- Ethereum has fallen by over 5% up to now couple of days.

- Ethereum change provide has fallen to its lowest in virtually 5 years.

Ethereum [ETH] received off to an important begin this yr, working to regain the positions it had misplaced over the previous couple of months. Current value actions, nonetheless, have stopped the rising pattern that began again in January.

Most buyers have responded this fashion regardless of the current swings between highs and lows.

Learn Ethereum (ETH) Value Prediction 2023-24

Ethereum continues its downtrend

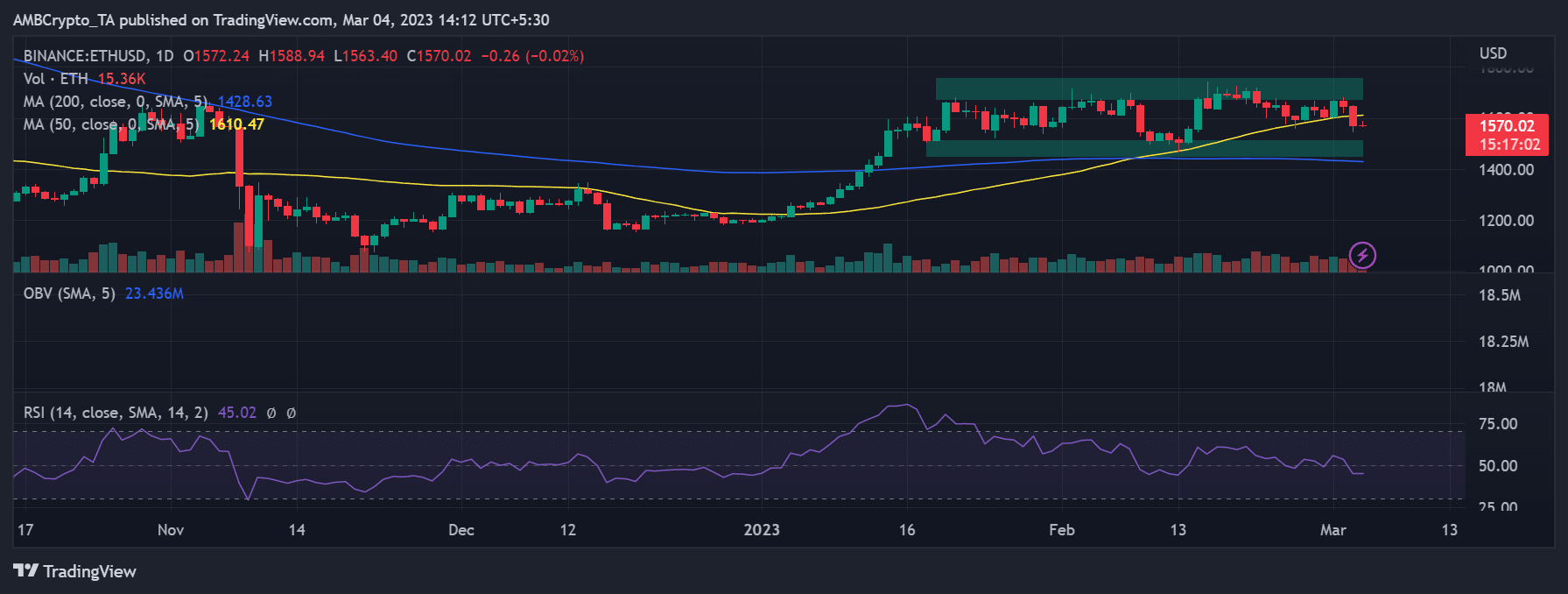

Within the earlier three days, Ethereum (ETH) has decreased by round 6%, in keeping with a every day timeframe evaluation.

Its value was roughly $1,560 as of the time of writing. Its value motion has fallen beneath the quick Shifting Common (yellow line) because of its over 4% worth decline on 3 March.

