- FTM ranked because the primary altcoin on LunarCrush’s AltRank.

- Bullish momentum is slowing, exhibiting that consumers could be exhausted.

Fantom [FTM] clinched the primary spot on the rating of altcoins that outperformed Bitcoin [BTC] on 14 December, knowledge from LunarCrush confirmed.

The cryptocurrency social analytics platform has an AltRank function by means of which it tracks the social and market exercise of 4,047 cash and the way they outperform main coin BTC.

Learn Fantom’s [FTM] Worth Prediction 2023-24

To log its place because the altcoin that outperformed BTC essentially the most by way of social exercise, of all of the 4,047 altcoins tracked, FTM’s social quantity was ranked 67 and recorded a social rating of 27.

With main social + market exercise, #Fantom has hit AltRank™ 🥇 out of the highest 4,047 cash.

LunarCrush AltRank™ seems to be for cash that outperform #Bitcoin. Stage up your account to realize entry to our unique AltRank™ insights.

Extra $ftm nsights: https://t.co/G3VYwsWOfa pic.twitter.com/HUvb3FNxHp

— LunarCrush (@LunarCrush) December 14, 2022

FTM for the win

Per knowledge from CoinMarketCap, FTM exchanged palms at $0.2384 at press time. Whereas the remainder of the market suffered a decline after FTX’s surprising demise, FTM’s decoupled from the remainder of the market to log features.

Within the final month, its worth has grown by 28%. Inside that interval, the alt’s market capitalization additionally jumped from $480 million to $660 million.

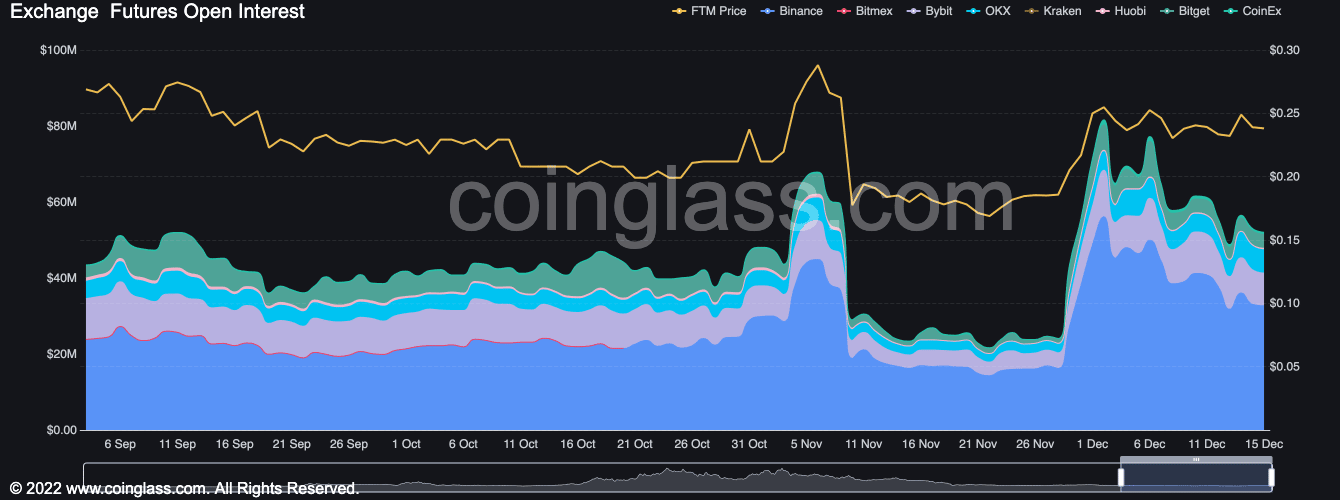

Additional, an evaluation of FTM’s Open Curiosity for the reason that FTX debacle revealed a rally since 10 November. Per knowledge from Coinglass, this was $52.04 million at press time, having grown by 79% since 10 November.

This confirmed {that a} sturdy bullish conviction lay behind the worth rally, which remained unaffected by FTX’s collapse.

