- Bitcoin’s worth reacted negatively because the FOMC report indicated an increase in rates of interest.

- Bitcoin examined the $18,000 area earlier than falling again, however there are indications of a possible improve.

Bitcoin (BTC) and the cryptocurrency market couldn’t have requested for a greater end result from the Federal Open Market Committee (FOMC) assembly that ended on December 14.

After recording a acquire that introduced it to a stage it had not seen for the reason that starting of the month, BTC responded unfavorably to the info from the FOMC. How massive of an impact did the information have on BTC, and what can we anticipate within the coming days?

A dive into the report

The Shopper Worth Index (CPI) was issued on 13 December, previous the FOMC report by Chair Jerome Powell. Inflation in the USA slowed to 0.1% from 0.4% in October, a constructive improvement for the Federal Reserve’s efforts to rein in skyrocketing costs.

Bitcoin (BTC) costs rose after the report was launched as a result of buyers believed the Federal Reserve can be inspired to gradual the tempo of rate of interest hikes if inflationary pressures on customers have been lessened.

Nonetheless, Bitcoin’s (BTC) market conduct following the discharge of the FOMC report instructed that the information had dampened buyers’ enthusiasm. U.S. rates of interest have been elevated by 50 foundation factors (Bps) on 14 December.

Additionally it is price noting that it has been 15 years for the reason that federal fund’s goal vary was this excessive. The Federal Reserve Board Chair Jerome Powell has instructed that the ultimate rate of interest (terminal price) will probably be higher than 5%.

Worth drops, however the development stays bullish

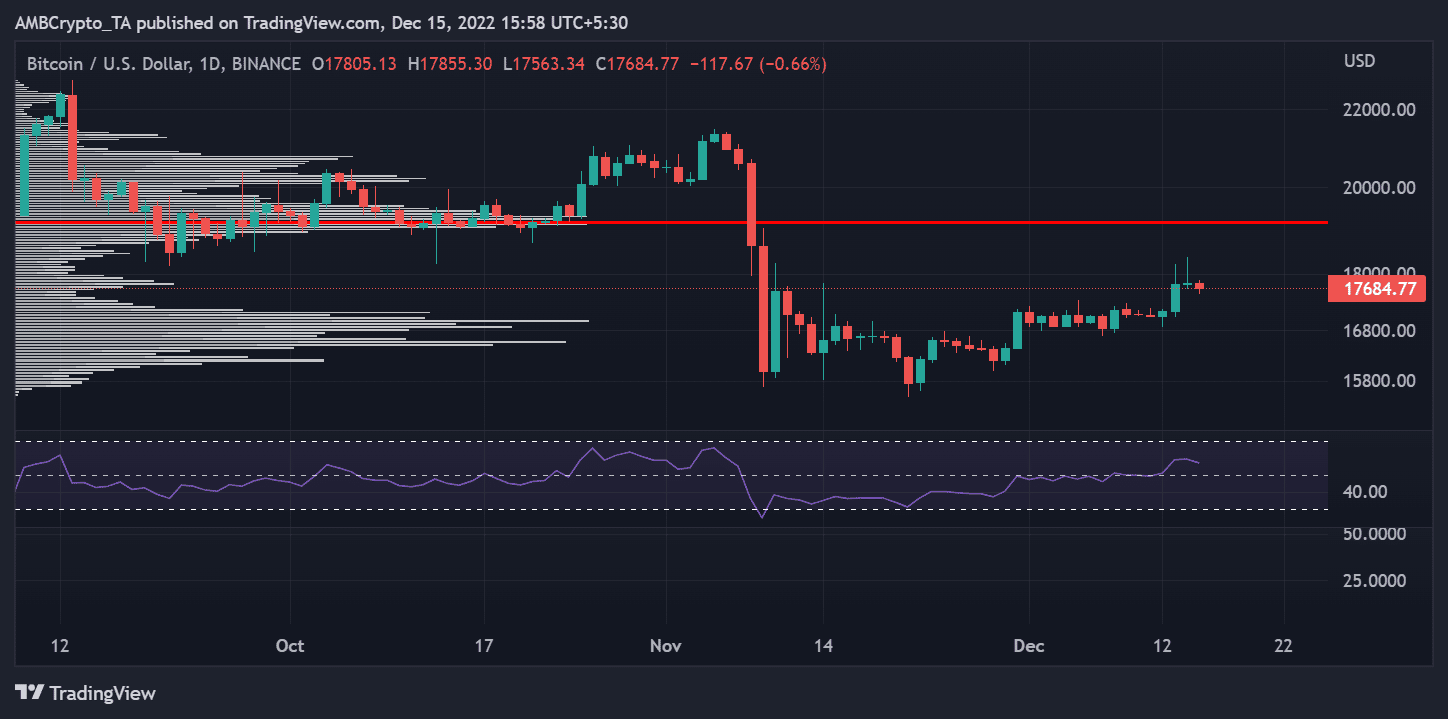

When wanting on the day by day timeframe for the BTC chart, it was clear that the asset didn’t reply effectively to the information. Based on the graph, Bitcoin’s worth peaked across the $18,000 space on 13 and 14 December earlier than crashing to roughly $17,600 on the time of writing.

The Seen Vary Quantity Profile evaluation confirmed that the value may nonetheless go greater regardless of the obvious decline.

