- SNX drops to a key help degree and ETH whales are accumulating.

- Why a pointy bounceback may not be on the playing cards.

Synthetix’s native token SNX has been tumbling for a lot of moons as has been the case for many cryptocurrencies. A number of indicators point out {that a} potential bullish takeover may be on the best way and right here’s why.

Learn Synthetix (SNX) value prediction 2023-2024

One of many newest Whalestats alerts revealed that SNX was among the many prime 10 most bought cryptocurrencies by ETH whales. This alert is of explicit curiosity particularly due to the press time value degree at which SNX was buying and selling.

JUST IN: $SNX @synthetix_io now on prime 10 bought tokens amongst 100 greatest #ETH whales within the final 24hrs 🐳

We have additionally obtained $UNI, $LINK, $SHIB & $CHZ on the record 👀

Whale leaderboard: https://t.co/N5qqsCAH8j#SNX #whalestats #babywhale #BBW pic.twitter.com/QZKsYFHfex

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 28, 2022

First, let’s have a look at SNX’s efficiency these days. Its $1.47 press time represents a 68% drop from its August highs. This explicit August excessive is necessary as a result of it marked the tip of the token’s final bull run which lasted between June and August. Extra importantly, the rally began from the identical vary as its present value vary.

Supply: TradingView

In different phrases, SNX’s present value vary is inside a key help vary and is now retesting its June lows. The probability of a bullish bounce from this vary is kind of excessive, particularly now that ETH whales are beginning to accumulate.

An evaluation of SNX’s metrics might assist present extra readability in regard as to if it’s in a superb purchase vary. Traders ought to word that there’s nonetheless a large probability that the token might proceed to go down.

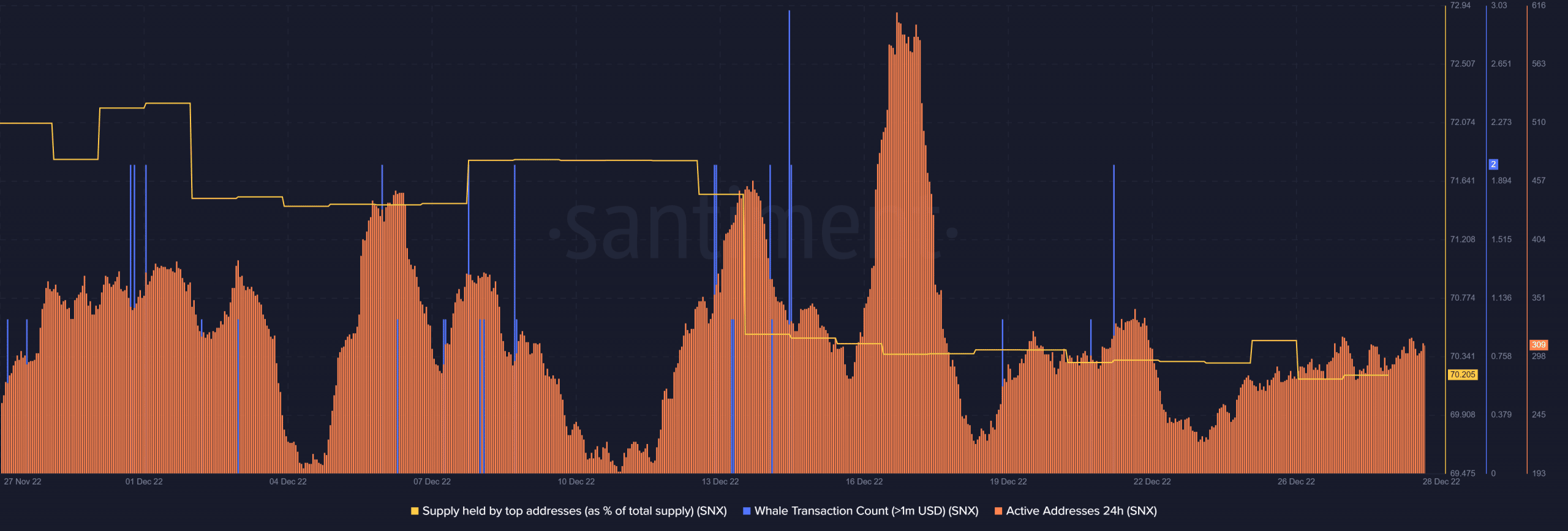

Bullish expectations on the present value degree might not essentially yield a pointy restoration. The provision held by the highest addresses remains to be comparatively low, indicating that whale exercise remains to be underwhelming.

Supply: Santiment

Whale transaction depend has additionally been missing within the final 4 days, confirming an absence of robust demand. The identical narrative is taking part in out on the retail entrance. The 24-hour lively addresses metric registered extra exercise within the final 4 days, however, at press time, it was nonetheless comparatively low.

What number of SNXs are you able to get for $1?

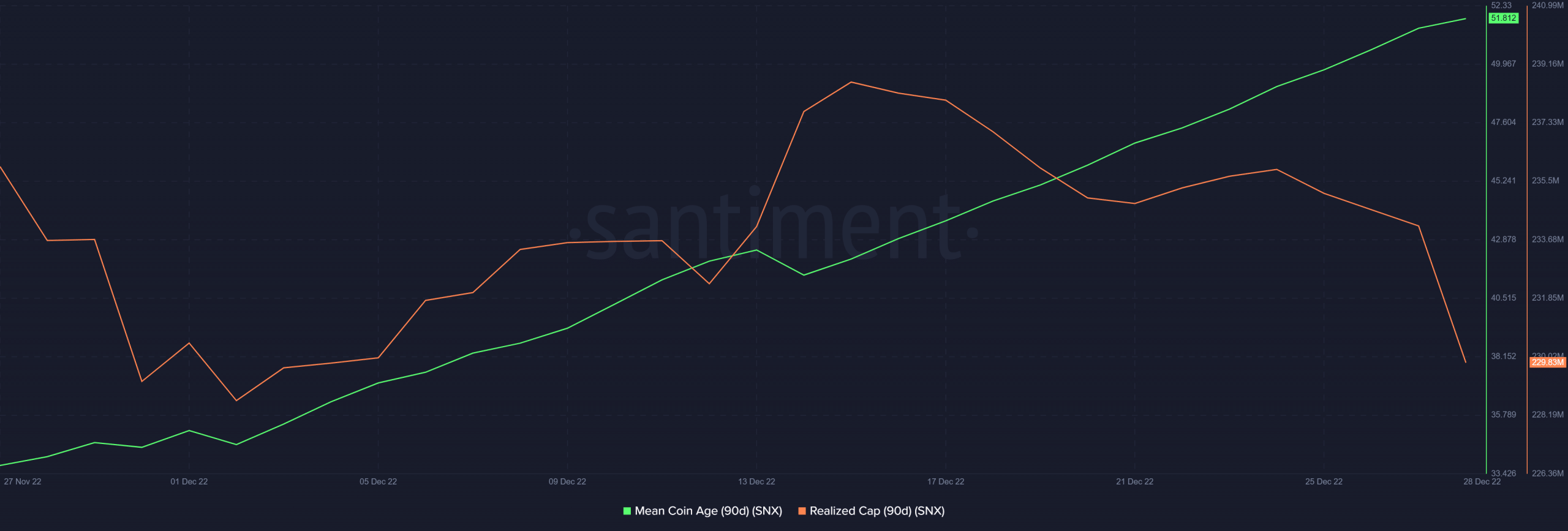

On the plus aspect of issues, the 90-day imply coin age was up within the final 4 weeks. That is affirmation that almost all SNX holders are holding on to their cash fairly than promoting them. Effectively, that is good for the token’s long-term worth.

Supply: Santiment

SNX’s 90-day realized cap metric tanked since mid-December. This means that many of the buyers are usually not but in revenue.

The alt’s value motion already demonstrates friction for the bears. Nonetheless, bullish demand remains to be low. Maybe that is an indicator that we would not see a pointy uptick within the second half of this week.