NFT

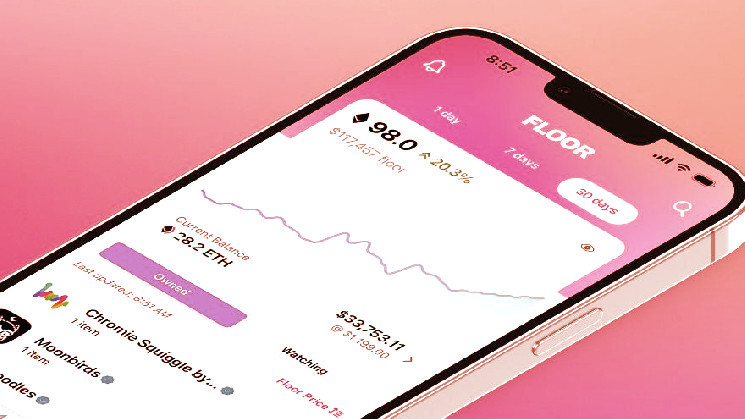

Flooring, the startup behind the NFT portfolio app of the identical identify, raised $8 million final 12 months and claims sizable progress for its token-gated app amid the NFT bear market. The agency has now unveiled the following step in its plans to develop each its function set and viewers, saying at the moment that it has acquired NFT analytics platform WGMI.io.

Whereas Flooring delivers a streamlined manner for NFT collectors to view and monitor their holdings, WGMI.io is concentrated on analytics round market exercise and buying and selling tendencies. Collectively, they goal to ship richer options for Flooring customers whereas bringing WGMI’s analytics options to a probably broader viewers.

“There have been large chunks of what they do this we thought may assist speed up us,” Flooring CEO and co-founder Chris Maddern informed Decrypt.

Former Robinhood, Button, Venmo Execs Elevate $8M for NFT Firm Flooring

Maddern added that he noticed “an actual curiosity and fervour” from WGMI founder Thomas Mancini in increasing the platform’s options and performance past its comparatively small viewers of die-hard “degen” merchants, and that there was “a ton of alignment” on a united path ahead. Phrases of the deal weren’t disclosed, however Mancini has joined Flooring full-time.

Flooring debuted in October 2021 to an preliminary viewers of customers that minted its Era I membership cross NFTs, offering entry to the token-gated iOS and Android app. The platform expanded by way of word-of-mouth amongst merchants and thru subsequent NFT mints within the months that adopted.

In June 2022, Flooring introduced that it had raised $8 million in seed funding led by sixth Man Ventures, and that Christine Corridor (nee Brown)—beforehand the COO at Robinhood Crypto—had joined as COO and co-founder. Maddern and fellow Flooring co-founder and CTO Sid Dabral beforehand co-founded ecommerce startup Button.

Constructing within the bear

By the point Flooring’s funding was introduced, the NFT market was getting into what would show to be a precipitous decline in each buying and selling quantity and asset costs, in parallel with crumbling crypto costs and high-profile collapses. The NFT bear market circumstances solely worsened over the course of the 12 months, except for a slight uptick in gross sales in December.

At the same time as broader momentum and hype round NFTs diminished late final 12 months, Maddern and Corridor informed Decrypt that Flooring steadily grew its person base, even whereas remaining gated behind an NFT entry cross. It partnered with main tasks like Doodles and Proof to offer NFT holders with entry, and let present customers airdrop passes to pals to onboard them into Flooring.

That led to what Flooring claims is a 700% improve in customers amid the bear market, with greater than 10,000 complete energetic customers which have to date linked over 22,000 complete crypto wallets to trace their property. The agency additional says that Flooring customers accounted for 8% of gross sales on main NFT market OpenSea in December, pointing to an viewers of plugged-in merchants.

Maddern mentioned that the WGMI.io deal offers “a possibility to boost our heads” after a number of months of behind-the-scenes constructing, and to start out sharing its imaginative and prescient for Flooring’s roadmap ahead.

Why Christine Brown Left Robinhood for an NFT App

Within the quick time period, meaning tapping a few of WGMI’s performance to counterpoint Flooring’s choices. Customers can anticipate new options like buying and selling evaluation and trait pricing—that’s, monitoring demand for the person traits of NFT tasks, like the varied visible particulars that make up a Bored Ape Yacht Membership profile image (PFP).

Maddern additionally envisions a function that may let customers specify what sort of NFT they need from a sure challenge (based mostly on particular traits) and at what worth level, after which obtain an alert when a market itemizing matches these standards. It might be akin to what StreetEasy affords for actual property, he mentioned, however for digital property like Doodles and Apes.

Flooring’s path ahead

Flooring’s bigger imaginative and prescient is to in the end turn into the go-to vacation spot for NFT collectors to not solely view their very own property and monitor tendencies, Maddern says, but in addition to remain linked with tasks, obtain updates from the group, and take the temperature of market sentiment. In different phrases, an all-in-one hub for NFT homeowners.

Corridor mentioned that in conventional markets, there’s “a variety of formality” round the way in which that corporations share data with traders, as a consequence of centralized constructions and rules. The long-term objective with Flooring is to combination and current data and “alerts from the group” alike to NFT collectors in a decentralized style—a shift she described in gaming parlance as going “from single-player mode to multiplayer mode.”

That’s additionally a shift for Corridor, who left the company world of public firm Robinhood for an NFT startup, however she mentioned that it’s been “most likely probably the most enjoyable 12 months of my profession to date.” She’s having fun with the expertise of constructing within the open, experimenting, and “getting your fingers soiled.”

Flooring finally hopes to achieve a a lot wider viewers, however the when and the way are nonetheless within the works. The invite-driven mannequin will stay intact for the foreseeable future, Maddern mentioned, as Flooring continues constructing within the bear market and making ready for what it expects shall be one other progress cycle for the NFT area forward.

“What’s enjoyable for us in a interval like that’s that we will actually perceive the core use instances of individuals which might be right here, and who’re nonetheless engaged and energetic,” mentioned Corridor, “but in addition spend a variety of time constructing for what we do consider would be the subsequent wave of progress and adoption.”