US monetary titan Goldman Sachs reportedly believes that the Federal Reserve won’t increase rates of interest this month following the high-profile collapses within the banking sector.

Goldman Sachs’ chief economist Jan Hatzius predicted on Sunday that the Fed will pause charge hikes this month as a substitute of bumping them up by one other 25 foundation factors, as was beforehand anticipated, in keeping with a report from CNBC.

“In gentle of the stress within the banking system, we now not count on the FOMC [Federal Open Market Committee] to ship a charge hike at its subsequent assembly on March twenty second.”

Fellow banking large JP Morgan, nevertheless, believes the alternative, in keeping with Wall Avenue Journal economics correspondent Nick Timiraos.

“In the event that they certainly have used the appropriate software to deal with monetary contagion dangers (time will inform), then they will additionally use the appropriate software to proceed to deal with inflation dangers – larger rates of interest. So, we proceed to search for a 25bp hike at subsequent week’s assembly.”

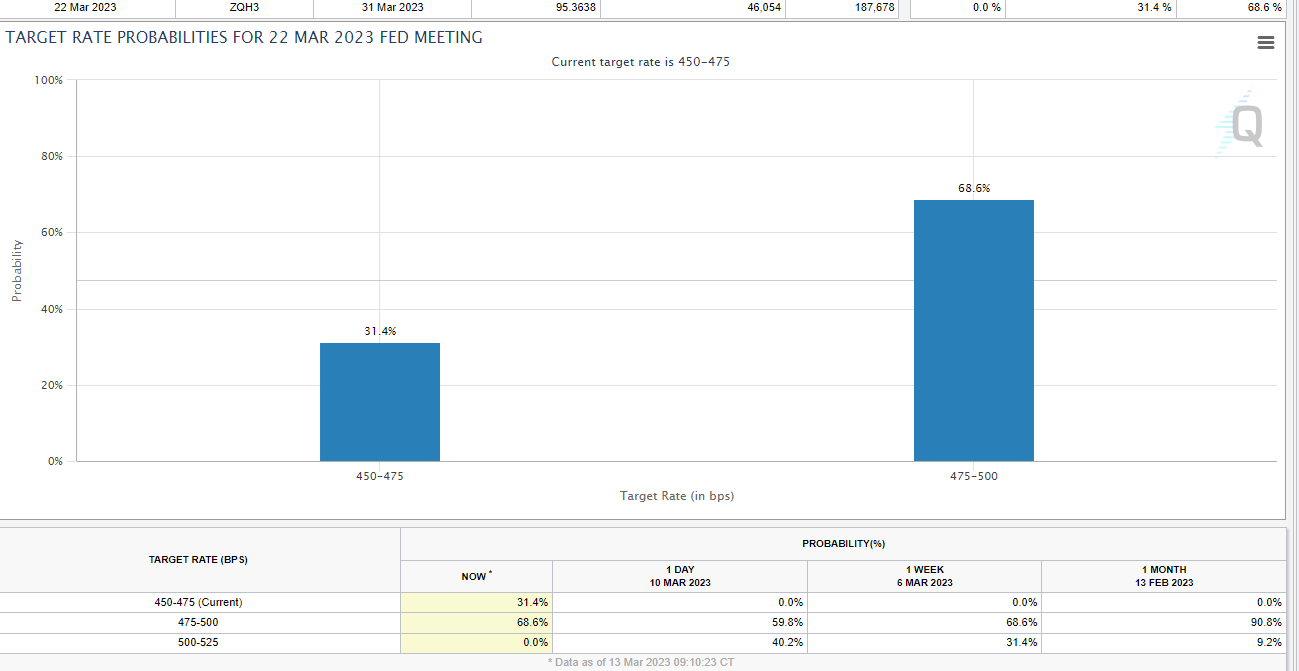

At time of writing, traders consider that there’s a virtually 69% likelihood that the Fed will enhance charges by 25 foundation factors subsequent week with a 31% likelihood that the company will pause.

Silicon Valley Financial institution (SVB) suffered a run and collapsed final week after it revealed $1.8 billion in losses, largely on account of promoting US bonds that misplaced a lot of their worth due to the Fed’s aggressive charge hikes.

The contagion unfold from SVB to New York-based establishment Signature Financial institution, which shut its doorways on Sunday after going through down a $10 billion run on deposits on Friday. Signature’s collapse was the third-biggest financial institution failure within the nation’s historical past, in keeping with CNBC.

Over the weekend, the Federal Reserve and Treasury Division announced they might make as much as $25 billion obtainable as loans for banks to make sure they will keep liquid and meet any withdrawals.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney