- An unknown technical glitch sends Hedera to a grinding halt.

- HBAR bears turbocharging their assault because the dices fall of their favor.

Hedera community customers and builders skilled a tough time on Thursday (9 March) resulting from community downtime. That is the primary time that the community has skilled such an occasion. Nonetheless, it joins the likes of the Solana community which has skilled quite a few such incidents prior to now together with a latest occasion.

Is your portfolio inexperienced? Try the Hedera Revenue Calculator

Hedera builders initially reported that good contract irregularities triggered the community disruption. The occasion rendered many customers unable to entry the community’s companies.

After intensive investigations, builders discovered that the foundation trigger was attackers attempting to take advantage of Hedera’s good contract service code. The dev crew was compelled to close down community proxies on the mainnet as a part of its precautionary measures geared toward defending customers.

At this time, attackers exploited the Sensible Contract Service code of the Hedera mainnet to switch Hedera Token Service tokens held by victims’ accounts to their very own account. (1/6)

— Hedera (@hedera) March 10, 2023

Except for customers being unable to entry the community, Hedera DApps and companies have been additionally affected. Builders paused the Hashport bridge which was the conduit that the attackers used to maneuver stolen tokens. Disabling the Hashport bridge allowed the crew to cease the exploit.

The affect on investor sentiment

Community downtimes often have a unfavourable affect on investor sentiment. They will doubtlessly set off an erosion of the religion that traders have within the community.

It’s fairly tough to gauge the affect of the community downtime on Hedera’s native cryptocurrency HBAR as a result of it was already bearish earlier than the incident.

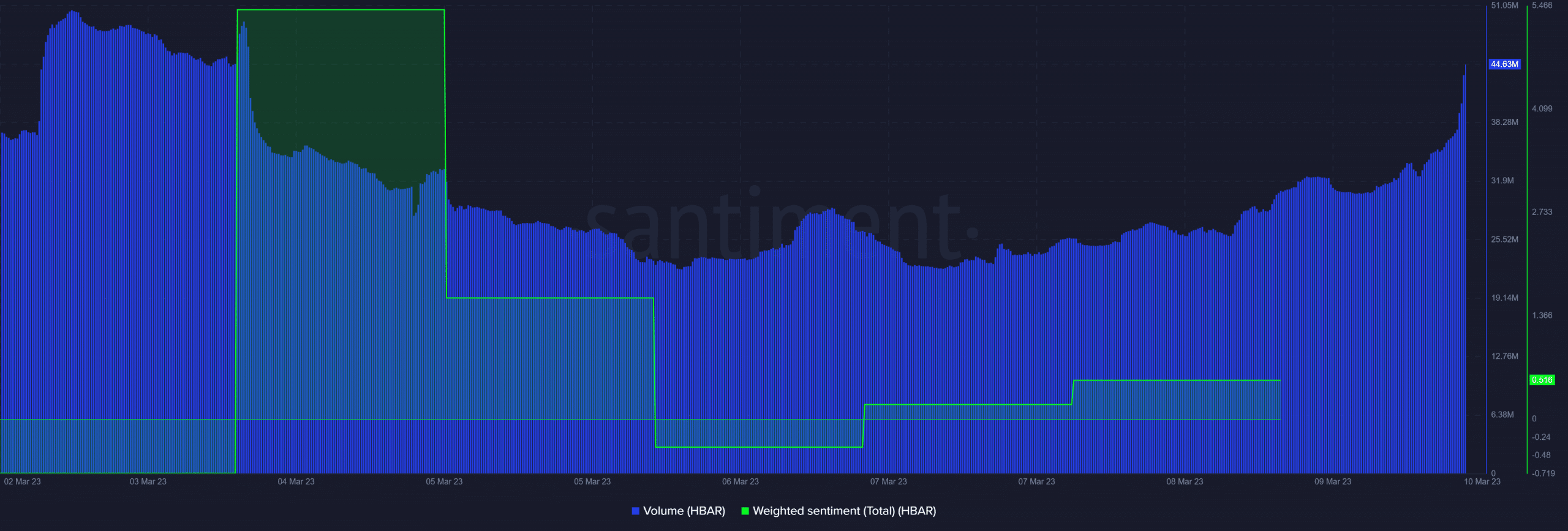

HBAR’s weighted sentiment metric kicked off the week with some draw back, confirming an general bearish expectation.

Regardless of this, the identical metric registered a little bit of an upside suggesting that some traders anticipate a pivot after the prolonged retracement.

Supply: Santiment

Hedera’s quantity metric registered a surge within the final 24 hours. Opposite to investor sentiments, the amount represents the rise in promote stress because of extra FUD available in the market.

HBAR tanked by greater than 8% within the final 24 hours, thus extending its retracement to 43% from its YTD highs. It exchanged fingers at $0.055 at press time, and the final time it traded inside this degree was within the third week of January.

Supply: TradingView

What number of are 1,10,100 HBARs price in the present day?

Hedera’s weighted sentiment is certain to lean in the direction of bullish expectations as has been the case within the final two days. The important thing cause is HBAR’s oversold nature after a sturdy pullback.

The MFI signifies that outflows have leveled out. The value should proceed tanking if market situations stay unfavorable.

![Hedera [HBAR] becomes the latest victim of network downtime](https://cryptonitenews.io/wp-content/uploads/2023/03/hedera-network-problem_ml_resize_x4_light_ai-1000x600-768x461.jpg)