Macro guru Henrik Zeberg is issuing a dire warning to buyers, saying {that a} kind of market meltdown not witnessed in almost a century is across the nook.

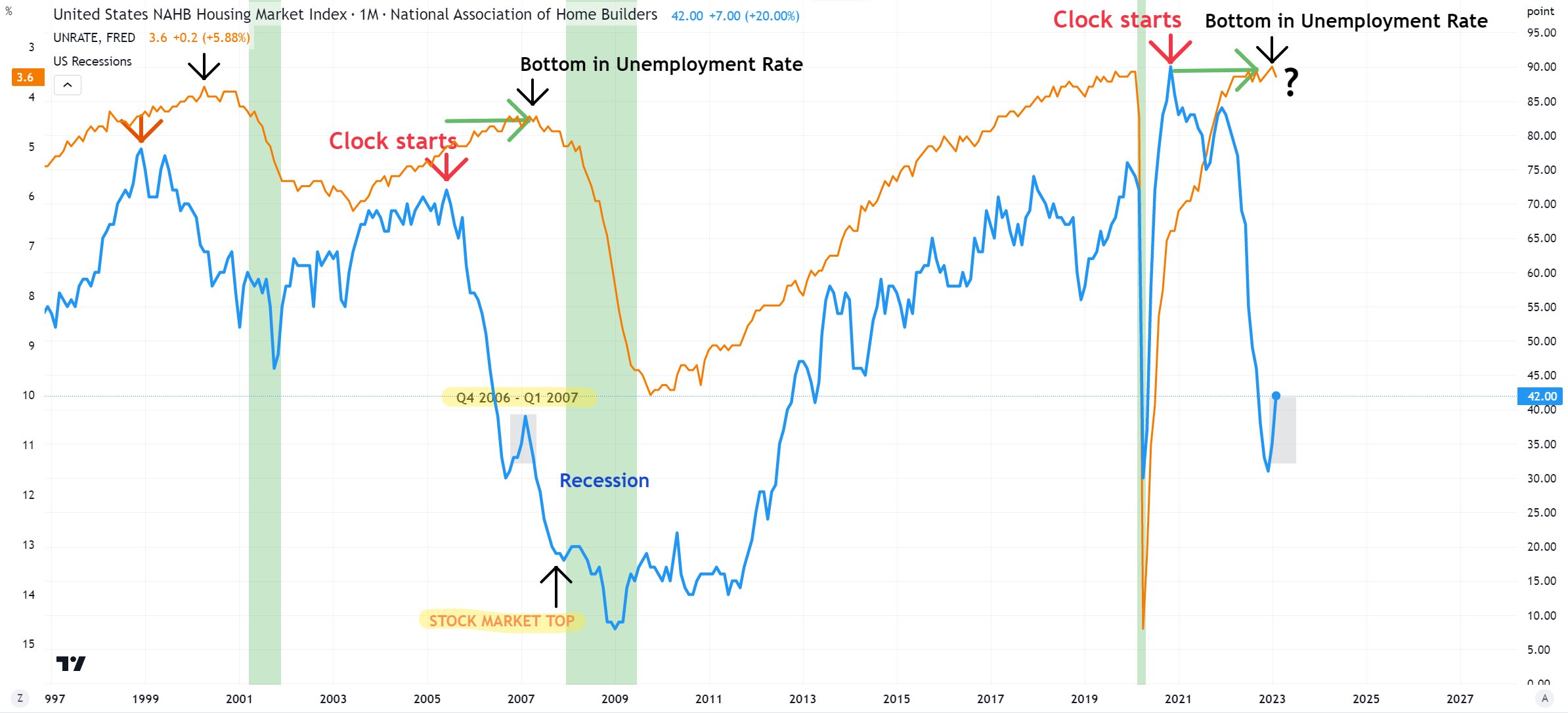

Zeberg shares together with his 102,100 Twitter followers a chart that reveals how the NAHB (Nationwide Affiliation of Dwelling Builders) Housing Market Index (HMI) and the US unemployment charge have a tendency to maneuver in tandem with one another.

The HMI seems to be on the well being of the US housing market by ranking the relative stage of present and future single-family dwelling gross sales.

Based on Zeberg, the HMI and the US unemployment charge are behaving eerily much like the way in which they did in the course of the 2007 housing market meltdown that triggered the Nice Monetary Disaster.

The macroeconomist additionally predicts an enormous inventory market rally because the housing market collapses.

“The similarities are scary!

EQUITY BLOW-OFF TOP COMING then LARGER MARKET CRASH THAN 2007-09 (and actually worst since 1929).”

Based on Zeberg, the high-profile collapse of Silicon Valley Financial institution (SVB) may trigger a sequence response that ignites his predicted surge within the inventory market.

“SVB is the catalyst for FED [Chair] Powell to PAUSE!!

This at a time the place the financial system is just not in recession.

The market response will probably be an EXTREME RALLY TO all-time highs earlier than recession units in and markets crash in largest crash since 1929.”

Zeberg additionally says that he expects the US financial system to be in a downturn earlier than this yr expires.

“100% US will enter a recession at finish of 2023.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia