Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- SOL was in a impartial construction on the three-hour chart.

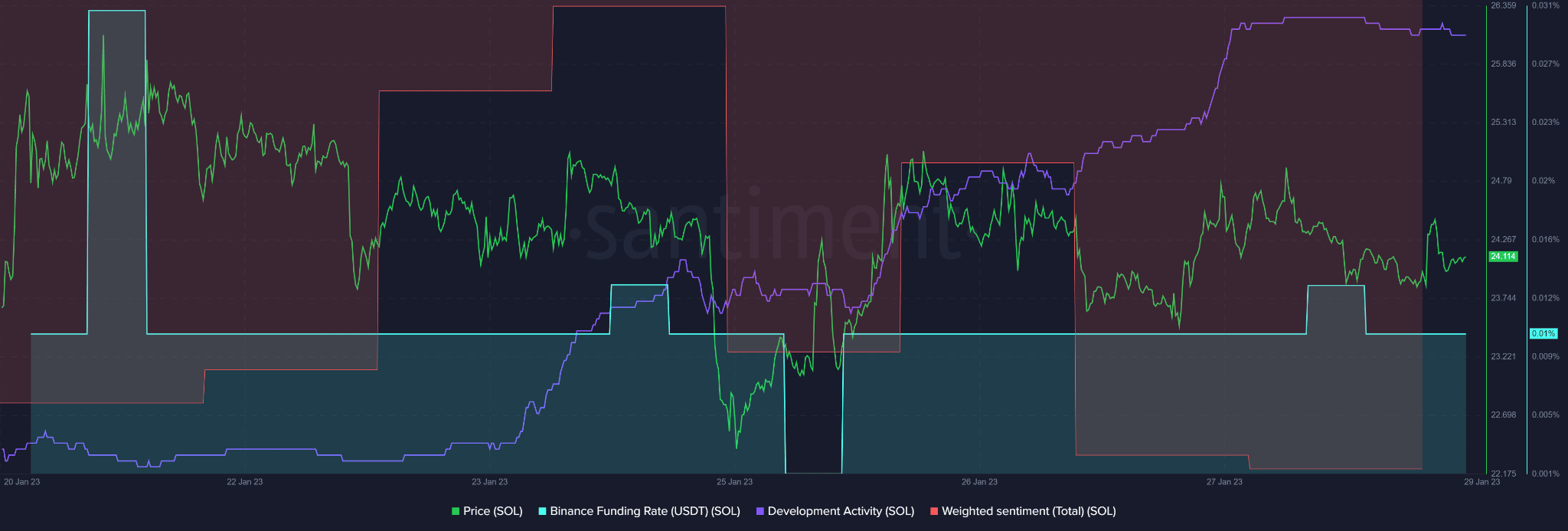

- The Funding Price remained optimistic regardless of a slowed growth exercise.

