The Bitcoin worth has presently stabilized strongly across the $17,000 mark. Nevertheless, the value might face additional headwinds within the coming days, because the VIX exposes.

The VIX is a real-time volatility index from the Chicago Board Choices Trade (CBOE). It was created to quantify market expectations of volatility.

In doing so, the VIX is forward-looking, that means that it solely reveals the implied volatility of the S&P 500 (SPX) for the following 30 days.

Mainly, if the VIX worth goes up, the S&P 500 will doubtless go down, and if the VIX worth goes down, the S&P 500 will doubtless stay secure or go up.

That is precisely what was seen yesterday. The VIX bounced as much as 19, a stage that was final seen in mid-August. Because of this, the S&P 500 misplaced the weekly help space at 4040 and fell 1.8%. In August, the final time the VIX was this low, it rebounded, and the S&P 500 fell 15%.

The Significance Of The VIX For Bitcoin

Moreover the VIX and the S&P 500, you will need to perceive that Bitcoin, with larger beta, is very correlated with the S&P 500. Which means the Bitcoin worth is extra delicate to modifications out there in each instructions.

As predicted by the VIX, BTC bounced off the $17,400 horizontal resistance yesterday and dropped under $17,000.

In October, when the VIX was down, and the S&P 500 was up, Bitcoin skilled a black swan occasion with the FTX collapse, after which BTC fell to $15,500. Thus, the Bitcoin worth didn’t benefit from the momentum of the VIX.

For the time being, a attainable reversal of the VIX at 19 might function a sort of sentiment barometer for the S&P 500 and Bitcoin for the following few weeks. The VIX is being in comparison with the 2006-2009 crash, a nasty outlook that might imply a lot decrease costs.

Analyst Sam Rule writes that the latest BTC rally following shares is happening at a time when the VIX is depressed to a stage of 20. Though there was a large business leverage wipe-out within the crypto business, the inventory market has but to expertise such an occasion.

Given Bitcoin’s correlation with the S&P 500, this might imply one other worth drop, as Rule writes:

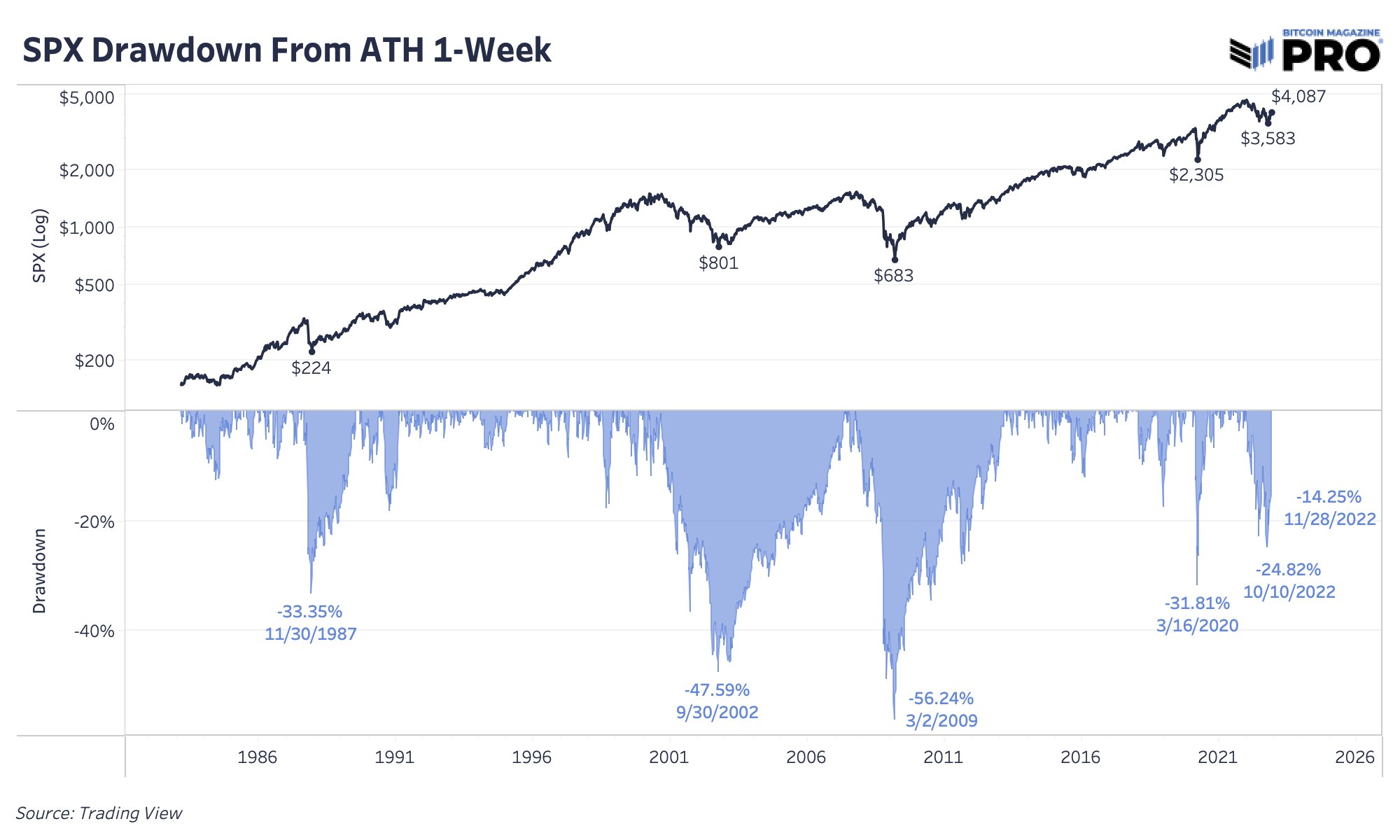

Is 25% drawdown from ATH all we’re getting in S&P 500 this cycle throughout the popping of the good all the pieces bubble? Would you count on #BTC to backside right here if SPX situation fell >40% from ATH in coming months?

SPX drawdowns from ATH 1-week, Supply: Twitter

Why VIX Has Restricted Applicability To BTC

Nevertheless, the VIX shouldn’t be used as the only real deterministic indicator of future market course. Why?

The VIX depends on expectations set by previous occasions fairly than what is going to occur sooner or later. Buyers are notoriously susceptible to irrational exuberance.

As well as, the VIX can’t account for sudden, surprising occasions that may trigger robust market reactions. Nevertheless, these occasions are key to figuring out a change in market course, corresponding to a bear market backside.

Subsequently, Bitcoin buyers also needs to regulate different elements, such because the upcoming determination by the U.S. Federal Reserve on additional rate of interest coverage, additional contagion results within the crypto market, and different intrinsic elements, corresponding to miner capitulation.