- BTC has logged unfavorable funding charges for the primary time this yr.

- On-chain knowledge reveals elevated promoting as many exit buying and selling positions.

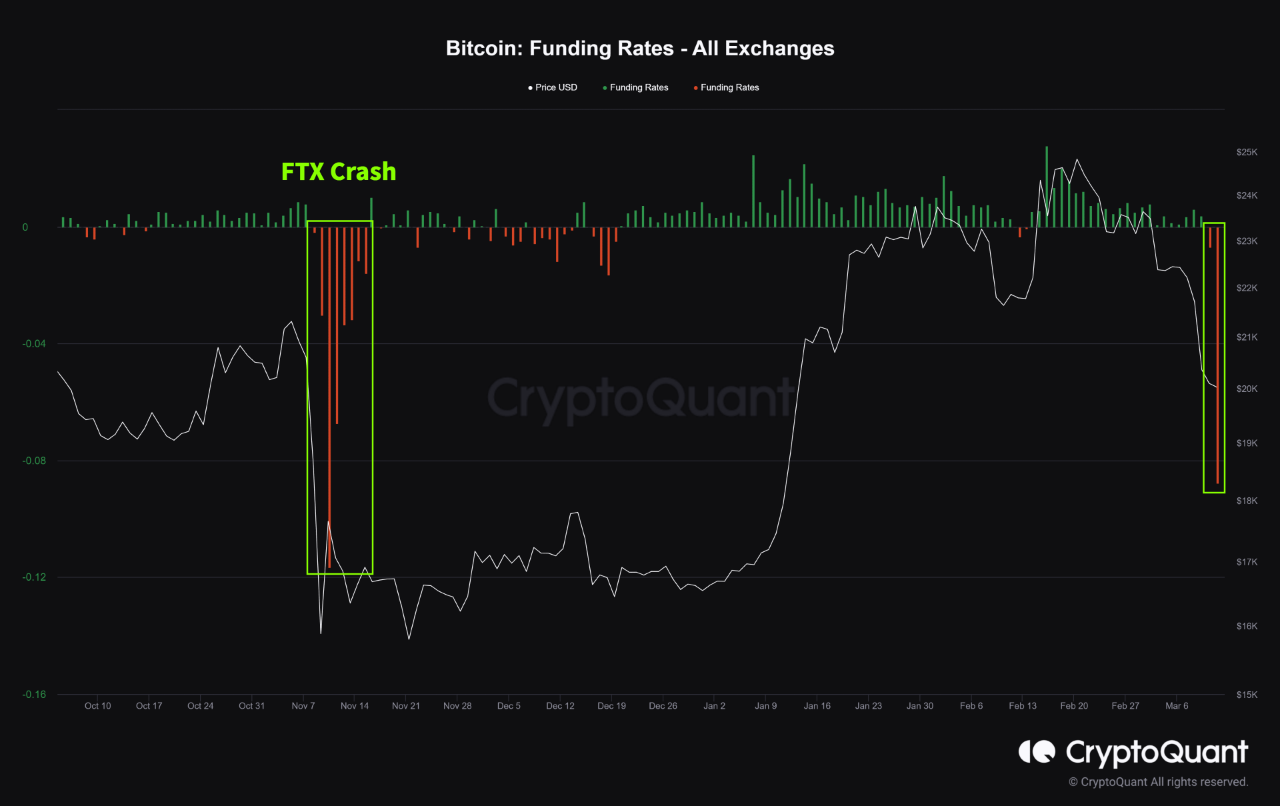

Because the cryptocurrency market grapples with the uncertainty that lies forward as banks resume operations on Monday, Bitcoin’s [BTC] funding charges turned unfavorable for the primary time because the yr started, knowledge from CryptoQuant revealed.

The BTC market has been hit by unfavorable sentiments because the Silicon Valley Financial institution saga started, in accordance with CryptoQuant’s Jay Bot. Consequently, funding charges turned unfavorable for the primary time this yr and have reached ranges much like these seen when FTX collapsed in November 2022.

Learn Bitcoin [BTC] Worth Prediction 2023-24

Funding charges are the charges merchants pay to carry positions in futures markets. When the funding fee turns unfavorable, merchants are paying extra to carry lengthy positions than brief positions.

