- DOT’s RSI and stochastic had been oversold, which was bullish

- Metrics additionally supported a value hike whereas a number of of the indications had been in opposition to it

Polkadot’s [DOT] latest value motion was not on top of things because it registered destructive weekly progress. As per CoinMarketCap, DOT was down by practically 3% over the past seven days. Moreover, it was buying and selling at $4.49 with a market capitalization of over $5.1 billion.

Nevertheless, CryptoQuant’s data revealed that issues may take a U-turn quickly!

Learn Polkadot’s [DOT] Value Prediction 2023-24

A celebration for buyers

As per CryptoQuant, Polkadot’s Relative Energy Index (RSI) and stochastic had been each in oversold positions. This was a serious bullish indicator that steered a value surge within the coming days.

Curiously, Polkadot Insider, a well-liked Twitter deal with that posts updates associated to the Polkadot ecosystem, revealed its weekly stats. This additional established the recognition of Polkadot within the crypto neighborhood.

Moreover, as per the tweet, Polkadot’s social engagement exceeded 43 million, reflecting its reputation. Not solely that, however Polkadot’s Galaxy rating additionally seemed constructive.

Due to @LunarCrush, we aggregated some vital social metrics about $DOT 👇

Let’s check out our graphic under. It is going to present you ways the neighborhood feels about @Polkadot within the final 7D 🔥#Polkadot $DOT #DOT pic.twitter.com/iVQFkoaUrV

— Polkadot Insider (@PolkadotInsider) December 25, 2022

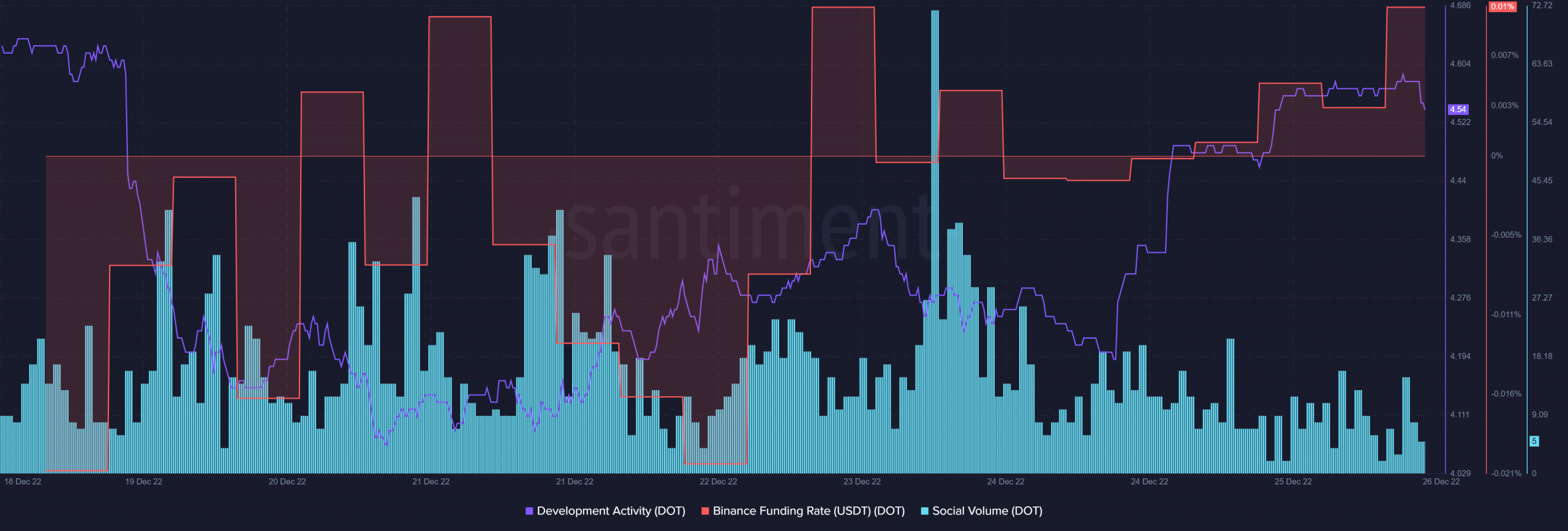

Moreover, Polkadot’s metrics additionally confirmed indicators of restoration, as most metrics steered that the token’s value would rise within the coming days. For example, DOT’s Bionance funding charge registered a rise, reflecting its demand within the derivatives market.

