Abstract:

- Gary Gensler’s SEC rejected Grayscale’s Bitcoin exchange-traded fund utility citing fraud and market manipulation issues.

- The digital asset supervisor sought regulatory permission to change its BTC spot belief index to an ETF, altering the product’s construction and decreasing an enormous low cost on the asset.

- CEO Michael Sonnenshein promised his firm would the SEC for its “capricious and discriminatory choice”.

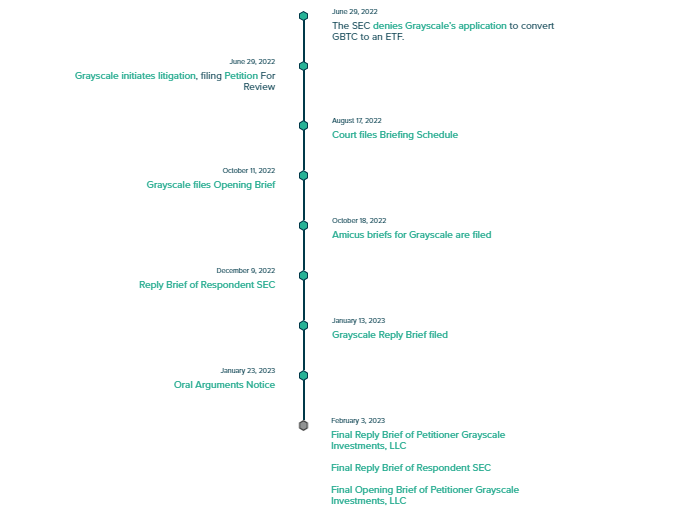

Crypto’s largest digital asset supervisor Grayscale just lately filed ultimate briefs in its lawsuit in opposition to the U.S. Securities and Alternate Fee for rejecting its Bitcoin spot ETF utility. The corporate which is a subsidiary of Barry Silbert’s Digital Foreign money Group (DCG) launched its authorized battle in opposition to Gary Gensler’s company again in October 2022.

Grayscale Bitcoin Belief (GBTC) was launched in 2013 as an index fund providing BTC spot publicity to prospects. The corporate filed to transform GBTC into an exchange-traded fund (ETF), altering the construction of the product and probably stemming an enormous low cost on the asset.

Certainly, the low cost on GBTC shares rose to virtually 40% in late 2022, a document excessive for the favored Bitcoin product value over $12 billion on the time.

SEC Rejects Grayscale Bitcoin ETF Software

Gary Gensler’s SEC rejected Grayscale’s utility claiming issues of trade fraud and crypto market manipulation. The choice garnered heavy backlash from the crypto asset supervisor who argued that the SEC had authorised comparable spot-based ETFs and futures merchandise.

Grayscale responded to the SEC’s verdict with a lawsuit on October 12, 2022, according to earlier guarantees of authorized actions from CEO Michael Sonnenshein. Sonnenshein mentioned the corporate would sue the SEC if its BTC ETF utility was rejected once more.

DCG Sells Grayscale Shares At Low cost

Grayscale’s father or mother firm Digital Foreign money Group (DCG) began promoting discounted shares from merchandise issued by its crypto asset supervisor. DCG determined to dump property from the $10 billion-strong portfolio to lift money. The group’s lending and buying and selling arm Genesis declared chapter final yr and owes over $3 billion to collectors, Gemini included.

Submitting with the SEC confirmed that DCG has primarily targeted on promoting property from the corporate’s Ethereum-based product below the ticker ETHE. Nonetheless, DCG may resolve to dump GBTC shares earlier than the Genesis chapter proceedings are over.