Supply: Coinglass

Here’s a caveat

Whereas FTM’s value may need rallied within the final month, an evaluation of its efficiency on a each day chart revealed that the alt has traded in a good vary for the reason that starting of the month.

Because of this, whereas key indicators remained bullish, that they had weakened over the previous two weeks. Furthermore, the worth has proven a sample of decrease highs, making the latest momentum lower comprehensible.

The Relative Power Index (RSI) was at 54.91 at press time. Beneath its impartial 50-region, the decline in bullish momentum triggered FTM’s Cash Move Index (MFI) to be noticed at 40.25, nonetheless in a downtrend.

Additional, its Chaikin Cash Move (CMF) and On-balance quantity (OBV) have been flat for the reason that starting of the month. Whereas these indicators remained bullish, their flatness since December confirmed that consumers could be present process exhaustion and a market takeover by sellers was imminent.

Supply: TradingView

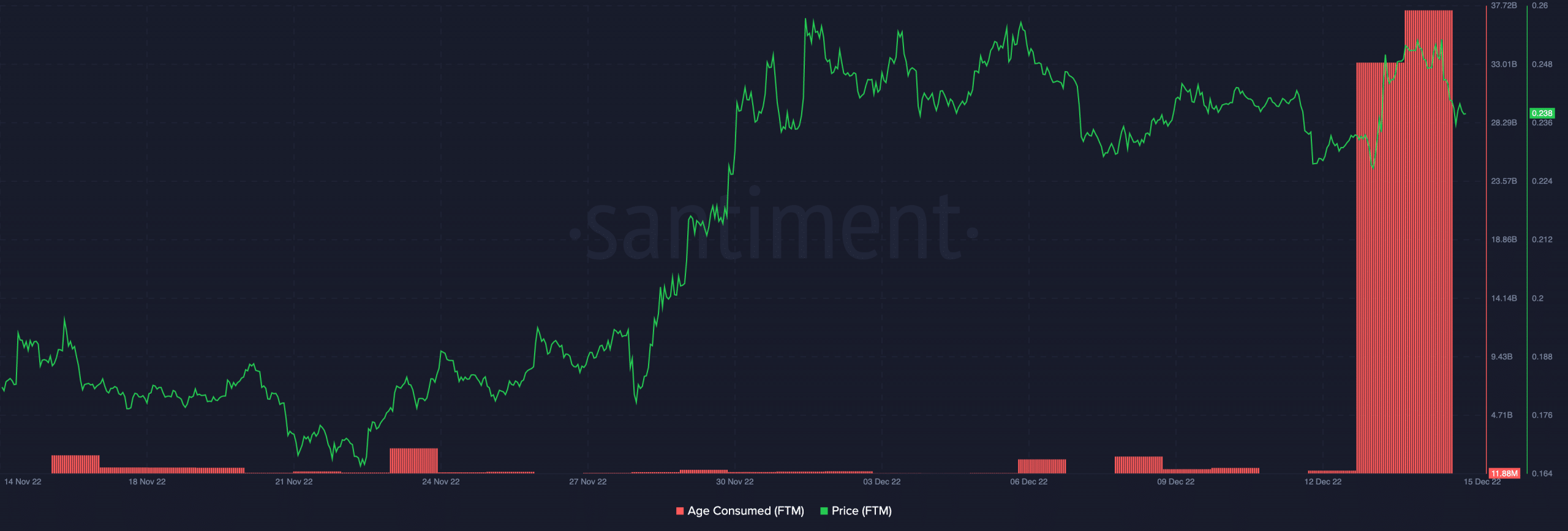

A have a look at FTM’s Age Consumed metric confirmed this. This metric tracks the exercise of beforehand dormant cash on the blockchain.

A rise in Age Consumed signifies that a lot of beforehand inactive tokens are actually being moved between addresses, doubtlessly indicating a sudden change within the conduct of long-term holders.

Per knowledge from Santiment, FTM noticed a spike in its Age Consumed, and a value decline adopted this. This indicated {that a} native backside had been reached and a adverse value reversal was coming.

Supply: Santiment