DOT’s improvement exercise additionally went up, which could possibly be taken a constructive sign. DOT additionally managed to stay fashionable as its social quantity spiked final week.

Supply: Santiment

Are your DOT holdings flashing inexperienced? Examine the Revenue Calculator

The ‘however’ buyers ought to be careful for…

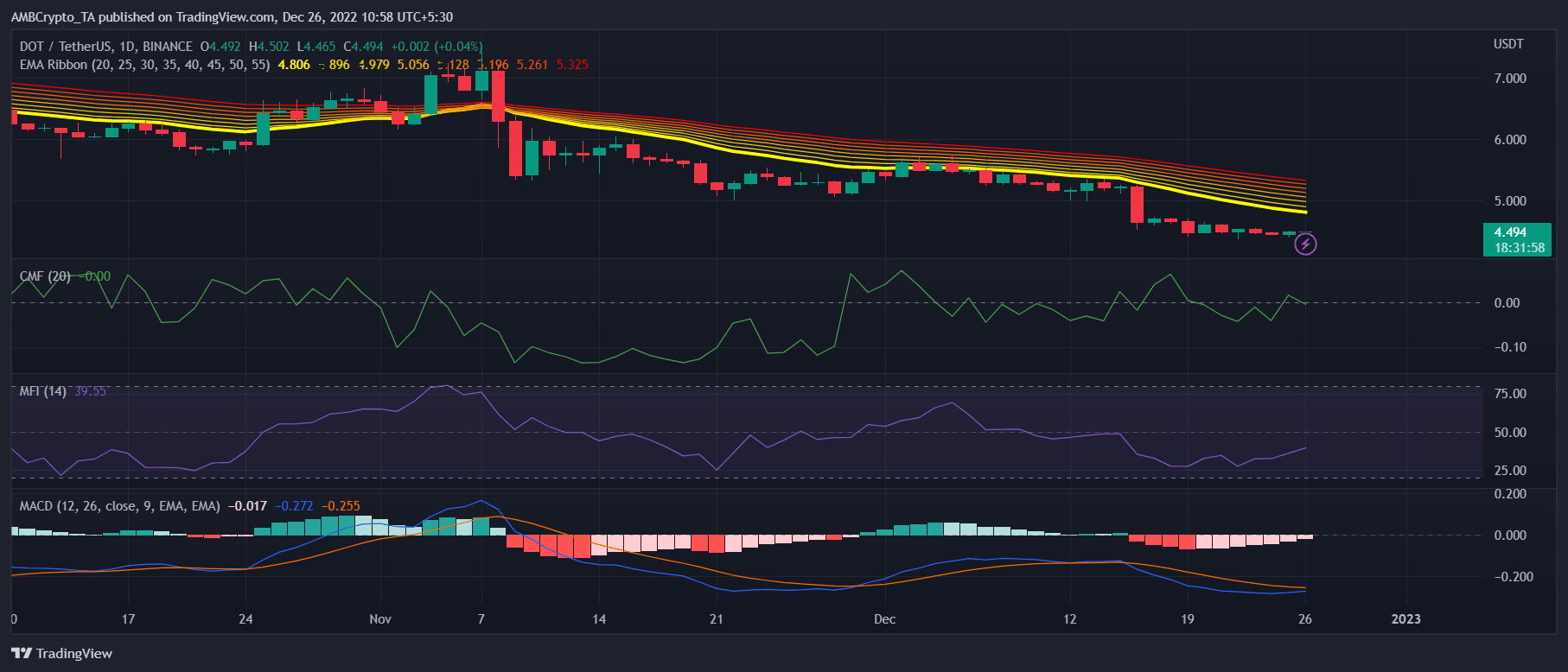

Whereas the metrics seemed bullish, DOT’s market indicators revealed an ambiguous image. For example, the Exponential Transferring Common (EMA) Ribbon identified that the bears had been main the market.

Furthermore, the Chaikin Cash Stream (CMF) additionally registered a slight downtick, which was regarding. Nonetheless, the Transferring Common Convergence Divergence (MACD) steered that the bulls may quickly take over because it displayed the potential for a bullish crossover.

DOT’s Cash Stream Index (MFI) additionally registered an uptick, which was within the patrons’ favor.

Supply: TradingView