Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- The pattern was clearly in favor of the SAND bears.

- A revisit to the decrease timeframe distribution from the previous weekend can provide a shorting alternative.

Since August, The Sandbox has confronted a torrid time on the token’s value charts. Patrons haven’t seen respite from promoting on the bigger timeframe charts. A number of vital assist ranges have been damaged.

Learn The Sandbox’s [SAND] Value Prediction 2023-24

Since 14 December, the Tether Dominance metric noticed some positive aspects as crypto market members fled to stablecoins within the face of promoting stress. Bitcoin was unable to interrupt out previous its vary, and would doubtless face resistance within the $17.6k-$17.8k space.

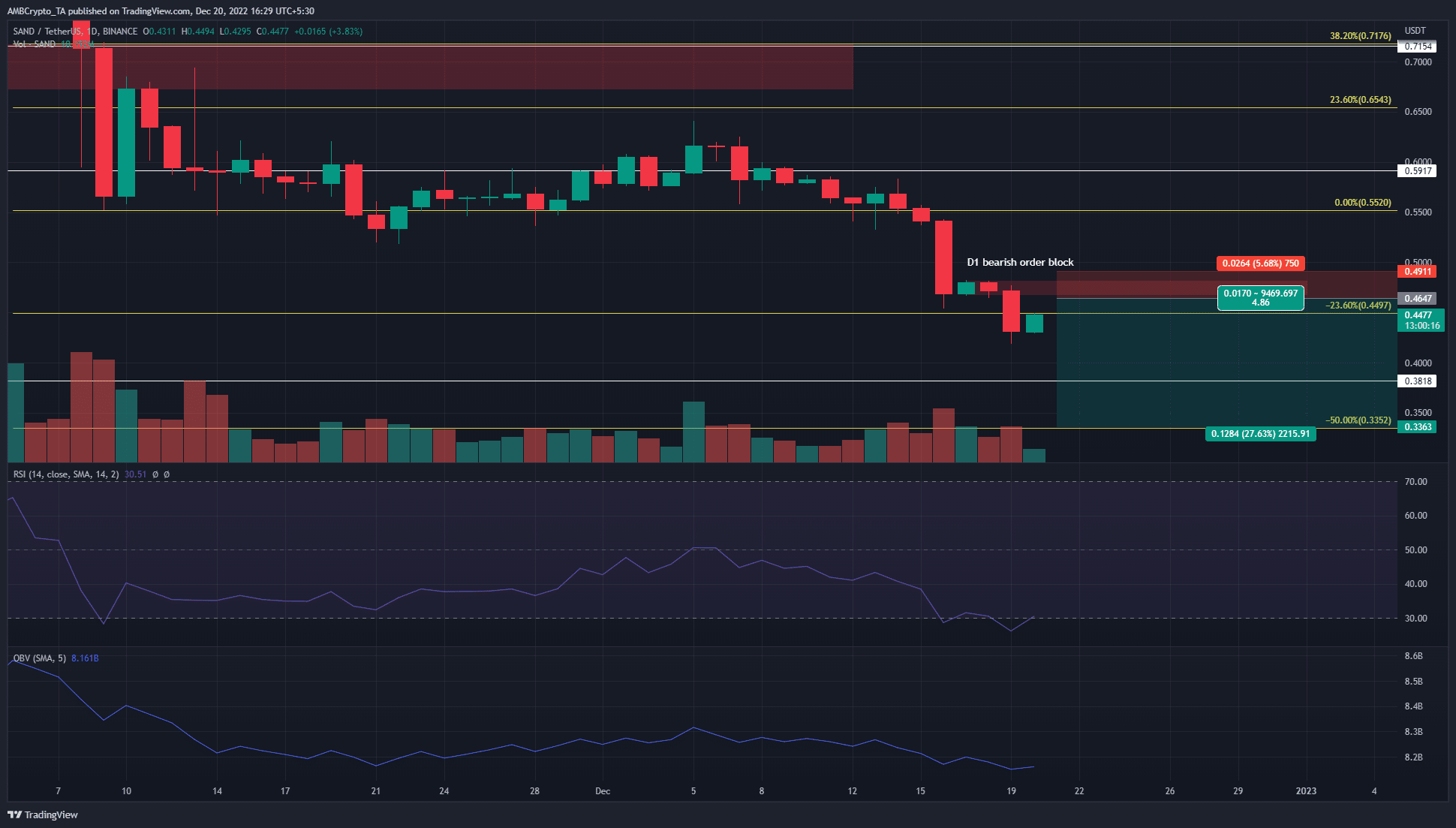

A bearish order block on the each day chart was noticed, bears can goal Fibonacci extension ranges

Supply: SAND/USDT on TradingView

The early November crash noticed the $0.715 area retested as resistance. Sellers have been extraordinarily sturdy in that zone and SAND continued its downtrend on the worth charts.

