Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The market construction remained bearish.

- A revisit to the breaker on the charts was a chance.

The Sandbox skilled a safety challenge towards the tip of February. This occurred when an worker’s pc was accessed by an unauthorized third occasion. Emails containing malware had been despatched out that had been falsely claimed to be from The Sandbox.

Learn The Sandbox’s [SAND] Value Prediction 2023-24

The Sandbox has been bearish on the charts since 22 February. This safety incident may not have swayed near-term sentiment to bearish, for the sentiment was already in favor of the sellers.

A bounce in SAND costs shouldn’t be a shock, however the pattern remained bearish

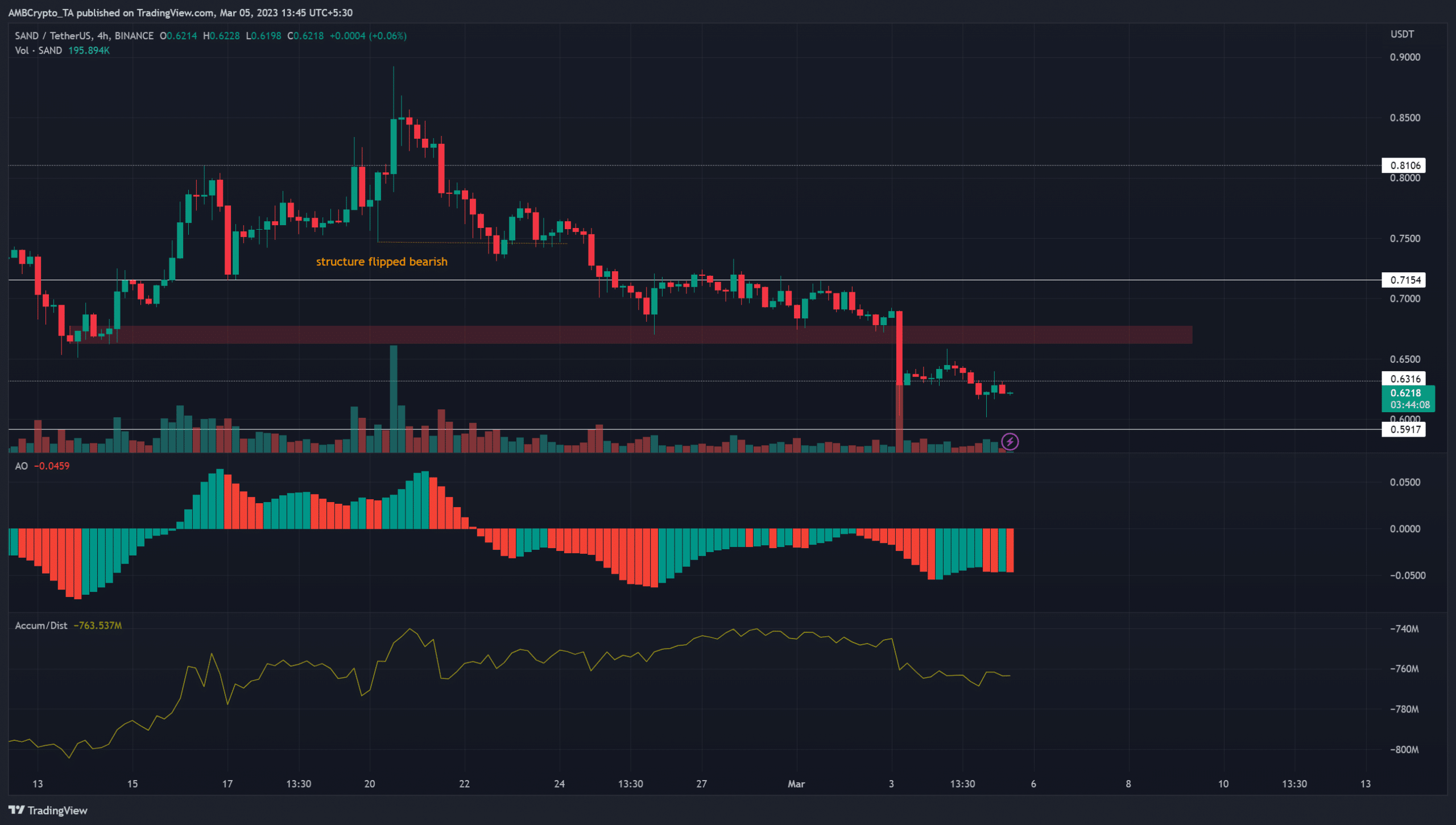

Supply: SAND/USDT on TradingView

The H4 bearish market construction break was highlighted in orange and shifted the bias towards the bears. On the identical time, the Superior Oscillator additionally fell beneath the zero line and confirmed a robust downtrend in progress.