Jay Bot, nonetheless, opined:

“If unhealthy information disappears and Bitcoin costs rebound, a brief squeeze might happen because the overheated brief positions are liquidated.”

Supply: CryptoQuant

BTC bears take management as market sentiment turns bitter

An on-chain evaluation of BTC’s efficiency thus far this weekend confirmed the exit of buying and selling positions by buyers.

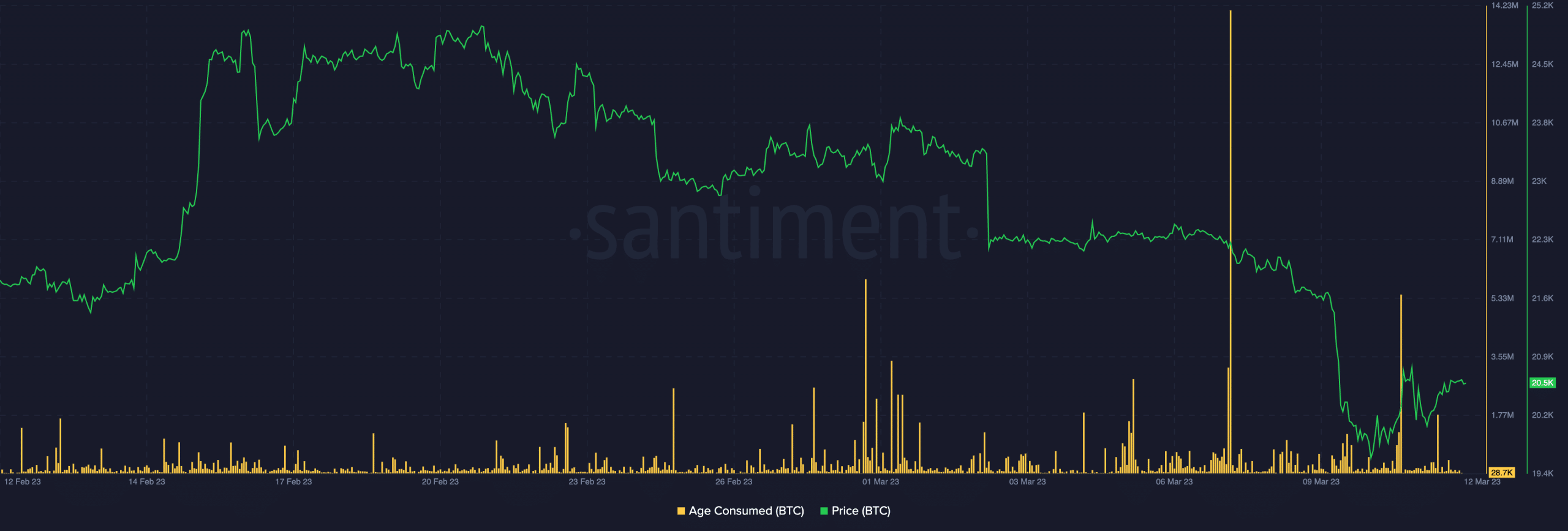

Knowledge from Santiment revealed a spike in BTC’s Age Consumed metric within the early buying and selling hours of 11 March. Traders’ confidence declined because the buying and selling day progressed, inflicting the worth of BTC to drop.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

A spike in an asset’s Age Consumed metric signifies that many beforehand idle tokens are actually being transferred between addresses. This means that there was a sudden and powerful change within the habits of long-term holders, who’re usually identified for making cautious selections.

HODLers and skilled merchants are identified for being deliberate of their actions, which is why the elevated exercise of dormant cash usually coincides with main shifts in market circumstances.

Moreso, a spike in Age Consumed adopted by a value drawdown, as is the case right here, marks the formation of a neighborhood prime, which regularly marks the start of a interval of value decline.

Supply: Santiment

Moreover, as BTC’s value dropped on 11 March, its Alternate Influx rallied, per knowledge from Santiment.

Typically, a rise within the variety of cash transferring to identified alternate wallets simply earlier than a neighborhood prime can point out a widespread sell-off.

Generally, this sell-off could also be too sudden and important for the bulls to handle. Nonetheless, this has been nothing out of the extraordinary in BTC’s case.

Supply: Santiment