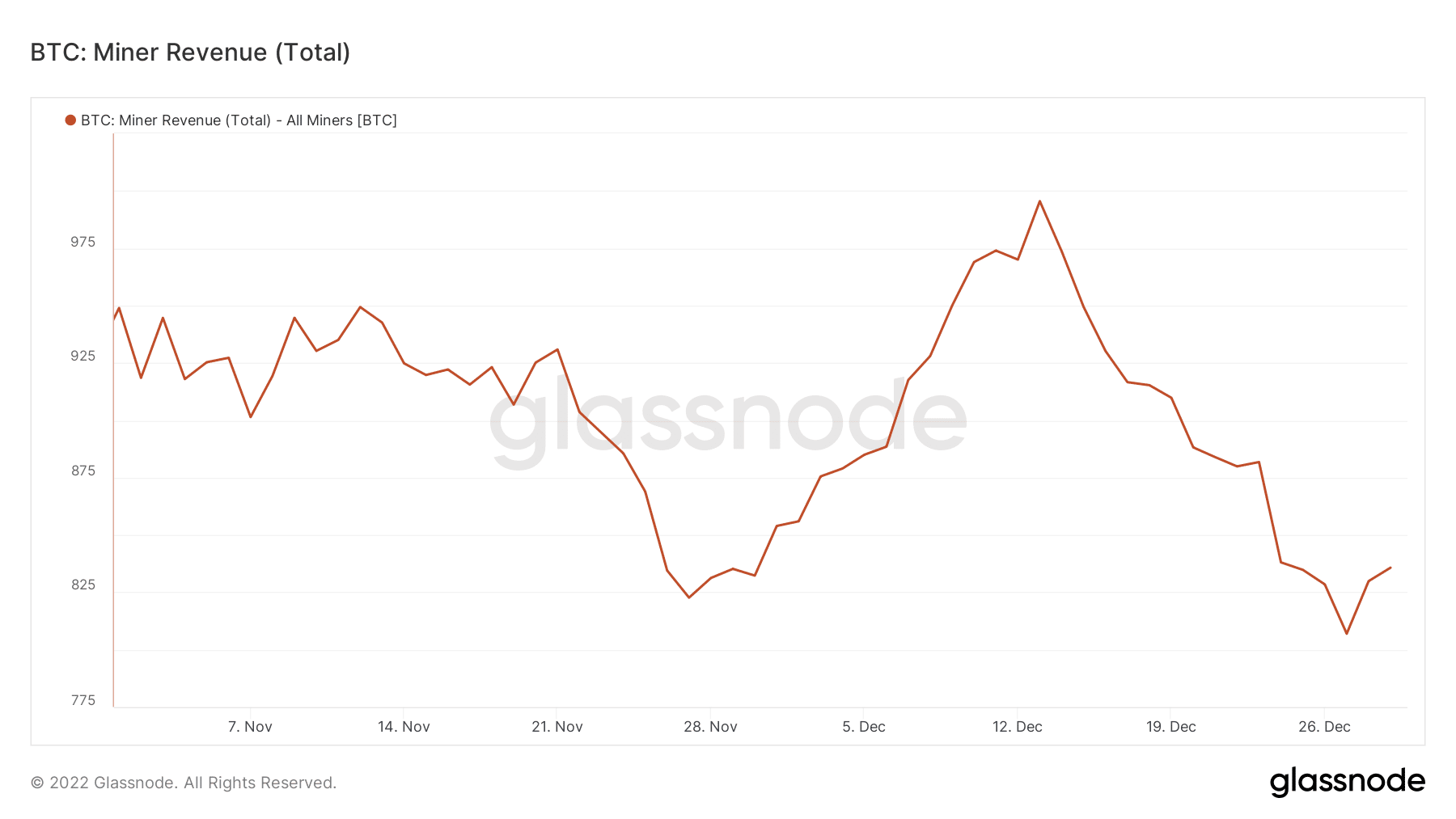

Nevertheless, miners held on to their BTC regardless of declining income. Primarily based on information gathered by Glassnode, BTC mining income decreased considerably over the previous few weeks. If the income generated by miners continued to say no, promoting stress on miners would improve within the close to future.

