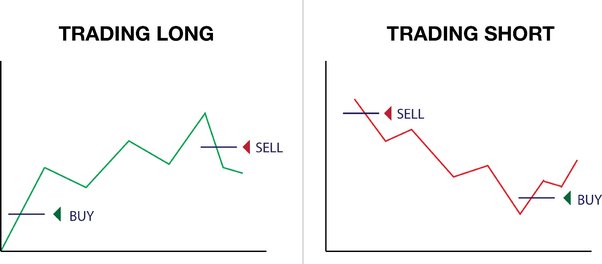

Cryptocurrency trade charges can change a number of occasions a day. Similar to fiat exchanges, there are two foremost behaviors amongst cryptocurrency gamers: a few of them purchase cash at a low worth (as most merchants do) or buy cash at their peak throughout the all-time excessive interval. It’s simpler to purchase a foreign money at a low worth and anticipate its development. Not one of the cash has ever proven a rise and not using a fall, so a cryptocurrency dealer wants to have the ability to brief.

Learn how to Quick Bitcoin?

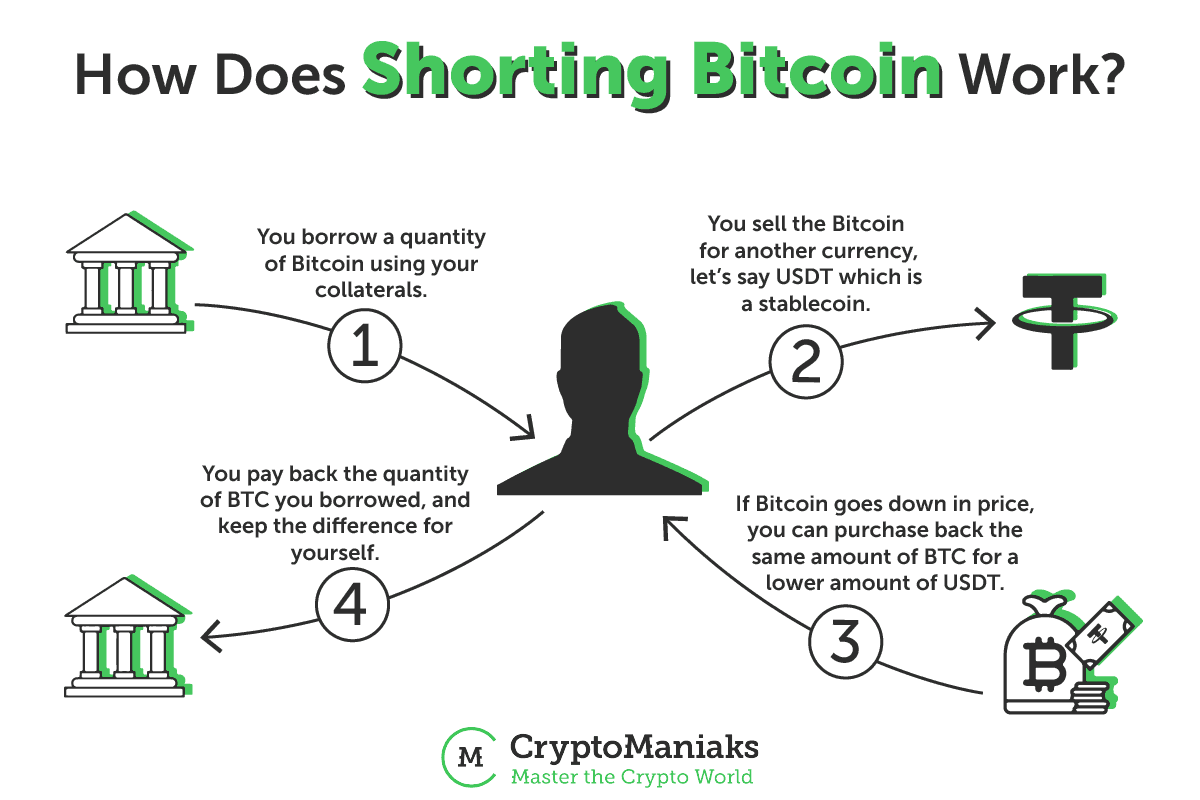

Quick-selling is a buying and selling follow that permits you to profit from a drop in an asset’s worth. To place it merely, it entails promoting an asset you don’t personal after which shopping for it again later. It goes like this:

- You borrow an asset

- You promote it

- You repurchase it when the value drops

Clearly, that’s not all there may be to it. Because you’re borrowing the asset you’re promoting, its unique proprietor can request you to return it — not personally (since all that is performed by way of a third-party service like a dealer or an trade), however robotically — after which you’ll be compelled to purchase the asset again on the present market worth. Go to the Dangers of Shorting Bitcoin part to be taught extra about this.

What Does Shorting Imply in Crypto?

Shorting within the context of cryptocurrency refers to betting towards the worth of a specific cryptocurrency. That is performed by borrowing the cryptocurrency from another person, promoting it on the present market worth, and hoping to purchase it again at a cheaper price later to repay the mortgage and pocket the distinction as revenue.

Think about a situation by which you assume that Bitcoin worth goes to drop quickly, both since you’ve performed your personal analysis or have learn anyone else’s (keep in mind to by no means blindly comply with different individuals’s monetary recommendation!). To revenue from this data, you borrow 1 BTC from an trade and promote it for $60,000. Per week later, simply as you predicted, Bitcoin drops to $40,000 — and also you promptly purchase again that 1 BTC you borrowed, thus getting $20,000 of revenue.

The Dangers of Shorting Bitcoin

If all the pieces goes in line with plan, then it is possible for you to to purchase again the property you borrowed at a cheaper price and make a hefty revenue. Sadly, issues hardly ever go in line with plan — and particularly so in a market as risky as crypto.

The largest draw back of shorting is that there’s technically no restrict on how a lot cash you possibly can lose. If you brief Bitcoin, you open a place. Normally, you select when to shut that place (purchase again the asset you borrowed) by your self, however that’s not at all times the case. If a margin name is issued, then your dealer or trade will robotically purchase again the property you borrowed utilizing the funds in your account.

Nonetheless, generally that’s not doable — the market might not be open, or the demand could far outweigh the availability — and in such circumstances, the buyback worth may even exceed your account steadiness, making you indebted to the trade. Nonetheless, that occurs very hardly ever. Nonetheless, at all times keep cautious and monitor the market and the value of the asset you need to purchase.

The place to Quick Crypto?

Nicely, now you’re in all probability questioning: How do you brief Bitcoin? Don’t fear, it’s very easy! As crypto turned extra well-liked, all kinds of buying and selling platforms match for each sort of person emerged. Listed below are the very best platforms for shorting Bitcoin:

- Changelly PRO: nice for inexperienced persons

- Binance: nice for consultants

Learn how to Quick BTC: 5 Methods to Quick Bitcoin

The way you brief Bitcoin will depend upon a number of components, together with however not restricted to your threat aversion, obtainable funds, stage of experience, and so forth. Listed below are the 5 foremost methods in which you’ll be able to brief cryptocurrency.

