- Ethereum witnessed declining income per core developer

- Regardless of this, retail buyers and validators continued to help Ethereum

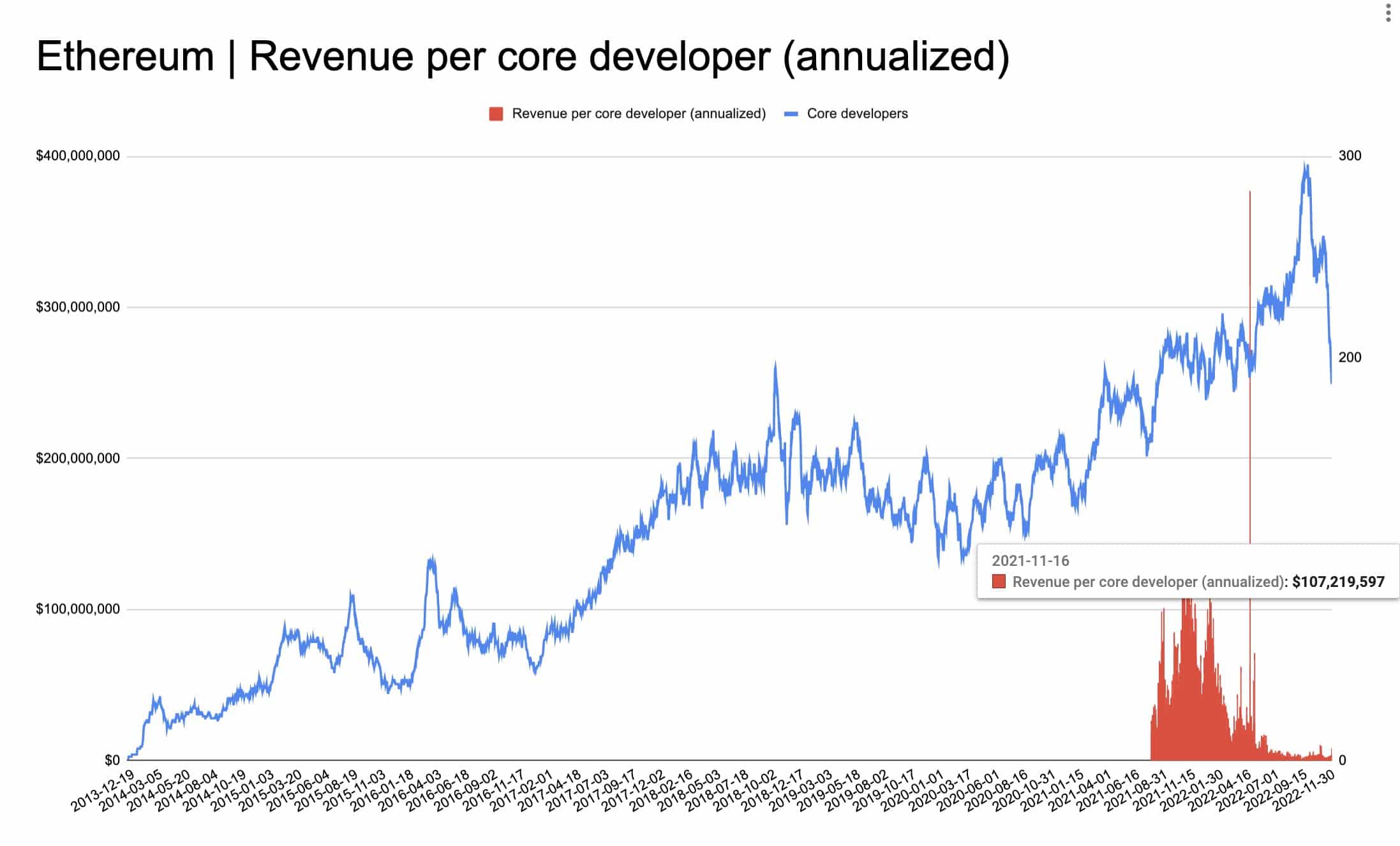

In response to a tweet by Token Terminal on 11 December, the quantity of Ethereum [ETH] income per developer had declined considerably because the starting of the bull market. With ETH going through growing volatility after the Merge, declining income may pose extra issues for Ethereum.

