NFT

Japan’s Nationwide Tax Company has printed an up to date guideline associated to the taxation of NFTs. Amongst different issues, NFT transactions in blockchain-based video games can be topic to taxation.

Japan’s Nationwide Tax Company has issued pointers for the taxation of NFT transactions, together with these concerned in blockchain video games. The authority printed the rules, providing a simplified technique to tax these transactions, that are quite a few and frequent.

The NTA said that “in-game foreign money (tokens) are incessantly acquired and used, and it’s difficult to judge every transaction.” As such, the taxation would solely contemplate the entire earnings based mostly on the in-game foreign money, evaluating it on the finish of the yr. It additionally mentions that taxation doesn’t apply if the asset isn’t exchanged outdoors the sport.

There may be some lack of readability relating to the taxation of NFTs, and traders within the house will need extra particulars on the precise tax calculation. Nonetheless, traders now know that earnings tax applies if an NFT is offered to a different celebration. Enterprise or miscellaneous earnings applies within the case of major NFT gross sales. ‘Switch earnings’”’ applies within the case of secondary gross sales.

NFT creators may also face their very own taxation. If creators promote their NFTs to Japanese shoppers and earn from them, they face consumption tax. There are extra such particular purposes of consumption tax, which the NTA will hopefully make clear quickly for Japan’s enthusiastic NFT use base.

Nationwide Tax Company Not the Solely One Specializing in NFTs

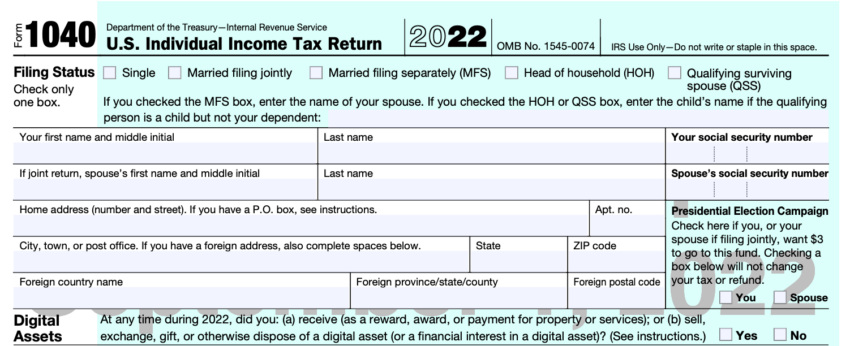

Japan is way from the one nation to start publishing tax pointers for NFTs. America just lately revised its tax varieties to make clear this matter. The Inside Income Service up to date pointers that NFTs can be taxed equally to different cryptocurrencies.

2022 1040 Tax Type Mentions Digital Belongings: IRS

The UK has taxed NFTs equally. The belongings are topic to capital positive aspects tax or earnings tax and comply with the identical taxation guidelines as typical cryptocurrencies.

79% of Indians need the federal government to manage crypto and NFTs, which may alter the established order. India has additionally imposed strict taxation for cryptocurrencies, which embody NFTs. This contains the minting of NFTs, which has doused the curiosity within the NFT market considerably within the nation.

Japan Making Large Strikes in Crypto

Whereas Japan is taxing crypto, the nation has proven curiosity within the web3 sector. Quite a few developments have taken place in current months, together with a proposed tax minimize by crypto advocates to maintain expertise within the nation. The nation hopes to revitalize its financial system by focusing strongly on the metaverse.

Banks are additionally becoming a member of in on the digital revolution. Nomura, one in all Japan’s largest banks, plans to roll out crypto buying and selling for institutional purchasers in early 2023. The agency will provide such companies as crypto buying and selling, DeFi, stablecoins, and NFTs.