On 5 December, The Sandbox broke out previous an area resistance at $0.6, and pushed as excessive as $0.64. However as a substitute of flipping the $0.6-$0.62 space to assist it collected the liquidity at $0.64 and noticed a fast bearish reversal.

On the each day timeframe, the RSI additionally indicated a robust downtrend in progress. Through the transfer to $0.64 and the next rejection, the RSI didn’t breach impartial 50. The OBV additionally retraced the positive aspects it made within the first week of December.

Over the weekend, the token consolidated for a while within the $0.46-$0.48 space. It fashioned a bearish order block on the each day timeframe and highlighted a area the place one other sharp rejection might materialize. Fibonacci extension ranges at $0.45 and $0.33 can even function resistance and assist ranges respectively within the subsequent few weeks.

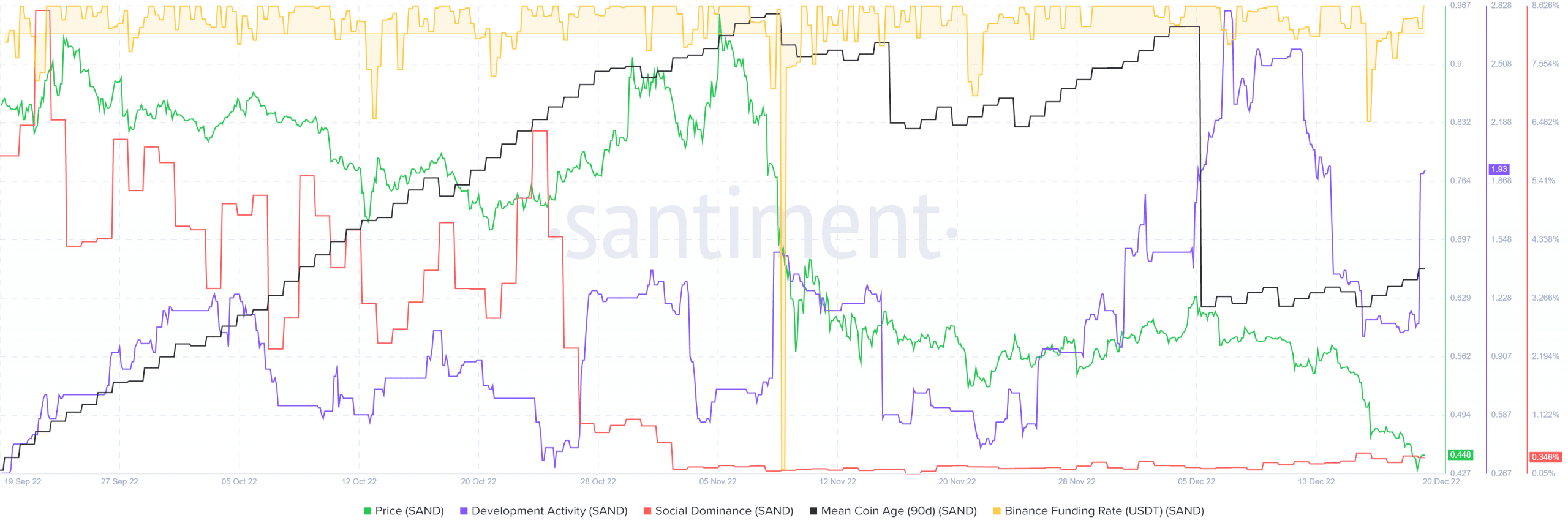

Imply coin age suffers a big dent however the funding charge climbed in latest hours

Supply: Santiment

The 90-day imply coin age noticed a pointy decline on December 6 to point out the widespread motion of SAND tokens. This marked the native prime for the asset at a value of $0.62 when the bears succeeded in reigning in bullish momentum.

Social dominance has been actually low since November however has climbed by a small quantity. Extra importantly, the event exercise reached a three-month excessive in early December regardless of the promoting stress the worth noticed.

This could encourage long-term consumers. At press time, the funding charge was constructive, however this may very well be as a result of decrease timeframe bounce from $0.43.

![The Sandbox [SAND] saw a bounce from $0.43, find out where short-sellers can enter](https://cryptonitenews.io/wp-content/uploads/2022/12/PP-3-SAND-cover-1000x600-768x461.jpg)