Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- The retracement under 78.6% meant Dogecoin could possibly be buying and selling inside a variety

- Lengthy positions have been blown up en masse in December, therefore bulls should stay cautious

Bitcoin had a quiet couple of days as volatility died out over the weekend. It may return with a vengeance on Monday. Inventory market indices akin to S&P 500 have been bearish over the previous week, and 19 December may set the development for the following week.

Learn Dogecoin’s [DOGE] Value Prediction 2023-24

Dogecoin fell again right into a area of help at $0.072 and noticed a 4% bounce during the last two days, however Open Curiosity was weak.. Nevertheless, it nonetheless confronted resistance at $0.08, a degree that has been important over the previous month. Can bulls reclaim this degree and push increased?

A bullish order block rescues Dogecoin, however this could possibly be nothing greater than a brief respite

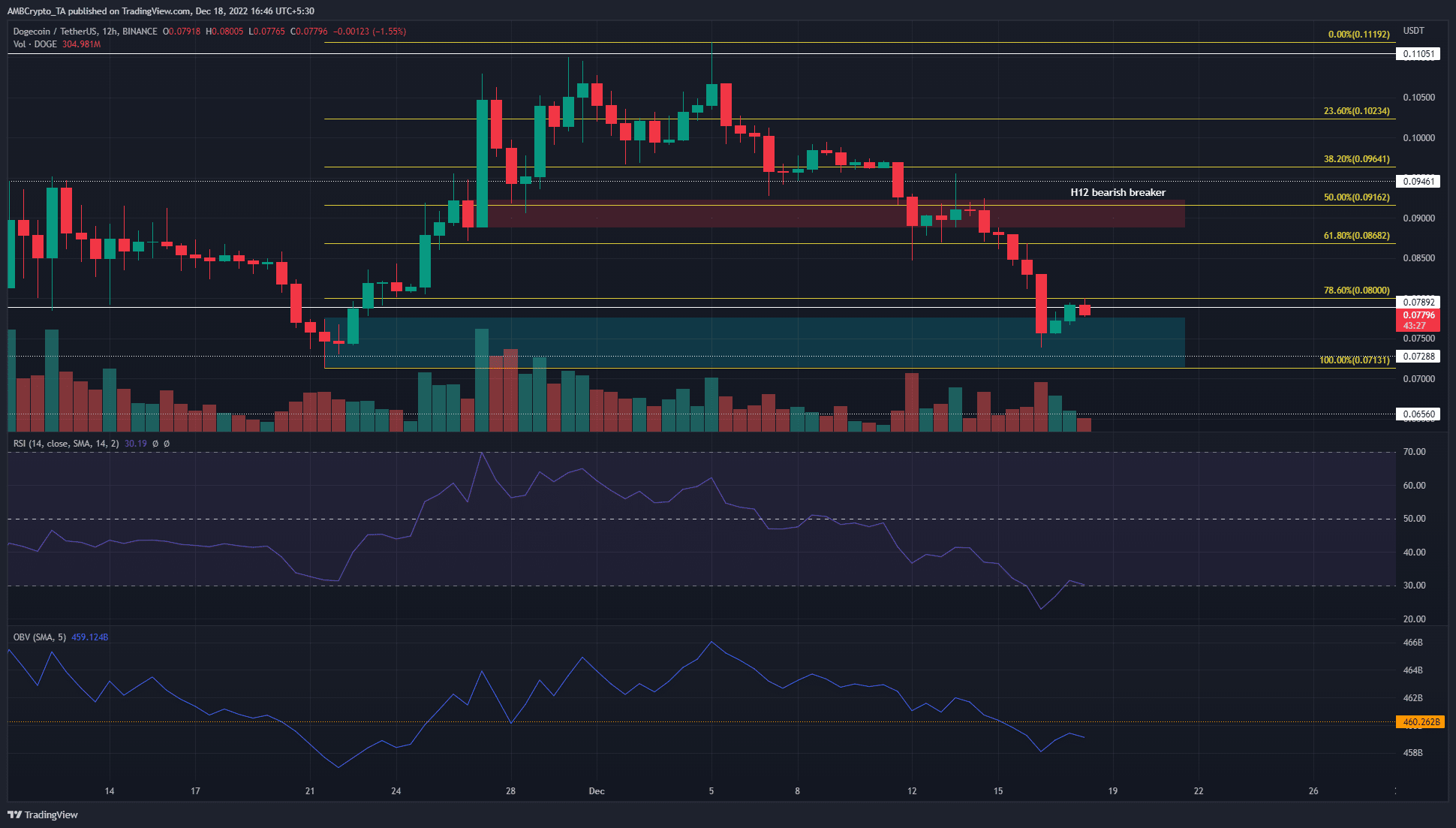

Supply: DOGE/USDT on TradingView

Primarily based on the late November transfer from $0.071 to $0.119, a set of Fibonacci retracement ranges (yellow) was drawn. On the time of writing, the worth has sunk beneath the 78.6% retracement degree. It encountered bullish order block, marked in cyan, above the $0.072 degree of help.

