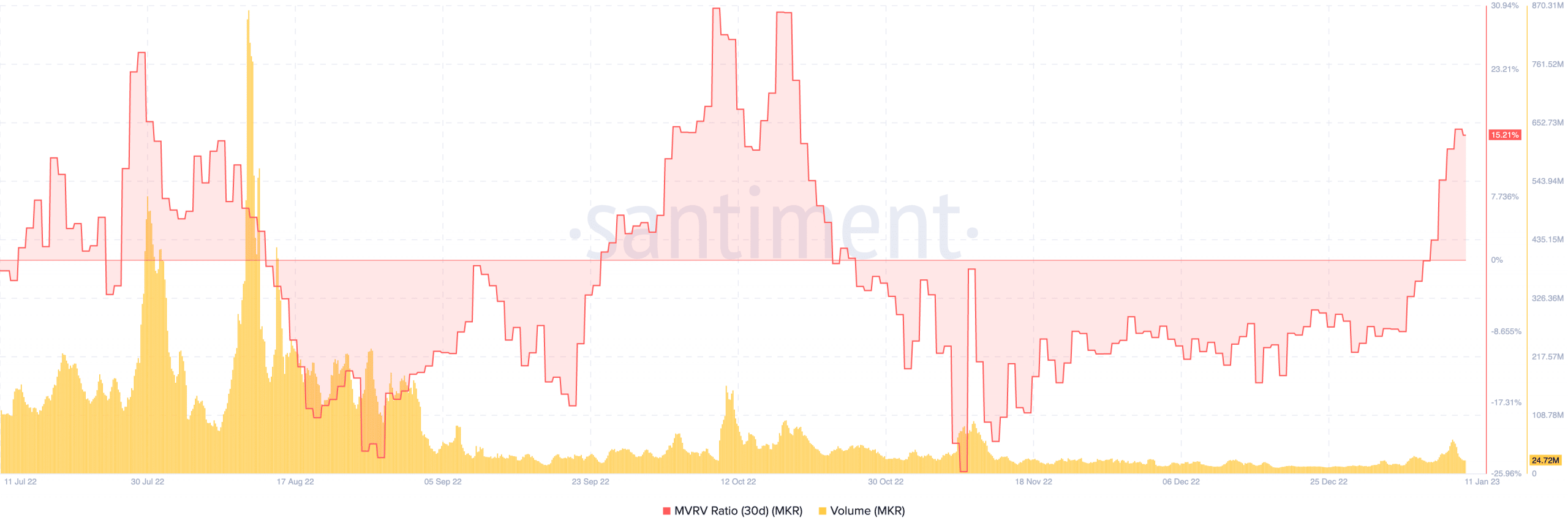

- The MVRV ratio standing confirmed that MKR was not but overbought

- Maker started a demo burn operation as 55% of its group voted towards the exercise

Based on an 11 January report lined by Santiment, the MakerDAO [MKR] value may not but right its development regardless of being one of many 12 months’s prime performers. The governance token of the Maker Protocol started the 12 months round $507.

But, it registered a 20.74% improve within the final seven days whereas buying and selling at $626.27 at press time. Cumulatively, its 30-day performance was a 5.92% uptick. This was the case regardless of many different cryptocurrencies recording reds throughout the identical interval.

Learn Maker’s [MKR] Value Prediction 2023-2024

The trail is just not but clear for bears

Often, the bull development displayed by MKR would possibly may falter very quickly, contemplating the market inconsistencies. However a exceptional reversal may very well be removed from it. The Santiment report, defending its viewpoint, talked about that the development of the Market Worth to Realized Worth (MVRV) ratio was chargeable for the judgment.

On the time of writing, the 30-day MVRV ratio was 15.52% regardless of being within the unfavorable area as of three January. The increase implied that MKR holders had made substantial positive factors in the previous couple of months and had been keen to promote.

Supply: Santiment

Nonetheless, the on-chain market intelligence platform identified that MKR was not “dangerously overbought.” Consequently, bullish calls for may not be over.

Nonetheless, the MKR quantity within the final 24 hours had subdued. At press time, the 24-hour buying and selling quantity shredded 49.37%. This meant that there had been a decline in profitable transactions on the Maker community.

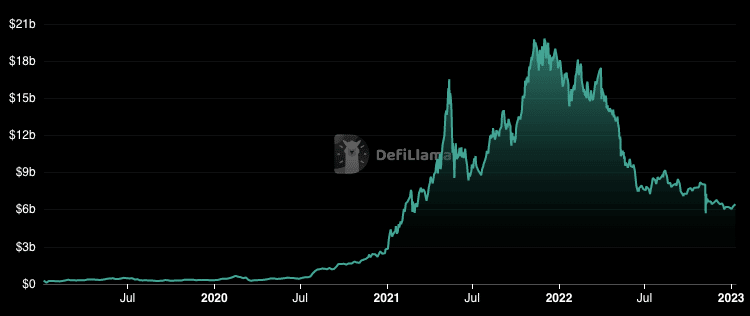

Regarding its Complete Worth Locked (TVL), info from DeFi Llama, maintained that Maker had been unable to retain the highest spot after dropping it to Lido Finance [LDO]. The MKR TVL gained 7.45% within the final seven days.

This left the TVL value $6.45 billion— a $1.5 million distinction from the LDO worth. Nonetheless, the rise confirmed that buyers had been within the dApps below the Maker chain whereas depositing into the protocols.

Supply: DeFi Llama

A 597.31x hike on the playing cards IF MKR hits Bitcoin’s market cap?

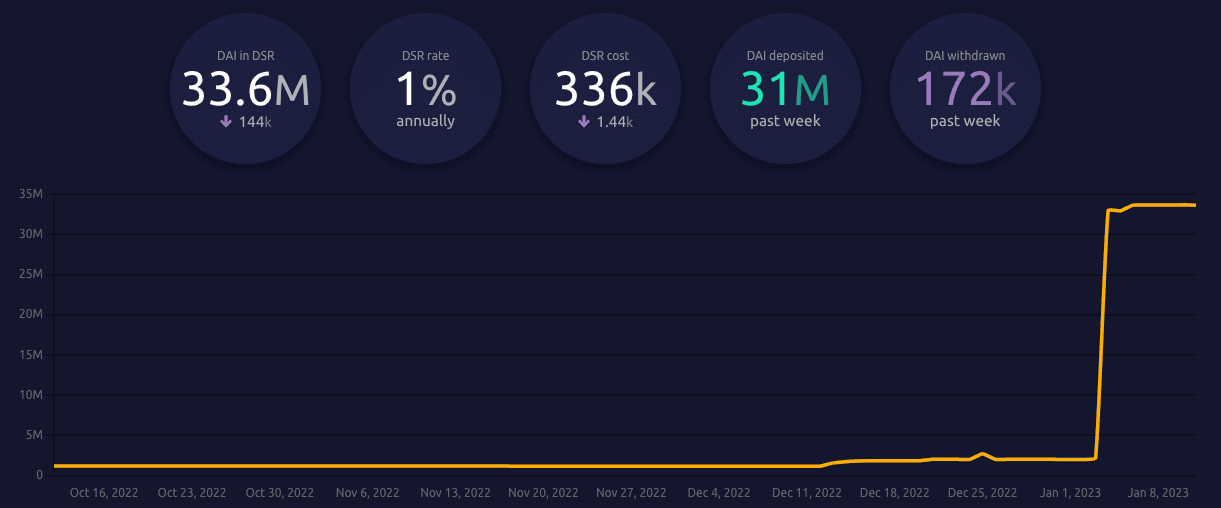

Burning the candles at each ends

Within the interim, the Maker group voted to reactivate the MKR burn. The buyback and burn mannequin goals to mint new DAI every time the stablecoin fluctuates from the greenback peg.

At press time, the continued voting outcomes confirmed that 55% had been towards burning any MKR. 30.68% opted for burning 0.5 million value of DAI, whereas 13.94% selected for the group to burn 3 million DAI. Nonetheless, Maker had already begun a trial operation which has seen an unimaginable variety of MKR burned since 3 January.

Supply: Makerburn