If you recognize Web3, you recognize OpenSea. Since its launch on the finish of 2017, the NFT market has largely been the poster baby for the world of Ethereum and crypto artwork, and it’s bought the numbers to show it.

OpenSea’s whole historic buying and selling quantity sits comfortably at simply shy of $41 billion, based on Dune analytics. To place that in perspective, KnownOrigin, one among OpenSea’s opponents that launched across the identical time, has a complete buying and selling quantity of simply over $30 million.

Having dominated the marketplace for nearly six years, OpenSea has been as influential to the NFT ecosystem as any challenge, artist, or builder. Nevertheless, this outsize affect hasn’t at all times been for the higher, as the corporate has more and more begun to conflict with NFT group members over some fairly important points associated to Web3.

The final six months, particularly, have introduced {the marketplace} with a number of challenges with which it’s nonetheless grappling, in addition to the primary actual contender with a shot at changing it as NFT market ruler. With that in thoughts, right here’s a have a look at every part it’s essential to learn about OpenSea.

What’s OpenSea?

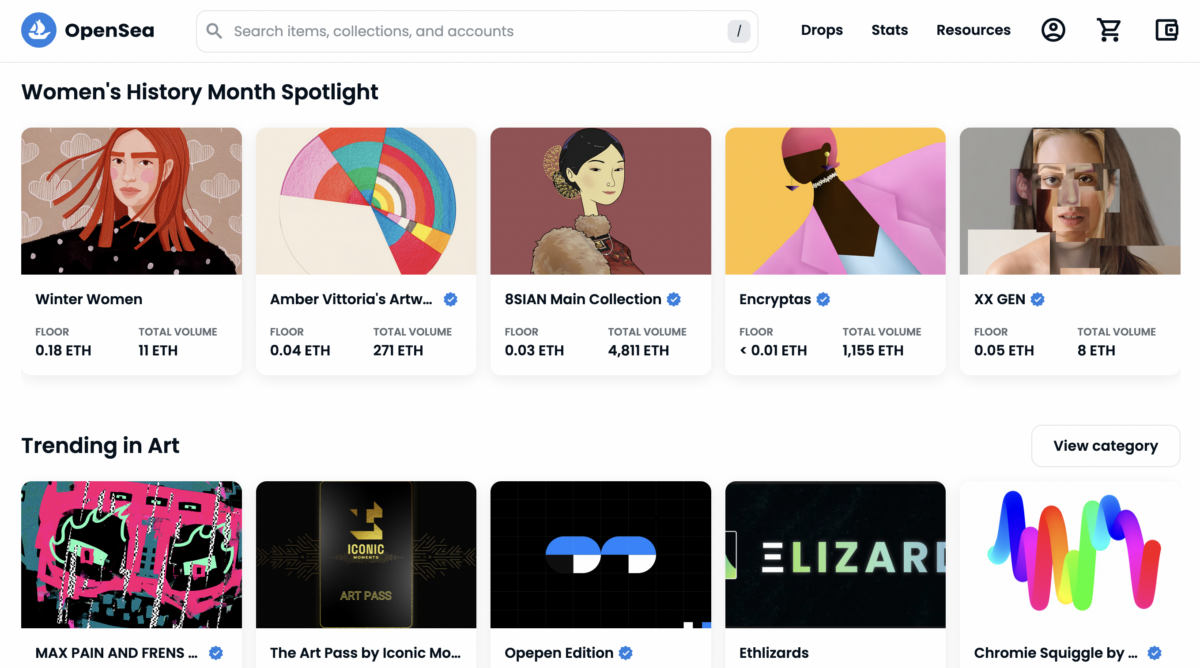

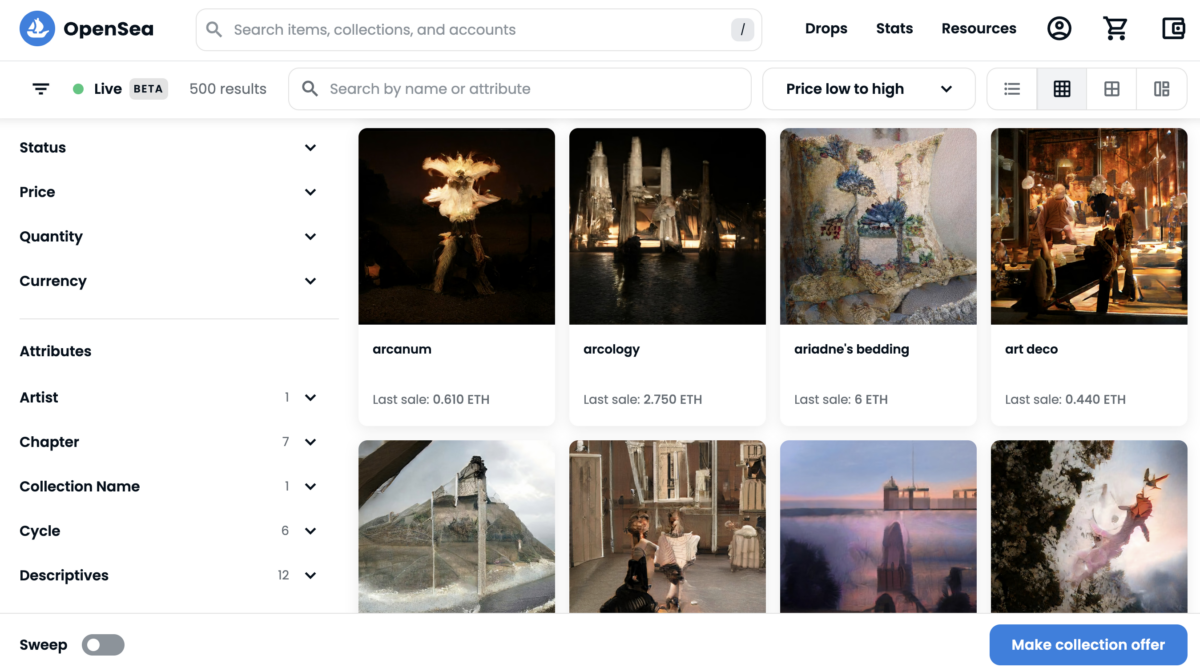

OpenSea is likely one of the most well-known, peer-to-peer NFT marketplaces in existence. Customers can purchase, promote, commerce, and create NFTs on the platform in varied classes starting from pictures and PFPs to gaming, membership tokens, and high quality artwork tasks.

OpenSea is the all-around hitter of NFT marketplaces. It’s straightforward to navigate and offers a restricted however versatile suite of analytics instruments and sorting choices for customers seeking to dig just a little deeper into assortment histories or NFT trait rarities. Moderately than honing in on a selected area of interest of Web3 customers, the platform is a strong one-stop store for a broad vary of Web3 lovers, together with newcomers, skilled merchants, and low-volume retail NFT patrons.

