- Litecoin maintains robust transaction quantity on BitPay incomes second place after Ethereum.

- LTC bears dominate whereas the community hash fee takes a stab at historic highs.

Litecoin (LTC) is celebrating one other win regardless of the continued market turmoil. The community’s newest replace confirms that it has maintained its transaction consistency on BitPay.

Is your portfolio inexperienced? Try the Litecoin Revenue Calculator

The Litecoin community had the second highest variety of transactions within the final six months, solely second to the Bitcoin community.

It maintained this consistency in February throughout which it managed 23.71% of all of the transactions on BitPay. The evaluation reveals that it outperformed Ethereum and the highest altcoins.

Litecoin transactions on the world’s largest cryptocurrency fee processor have grown to make $LTC by far some of the constantly transacted crypto this month and each month. #Litecoin & @BitPay making it simpler to #PaywithLitecoin pic.twitter.com/uCvcQRqSCQ

— Litecoin (@litecoin) March 9, 2023

Whereas this can be a win for the Litecoin community, it didn’t stop LTC from tumbling. The market skilled its most bearish week in 2023, resulting in lots of downsides for many of the high cryptocurrencies.

How has Litecoin faired through the newest market circumstances?

Litecoin was hit arduous by heavy liquidity outflows because the begin of March. It has already tanked by 30% within the final 10 days. The promoting stress has significantly intensified this week courtesy of the intensive bearish assault that has performed out.

Supply: TradingView

Litecoin’s promote stress was robust sufficient to push beneath the 200-day transferring common, albeit briefly. It managed to drag again above the identical indicator on the time of writing. Nevertheless, the value stays throughout the oversold territory.

What number of are 1,10,100 Litecoins value right now?

LTC’s value is just not the one facet of the cryptocurrency that has been experiencing a draw back. The demand for cryptocurrency tanked this week, in step with the spot market efficiency.

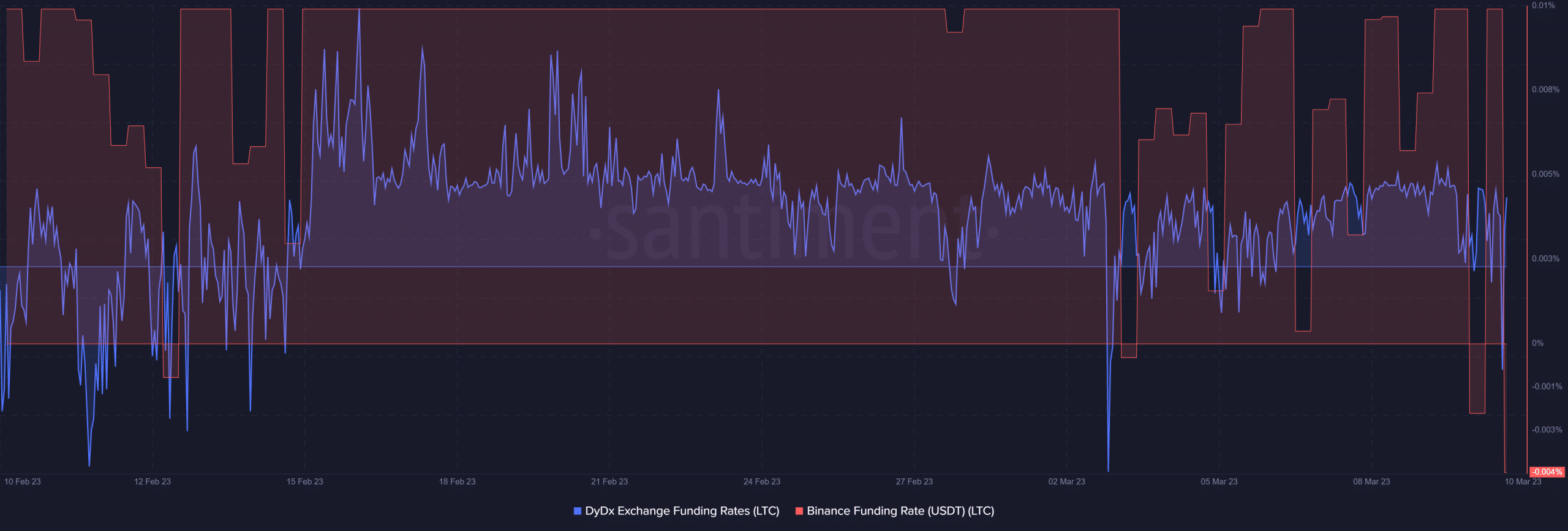

Each the Binance and DYDX funding charges had been down, particularly within the final 24 hours.