The lengthy Shifting Common (blue line), which additionally served as assist, was acknowledged at about $1,513 and $1,448. Additionally, the resistance was found within the $1,600 to $1,700 value vary.

Supply: TradingView

As well as, the current lower has turned Ethereum’s (ETH) pattern from bull to bear. Within the every day timeframe, the Relative Energy Index (RSI) line has dipped simply barely beneath the impartial area.

Alternate Provide falls to 5 years low

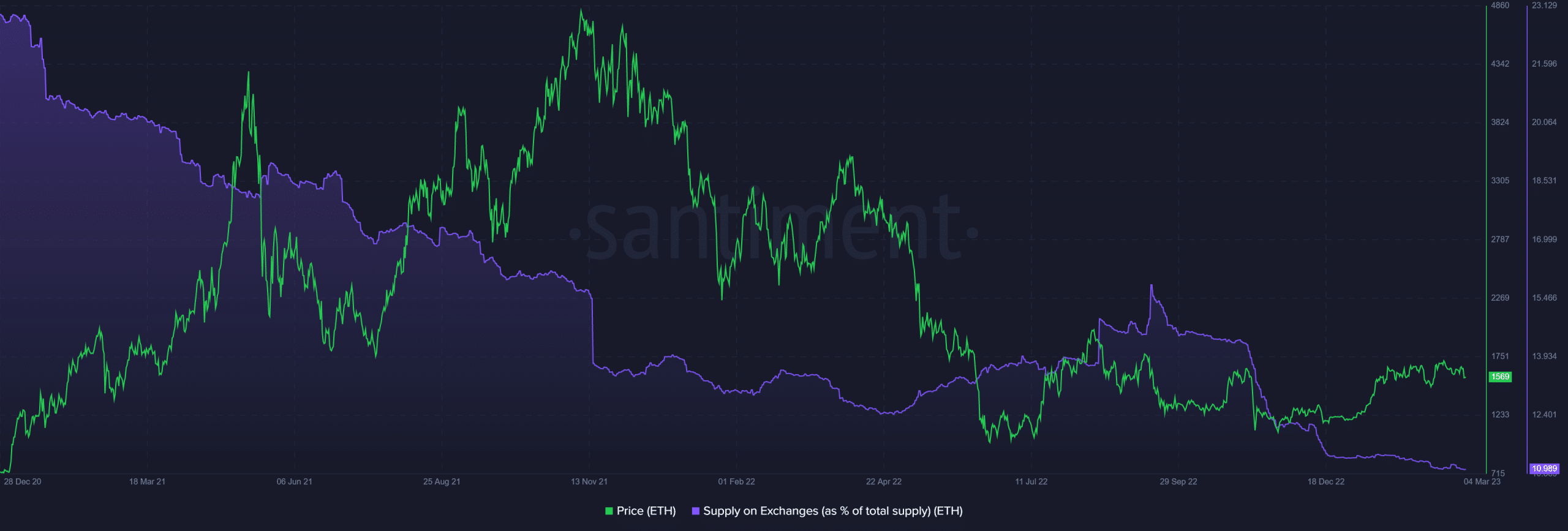

A current Santiment report confirmed that the proportion of the general Ethereum (ETH) provide on exchanges has decreased because of the value decline.

In accordance with the indicator, the change provide reached its lowest degree in practically 5 years. It made up virtually 11% of your complete provide as of the time of writing, down from over 11% in December and virtually 15% in November.

It confirmed that fewer individuals had been transferring their holdings to exchanges and as an alternative wished to maintain them of their wallets.

