CryptoSlate evaluation of Bitcoin (BTC) metrics reveals that the market backside might have been reached as traders proceed accumulating BTC and pushing illiquid provide as much as 80%.

Analysts reviewed metrics, together with the MVRV-Z and Realized Value metrics, to find each point out bullish sentiments.

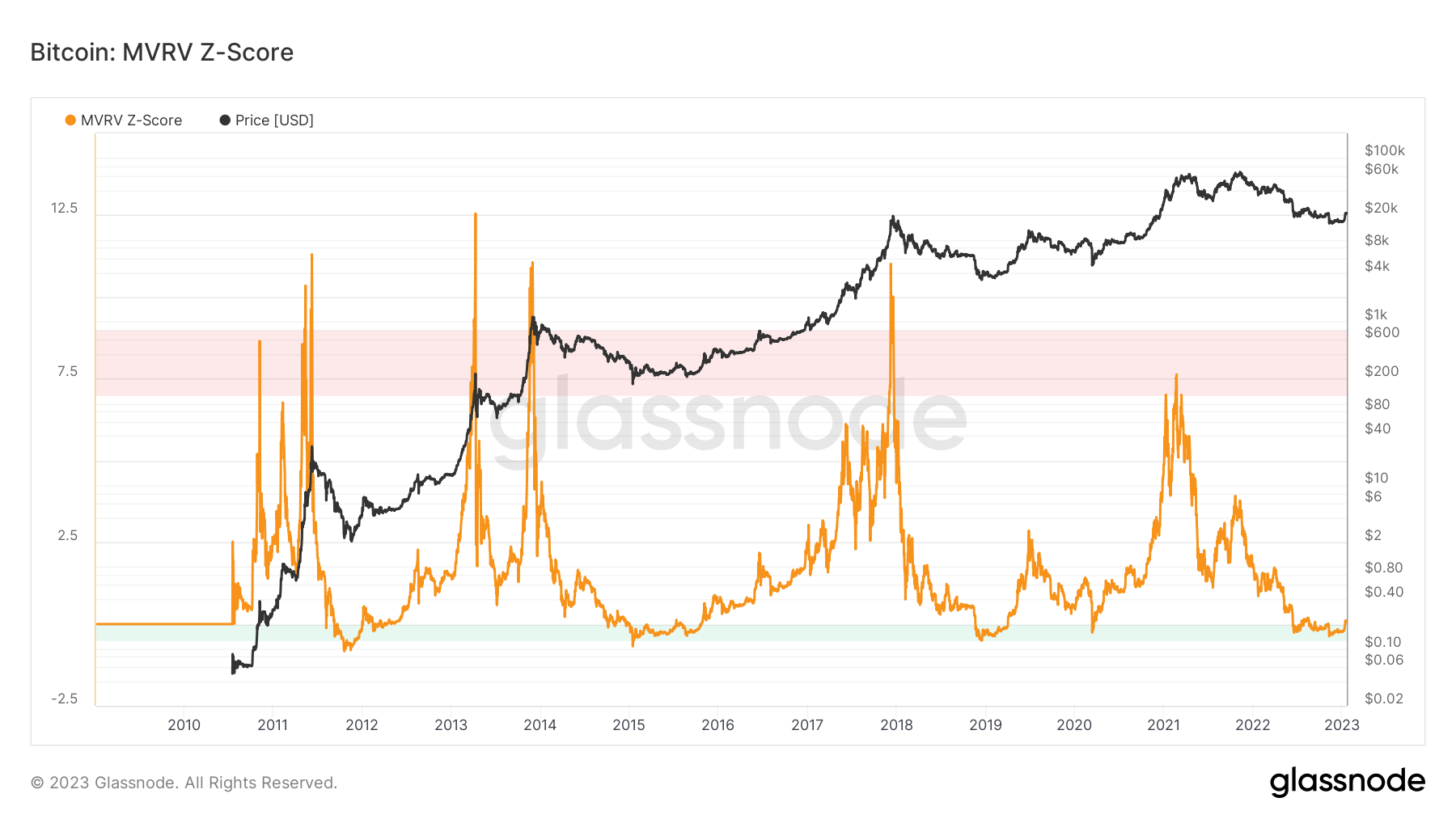

MVRV-Z metric

The MVRV-Z rating is used to evaluate whether or not BTC is over or under-valued. When the market worth is considerably increased than BTC’s “truthful worth,” the metric stays within the pink zone. Then again, if the worth is decrease than BTC’s realized worth, the metric lingers round within the inexperienced space. The chart under represents the MVRV-Z metric with the orange line.

The metric entered the inexperienced zone in mid-2022, proper after the LUNA collapse, and has been transferring throughout the inexperienced space since then. It solely broke via very not too long ago, which could sign that the market backside has been reached.

Traditionally, Bitcoin’s value has considerably decreased every time the MVRV-Z metric reached the pink zone. In accordance with the chart, this correlation has been seen six occasions since 2010. Due to this fact, it’s attainable to conclude that the MVRV-Z metric signifies a market prime whether it is within the pink zone.

