- ETH whales make the most of the chance to make short-term features for Shiba Inu.

- An absence of robust demand could relegate SHIB to a slender vary.

In line with a Whalestats evaluation on 5 January, Shiba Inu [SHIB] made its method again to the highest 10 listing of crypto tokens by buying and selling quantity among the many 500 largest ETH whales.

It is a good signal so far as demand is anxious, as the worth was trying to bounce off a significant help stage. Nonetheless, there may be a twist to this remark that will not translate to bullish volumes.

JUST IN: $SHIB @Shibtoken is again on prime 10 by buying and selling quantity amongst 500 largest #ETH whales within the final 24hrs 🐳

Peep the highest 100 whales right here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see knowledge for the highest 500!)#SHIB #whalestats #babywhale #BBW pic.twitter.com/e9KCp8HHCF

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 5, 2023

Are your holdings flashing inexperienced? Examine SHIB revenue calculator

Whale exercise will be lower each methods by contributing both bullish or bearish volumes. The final time ETH whale exercise favored SHIB was on the finish of December.

Quick ahead just a few days later, and the cryptocurrency had already achieved some upside. Not a robust upside, however sufficient to generate sizable earnings for big trades.

One other run-of-the-mill retail shakedown?

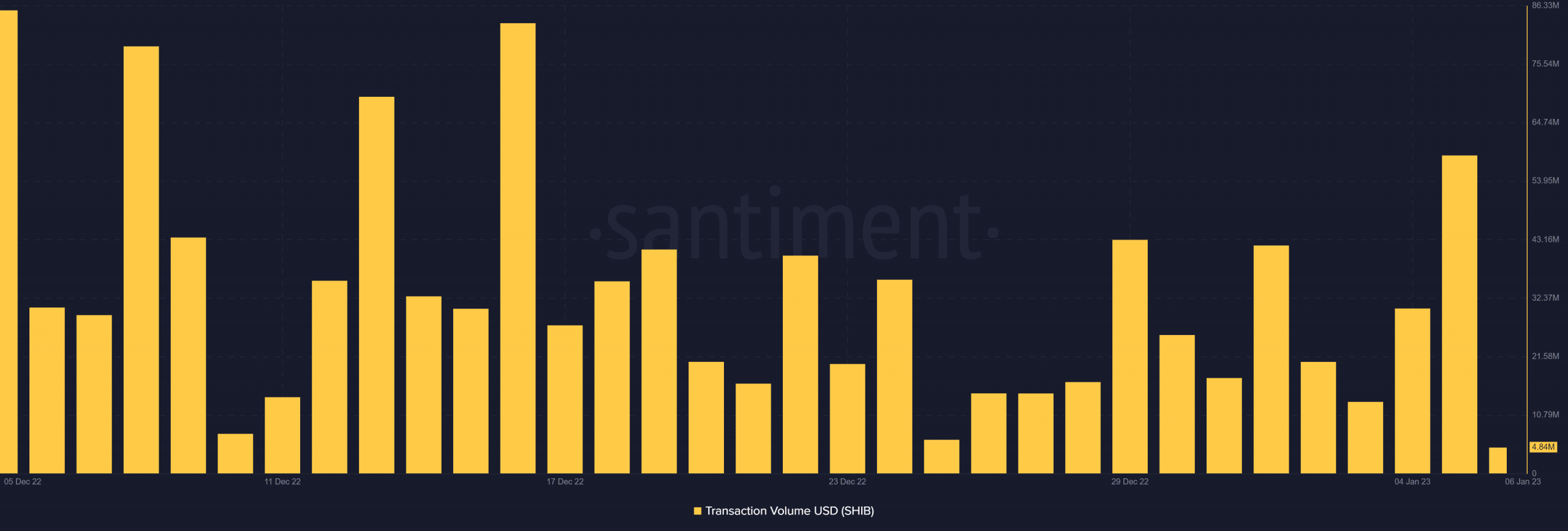

SHIB’s transaction quantity noticed a surge that peaked on 29 December. The transaction quantity dipped for the following few days till 5 January, when there was one other spike in transaction quantity.