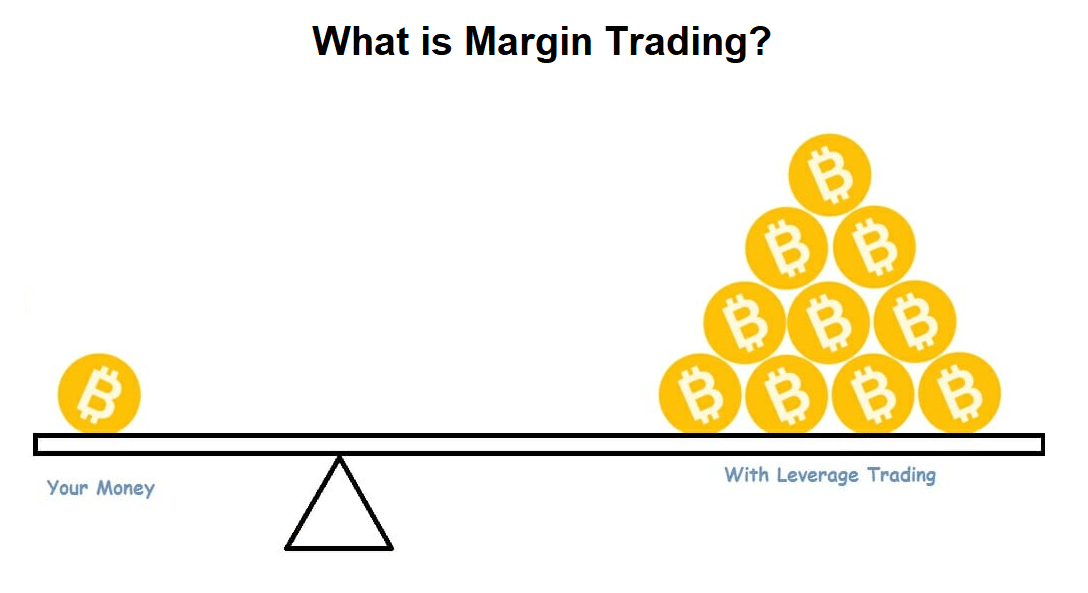

Margin Buying and selling

This is likely one of the best methods to brief Bitcoin.

Getting a margin account on Changelly PRO is as straightforward as ABC! All it is advisable do is allow 2-factor authentication and move KYC. That’s it!

Margin buying and selling additionally means that you can use leverage, that means you possibly can borrow more cash from the trade than you’ve deposited in your account. Whereas this opens up doorways for greater earnings, it’s naturally riskier, too — your place could shut before you anticipated when you’re partaking in leveraged shorting.

Be taught extra about margin buying and selling in our final information: Margin Buying and selling on Changelly PRO.

Futures Market

Similar to different property, Bitcoin has a futures market. In a futures commerce, you mainly agree to purchase an asset — in our case, BTC — on the situation that it is going to be offered later at a predetermined worth. This settlement is known as a futures contract.

Nonetheless, it’s also doable to promote futures contracts. In that case, in contrast to when shopping for them, it is possible for you to to learn from the asset’s worth dropping.

Learn extra in regards to the Bitcoin futures market right here.

Binary Choices Buying and selling

Binary choices buying and selling means that you can wager on “sure or no” situations. This monetary product gives consumers with the choice however not the duty to finish the deal. You mainly wager on whether or not an asset’s worth will go up or down. To brief promote crypto utilizing this technique, buy put choices.

Binary choices buying and selling provides nice flexibility and higher-than-usual leverage. We’d advise towards partaking in it except you’re an skilled dealer.

Prediction Markets

Prediction markets are considerably much like sports activities betting businesses. Such platforms haven’t been round within the crypto trade for a very long time, but they current a great way to brief Bitcoin. They let you make a wager on a selected consequence, comparable to “Bitcoin goes to fall by 10% subsequent week.” If anyone takes you up on the wager, you may make fairly a hefty revenue.

Quick Promoting Bitcoin Property

In case you have sufficient of your personal funds, you can even brief promote Bitcoin straight. All it is advisable do is promote BTC when the value is excessive after which purchase again when it’s low. This technique of brief promoting Bitcoin is comparatively beginner-friendly, as you don’t must discover ways to use buying and selling platforms to put it to use. It is usually quite a bit much less dangerous since you possibly can’t lose greater than you personal. However, it’s much less worthwhile. As at all times, the upper the danger, the upper the reward.

Issues to Be careful for Whereas Shorting Crypto

Similar to different buying and selling practices, brief promoting requires you to watch out and knowledgeable. Completely analysis all property you’re planning to brief and solely ever spend cash you possibly can afford to lose.

Danger

Shorting is a high-risk, high-reward exercise. In truth, it is likely one of the riskiest methods to earn money since your revenue is proscribed whereas your losses usually are not.

Moreover what we’ve already talked about, one other threat it’s best to look out for is potential rules. There have been bans issued on brief promoting prior to now, forcing merchants to cowl their positions at massive losses.

Quick promoting can be not match for merchants who don’t know the way to cease themselves. If you recognize you’ve a tough time admitting your losses, we’d advise you towards making an attempt shorting.