Equally, historic proof additionally reveals that Bitcoin’s value will increase after the metric reaches the inexperienced zone, indicating a market backside. The value actions recorded in early 2012, 2015, 2019, and 2020 correspond to market bottoms.

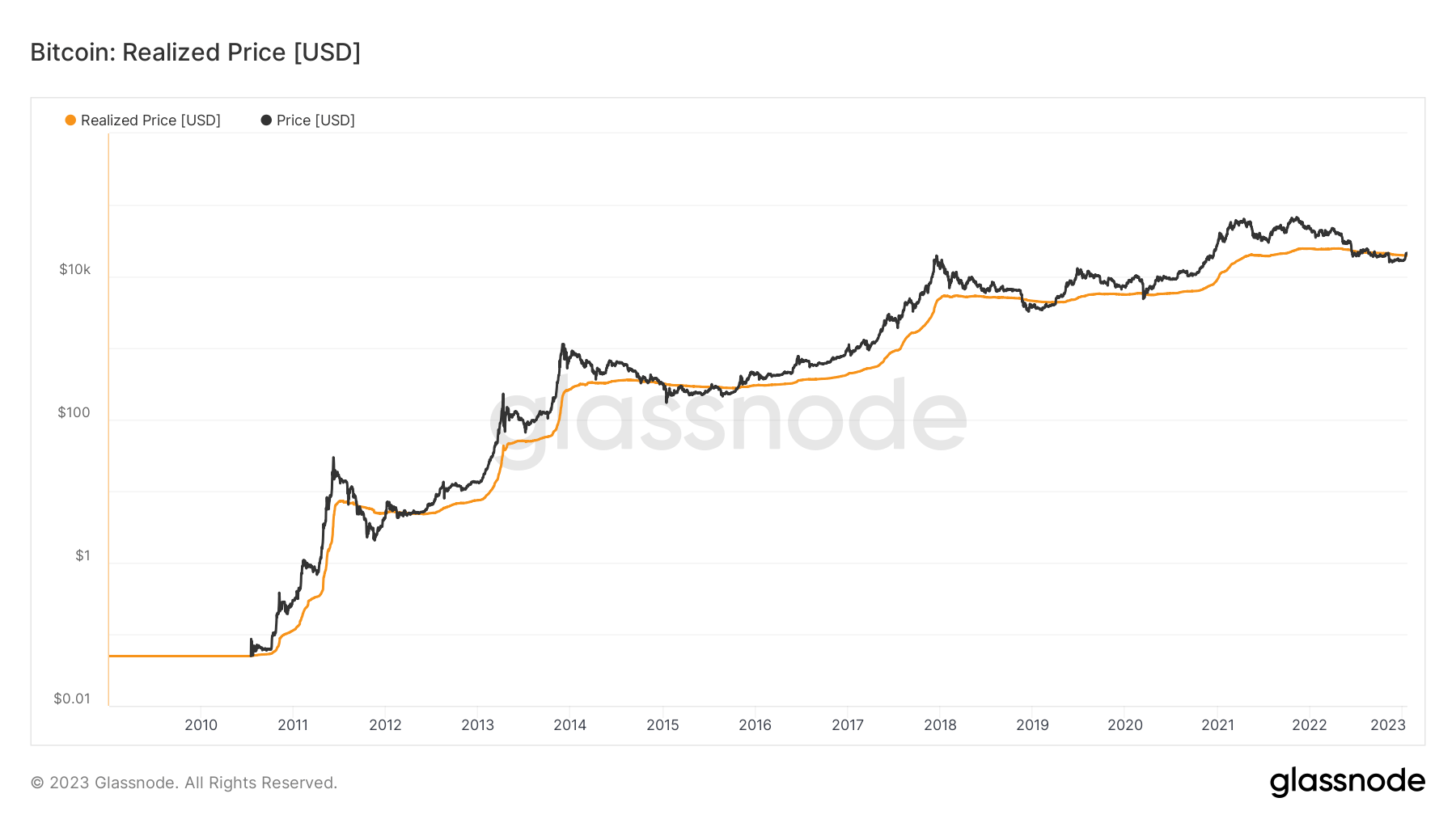

BTC realized value

The realized value is calculated by dividing the realized cap by the present provide. The metric signifies a bear market when the precise value falls under the realized value. Conversely, if the actual value will increase above the realized value, it signifies a bull market.

The chart above represents the connection between BTC’s realized value and precise value since 2010. The true BTC value has been under the realized value since mid-2022. Nonetheless, this steadiness modified very not too long ago because the precise value surpassed the realized value, which signifies a bull market sentiment.