Supply: Santiment

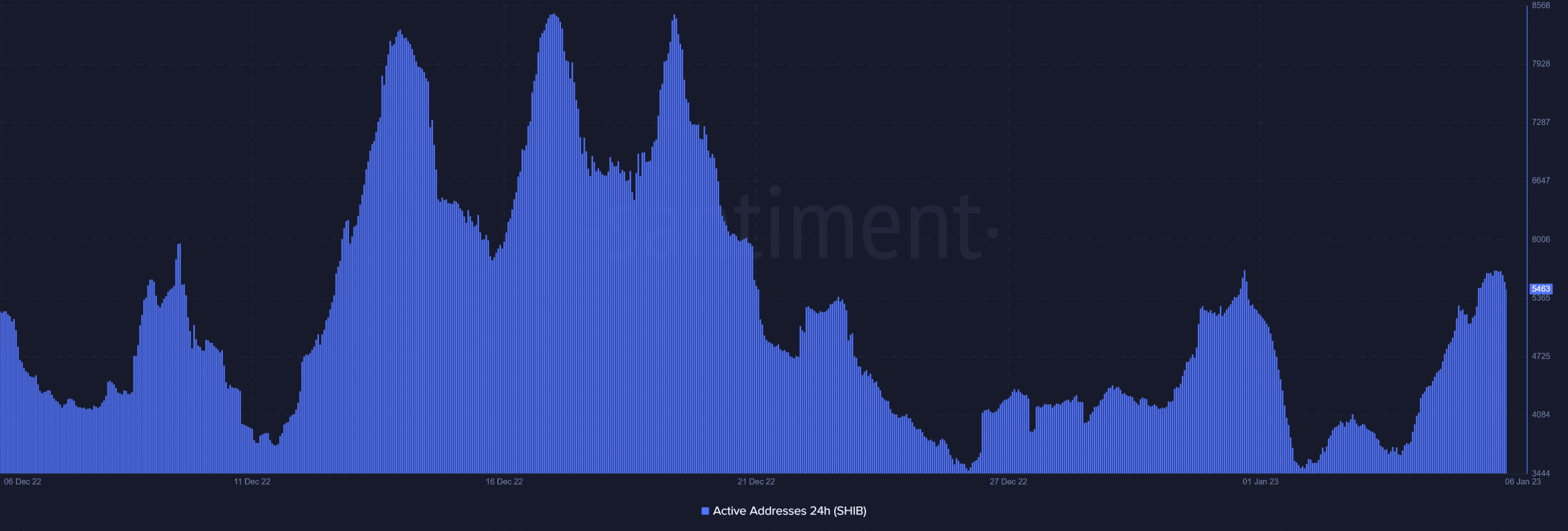

Furthermore, there was an attention-grabbing correlation between the transaction quantity and tackle exercise. There was a surge in 24-hour lively addresses from 26 December – 1 January earlier than exercise rapidly tapered out. There was one other resurgence of tackle exercise from 4 January till the time of writing.

Supply: Santiment

These observations indicated that ETH whales have been concentrating on short-term marginal earnings, and right here’s why. The spike in tackle exercise and transaction quantity in direction of the tip of December led to a bullish pivot. This was backed by accumulation by ETH whales, which can have inspired retail merchants to FOMO in, creating some exit liquidity.

What do the metrics of Shiba Inu recommend?

An outline of the worth motion throughout the identical interval could assist hammer down the identical level. SHIB managed to tug off a rally by as a lot as 12% from its December lows, which resulted in an interplay with the 50-day shifting common.

Supply: TradingView

What number of SHIBs are you able to get for $1?

The attention-grabbing factor right here is that the 50-day MA acted as a sign for profit-taking. This additionally occurred because the RSI touched its mid-point, thus contributing to a different promote sign. Therefore the current surge in ETH whale volumes would possibly really be promote stress. The worth has since then dropped by roughly 5% to its press time worth.

SHIB’s current upside seems prefer it was backed by low exercise, thus the shortage of robust momentum. ETH whales could thus have taken the benefit of cashing out some earnings. Thus, SHIB could enter a slender vary as soon as once more within the brief time period, contemplating the present help stage and restricted demand.

![Shiba Inu’s [SHIB] short-term upside might be limited, here’s why](https://cryptonitenews.io/wp-content/uploads/2023/01/1667553882961-e04dac77-0690-4ab9-b4f7-6f851e7664e2-1000x600-768x461.png)