Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The fast surge of DOT costs over the previous week has emboldened bulls

- Bears can look ahead to a rejection across the $5.11 degree

Bitcoin climbed previous the $17k mark and most cash within the crypto market noticed aid rallies as properly. Many belongings noticed their increased timeframe market construction overwhelmed and flipped to a bullishly biased one.

Learn Polkadot’s Value Prediction 2023-24

Polkadot was one in all these belongings. It has posted important positive aspects regardless of the fearful sentiment of the previous few weeks. The inefficiency on the charts has been crammed, and a rejection at key Fibonacci retracement degree might see a reversal.

Polkadot reaches the psychologically important $5 mark

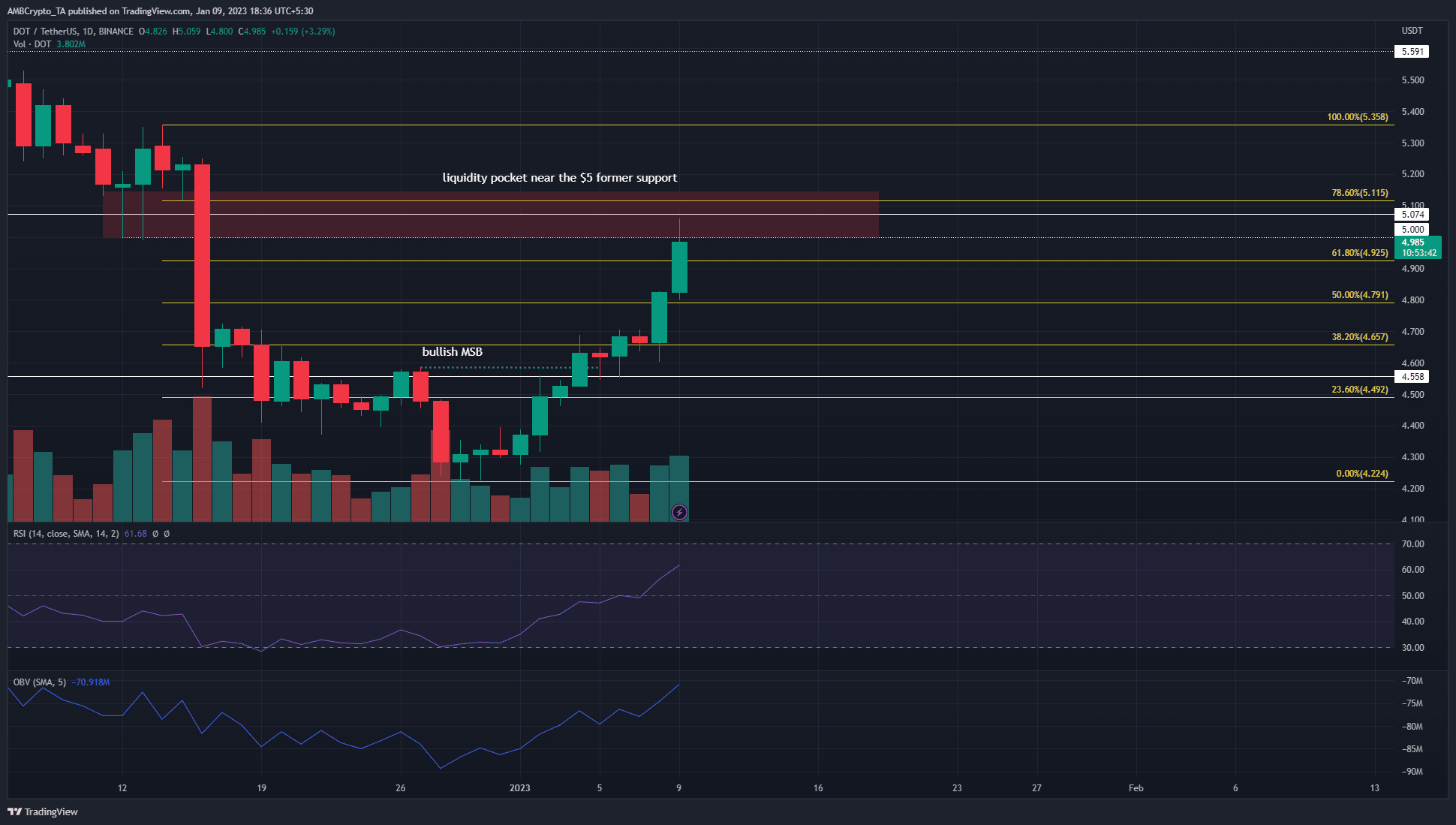

Supply: DOT/USDT on TradingView

The $5 mark is a vital spherical quantity that bulls can be desperate to beat. Furthermore it had confluence with the 78.6% Fibonacci retracement degree. This was primarily based on the transfer down from $5.35 to $4.22 in December.

The sharp fall final month noticed a good worth hole seem on the each day and 12-hour chart that prolonged from $4.7 to $4.99. This inefficiency has been crammed on the time of writing. Nevertheless, the market construction was bullish, having been flipped just a few days earlier. Taken collectively, it could possibly be the case that the worth has shot increased to gather liquidity simply as BTC runs right into a zone of resistance at $17.3k.

