- SushiSwap’s stochastic was in an oversold place

- Although whale curiosity and improvement exercise elevated, different metrics didn’t help a value surge

SushiSwap [SUSHI] has been upsetting buyers for fairly a while now due to its damaging value motion. CoinMarketCap’s information revealed that SUSHI registered 12% damaging weekly losses and was trading at $1.18 at press time, with a market capitalization of over $150 million.

Nevertheless, buyers would possibly hear some excellent news quickly. This may be stated as a result of some metrics and market indicators revealed the potential of a pattern reversal.

Learn SushiSwap’s [SUSHI] Worth Prediction 2023-2024

Is a pattern reversal inevitable?

CryptoQuant’s data revealed that SUSHI’s stochastic was in an oversold place. This might be thought of as an enormous bullish indicator.

SUSHI additionally acquired curiosity from the whales, because it was one of many high 10 bought tokens among the many 100 largest Ethereum whales. This too, was an optimistic improvement, because it mirrored whales’ belief within the token.

JUST IN: $SUSHI @sushiswap now on high 10 bought tokens amongst 100 largest #ETH whales within the final 24hrs 🐳

We have additionally bought $MOH, $QRDO, $QWLA, $aDAI & $BOBA on the checklist 👀

Whale leaderboard: https://t.co/N5qqsCAH8j#SUSHI #whalestats #babywhale #BBW pic.twitter.com/TWNaSe2p5T

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 10, 2022

Moreover, in line with CryptoMiso’s chart, SUSHI ranked second when it comes to essentially the most energetic cryptos based mostly on GitHub commitments within the final three months. This revealed that builders have been placing their finest foot ahead to boost the community additional.

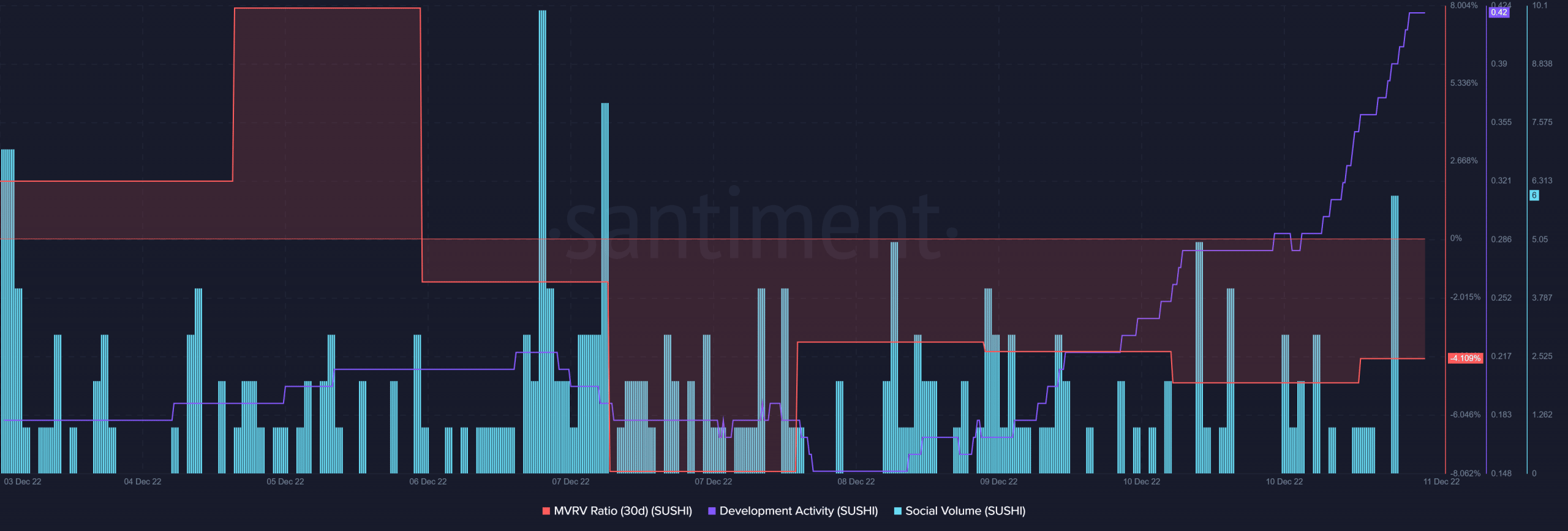

Santiment’s information supplied additional hope as a number of on-chain metrics supported a pattern reversal. As an example, SUSHI’s Market Worth to Realized Worth (MVRV) Ratio registered a slight uptick. This appeared promising for the token.

Moreover, SUSHI’s improvement exercise additionally witnessed a pointy surge. The token additionally remained fairly standard within the crypto trade, as its social quantity spiked final week.

Supply: Santiment

Ought to SUSHI buyers be involved?

