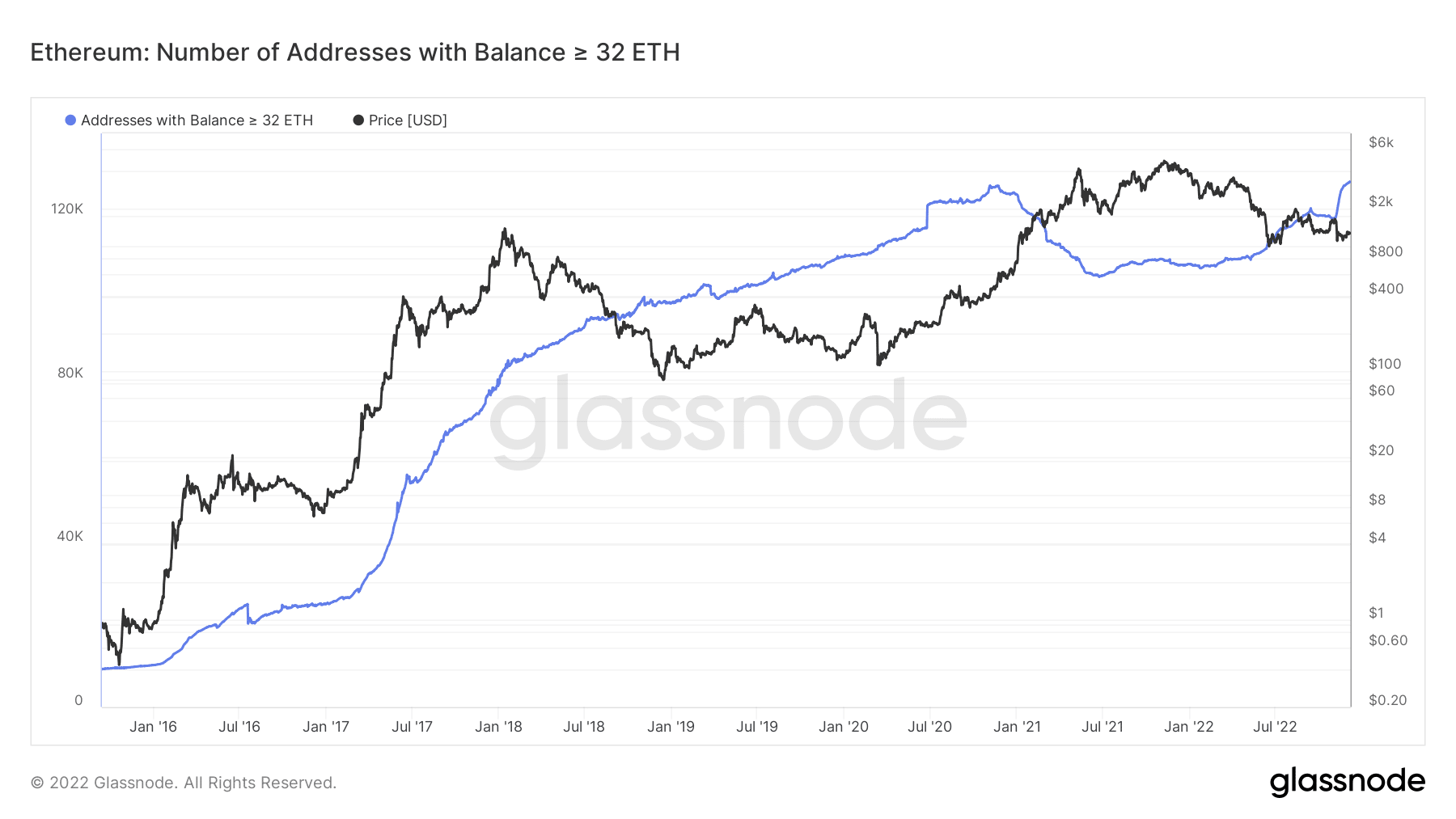

- In keeping with knowledge from glassnode, addresses holding 32 ETH and above had elevated to an all-time excessive