Supply: Santiment

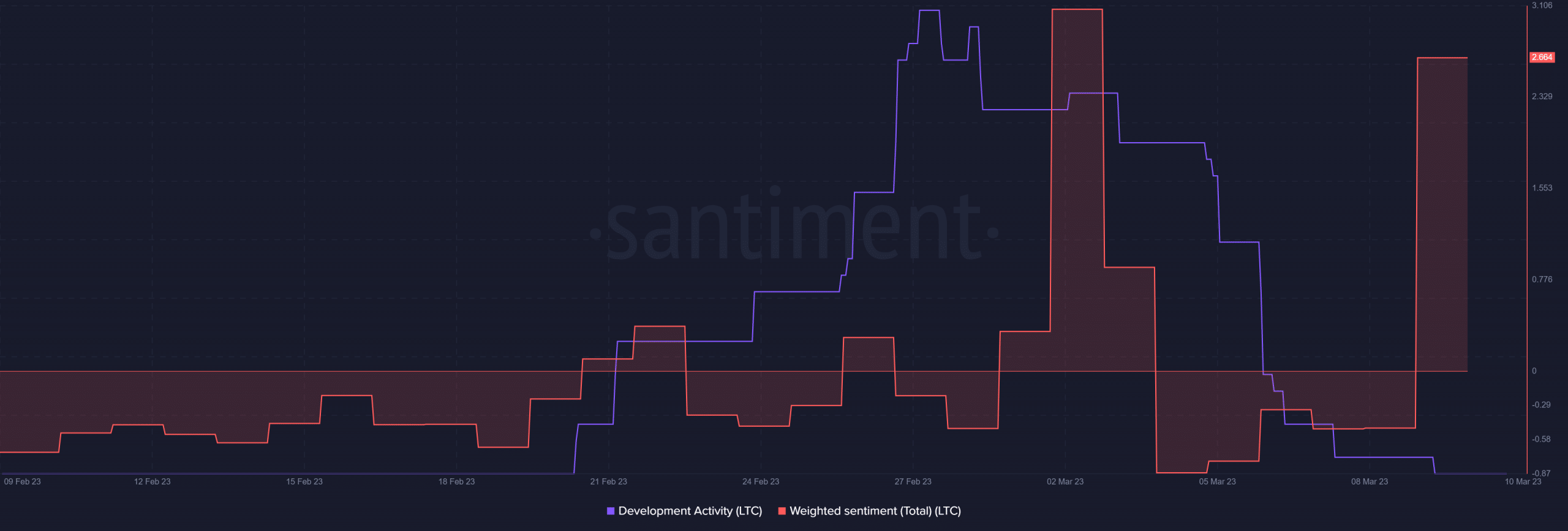

Litecoin’s improvement exercise skilled a revival within the final week of February.

Nevertheless, it was short-lived and has since then tanked again to its month-to-month lows. A possible cause for a adverse impression on investor sentiment. Talking of, the weighted sentiment additionally tanked firstly of March.

Supply: Santiment

Regardless of the shortcomings within the improvement exercise and the heavy value low cost, Litecoin’s weighted sentiment registered a big uptick within the final two days.

This was a affirmation that traders now understand LTC as closely oversold.

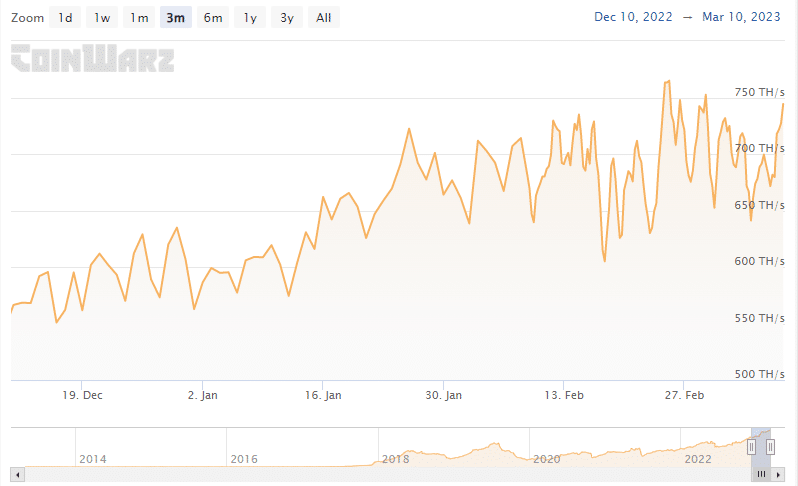

Supply: CoinWarz

Alternatively, Litecoin can be wanting good by way of its hash fee. The latter has been enhancing for the previous few months. It peaked at 764 TH/S in February earlier than dropping beneath 650 TH/S briefly earlier this week.