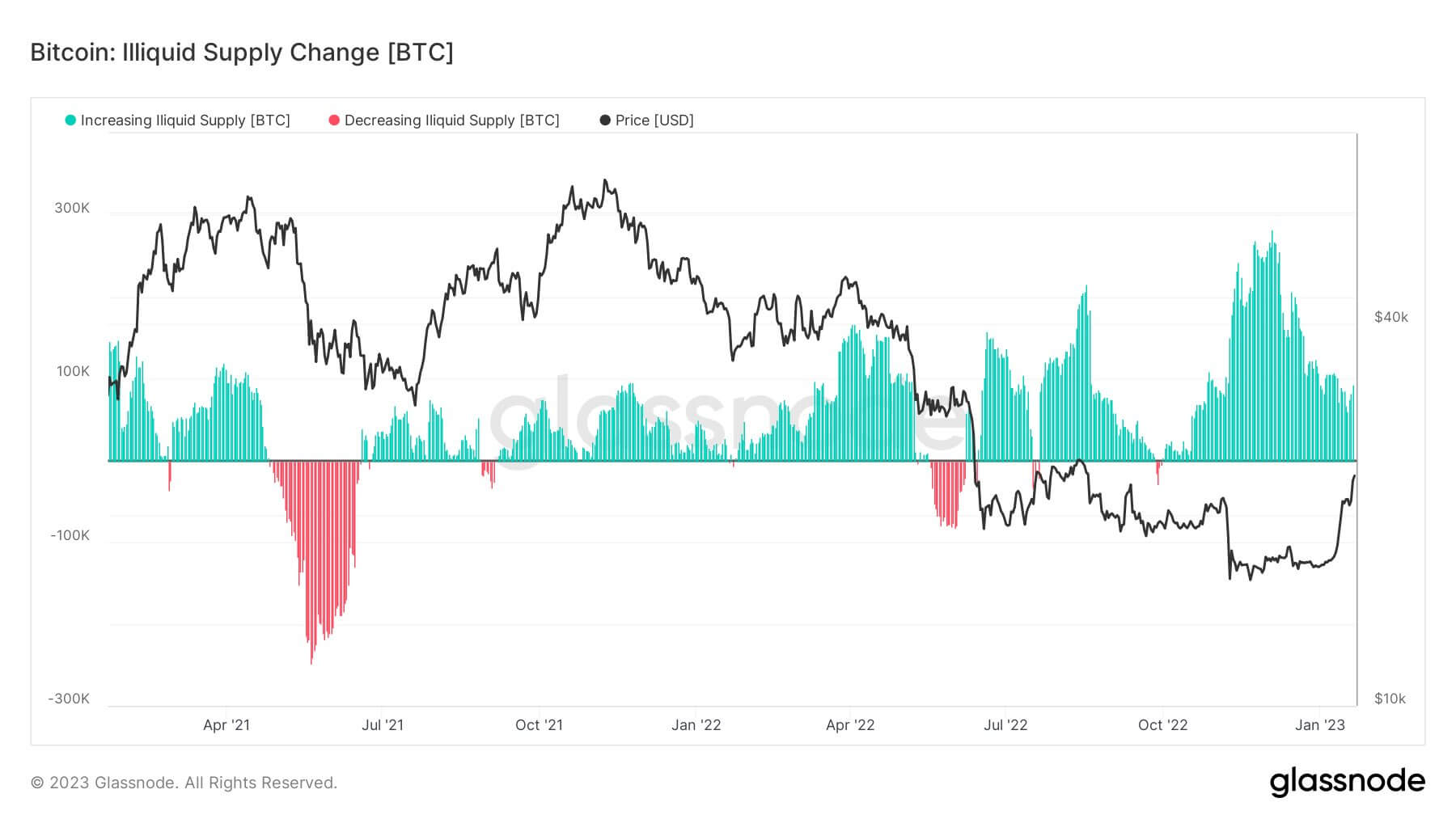

80% of BTC is illiquid

Buyers have been accumulating BTC over the previous few months. Nonetheless, cCyptoSlate evaluation from Dec. 13, 2022, revealed that the quantity of BTC that sat on exchanges had hit its all-time low since 2018.

The withdrawals have additionally been in giant chunks, and on the finish of November, over $2 billion price of BTC was withdrawn from Coinbase. On Dec. 23, Binance misplaced 90,000 BTC from its reserves in every week. One other $120 million price of Bitcoin was withdrawn from totally different exchanges in the course of the first ten days of 2023.

The present metrics have been signaling a BTC backside since Jan. 19. On Jan. 21, BTC broke via the $23,000 degree, recording a 50% improve since its bear-market low of $15,400. Nonetheless, the upwards value actions didn’t cease the BTC withdrawals. A0,000 BTC was withdrawn from exchanges on Jan. 20, with the bulk being pulled out from Binance.

Knowledge additionally signifies that a considerable amount of withdrawn BTC is being despatched to chilly storage. For instance, 450,000 BTC held on scorching wallets or exchanges have been moved to chilly storage in 2022.

One other 110,000 BTC has been despatched to chilly storage up to now in 2023. With this, the quantity of illiquid BTC held in chilly wallets reached an all-time excessive of 15.1 million cash. This quantity accounts for 80% of the entire circulating provide of BTC.

The chart above represents the illiquid BTC provide with the inexperienced zones whereas displaying the liquid provide with the pink. The BTC accumulations have considerably elevated the illiquid provide since July 2022, apart from transient intervals throughout July and October.