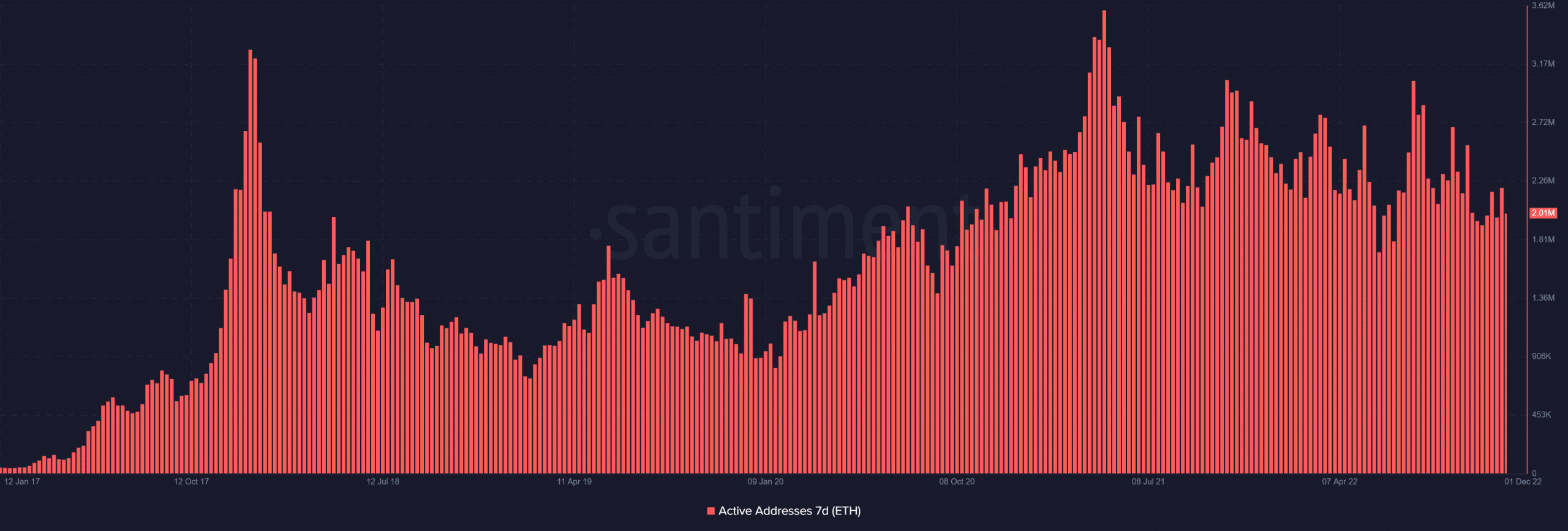

- A rise on this metric didn’t nevertheless replicate on the each day energetic handle and 7-day energetic handle metrics

In latest weeks and months, the worth of Ethereum (ETH) has not been very spectacular. Not simply ETH’s low value motion, however that of different cryptocurrencies available in the market has been closely attributed to the overall state of affairs of the market.

That, nevertheless, doesn’t seem to have had a damaging influence on its accumulation. Current analysis means that buyers holding a certain amount of ETH have been rising.

32 ETH holder hits All-time Excessive

Regardless of the decline and volatility within the value of Ethereum (ETH), glassnode showed a rise within the variety of addresses holding 32 ETH or extra.

In keeping with the chart that might be seen on the time of this writing, there have been over 127,000 addresses that had been registered. Moreover, it was clear that the variety of addresses presently had reached an all-time excessive in recent times, not solely elevated.

Supply: glassnode

Divergence with energetic addresses

Though there seemed to be an increase within the variety of these ETH homeowners, the each day energetic handle statistic didn’t correspond.

Santiment’s each day energetic handle metric had declined, as seen by a take a look at it. There have been about 382,000 energetic addresses that might be seen. The full was lower than what was seen in July when there have been over 500,000 people.

Supply: Santiment

A assessment of energetic addresses all through the earlier week additionally revealed a decline. About two million energetic addresses have been seen on the chart that was noticed. A more in-depth inspection additionally revealed that this quantity had decreased from what had beforehand been obtainable in earlier months.