On the peak of the bull market final yr, Ethereum had a ‘income per core developer’ determine of ~$100M 🤯

In the intervening time, the determine is ~$3M pic.twitter.com/Q6eaTPt81w

— Token Terminal (@tokenterminal) December 11, 2022

Learn Ethereum’s [ETH] Value Prediction 2023-2024

As may be seen from the picture under, the income per core developer decreased materially. This occurred as the general variety of core builders engaged on Ethereum plummeted over the previous few weeks. The identical cam be seen within the chart given under.

Supply: Token Terminal

Regardless of this and different FUD surrounding Ethereum, retail buyers continued to point out their help for the altcoin. In response to information sourced from Glassnode, a crypto analytics group, the variety of non-zero addresses on the Ethereum community reached an all-time excessive of 91.1 million on 12 December.

📈 #Ethereum $ETH Variety of Non-Zero Addresses simply reached an ATH of 91,104,236

View metric:https://t.co/beS1MtIgAZ pic.twitter.com/d859yPOaRI

— glassnode alerts (@glassnodealerts) December 12, 2022

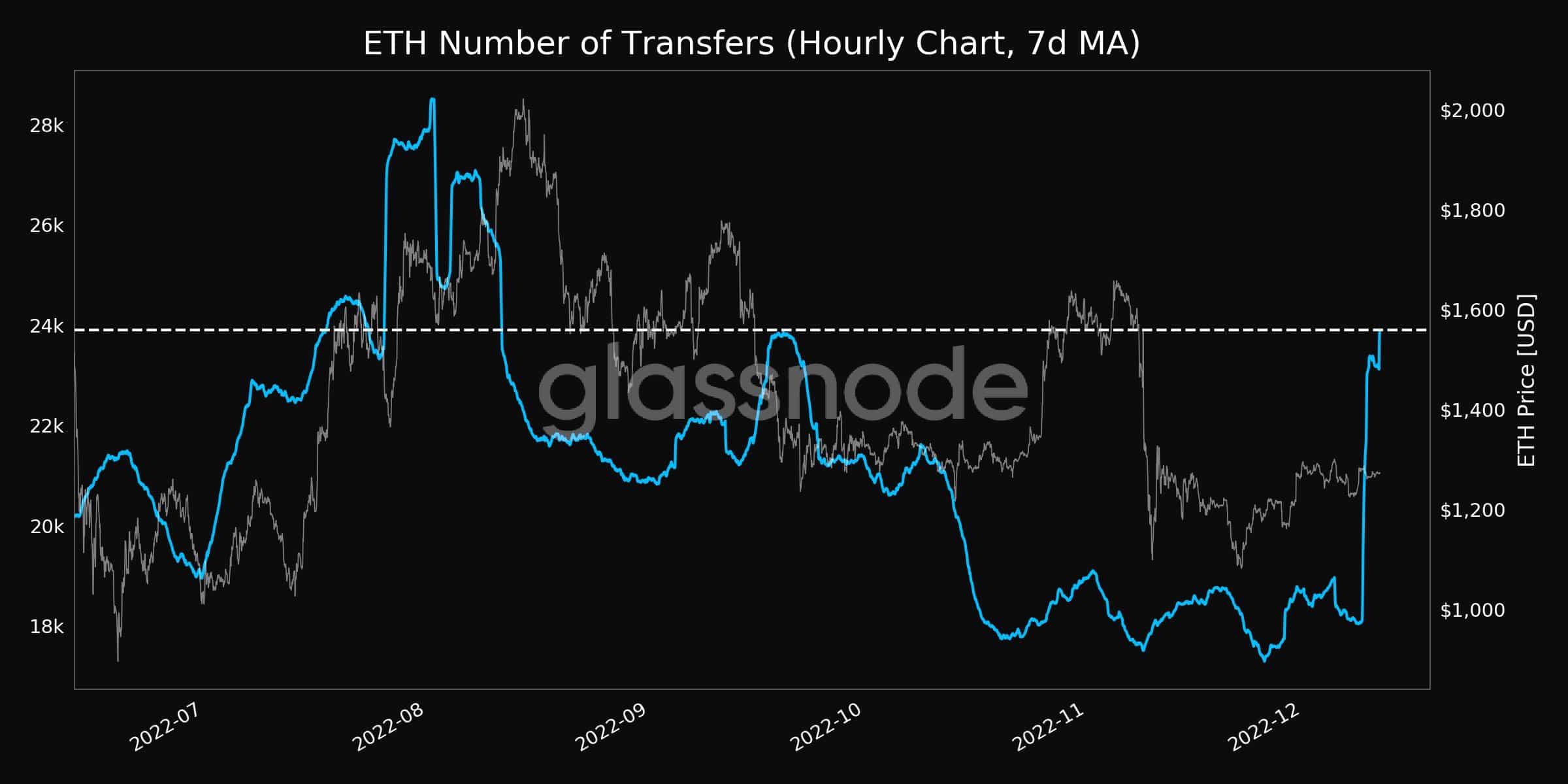

Moreover, the exercise on the community elevated as nicely. From the chart under, it may be noticed that the variety of transfers on the Ethereum reached a four-month excessive on 12 December.

Supply: glassnode

Validators stay unfazed

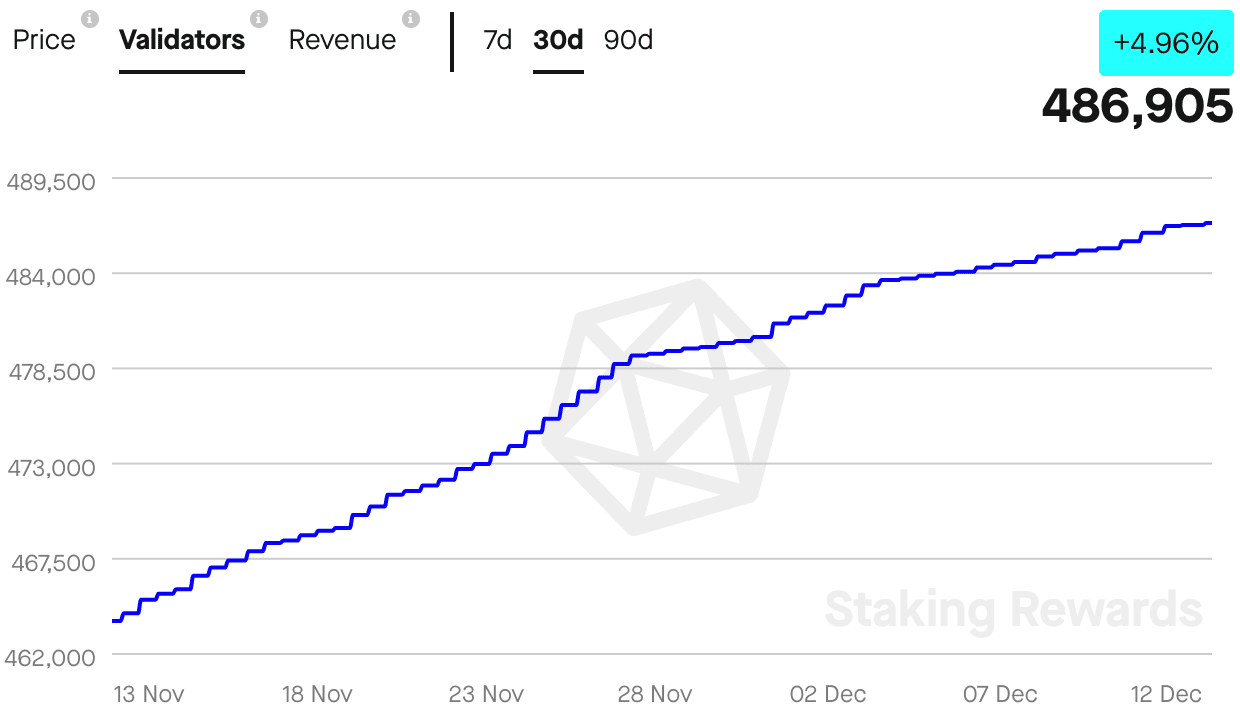

Alongside the aforementioned infromation, the variety of validators on the community grew by 4.96% during the last 30 days. At press time, there have been 486,000 validators on the Ethereum community.

