Candlestick charts are, in a method, a logo of buying and selling. They’re the very first thing folks consider after they think about merchants, alongside line charts and purple/inexperienced numbers on an enormous display screen.

Though they could appear complicated at first look, candlestick charts are literally fairly simple to learn — and so as to begin utilizing them to your benefit, you solely have to study a number of patterns. On this article, we’ll give you all the ideas you would possibly have to discover ways to learn candlesticks!

What Are Candlestick Graphs/Charts?

Candlestick charts are graphical representations of value motion throughout a selected time interval. They appear to be packing containers which have straight traces going out of them on the high and the underside. Whereas candlesticks can signify any timeframe — a 12 months, a month, a day, a minute — those on the identical chart at all times replicate the identical time interval.

One of these chart was invented again within the 18th century by a Japanese rice dealer referred to as Munehisa Homma. They had been launched to the Western market through Steven Nison’s ebook “Japanese Candlestick Charting Methods”.

Candlestick charts can be utilized to research any info on monetary markets, the inventory market, and, after all, the crypto market, too. They’re the most effective instruments for predicting future short-term value actions of property.

Candlestick vs. Bar Charts

Bar charts and candlestick charts have many similarities. Most significantly, they each present the identical info: open, shut, and excessive and low costs. The variations between them are fairly minor, and merchants often select to make use of one or the opposite primarily based on private preferences.

Right here’s what a typical bar chart appears like:

Bar charts additionally often are available in two colours (e.g., purple and black). In contrast to candlestick charts, bar charts place larger significance on the relation of the present interval’s shut value to that of the earlier “bar.”

Composition of a Candlestick Chart

Candlestick charts are comprised of a group of a number of candles, and every of them represents a predetermined time frame.

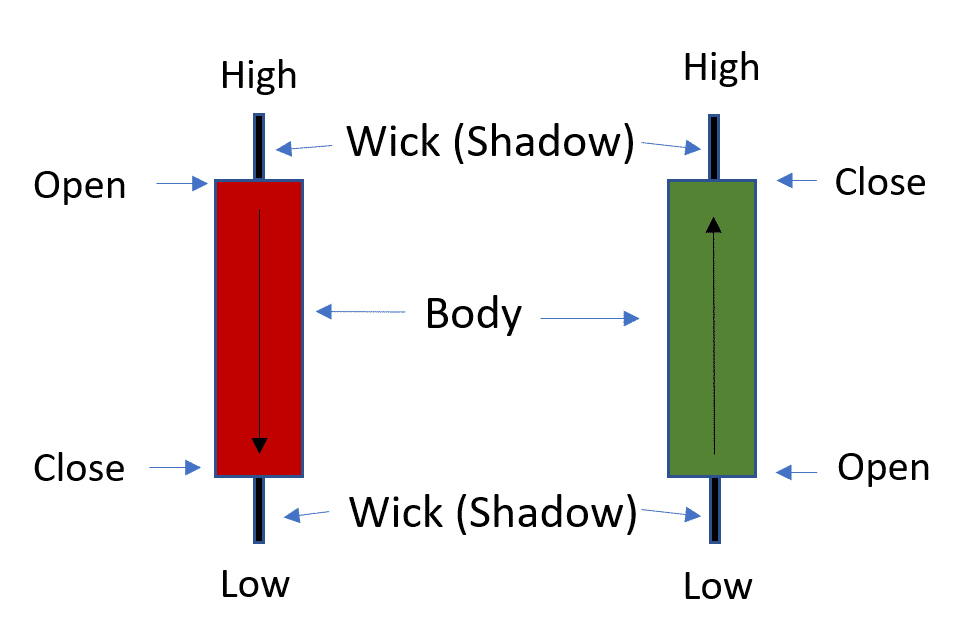

Every candle in a chart has the identical construction: it’s made up of a physique and two wicks (additionally referred to as “shadows”).

Relying on the colour of the candlestick physique, its high can both signify the closing or the opening value.

- “Open” is the preliminary value at which the asset was being traded at the start of that particular timeframe.

- “Shut” is the final recorded value of the asset in that particular timeframe.

- “Low” is the bottom buying and selling value of the asset throughout that point interval.

- “Excessive” is the very best recorded value of the asset in that timeframe.

How Do You Learn Candlestick Charts for Day Buying and selling for Newbies?

While you learn candlestick charts, there are three important issues that you would be able to notice: the colour of the physique, its size, and the size of the wicks.

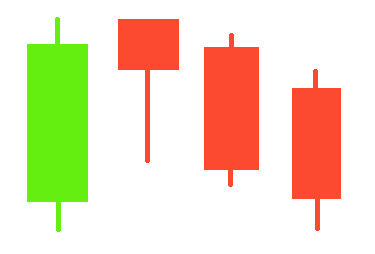

Colour

Candlesticks are available in two colours: purple and inexperienced. The previous is named a “bearish candle,” whereas the latter is a “bullish candle.” Similar to the identify suggests, they signify bearish or bullish value motion throughout that particular time interval.

A bearish candle represents a interval throughout which the closing value was decrease than the opening value — it signifies that the worth of an asset has dropped in that timeframe.