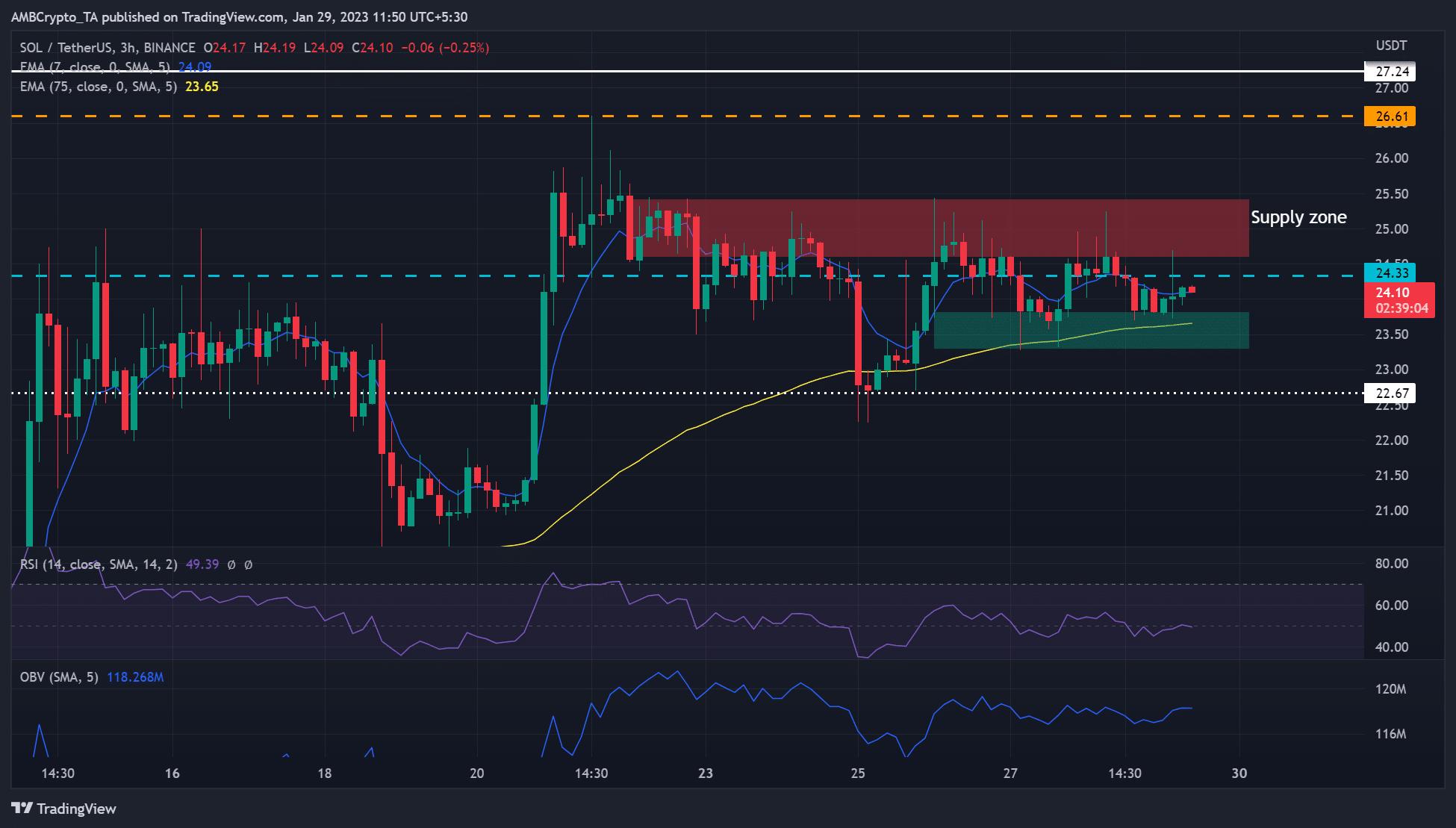

Solana [SOL] swiftly went from $20 to $25 on Friday, 20 January. Afterward, a vital short-term provide zone blocked its upward worth motion extensively. At press time, SOL traded at $24.10 and nonetheless needed to take care of the above-mentioned provide zone.

Learn Solana [SOL] Worth Prediction 2023-24

Fed watchers anticipate a dovish announcement from subsequent week’s FOMC assembly. If their bets are confirmed, the markets might be triggered positively, tipping Bitcoin [BTC] and the remainder of the altcoins for an additional spherical of worth rallies.

However a hawkish FOMC launch would clear the latest features and ship the markets into a brief correction part, affecting SOL too.

The availability zone blockage: Can bulls overcome it?

Supply: SOL/USDT on TradingView

On the three-hour chart, the Relative Power Index (RSI) was 49 and rested close to the mid-level of fifty – thus exhibiting a impartial construction.

Nevertheless, it had retreated from the decrease vary, accompanied by rising On Steadiness Quantity (OBV), indicating a real demand and rising shopping for strain.

If the development is sustained, the RSI might crossover the mid-level and push SOL to beat the $24.33 hurdle and transfer close to the availability zone’s (pink) decrease boundary of $24.60.

How a lot are 1,10,100 SOLs value as we speak?

Nevertheless, bypassing the availability zone of $24.60 – $25.42 can solely happen if BTC exceeds the $23.5K degree. SOL might retest the overhead resistance at $26.61 if it clears the availability zone blockage.

However the above bias can be invalidated if bears devalue SOL past the demand zone (inexperienced) of $23.3 – $23.8. The drop might be contained by the 75-period EMA (exponential shifting common) or the $22.67 assist degree.

Growth exercise slowed, however demand remained spectacular

Supply: Santiment

As per Santiment information, SOL’s growth exercise continues to rise, enhancing traders’ confidence as indicated by enhancing weighted sentiment. Nevertheless, at press time, the event exercise remained comparatively flat as costs declined, denting traders’ confidence within the course of.

However the Funding Price remained optimistic, indicating a real demand within the derivatives market and a bullish outlook for the asset. As such, SOL might be tipped to beat its resistance ranges on its upward path.

![Solana [SOL] blocked by a short-term supply zone – Can bulls bypass it?](https://cryptonitenews.io/wp-content/uploads/2023/01/guerrillabuzz-blockchain-pr-agency-5_asf_AsG-I-unsplash-1000x600-768x461.jpg)