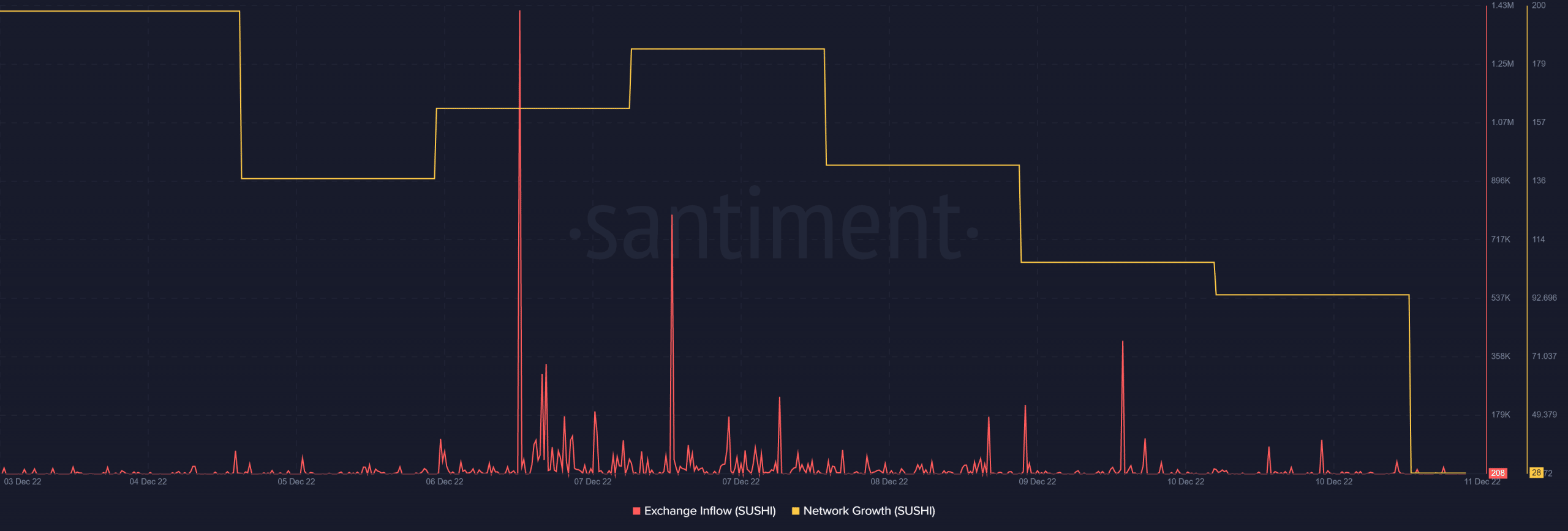

Whereas the above metrics appeared optimistic, a number of of them indicated that the value plummet would possibly go on for some time. SUSHI’s trade reserve was growing, which was a bearish sign because it indicated greater promoting stress.

Not solely that, however the token’s trade influx registered a spike. SUSHI’s community progress additionally went down within the final seven days. This drives the possibilities of a continued downtrend.

Supply: Santiment

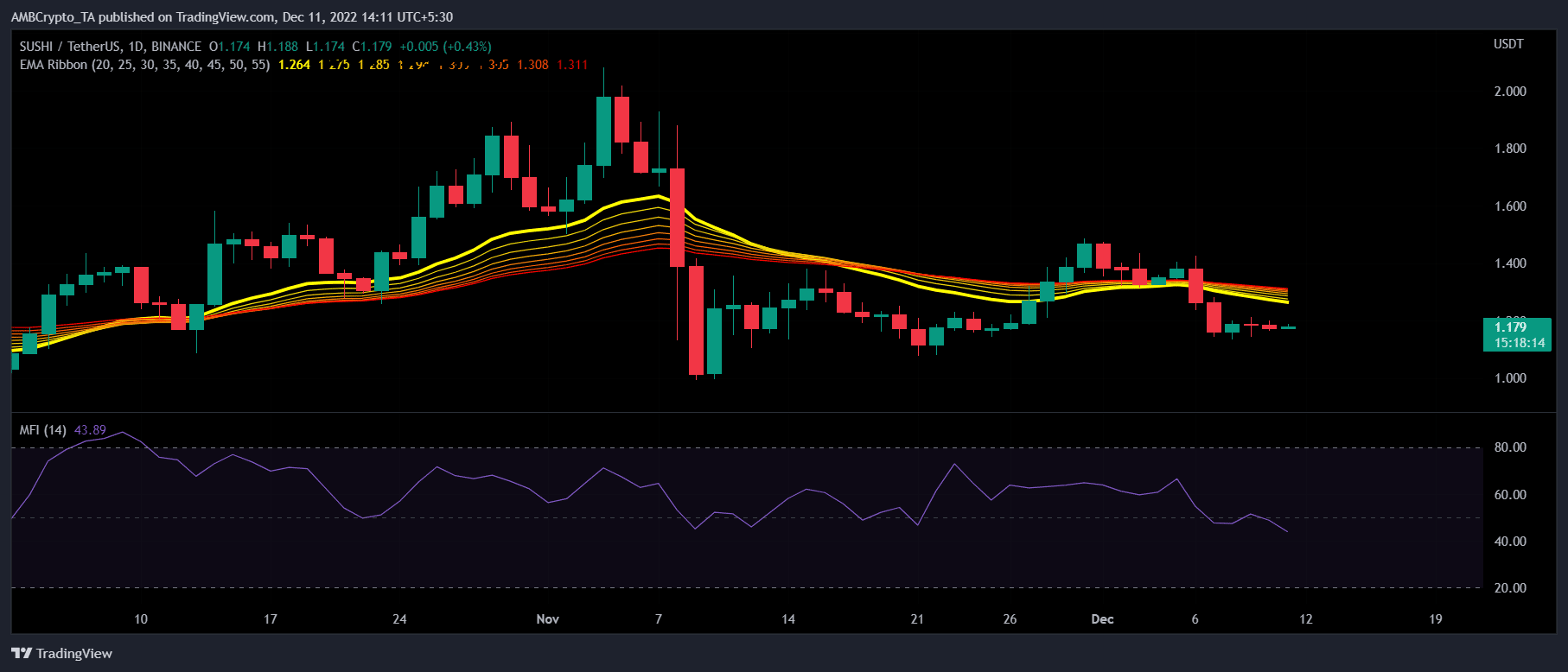

Curiously, SUSHI’s every day chart instructed that the bears nonetheless had the higher hand available in the market. The Exponential Transferring Common (EMA) Ribbon displayed a bearish crossover. Furthermore, the Cash Stream Index (MFI) headed additional beneath the impartial degree, which might be regarding for buyers.

Supply: TradingView