Supply: Santiment

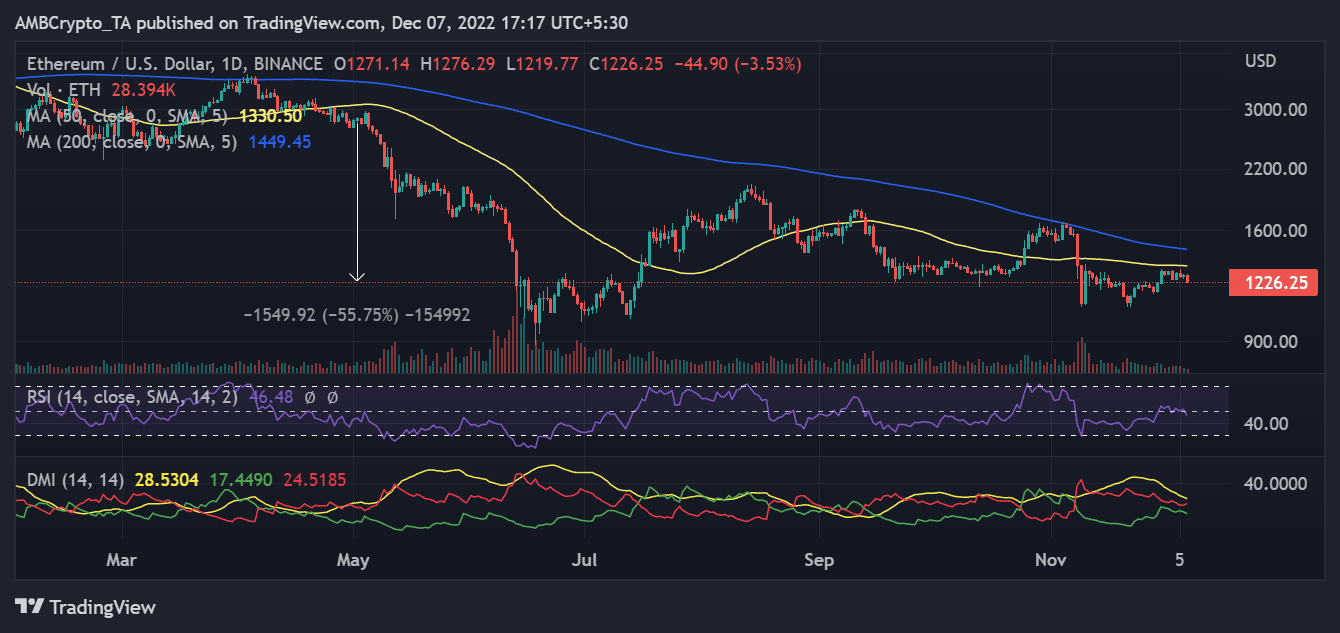

May ETH value transfer be the set off?

In latest months, the asset had been unstable, based on a verify at ETH in a each day timeframe. Regardless of the worth’s drop, historic knowledge confirmed it was nonetheless above its lowest level.

As of the time of writing, the worth had fallen to virtually $1,200. The drop represented a lower of greater than 3% from the earlier buying and selling session. An extra examination of the chart within the each day timeframe confirmed that for the reason that downtrend began in April, ETH had dropped by greater than 50%.

Supply: TradingView

In keeping with the Relative Energy Index (RSI), ETH was barely in a bearish development regardless of its latest fall. A faint bear development might be seen by wanting on the RSI line barely beneath the impartial line.

On the peak of the worth motion, the 50 and 200 Shifting Averages (yellow and blue strains) might be seen. The yellow and blue strains additionally acted as resistance, given their areas. If ETH can overcome this resistance degree, an increase to $2,000 is possible, given its earlier pricing.

In keeping with these measures, the current value and the anticipated improve might have been the driving drive behind these addresses’ accumulation of ETH. If it may possibly reclaim its April degree, ETH buyers will see over a 50% improve within the worth of their holdings.