- Polkadot’s TVL grew over the previous few months

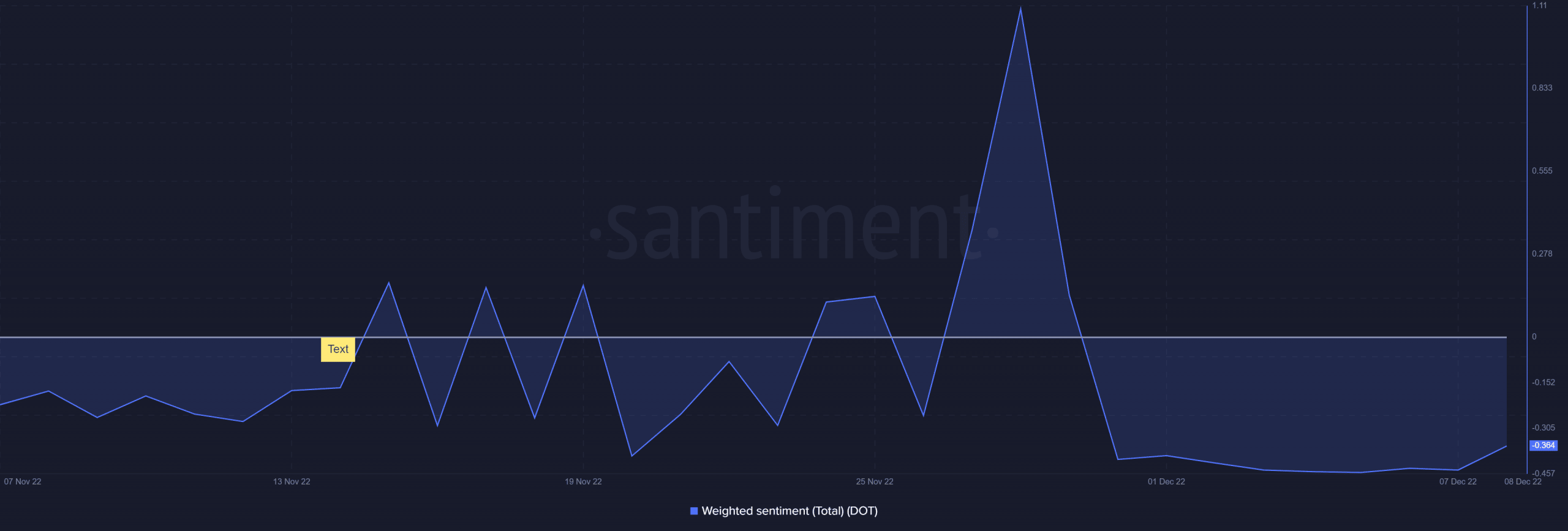

- DOT’s weighted sentiment elevated in the direction of the tip of November, however rapidly fell

Polkadot has maintained a robust presence within the listing of prime crypto initiatives by market cap. Many savvy analysts observing the crypto house have excessive expectations for this crypto undertaking, particularly as a result of its totally different strategy.

Learn Polkadot’s [DOT] Value Prediction 2023-24

However there may be one different measure of development that will assist traders perceive what to anticipate in 2023 by way of development, and the place that development is prone to come from.

Polkadot parachains are optimistic

Whole worth locked (TVL) is likely one of the greatest yardsticks for measuring community development. Current knowledge revealed a listing of Polkadot parachains which have to date achieved a large TVL development.

In keeping with the listing, the Acala community had the best TVL at $204 million. Parallel was a detailed second with a $196.6 million TVL. Moonbeam, Bifrost and Astar additionally made the listing.

The @Polkadot ecosystem simply began in Jan 2022 when the primary 5 parachains launched, and traction continues to mount 🦾

Acala delivered a DeFi appchain with merchandise that serve the entire ecosystem. We’re pleased with the progress to date and grateful for the entire assist 🧑💻 pic.twitter.com/vzWywFdTnI

— Acala (@AcalaNetwork) December 7, 2022

The TVL development achieved by these Polkadot parachain initiatives might sound unimpressive at first look. However what makes it fascinating is that that is development that has been achieved inside the final 12 months. Why is that this essential? They achieved such development throughout a few of the most tough market situations for the crypto market.

The identical initiatives, and others constructing on Polkadot, have strengthened the community’s potential for 2023. Polkadot is in a greater place to leverage development within the blockchain trade now greater than ever. It underscores the strong potential for development.

Polkadot has introduced a brand new staking dashboard designed to make it simpler for customers. It is a transfer that would set off an enormous enhance in TVL within the subsequent few months.

Due to the brand new Staking Dashboard, staking natively on Polkadot is now simpler than ever – take a look at new Polkadot technical explainers from @Web3foundation‘s @filippoweb3 for a walkthrough of a few of its options.

To study extra: https://t.co/CTPc2TIZOHhttps://t.co/RMWcLt1lZC

— Polkadot (@Polkadot) December 8, 2022

Evaluating the potential impression on DOT

The above observations conclude that Polkadot is already on a wholesome momentum so far as development is anxious. It is usually making ready to leverage extra development within the coming 12 months.

However can traders and merchants faucet into that development by means of its native cryptocurrency, DOT? The reply will rely upon the extent of demand it could actually command out there.

DOT’s weighted sentiment metric registered a pointy upsurge in the direction of the tip of November. Sadly, it was rapidly hosed down, resulting in dampened investor sentiment.