OpenSea’s rise to energy

It’s tough to overstate the magnitude of OpenSea’s rise over the previous few years. Having been based in 2017 by software program engineer and entrepreneur Devin Finzer and programmer Alex Atallah, {the marketplace} hit a $1.5 billion valuation by the summer time of 2021. By January 2022, that quantity surged to $13.3 billion after the corporate raised $300 million in a Sequence C funding spherical.

Whereas NFTs had been round in some kind or one other since 2011, they’d but to hit an inflection level and acquire important traction within the public’s eye, even in 2017. In creating OpenSea, Finzer and Atallah had recognized a have to construct a platform that might operate as a focus for the then largely disparate communities of Web3 lovers.

“At first, Devin and Alex got down to create a market to unite siloed communities throughout the early days of NFTs,” stated an OpenSea spokesperson whereas talking to nft now on the corporate’s origins. “Whereas embracing a spread of potential outcomes, the upside was at all times there: turning into a vacation spot the place folks might work together with NFTs, and thus discover a model new economic system on the web.”

That economic system has grown considerably for the reason that platform’s late-2017 launch, even contemplating Web3’s most up-to-date crypto winter. As of September 2022, buying and selling quantity within the Ethereum NFT sphere hit 8.22 million ETH ($11.5 billion). Moreover, a latest report by analysis and consulting agency Verified Market Analysis predicted the market cap for the NFT business might attain $231 billion by 2030.

OpenSea has performed a vital function in serving to that market mature. From Might 2021 to November 2022, the platform was accountable for almost all of buying and selling quantity within the NFT house.

OpenSea instruments and options

OpenSea rolls out new options and instruments on the platform with some regularity, all geared toward rising belief within the platform, person security, and bettering infrastructure for the bigger ecosystem.

