Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- Fantom bounces exhausting from the $0.23 area of assist

- The short-term outlook was additionally strongly bullish and might see FTM rally increased

Over the previous couple of days, beforehand stablecoin-hugging merchants and traders have deployed capital and entered the crypto markets with some confidence. Proof for this was current on the Tether Dominance chart which fell from 8.27% on Monday to face at 7.94% at press time.

Learn Fantom’s [FTM] Value Prediction 2023-24

This indicated shopping for strain might have appeared over the previous two days. Fantom rallied after a drop to $0.223 and confirmed indicators of transferring again towards $0.26 and $0.289. With Bitcoin additionally capable of break above $17.8k, a number of bullish days might be forward.

The confluence between Level of Management and inefficiency meant bulls had the higher hand

Supply: FTM/USDT on TradingView

From 28 November to 2 December, Fantom rallied from $0.185 to $0.255. This represented features of round 37%. In doing so, FTM left behind an inefficiency on the 12-hour chart. Highlighted in white, this FVG has already been visited, and the worth climbed increased swiftly.

The FVG additionally has confluence with the Quantity Profile Seen Vary’s Level of Management, which lay at $0.228. The decrease timeframe bullish market construction break that occurred on 13 December when FTM broke above $0.242 additionally strengthened the bullish place.

On decrease timeframes, the $0.238-$0.242 has been an vital zone. A retest of the identical searching for liquidity can provide merchants with a very good risk-to-reward shopping for alternative.

The RSI confirmed momentum remained bullish however has weakened over the previous two weeks. On the similar time, the worth has fashioned decrease highs, therefore this fall off on momentum was comprehensible. As long as FTM can hold itself above the $0.222 mark, its bullish bias could be preserved. In the meantime, the OBV has been flat in December.

Any consumers within the neighborhood of $0.24 can look to take revenue on the Worth Space Excessive at $0.257 (which can be an area resistance) and the $0.289 resistance ranges.

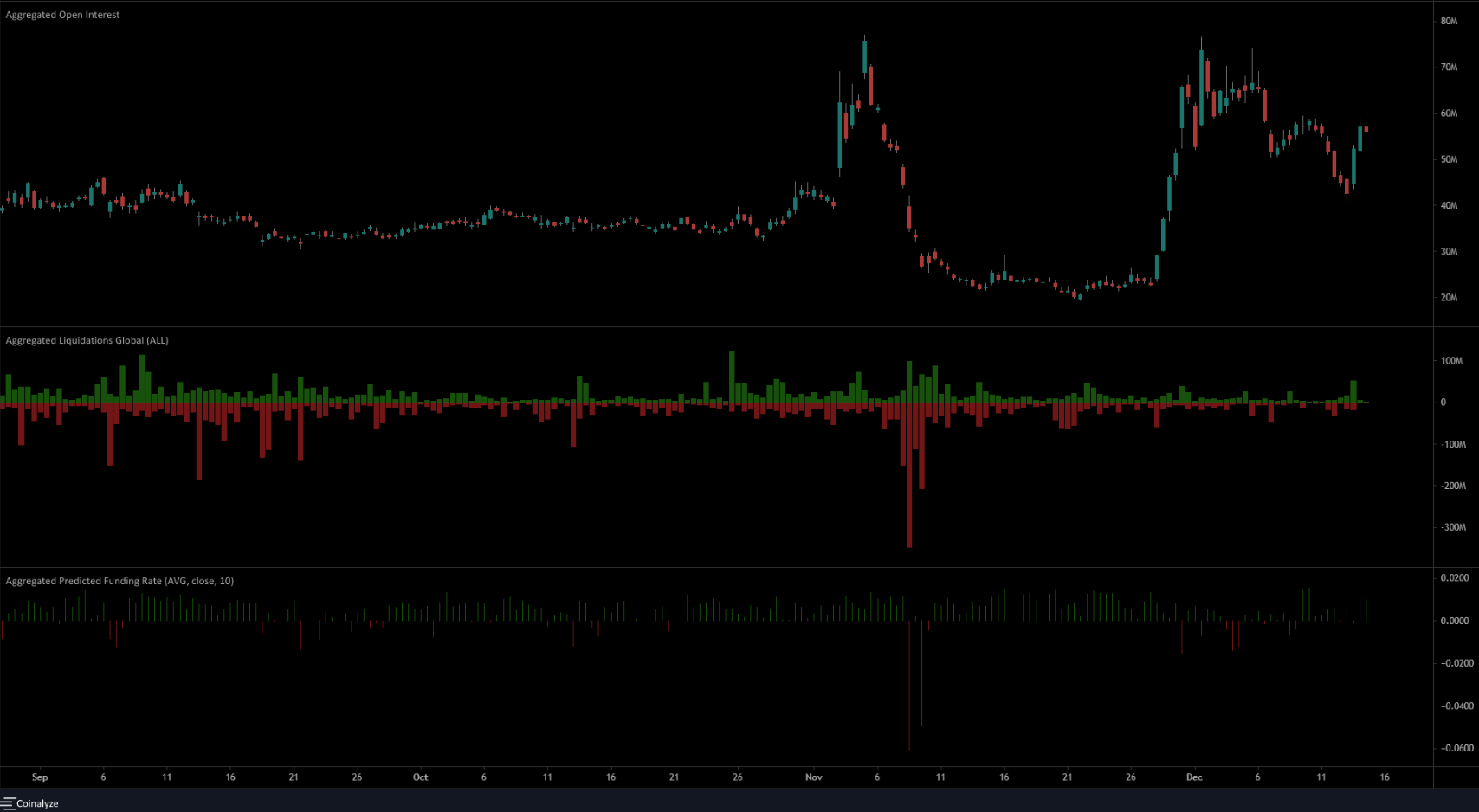

Open Curiosity picked up drastically in late November and merchants stay bullish

Supply: Coinalyze

Throughout FTM’s fast rally late in November, the Open Curiosity noticed an enormous transfer upward. Simply earlier than this rally, it had been flat close to the $23 million mark, nevertheless it surged to virtually $72 million just some days thereafter. This confirmed a powerful bullish conviction behind the rally.

The sweep of the FVG was accompanied by a fall in OI. These indicated bulls have been seemingly being compelled to shut at a loss. Nonetheless, the funding price has been constructive in latest days and confirmed merchants remained bullishly positioned.

If FTM can transfer again above $0.255, and the OI additionally perks up, it could be a agency indication of bullish intent.

![Fantom [FTM] bulls left emboldened after a rally from $0.22, analysis inside](https://cryptonitenews.io/wp-content/uploads/2022/12/PP-3-FTM-cover-1000x600-768x461.jpg)