Supply: Glassnode

Luckily, declining income generated by miners didn’t have an effect on massive addresses thinking about BTC.

Are your BTC holdings flashing inexperienced? Examine the revenue calculator

Bitcoin taking a loss

From information offered by Glassnode, it was noticed that addresses holding over 10 Bitcoin reached a two-year excessive of 155,711 addresses as of 29 December.

📈 #Bitcoin $BTC Variety of Addresses Holding 10+ Cash simply reached a 2-year excessive of 155,171

View metric:https://t.co/0NzRiyaeFg pic.twitter.com/MNXHKdphIM

— glassnode alerts (@glassnodealerts) December 29, 2022

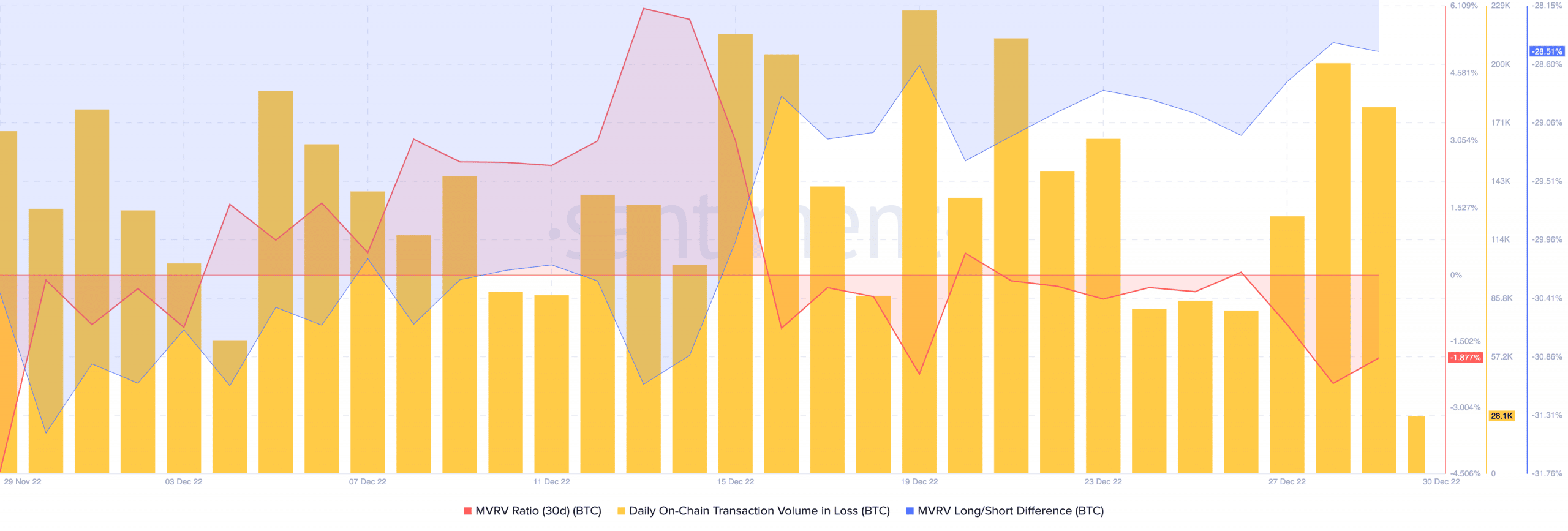

Regardless that the variety of massive addresses continued to develop on the Bitcoin community, their holdings weren’t worthwhile. This was demonstrated by the king coin’s declining MVRV ratio.

A declining MVRV ratio instructed that if most BTC holders have been to promote their Bitcoin, they’d achieve this at a loss. The declining lengthy/brief distinction, coupled with the spike in transaction quantity in loss, instructed that quite a few short-term BTC holders had already exited their positions with their portfolios bleeding.

Supply: Santiment

It stays to be seen whether or not different long-term holders will observe swimsuit within the coming months. That mentioned, at the time of writing, BTC was buying and selling at $16,566.19. Its value fell by 0.06% within the final 24 hours.