One of many platform’s latest and important updates got here in June 2022 with the introduction of Seaport, a Web3 market protocol that allows customers to extra safely and effectively purchase and promote NFTs. Earlier than Seaport, OpenSea used Wyvern, a less-efficient protocol created by a 3rd get together. As compared, Seaport cuts down on redundant transfers and, based on an organization weblog publish on the event, reduces gasoline charges for customers by 35 %. Seaport is open supply; OpenSea doesn’t management or function it, and the corporate has inspired good contract builders to enhance the protocol with them.

{The marketplace} has launched a number of options within the final yr, together with a copymint detection system, a approach to disguise suspicious NFT transfers to customers’ wallets, and a capability for creators to launch collections with devoted drop pages instantly on OpenSea known as Drops. However not all of its product launches have been well-received.

OpenSea’s royalty woes

All through the years, OpenSea has launched or made modifications to services it presents that hook up with Web3’s most urgent points — and never at all times gracefully. The platform has steadily clashed with artists and creators, who castigate {the marketplace} for what they understand to be offenses to the well being of the NFT group and the people that kind its bedrock.

The critiques could be tough to weigh pretty. As a consequence of its stature and lengthy historical past within the house, OpenSea makes for a simple goal, whether or not or not its detractors’ arguments are official. Regardless, like each market within the ecosystem, the corporate has had its share of difficulties and shortcomings over time. The platform has struggled with growing a good and efficient stolen gadgets coverage, has a historical past of website performance points throughout instances of excessive visitors and following durations of intense progress, and has taken a somewhat centralized method to implementing guidelines regarding its person base.

However the highest-profile situation that the Web3 group takes with OpenSea is its inconsistent stance on creator royalties. Royalties (also called creator charges) allow artists to be compensated for a piece properly past its major sale, giving them a minimize of the earnings each time their NFT modifications arms. Royalties have helped artists and builders in Web3 create a wealthy, various, and thriving artwork ecosystem and play a serious function in its sustainability, offering a vital revenue supply for the funding of future tasks.

Till the latest improvement of on-chain enforcement instruments, royalties weren’t initially enforceable on a technical degree. Even so, some collections on OpenSea weren’t created on upgradable good contracts, stopping them from having the ability to use the newly developed instruments. For collections constructed on upgradable contracts, nonetheless, it’s as much as the marketplaces facilitating the shopping for and promoting of their NFTs to implement and implement these royalties funds by these new instruments.

Till just lately, OpenSea had performed a terrific deal to assist artists on this means. As of October 2022, {the marketplace} was the platform that had paid out essentially the most creator royalties by a big margin. And in November of the identical yr, {the marketplace} introduced that it could introduce a device for brand spanking new collections to implement royalties on its platform.

The announcement marked OpenSea’s first crack at an on-chain resolution for royalties enforcement. And whereas this was hailed as a constructive, creator-friendly transfer, customers had been unsettled by the truth that such royalty enforcement wasn’t going to use to present collections on OpenSea — the very collections that helped set up the platform as a number one Web3 drive.

After extreme backlash from almost each distinguished NFT artist and challenge head within the house, OpenSea announced it could proceed to implement creator charges on legacy collections, a transfer that many on the time noticed as each a win for creators and an occasion that catalyzed a type of unionization motion in Web3.

In February 2023, nonetheless, OpenSea altered its place on royalties as soon as once more. In a Twitter thread, the corporate introduced that it could be transferring collections that don’t use on-chain enforcement instruments (the overwhelming majority of collections on its platform) to non-obligatory royalties. And as soon as once more, many artists locally took umbrage with this.

OpenSea has cited a sea change in marketplace dynamics as the primary purpose for its transfer to non-obligatory royalties on its platform, and there’s some credibility in that declare. Collectors in Web3 merely don’t need to pay royalties if they will keep away from it, and marketplaces must take heed to the collectors that make up their target market. This pattern isn’t theoretical — marketplaces are more and more abandoning royalties enforcement, and zero-royalty platforms like Blur have begun siphoning off large quantities of buying and selling quantity from OpenSea, usurping the corporate’s previously-held majority market share.

OpenSea vs. Blur

The rise of Blur is likely one of the most vital developments in NFT market historical past and has every part to do with what OpenSea is making an attempt to realize with its royalties strikes in latest months. Blur’s technique of interesting to a small however strong demographic of professional merchants by rewarding its customers with free airdrops of its personal token has confirmed broadly efficient in its present purpose of optimizing for market share. Since November 2022, Blur has both sat neck-and-neck with OpenSea or utterly outpaced it when it comes to buying and selling quantity (though OpenSea nonetheless retains the upper depend of energetic customers).

