- Bitcoin lacked demand regardless of the spectacular run of the primary ten days in 2023

- A brief time period retreat could possibly be probably relying on the CPI consequence as provide in revenue spikes

Anticipating a return of the Bitcoin [BTC] bull market would possibly sound too hasty regardless of the king coin resurgence above $17,000. CryptoQuant analyst, Cauceconomy opined this after assessing the situation of the Bitcoin demand.

BTC, which had extra inexperienced days than reds since 2023 started, had helped renew the passion of its traders. However for Cauceconomy, a big breakout is perhaps unlikely.

Are your holdings flashing inexperienced? Test the BTC Revenue Calculator

Buying and selling quantity restraining demand

In line with his publication on the crypto knowledge perception platform, Bitcoin’s lack of demand could possibly be traced to its community utilization. It’s because every block affirmation interprets to elevated every day transactions.

Nonetheless, that has not been the scenario recently as miners have not essentially been profitable to extend productiveness by confirming extra blocks. Therefore, the buying and selling quantity has been repressed.

In line with CoinMarketCap, the BTC 24-hour buying and selling quantity was a 1.75% lower at press time. This aligned with the analyst’s reference to a dip in transactions on the Bitcoin community.

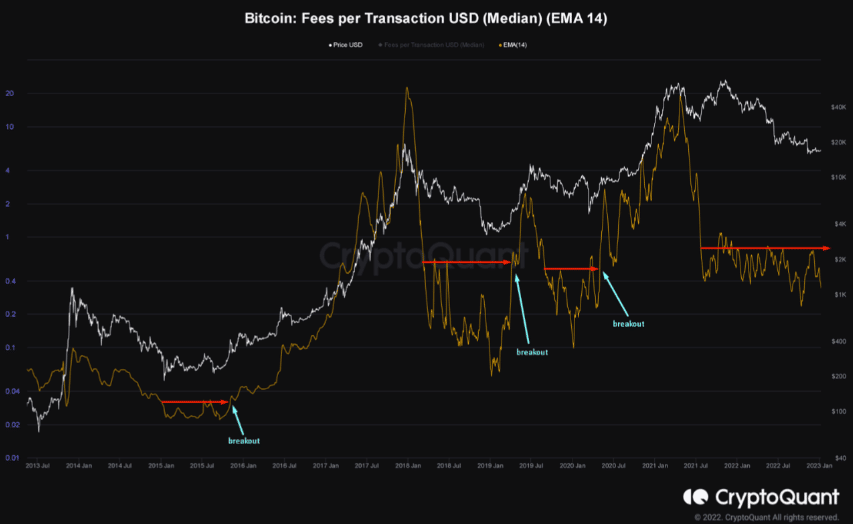

Supply: CryptoQuant

In addition to, Cauceconomy backed up his opinion by citing the historic development. He identified that there was often a notable breakout through the bear market earlier than the bull season in earlier cycles as proven by the above picture. In the meantime the present momentum displayed by BTC has proven nothing of such. The analyst stated,

“For us to have development within the fundamentals of the community, we might want to see higher demand for buying and selling and, consequently, greater charges for every day transactions. Right now, we haven’t had that breakout but and buying and selling quantity stays low, indicating low demand.”