On the time of writing, the AO didn’t but step again above the zero line. Nonetheless, the A/D line made a collection of upper lows until the tip of February however slid decrease previously few days.

Total, the symptoms confirmed sturdy promoting stress in March but in addition hinted at some accumulation within the final week of February.

Life like or not, right here’s SAND’s market cap in BTC’s phrases

The pink field at $0.66 denoted the bearish breaker that SAND fashioned on 13 February. At the moment, the swing low at $0.65 was adopted by a rally to $0.81 and $0.89.

On the best way down, this former bullish order block didn’t halt the bears’ advance, therefore it was a bearish breaker. It additionally has confluence with the honest worth hole SAND left on the charts.

Subsequently, a revisit to the $0.65-$0.68 space would current a perfect promoting alternative for SAND merchants. To the south, the $0.59 and $0.53 ranges had been notable help ranges.

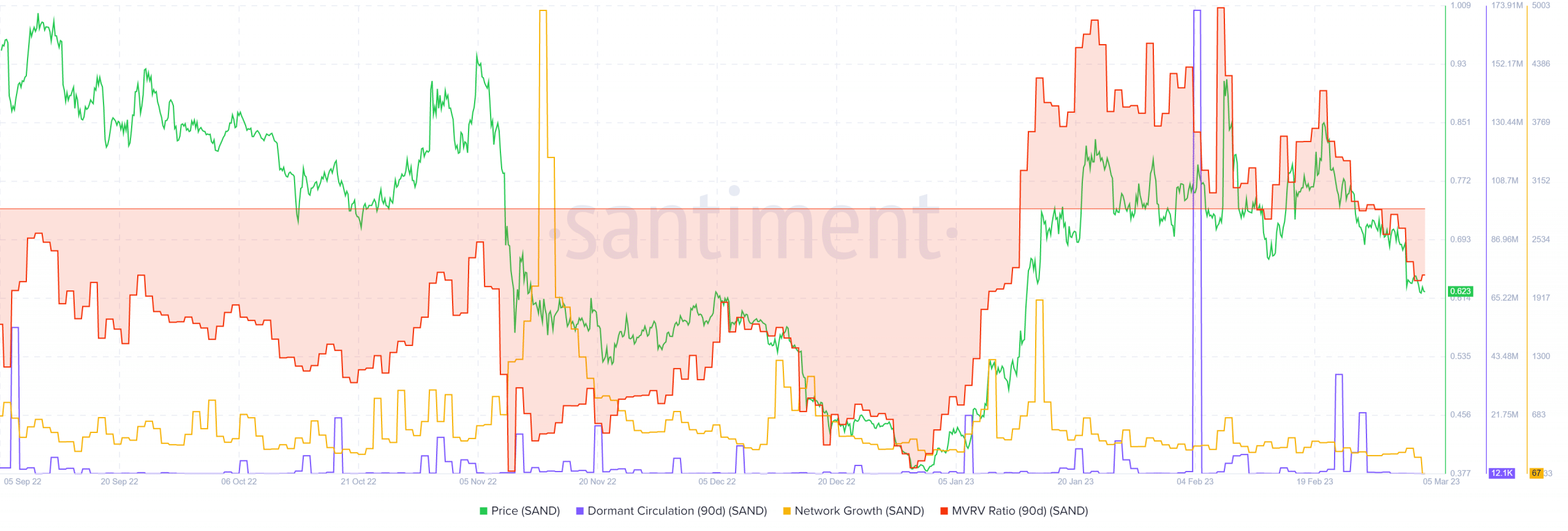

The falling MVRV ratio confirmed the holders had been enduring losses

Supply: Santiment

The dormant circulation noticed an enormous spike on 4 February. At the moment, The Sandbox was buying and selling at $0.8 and fell by 11% simply three days later to fall to $0.7. Up to now few weeks, the 90-day dormant circulation didn’t word a spike, which prompt sturdy promoting stress may not be current.

Nonetheless, the 90-day MVRV ratio slid into adverse territory and indicated that SAND holders’ portfolio was within the pink. Furthermore, the community progress metric didn’t word beneficial properties in latest weeks both.

Taken collectively, the metrics confirmed an absence of progress and the falling costs fueled bearish sentiment. A spike within the dormant metric circulation may warn merchants of one other sharp transfer downward.