Nevertheless, OpenSea might bear some duty for partially catalyzing the market shift it’s now lamenting. The royalty coverage it just lately canned had pressured creators to decide on between incomes full royalties on both OpenSea or Blur, setting royalties to non-obligatory upon detection of a set’s buying and selling on royalty-optional platforms. Paradoxically, it was OpenSea’s personal Seaport that enabled Blur to sidestep this very coverage, drawing much more customers to Blur’s shores. Regardless, the transfer put creators and collectors in an uncomfortable place.

OpenSea’s attempts to uphold royalties so long as it did are value appreciating, and the platform isn’t the artist-hating behemoth that some make it out to be. However because it and others vie for dominance within the NFT ecosystem, creators are caught within the center in what many see as a race to the underside of one among Web3’s founding ideas: empowering and correctly compensating artists for his or her work.

In the end, as some have argued, it could be the case that Web3 platforms are merely extra involved with gaining market share, as success on this purpose permits them to safe extra financing by enterprise rounds. Both means, the present market dynamic sits poorly with the group of artists that generates the wealth the NFT ecosystem swims in and who sincerely imagine within the capability of Web3 tech to foster a extra equitable future for creatives.

The decentralization conundrum

A number of of the issues OpenSea will get criticized for haven’t any straightforward options. The platform’s stolen merchandise coverage, which has beforehand led to the inadvertent punishment of customers who unknowingly bought a stolen NFT on {the marketplace}, is one instance of this. It’s value noting that OpenSea listened to group suggestions and consequently updated its policy to higher disincentivize theft and enhance the accuracy of stolen merchandise reviews. It’s additionally carried out malicious URL detection and removing and a system that goals to forestall the reselling of stolen gadgets.

Whereas there may be an argument that OpenSea can and should have done more to develop as honest and efficient a coverage as attainable for stolen gadgets sooner than it did, it’s additionally not a stretch to say that coping with safety in a decentralized world stays an inexact science, particularly when a company is making an attempt to make sure authorized compliance within the U.S.

The platform’s March 2022 hiccup in the way it approached U.S. sanctions regulation necessities likewise falls beneath this class. Balancing a largely nameless and worldwide person base with doubtlessly ruinous authorized repercussions is tough.