The community’s validators continued to point out help for Ethereum regardless of the income declining by 25.66% within the final 30 days, in keeping with Staking Rewards.

Supply: Staking Rewards

Holders are going to HODL

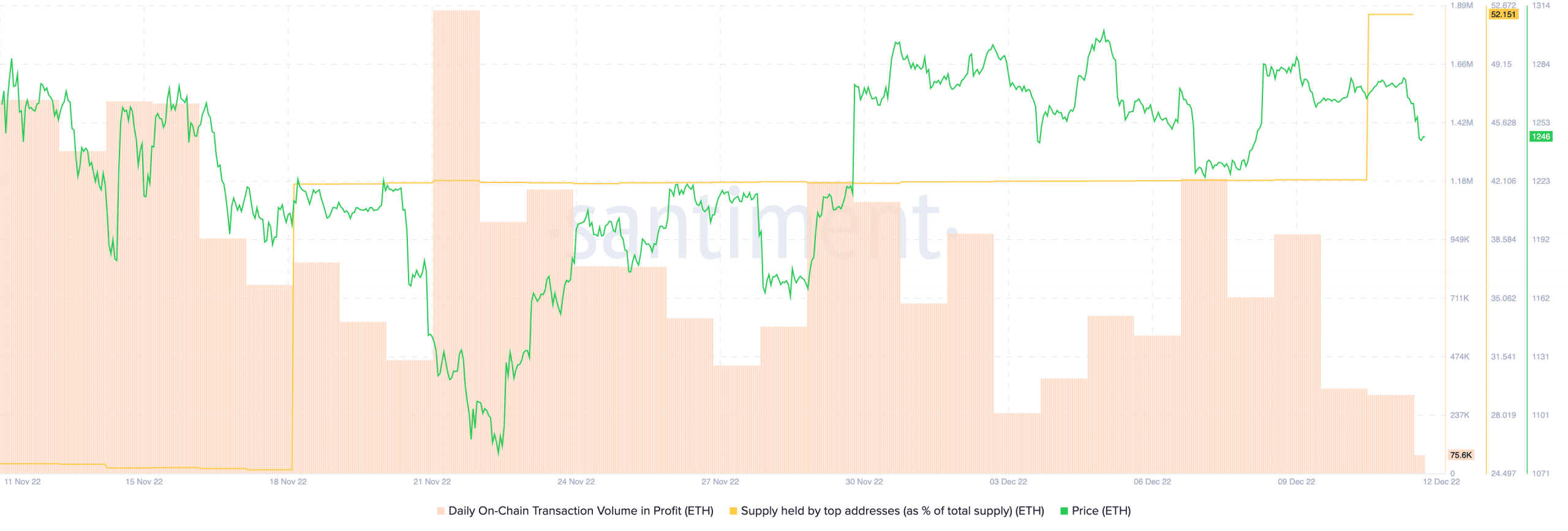

It wasn’t simply validators that confirmed help for Ethereum. From the picture under, it may be seen that regardless of Ethereum’s rising costs, the every day transaction quantity in revenue decreased.

This indicated that though many Ethereum holders had an opportunity to profit from this current rally, they determined to not promote and held on to the altcoin. Moreover, whale curiosity surrounding Ethereum grew over the previous few days, in keeping with Santiment.

Supply: Santiment

Regardless that there’s numerous volatility surrounding the crypto market, it seems that the crypto neighborhood stood in favor of holding on to their Ethereum tokens.