Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

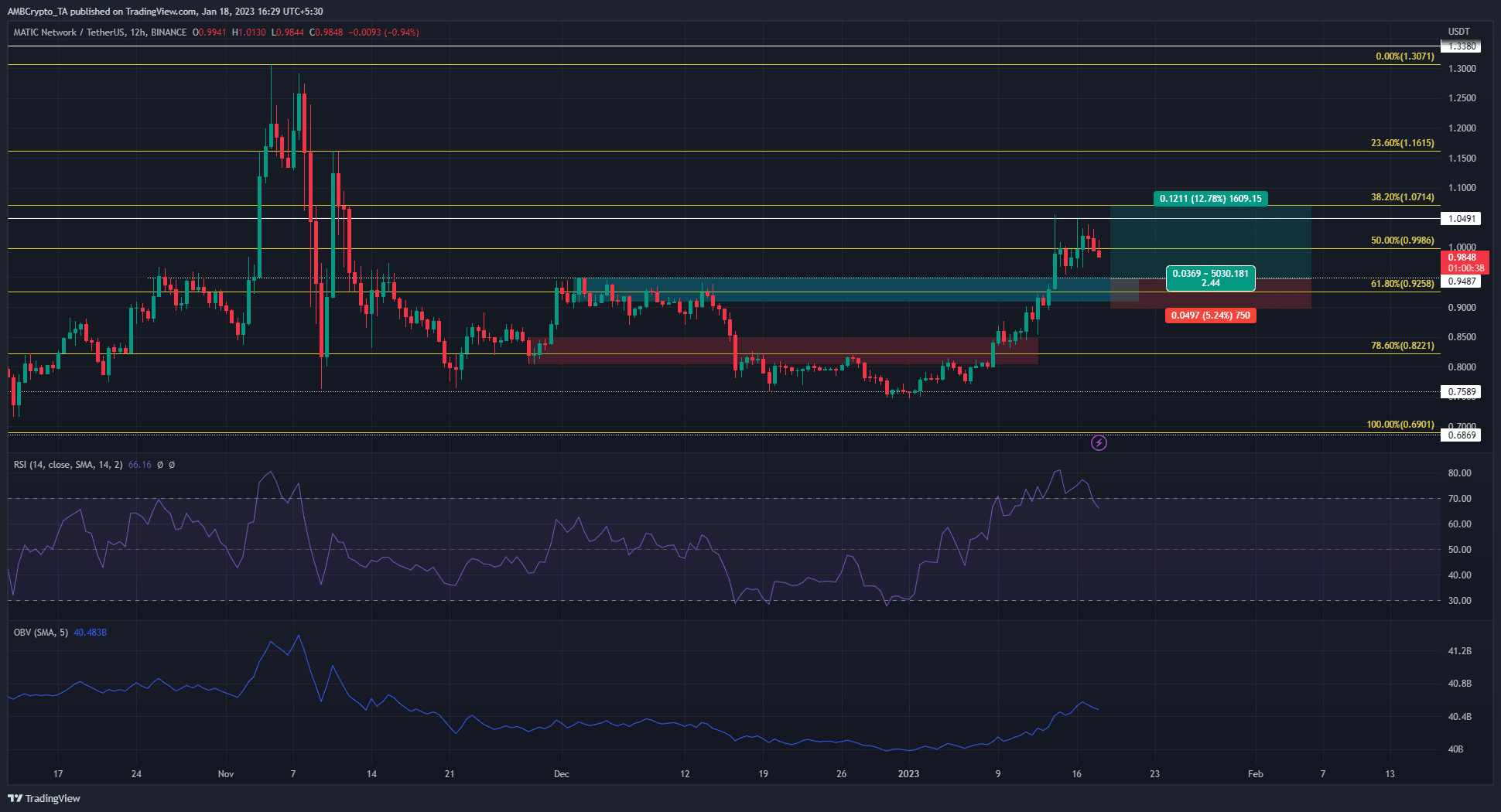

- The bullish breaker from early December 2022 represented an space of significance for MATIC on the 12-hour chart.

- The upper timeframe market construction was bullish and merchants might search for pullbacks to purchase.

Altcoins throughout the market noticed decrease timeframe promoting strain and retraced a minor quantity of the beneficial properties they’ve famous over the previous two weeks. Polygon’s [MATIC] native token was one such on the value chart.

Learn Polygon’s [MATIC] Value Prediction 2023-24

The $21.2k and $20.8k ranges are near-term important ranges for Bitcoin [BTC]. A dip beneath $20.8k might see BTC revisit the $20k mark and drag the altcoin market decrease. This situation could be excellent for MATIC merchants, as it will give a very good risk-to-reward shopping for alternative.