Volatility

It’s no secret that the crypto market is extremely risky, which presents apparent challenges when brief promoting: the value of Bitcoin can change fairly drastically at any level. Some individuals use advanced evaluation to foretell worth actions, however even probably the most well-researched predictions aren’t appropriate 100% of the time.

With costs being so unpredictable, brief promoting turns into considerably of a bet. Nonetheless, there’s a technique to safeguard your self towards excessive market volatility: stop-loss orders.

A stop-loss order is an order positioned by way of a dealer or an trade that may promote/purchase the asset as soon as its worth reaches a sure level.

Conclusion

Quick promoting Bitcoin is an effective technique to make a revenue if you’re assured in your skill to analysis the market. Moreover those we’ve talked about right here, there are different methods to brief promote Bitcoin, like unfold betting or CFDs buying and selling. If you happen to’re excited by shorting cryptocurrency, we encourage you to begin with one thing comparatively straightforward and never rush straight into advanced methods.

Keep in mind to at all times do your personal analysis and ensure to solely make investments what you possibly can afford to lose. And when you want a dependable launchpad to kickstart your buying and selling journey or need to check out a number of the issues we’ve talked about right here, try Changelly PRO, our full-featured but easy-to-use buying and selling platform.

Bitcoin Quick Promoting: FAQ

Do you lose cash if Bitcoin goes down?

No, due to the character of shorting, you’ll really make a revenue if Bitcoin’s worth drops.

Is brief promoting unethical?

To a non-trader, brief promoting could seem unethical and even downright evil — in any case, you’re mainly betting on a enterprise or an underlying asset doing badly. Since so many individuals are obsessed with Bitcoin as a know-how, they could see betting towards the cryptocurrency’s success as one thing unfavourable.

Nonetheless, this couldn’t be farther from the reality. Quick sellers, to a sure extent, are very useful to any market. Along with offering liquidity, additionally they forestall asset costs from inflating an excessive amount of. After all, some unethical brief sellers use methods like “brief and deform,” nevertheless it’s not that totally different from individuals who use “pump-and-dump” schemes in conventional buying and selling. On the finish of the day, it’s not the exercise itself that’s unethical — it’s the (few and much between) individuals who bask in unethical practices.

Along with what we’ve already mentioned, brief sellers may assist expose monetary fraud since one has to do a whole lot of analysis to brief promote efficiently. So, brief sellers often discover errors, inflated numbers, and so forth. in monetary studies.

What occurs if a brief vendor defaults?

Generally, that may by no means occur — your place will probably be closed as soon as the value of an asset goes up and a margin name is issued. Nonetheless, if the value rises considerably whereas the markets are closed, and the loss you incur can’t be lined by your account steadiness, the trade/dealer must chip in and help you with closing your place. They will sue you afterward to get that cash again.

Is there a technique to brief Dogecoin?

Sure, you possibly can brief any cryptocurrency, together with Dogecoin, Ethereum, and plenty of others. All of it is determined by what buying and selling pairs can be found in your trade of alternative.

Is brief promoting dangerous?

The act of brief promoting crypto is a dangerous maneuver. Whether or not or not it’s dangerous is determined by the person’s strategy. If an individual absolutely understands the implications of brief promoting crypto and takes precautions to guard themselves from losses, then they’ll profit drastically from the short potential appreciation in crypto costs. Nonetheless, if an individual doesn’t grasp related dangers or fails to safeguard their investments, then brief promoting may result in disastrous outcomes.

How have you learnt if a inventory is being shorted?

To be taught whether or not the inventory is being shorted, look at its lengthy/brief ratio. That is additionally an effective way to look out for brief squeezes — a state of affairs the place the variety of brief positions for an asset considerably prevails. It’s often a harbinger of worth spikes.

Are you able to maintain a brief place without end?

Nicely, sure. Nonetheless, in actuality, no brief place is held without end.

Your place could be closed for 2 causes: both you shut it your self when the market worth of the asset you borrowed drops sufficient so that you can make the revenue you needed, or it will get closed robotically as a result of the value has risen too far. After all, technically, the value could stay the identical, nevertheless it’s greater than extremely unlikely. Alternatively, you possibly can lose entry to your buying and selling account or neglect that you just opened a commerce.

Disclaimer: Please word that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.