Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- Two obstacles block FIL’s path to its pre-FTX ranges.

- FIL’s growth exercise fell, however the Funding Fee remained constructive.

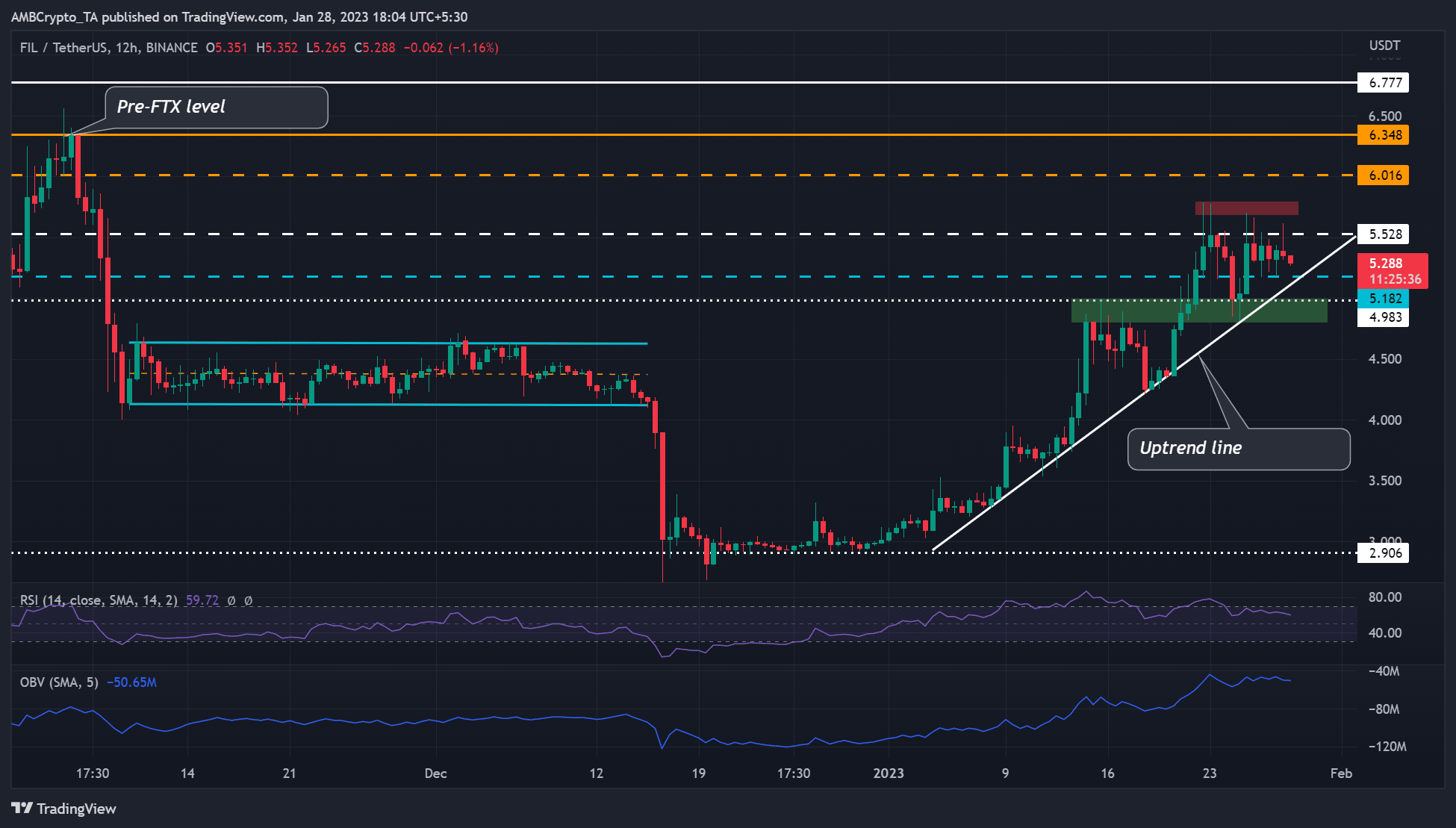

Filecoin [FIL] rally in January supplied buyers over 90% beneficial properties after rising from $2.992 to a excessive of $5.788. Nevertheless it was nonetheless two obstacles from its pre-FTX degree of $6.348. At press time, FIL’s worth was $5.288, flickered pink after Bitcoin [BTC] misplaced maintain of the $23K zone.

Learn Filecoin [FIL] Worth Prediction 2023-24

Promoting strain and the $6.016 hurdles: Can bulls clear them?

Supply: FIL/USDT on TradingView

FIL acquired into an prolonged value consolidation between mid-November and mid-December 2022 after a large drop following the FTX saga.

It fell from $6.554 to $2.433, shedding over 60% of its worth. However the $2.906 assist degree was regular sufficient for bulls to launch restoration from.

Is your portfolio inexperienced? Examine the FIL Revenue Calculator

FIL’s uptrend momentum in January has seen buyers get well many of the losses after the FTX saga. However a short-term promoting strain zone ( $5.679 – $5.790) and $6.016 hurdles prevented full restoration to the pre-FTX degree of $6.348.

FIL may overcome these two obstacles if BTC recovers and surges above the $23.5K zone.

Nonetheless, a break beneath $5.182 and the uptrend line would invalidate the bullish bias described above. Such a drop may settle on the $4.983 assist degree.

FIL’s growth exercise tanked, however demand remained regular

Supply: Santiment

In response to Santiment, FIL’s growth exercise declined progressively and affected buyers’ outlook on the asset, as proven by the drop in constructive weighted sentiment. The prolonged decline may undermine the wanted momentum to beat the 2 obstacles.

Nonetheless, FIL’s Funding Fee remained constructive, suggesting an underlying bullish outlook on the asset. Additional demand for FIL within the derivatives market may bolster the uptrend momentum and inflict a value reversal.

As well as, there was an uptick in FIL’s buying and selling quantity after a pointy decline. However the uptick was but to bolster shopping for strain by press time. Due to this fact, buyers ought to observe BTC efficiency, particularly on the $23.5K and $22.5K ranges.

![Filecoin [FIL] could ensure another 20% hike, if Bitcoin [BTC]….](https://cryptonitenews.io/wp-content/uploads/2023/01/traxer-MP2doWMbGRw-unsplash-1000x600-768x461.jpg)