Are your holdings flashing inexperienced? Examine the DOT Revenue Calculator

To the north, a pocket of liquidity ran from $5 to $5.15. This area can see some decrease timeframe promoting strain. On the each day chart, the RSI confirmed robust bullish momentum with a studying of 61 and the OBV additionally made positive aspects.

But, a transfer above $5.11-$5.15 and a retest of this zone would supply bulls the next probability of one other transfer upward towards $5.35. This was as a result of the $5 and $5.11 ranges can act as cussed resistance ranges.

Merchants can look ahead to a decisive transfer previous $5.11 earlier than shopping for. Alternatively, they will look ahead to a transfer to the $5.11-$5.15 area and search for a drop again under $5 earlier than seeking to enter quick positions. As issues stand, the market had not but proven its hand.

Spot CVD and Open Curiosity see some resurgence up to now few days however is it sufficient?

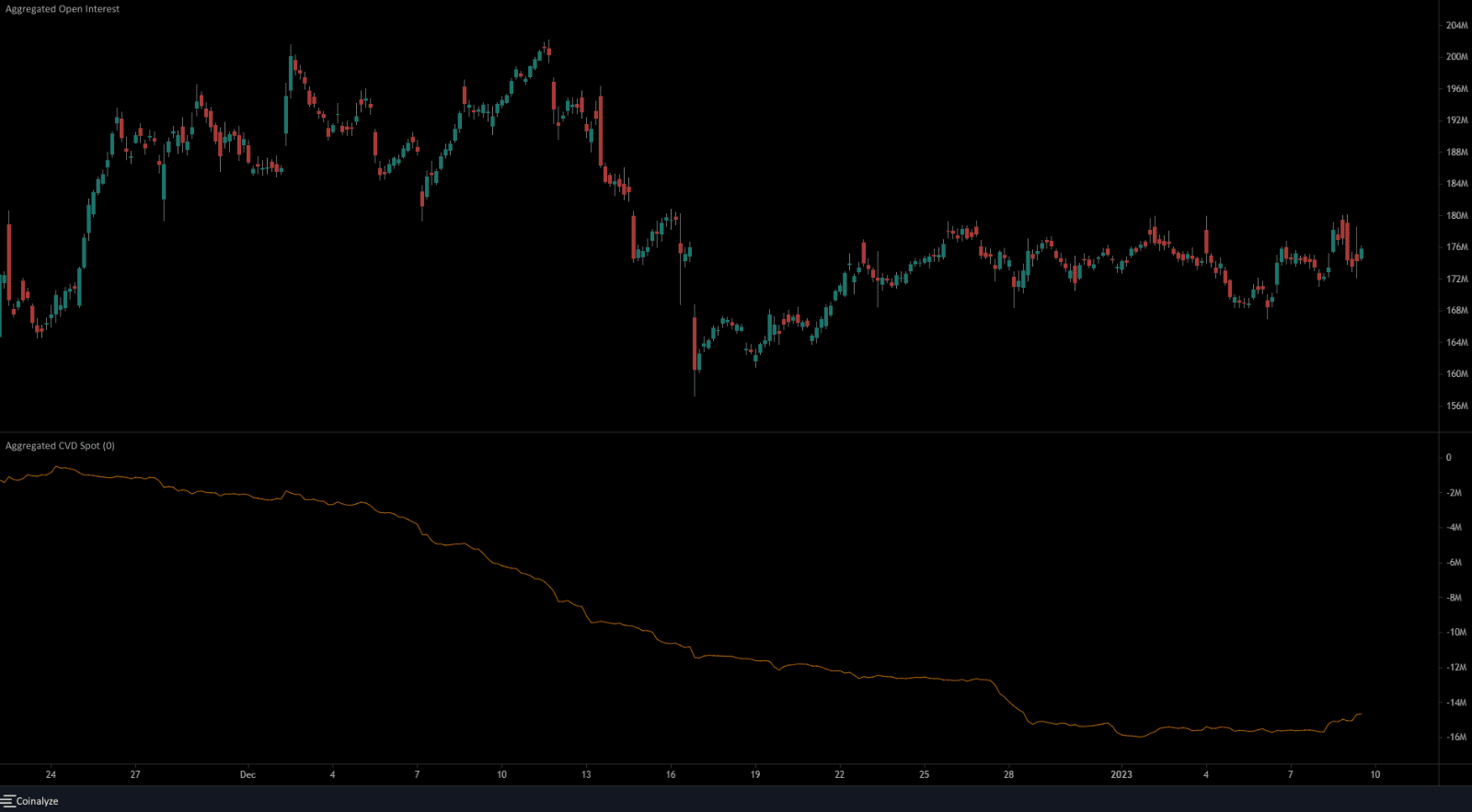

Supply: Coinalyze

Over the previous 5 days, the Open Curiosity has been slowly gaining floor to point out capital circulation into the market. In the meantime the worth has been in a robust uptrend. Subsequently, the inference was bullish momentum. The spot CVD additionally rose by a small margin to point out shopping for strain behind the coin.

Additional rise in costs alongside a rising OI will point out robust bullish sentiment, and patrons can search for decrease timeframe shopping for alternatives. In the meantime, a rejection on the $5.11 degree and a session shut beneath $5 thereafter might curiosity the bears.