A bearish candlestick represents a interval throughout which the opening value of an asset was decrease than the closing value.

Physique Size

Physique size represents how totally different the opening and shutting costs had been; it reveals the shopping for/promoting strain throughout that particular time interval. The longer the physique, the extra intense the strain. A brief candlestick represents a market with little value motion.

Wicks Size

The shadow, or wick, size represents the distinction between the opening/closing value and the very best/lowest value recorded throughout that point interval. Shorter wicks level towards most value motion being huddled across the closing and opening of the candlestick.

There are a lot of methods to interpret the wick size in relation to all the data proven by a candlestick, however right here’s a easy rule of thumb: do not forget that the higher shadow, the one which reveals the very best value recorded, is a illustration of patrons. The bottom value recorded is about by the sellers. An extended shadow on both aspect represents the prevalence of that aspect’s presence available on the market, whereas equally lengthy wicks on each the highest and backside of the candlestick present indecision.

The best way to Analyze a Candlestick Chart

There are a lot of methods to research candlestick charts — they’re an incredible software for making each buying and selling session rely. Nevertheless, in case you are a newbie, we might suggest studying how you can interpret and establish candlestick chart patterns.

How Do You Predict the Subsequent Candlestick?

Candlesticks replicate market sentiment and may usually be used to foretell what’s going to occur subsequent.

There are a lot of issues to look out for, however you’ll solely start to note most of them as you acquire buying and selling expertise. Listed here are the 2 important easy candlestick patterns that may allow you to predict what’s going to occur subsequent.

- Lengthy inexperienced candlesticks can point out a turning level and a possible starting of a bullish development after a protracted decline.

- Conversely, lengthy purple candles signify a possible starting of a bearish development and will point out panic available on the market in the event that they present up after a protracted decline.

Fundamental Candlestick Patterns

There are some primary candlestick chart patterns that may assist anybody, particularly newcomers, higher perceive what’s occurring out there.

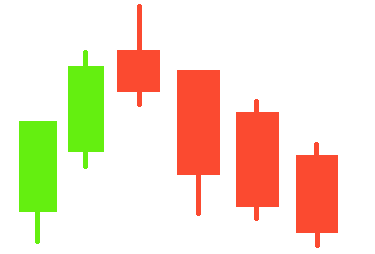

Bearish Patterns

Bearish patterns just like the bearish engulfing, darkish cloud cowl, or the bearish deserted child can sign that the market is both about to proceed its downtrend or enter one after a earlier uptrend. Listed here are among the bearish candlestick patterns that may allow you to out when in search of shopping for and promoting alternatives.

Hanging Man

A dangling man is a bearish reversal sample, which means it reveals that the worth development will quickly flip purple. This candlestick sample is often shaped on the finish of an uptrend and consists of a candle with a small physique and a protracted decrease wick.

A protracted decrease wick on a candle with a comparatively brief physique after an uptrend reveals that there was a large sell-off. Though the worth has been pushed up, there could also be an opportunity the restoration is momentary, and bears are about to take management of the market.

Capturing Star

This candlestick sample often seems after a value spike and is made up of a brief (usually purple) candle with a protracted higher wick. It often has no decrease wick to talk of and represents a bearish market reversal.

The taking pictures star candlestick chart sample signifies that though bulls are nonetheless prepared to pay excessive costs, the present development is reversing, and the vast majority of the market is making an attempt to promote. Nevertheless, it may be deceiving, so we suggest ready for a number of extra candlesticks earlier than making any choices

Bearish Harami

This candlestick sample is represented by a small purple candle that follows an extended inexperienced one. The purple candle’s physique might be utterly engulfed by the physique of the earlier candle.

A bearish harami can point out a lower in shopping for strain.

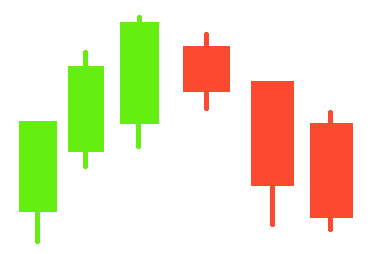

Bullish Patterns

Candlestick chart patterns just like the morning star or the bullish deserted child all present both a continuation or the start of an uptrend. Listed here are another candlestick patterns that give a bullish sign.

Hammer

It is a bullish equal of the hanging man. This candlestick sample consists of a downtrend that features a candle with a protracted decrease wick at its backside. The decrease shadow must be a minimum of twice the scale of the candle’s physique for it to be thought of a hammer.

It is a bullish reversal candlestick sample: the lengthy decrease wick reveals that the promoting strain was excessive, however, regardless of that, the bulls managed to win in the long run. A brief physique reveals that the closing value was near the opening one, which means bears didn’t handle to drive the worth of the asset down.

Hammers might be each purple and inexperienced, however the latter represents even stronger shopping for strain.

There’s additionally an inverted model of the identical sample. The inverted hammer candlestick sample has a protracted higher wick as a substitute. It additionally usually factors towards a bullish development reversal.