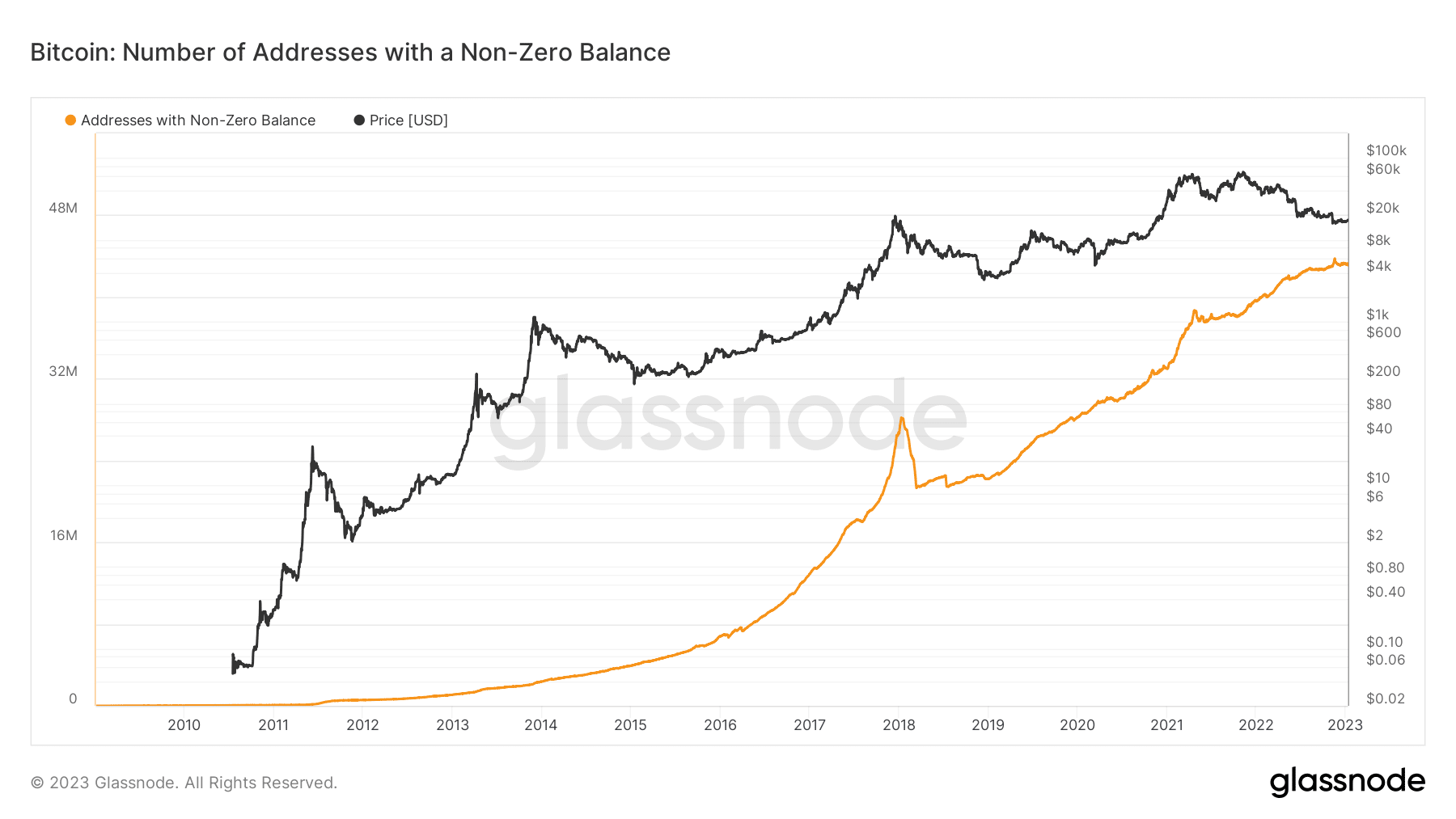

On evaluating the Bitcoin addresses with non-zero balance, Glassnode confirmed that there was a slight lower from the height registered in November 2022.

The info on the time of writing, reported the quantity to be 43,170,375. Though this was a marginal distinction, it recommended a lackluster perspective in direction of community utilization person base enlargement.

Supply: Glassnode

What number of BTCs are you able to get for $1?

The trigger to take heed

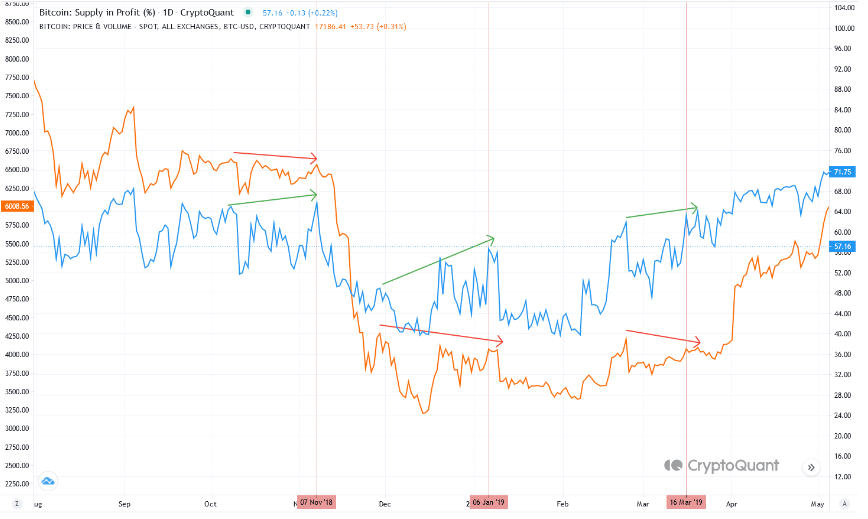

As well as, one other publish on CryptoQuant warned optimistic traders of an impending value drop. On-chain analyst Gigisulivan was the one who raised the alarm after his evaluation of the availability in revenue share. At press time, the Bitcoin provide in revenue share headed in direction of peaks, and was forming a divergence.

Like Cauceconomy, he additionally referred to historical past as conditions like that ultimately led to a brief time period BTC pull again. For context, in 2018 and 2019, it solely took a couple of days earlier than the projected consequence occurred. So, it is perhaps the case as nicely contemplating the current circumstances.

Supply: CryptoQuant

Nonetheless, the analyst talked about that macroeconomic elements would even have a say within the potential BTC development. Due to this fact, the results of the Shopper Value Index (CPI) report on 12 January may decide if the availability in revenue share goes forward with the forecast.