The confluence of horizontal help, breaker, and Fibonacci ranges confirmed sturdy help at $0.92

Supply: MATIC/USDT on TradingView

From September to November 2022, MATIC rallied from $0.69 to $1.3. A set of Fibonacci retracement ranges (yellow) have been plotted based mostly on this transfer upward. The 50% retracement stage lay close to $1, which was an essential psychological, spherical quantity stage.

The $0.95 stage highlighted on the chart has been important in current months. In mid-November, the value retested this stage as resistance earlier than a drop to the $0.76 swing low. In December, the world from $0.91-$0.95 (highlighted in cyan) acted as stern resistance.

How a lot is 1,10,100 MATIC value right this moment?

The world highlighted represented a bearish order block on the 12-hour chart fashioned in early December. Furthermore, January’s rally flipped this to a bullish breaker. The 61.8% retracement stage additionally sat inside this space of curiosity.

A 12-hour session shut beneath $0.955 will technically break the construction. It remained seemingly that the value would go decrease to hunt enthusiastic bulls earlier than rising upward as soon as extra. To the north, the Fibonacci ranges at $1.07 and $1.16 can be utilized to take a revenue.

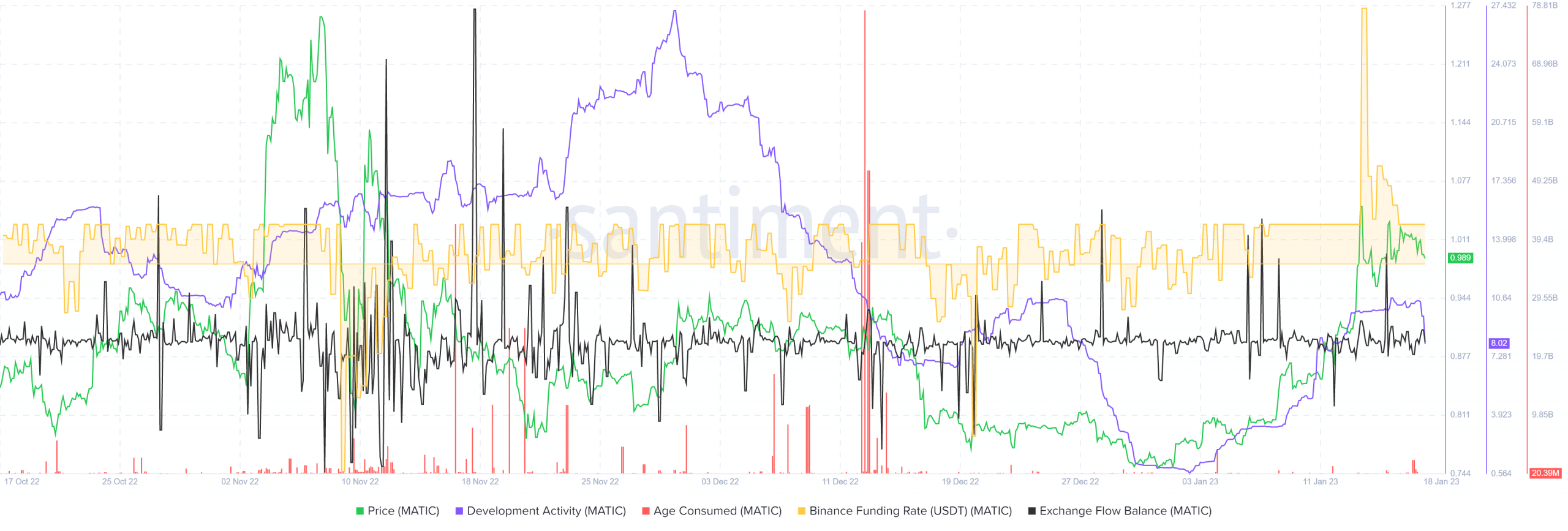

Neither the age consumed nor the change movement steadiness metrics noticed massive spikes

Supply: Santiment

The dearth of a spike within the age consumed or change movement metrics was heartening for the bulls. It confirmed that a big switch of MATIC tokens into exchanges didn’t happen in current days. If it does, it will point out a big wave of promoting seemingly across the nook. The funding price additionally remained optimistic to stipulate bullish sentiment.

The dearth of correlation between growth exercise and value motion in current months can even encourage long-term traders.

Over the previous couple of days, the Open Interest behind MATIC had decreased barely. The inference was that bulls weren’t bidding as strongly, and subsequently the value might decline a bit extra. Whether or not the $0.91-$0.95 space is examined and defended or damaged by the bears will seemingly dictate the route of the following value transfer.