Supply: TradingView

As Bitcoin approaches $17,600, it enters a low-volume node area, which can point out imminent worth volatility. A major worth settlement typically accompanied by much less fast worth fluctuation is represented by a high-volume node.

When in comparison with high-volume nodes, low-volume nodes denote much less bustling hubs. To achieve the subsequent space of settlement, costs typically transfer swiftly by way of these zones. The Relative Power Index (RSI) indicator revealed that Bitcoin was nonetheless fairly bullish regardless of the obvious, albeit modest, worth downturn.

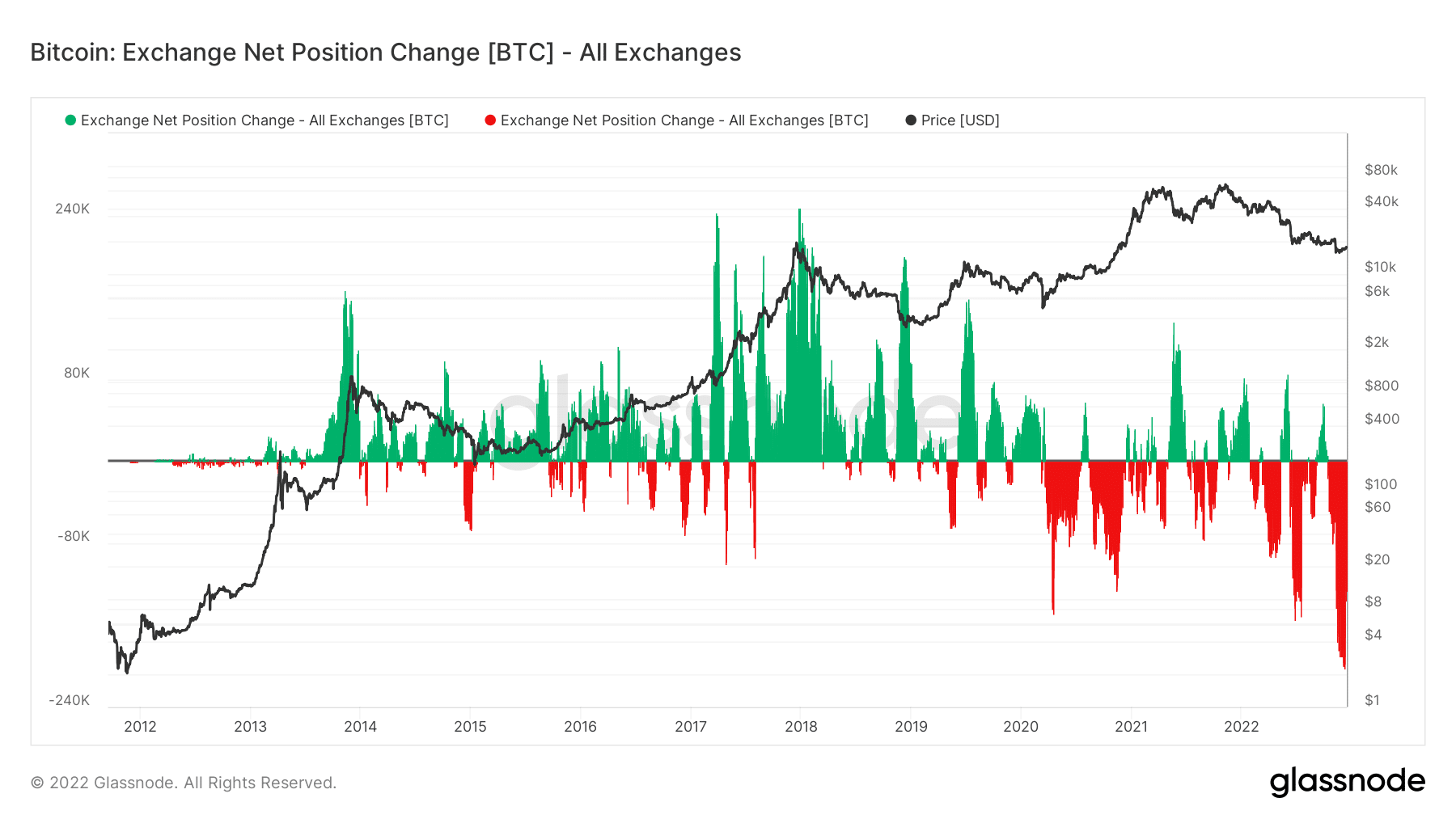

BTC outflow dominates

The Change Web Place Change metric could clarify why Bitcoin remained bullish regardless of its obvious worth decline. Glassnode’s knowledge confirmed that the general share of BTC leaving exchanges had elevated.

If the worth of this indicator is constructive, it signifies that there are actually extra deposits being made to exchanges than withdrawals being made.

Supply: Glassnode

As buyers usually deposit their BTC in preparation for promoting, this development may be bearish. When the indicator’s worth drops beneath zero, nonetheless, it signifies that extra cash are being faraway from trade wallets than deposited, which may translate to a bullish development.

It’s necessary to do not forget that the present market situations symbolize a interval of traditionally low costs whereas analyzing BTC’s worth motion. Traditionally, December and January are probably the most bearish for property.

![Here is what Bitcoin [BTC] holders can expect after the FOMC reports](https://cryptonitenews.io/wp-content/uploads/2022/12/andre-francois-mckenzie-iGYiBhdNTpE-unsplash-4-1000x600-768x461.jpg)