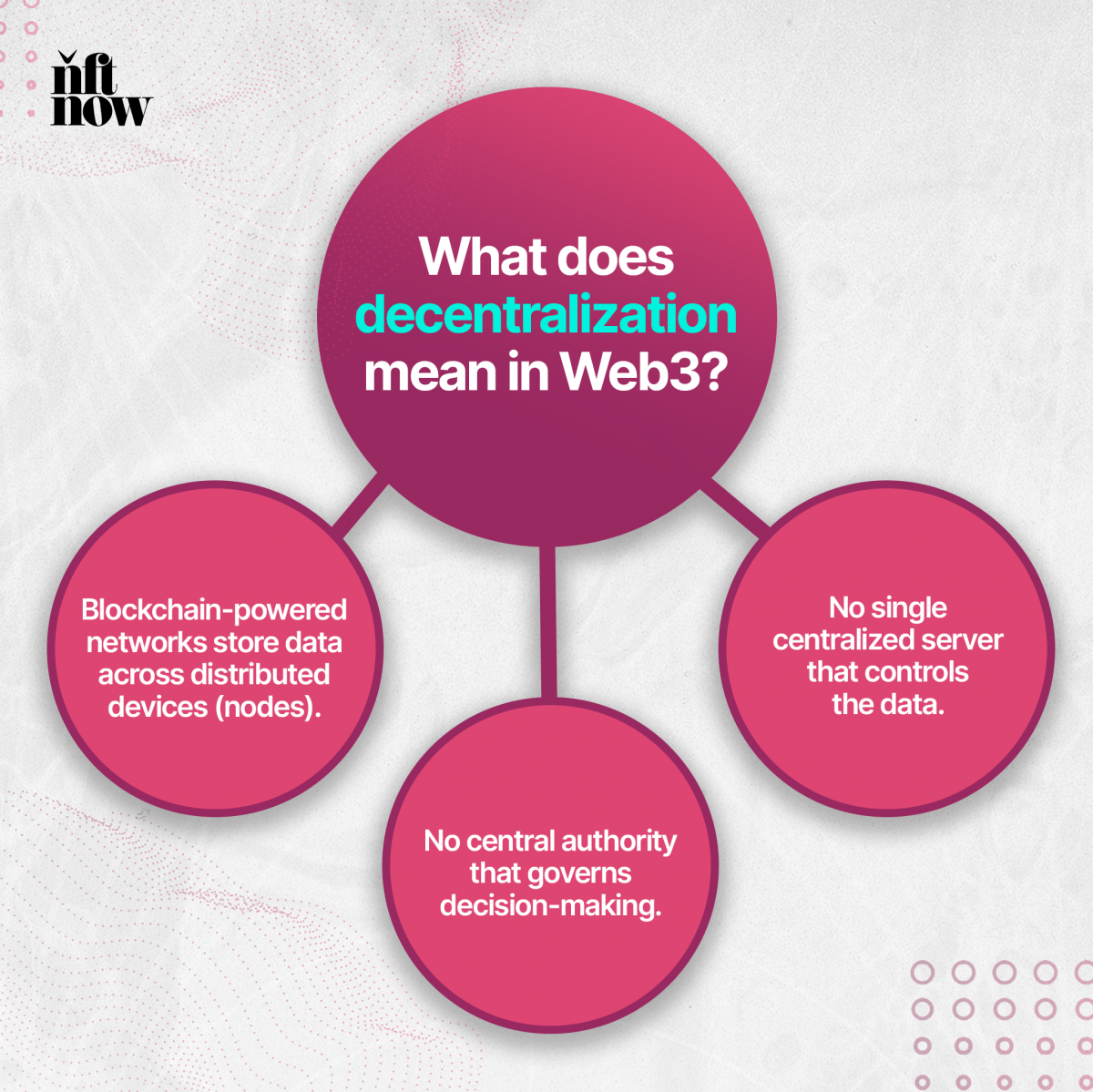

All of those points stay beneath the banner of one among Web3’s founding tenets: decentralization, the concept broad authority to make modifications affecting a group needs to be dispersed all through that group somewhat than vested in a single particular person or group. Large NFT platforms like Opensea are in an unenviable place right here. Requires a “actually decentralized market” will probably be acquainted to anybody who has been within the NFT house for various weeks. These calls, nonetheless well-intentioned, are typically ill-thought-out.

OpenSea believes that the centralization debate is a vital and compelling one which, like each controversial situation within the house, evolves over time and requires an method that may be adjusted if essential. And whereas it’s straightforward to argue that OpenSea is a centralized entity, it’s additionally value noting that most Web3 entities are.

Centralization is a spectrum. Nifty Gateway, for instance, is a custodial platform that shops its customers’ NFTs in a pockets from which they should be withdrawn to be traded on different platforms. And even the founders of SuperRare have acknowledged that decentralization is a piece in progress and that “decentralization by centralized means” could also be top-of-the-line methods of fullying realizing the promise of this specific tenet of Web3.

OpenSea believes that coordinated motion on some authoritative degree is typically essential to maintain issues working easily and its customers protected in an surroundings stuffed with dangers and unknowns. Web3 is a unstable panorama that shifts by the hour. Anticipating anybody particular person to maintain up and reply completely to it’s unreasonable; having the identical expectations of an unwieldy, multi-billion-dollar group is unreasonable.

OpenSea’s future

None of which is to say that OpenSea can’t do a greater job on the issues the NFT group usually rebukes it for; it should if it desires to keep up its spot as a high Web3 market. It owes creators — not simply collectors — innovation that they will use and that upholds their rights as Web3 residents. Likewise, it could do extra to obviously talk sudden modifications in coverage to its customers and implement selections in a extra clear and exact means.

“We imagine that finally, the bodily economic system will shift on this path, and it’s attainable that someday, almost every part we personal will probably be owned and transferrable on the blockchain within the type of an NFT,” CEO Devin Finzer underscored of the corporate’s method to the evolution of Web3 in a November 2022 weblog publish. “We’ve conviction that this know-how will finally energy the largest markets on the planet and basically remodel society. That’s the imaginative and prescient we’re rallying round at OpenSea.”

All of which sounds rhetorically on the cash. However rhetoric is straightforward; how {the marketplace} decides to execute that imaginative and prescient pretty whereas going through quickly shifting market dynamics, rising aggressive strain, and a motion of creators coalescing across the royalties situation stays to be seen.