Supply: Santiment

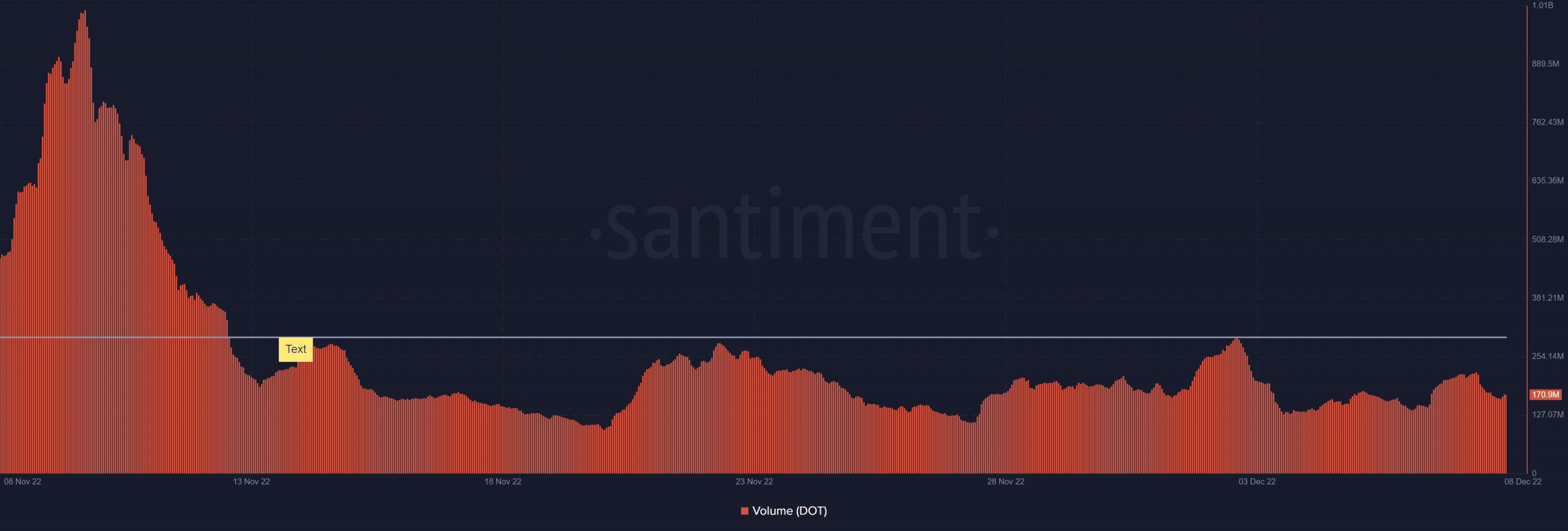

The surge signifies that traders had been optimistic about DOT’s prospects. Nevertheless, the fast sentiment shift suggests a scarcity of market confidence. It additionally didn’t maintain sturdy volumes, suggesting that demand remains to be low.

Supply: Santiment

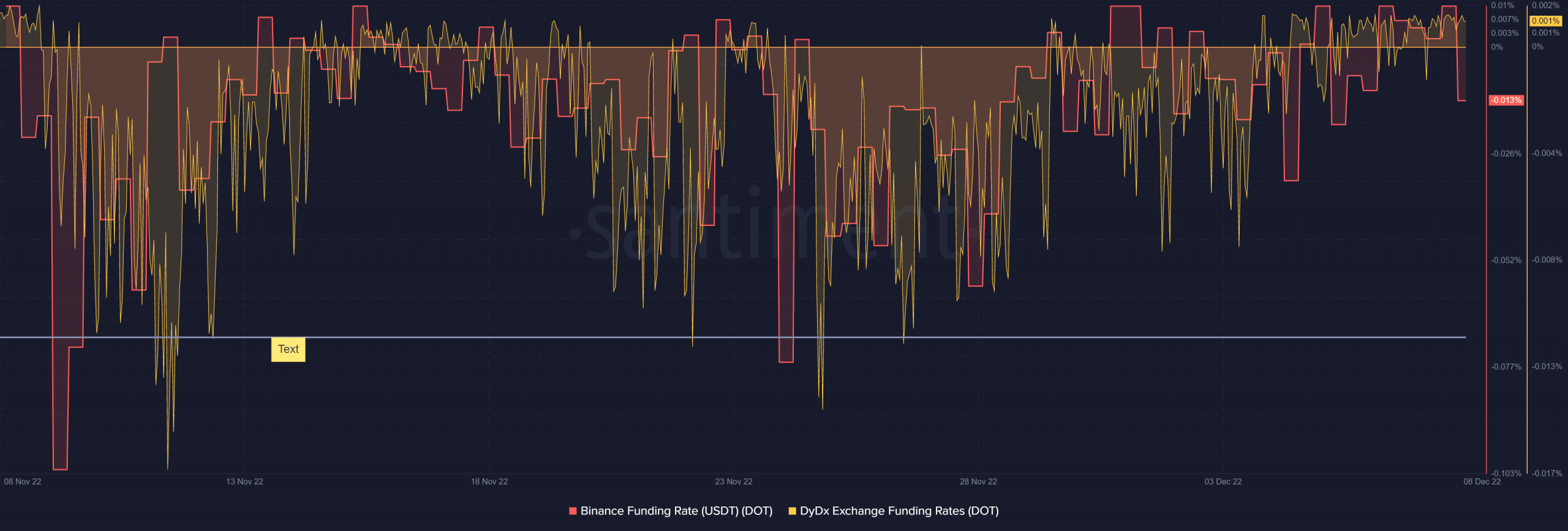

Though spot demand has been low, some observations within the derivatives market counsel enhancements. The demand for DOT has improved regularly for the reason that final week of November, in accordance with the Binance and DYDX funding charges.

Supply: Santiment

Sadly for DOT holders, the enhancements in derivatives demand present no correlation with the value. DOT skilled value slippage in November, and the identical pattern continued within the first week of December. It traded at $619 at press time.