The just about full retracement meant that Dogecoin probably traded inside a variety and was not in a robust development. The Relative Energy Index (RSI) oscillated from strongly bullish to strongly bearish momentum regardless that DOGE has not displayed a longer-term development since mid-November. The On-Steadiness Quantity (OBV) additionally sank beneath a degree of help from late November.

Collectively, they recommended that the sellers have been dominant. A day by day session shut beneath $0.071 would probably provoke a leg downward for DOGE. Nevertheless, courageous bulls can look to bid the asset inside this zone.

The $0.8 degree was flipped to help earlier than the surge to $0.119 a few weeks in the past. As a horizontal degree in addition to a Fibonacci retracement degree, it held significance. A retest as help within the coming days can provide a shopping for alternative. Take-profit targets can be the bearish breaker at $0.091, and the $0.11 highs. Under $0.072, the following degree of help lies at $0.065.

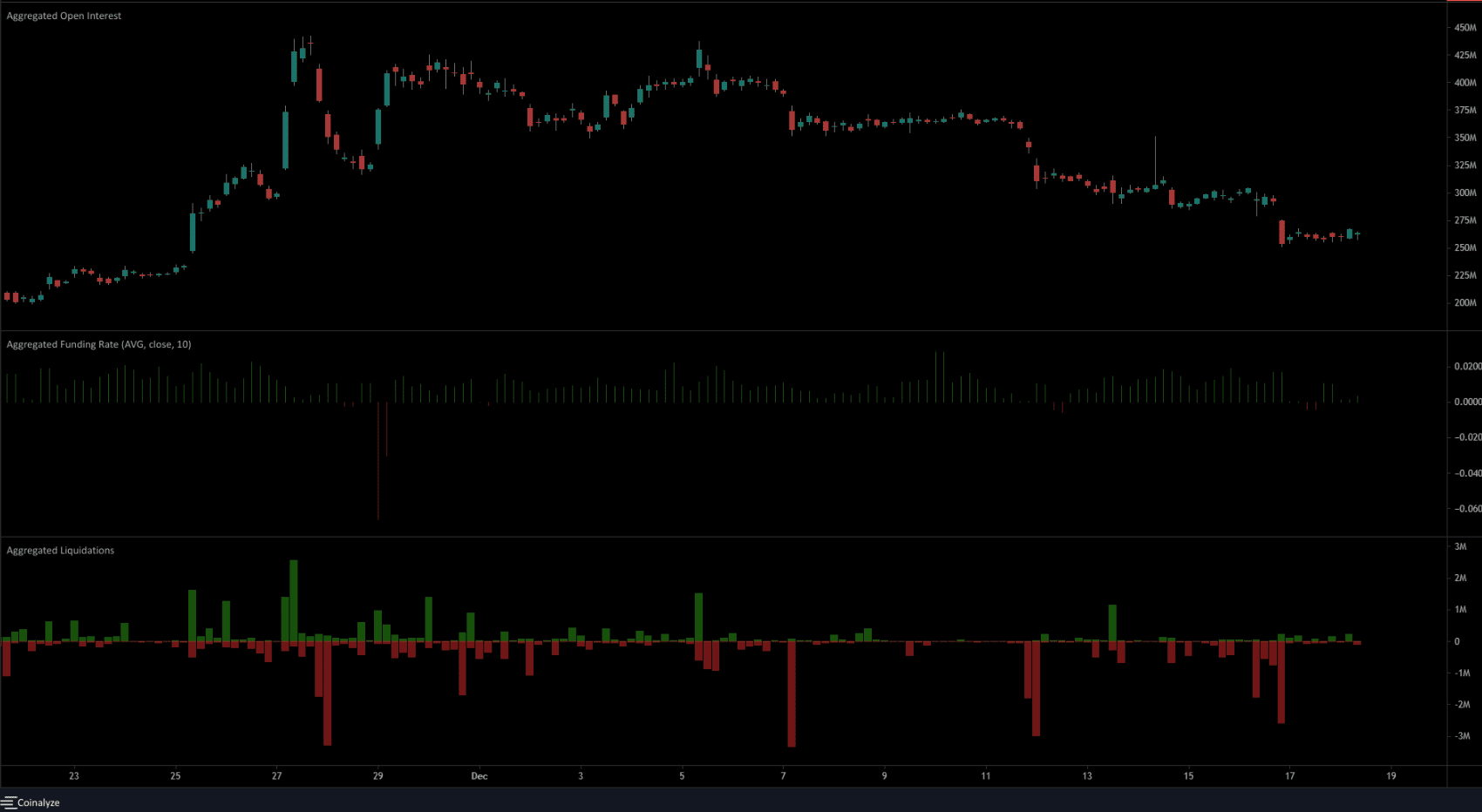

Open Curiosity noticed a small hike over the weekend and funding charge remained constructive

Supply: Coinalyze

For the reason that starting of December, Dogecoin has seen session with a pointy drop in costs. These have been accompanied by tens of millions of {dollars} price of lengthy positions being liquidated. All through the descent from $0.119 on 5 December to $0.075 on 16 December, the Open Curiosity additionally noticed a decline.

This indicated lengthy positions have been discouraged. The funding charge remained in constructive territory, which additionally confirmed that almost all of the market didn’t start to pile into quick positions.