- Aave Corporations confirmed the acquisition of Sonar, a Web3 social gaming utility

- AAVE’s worth continued to say no and remained considerably unprofitable

Aave Corporations, the builders of DeFi protocol Aave and decentralized social community Lens Protocol, announced the acquisition of web3 social gaming utility Sonar on 5 December.

Following the acquisition, Sonar can be built-in with Lens Protocol. Consequently, Sonar customers and its Moji NFT holders will be capable of mint their Lens account profiles at declare.lens.xyz for the following two weeks.

Learn Aave’s [AAVE] Worth Prediction 2023-2024

Sonar’s co-founders, Ben South Lee and Randolph Lee, the corporate’s Head of Development Armand Saramout, and engineer Paul Xu will be part of Lens’ improvement group following the acquisition. They goal to,

“Concentrate on constructing cell consumer-facing social functions powered by Lens in addition to different web3 client functions launching in 2023.”

AAVE on the chain

Based on knowledge from CoinMarketCap, AAVE traded at $63.97 at press time. As a result of influence of FTX’s sudden collapse, the token’s worth declined by 30% in November.

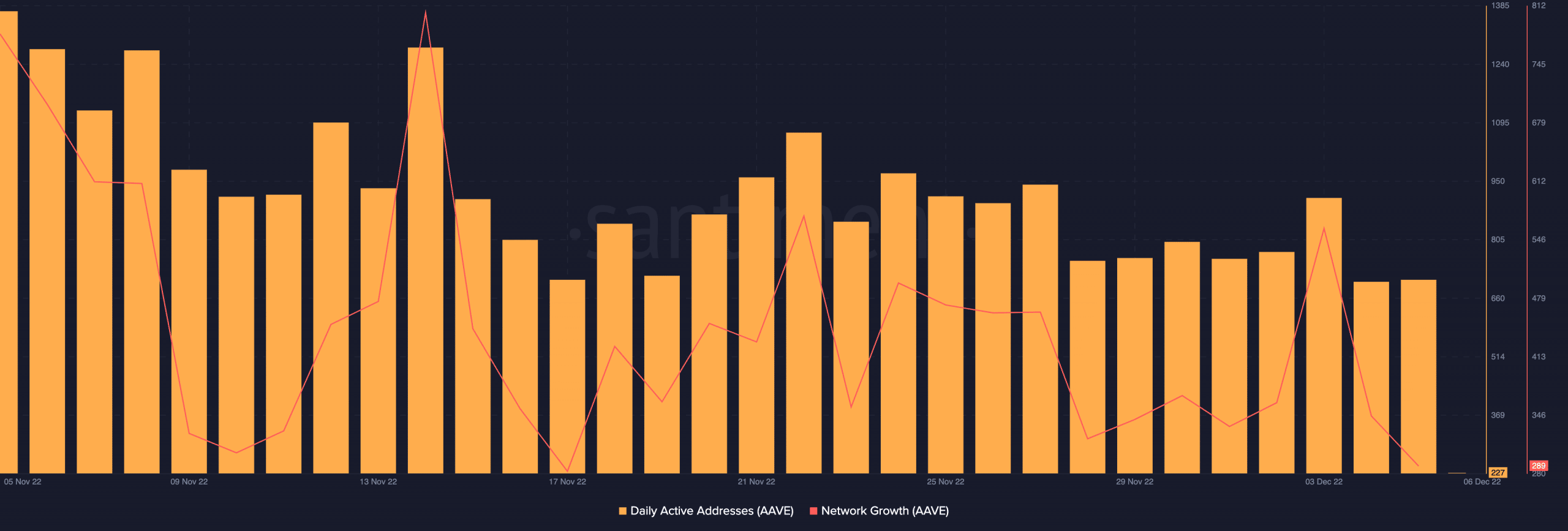

Moreover, day by day energetic addresses and new demand for AAVE dropped drastically. As per knowledge from Santiment, final month witnessed the depend of distinctive addresses that traded fall by 83%. Likewise, the depend of recent addresses that joined the community day by day declined by 63%.

Supply: Santiment

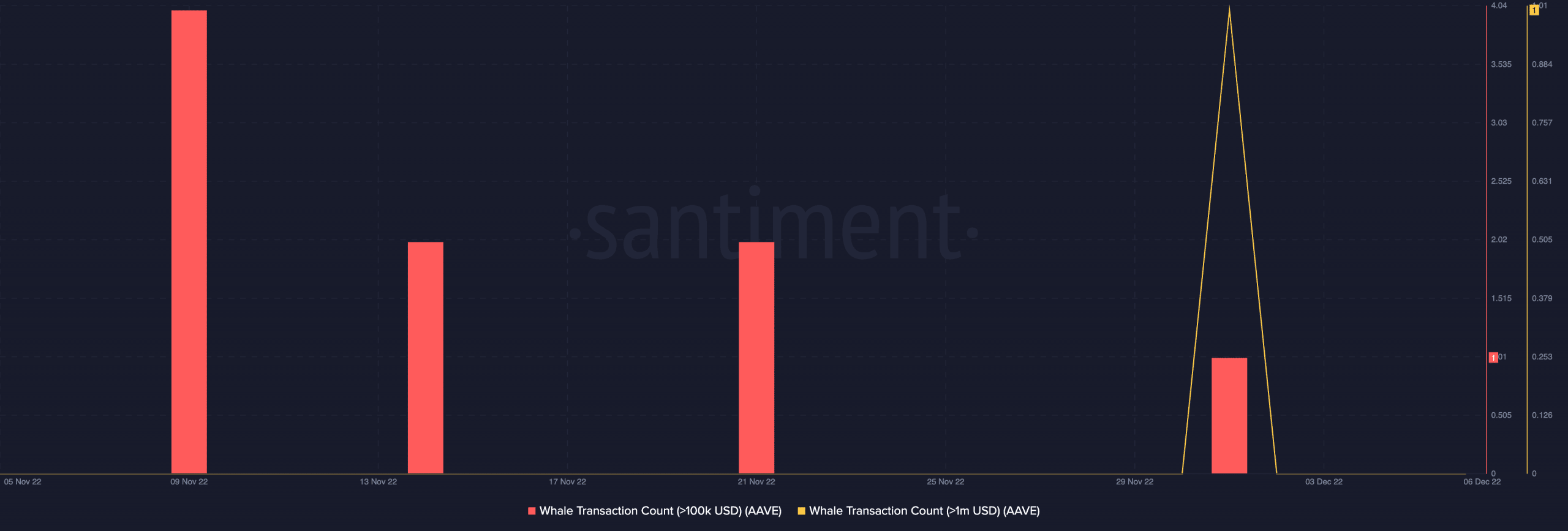

Nonetheless, inside that very same interval, AAVE recorded a drought of whale transactions. Knowledge from Santiment revealed that within the final 30 days, solely 9 whale transactions exceeded $100,000.

Furthermore, whale transactions of over $1 million had been virtually non-existent throughout the interval underneath overview – just one transaction was accomplished within the final 30 days.

Supply: Santiment

Moreover, holding AAVE has been considerably unprofitable for its buyers within the final month. In truth, this has been the scenario for the reason that starting of the 12 months. As of this writing, AAVE’s Market Worth to Realized Worth (MVRV) posted a damaging worth of -77.57%. This confirmed that sell-offs at their present worth would solely return losses on such an funding.

With a continuous decline in worth, buyers’ sentiment remained damaging at press time.

Supply: Santiment