Bullish Harami

Similar to the bearish Harami, the bullish one additionally has an extended candle adopted by a a lot smaller one. Solely on this candlestick sample, a protracted purple candle is adopted by a smaller inexperienced one as a substitute. It reveals the slowdown of a downward development and a possible bullish reversal.

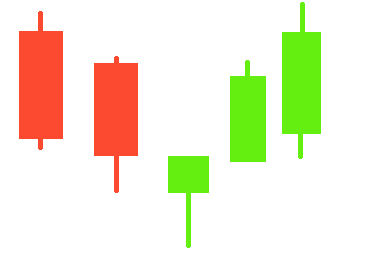

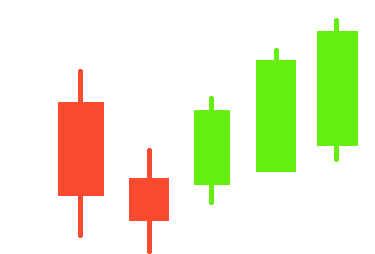

Three White Troopers

It is a moderately easy bullish reversal sample — it’s made up of three consecutive (usually) lengthy inexperienced candles that each one open above the earlier candle’s opening value however beneath its shut. The three white troopers additionally shut above the earlier candle’s excessive.

These candles often have brief wicks and point out a gentle buildup of shopping for strain available on the market. The longer their our bodies, the upper the prospect that there can be an precise bullish reversal.

What Is the Finest Candlestick Sample to Commerce?

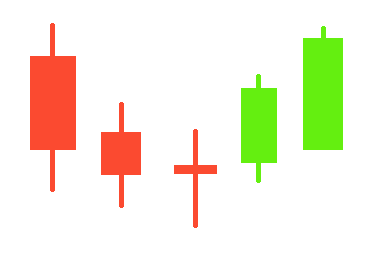

The very best candlestick sample to commerce for newcomers is the one which’s the best to establish… and that’s doji.

It’s a candle that has a particularly brief physique (effectively, no actual physique to talk of, truly), and if it seems after a gentle downtrend/uptrend, it might signify a reversal.

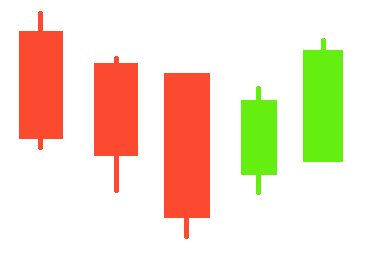

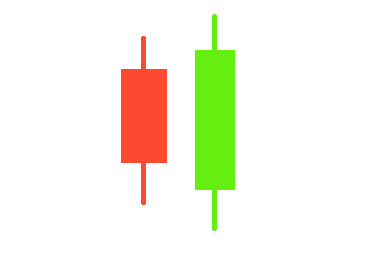

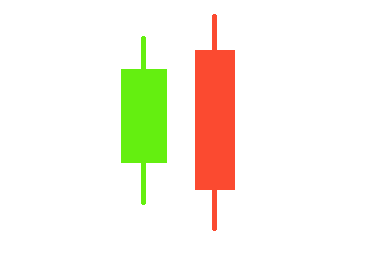

One other easy-to-identify candlestick sample is the engulfing sample. It may be both bearish or bullish and is made up of two candles, with the second utterly “engulfing” the opposite.

A bullish engulfing sample has a inexperienced candle engulfing the purple one and signifies that there’s robust shopping for strain and bulls are taking on the market.

A bearish engulfing sample, alternatively, reveals the opportunity of the market being taken over by the bears. It has a purple candle engulfing the inexperienced one.

Do Candlestick Charts Work?

Studying how you can learn a candle chart and acknowledge candlestick patterns can certainly be very worthwhile. Though they’re simplest for skilled merchants, they are often fairly helpful for newcomers, too.

Take into accout, nonetheless, that there’s a lot of knowledge {that a} candlestick chart won’t be able to point out you — for instance, the sequence of occasions in the course of the chosen timeframe, the relation of the present crypto and inventory value to those from the earlier durations, and so forth.

Moreover, candlestick charts can change into unreliable even on the inventory market throughout instances of nice volatility. Maintain that in thoughts when utilizing them for crypto buying and selling, which might be extraordinarily speculative.

Is Candlestick Buying and selling Worthwhile?

Candlestick charts can be utilized to create profitable and efficient day buying and selling methods and buying and selling choices. Nevertheless, it isn’t sufficient simply to know what the figures within the chart imply — so as to make a revenue, you could discover ways to perceive the market, use assist and resistance ranges, stop-loss orders, comply with the most recent information, and extra.

Which Candlestick Sample Is the Most Bullish?

There are a lot of robust bullish candlestick patterns, and it’s exhausting to find out probably the most decisive out of them.

Typically talking, the bullish engulfing sample, hammer, and bullish harami are all named the strongest bullish candlestick patterns.

What Do Candlesticks Characterize in Shares?

Inventory candle patterns can show value path and sign a continuation or a reversal of a value development. Each single candlestick represents market information in regards to the asset’s buying and selling worth throughout a predetermined time frame. The candle physique, for instance, can present whether or not the asset’s closing value was decrease (purple) or greater than its opening value (inexperienced).

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.