Supply: Santiment

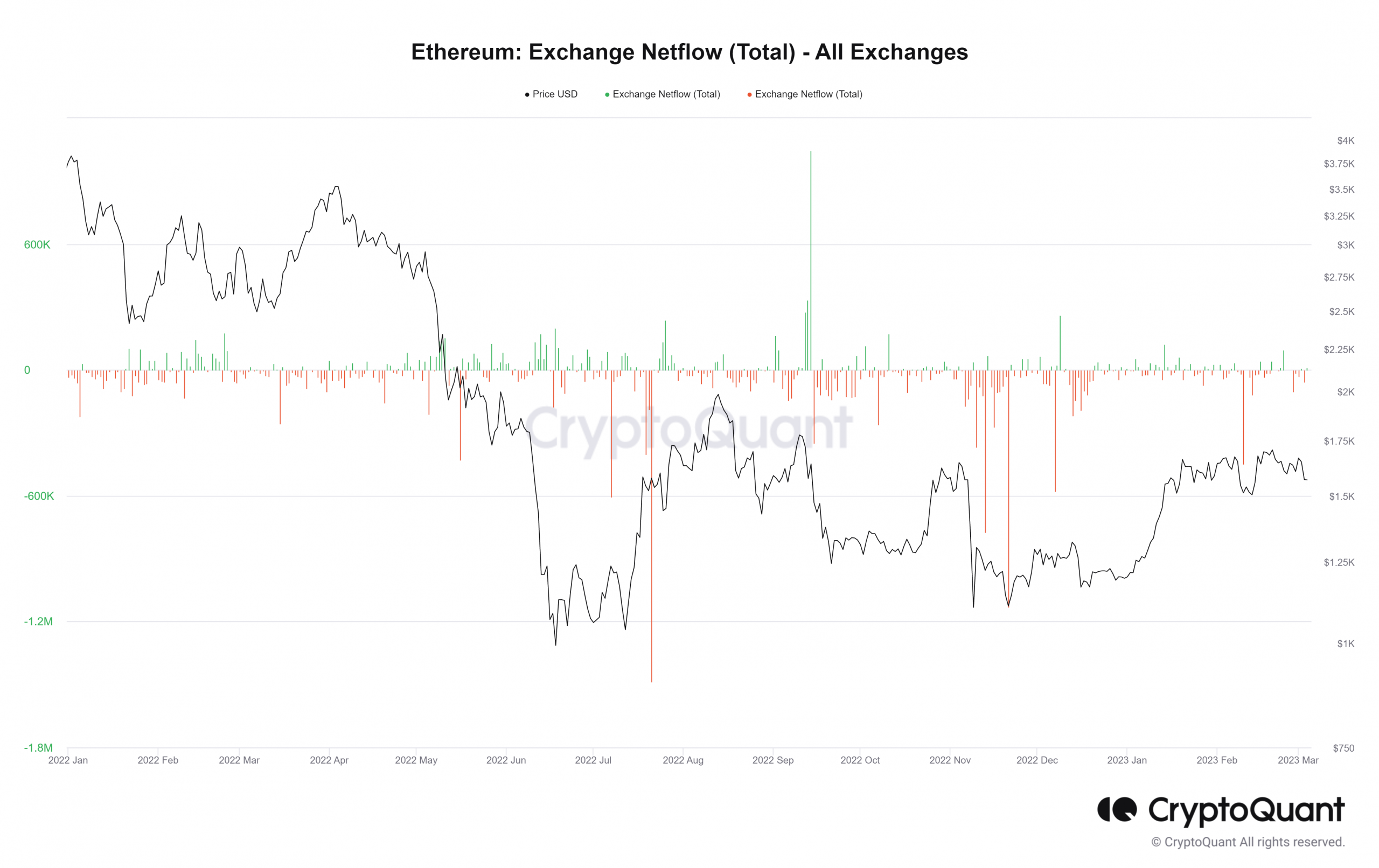

Evaluating one other comparable metric with the change provide metric revealed a definite sample of token motion on and off exchanges.

In accordance with CryptoQuant’s Alternate Netflow statistic, there have been extra Ethereum (ETH) outflows in current days than inflows.

It’s protected to deduce that the autumn in value spurred withdrawal quite than a sell-off, given the quantity of outflow’s dominance on the change Netflow indicator and the decline in change provide.

Supply: CryptoQuant

How a lot are 1,10,100 ETHs value immediately

Quantity signifies low actions

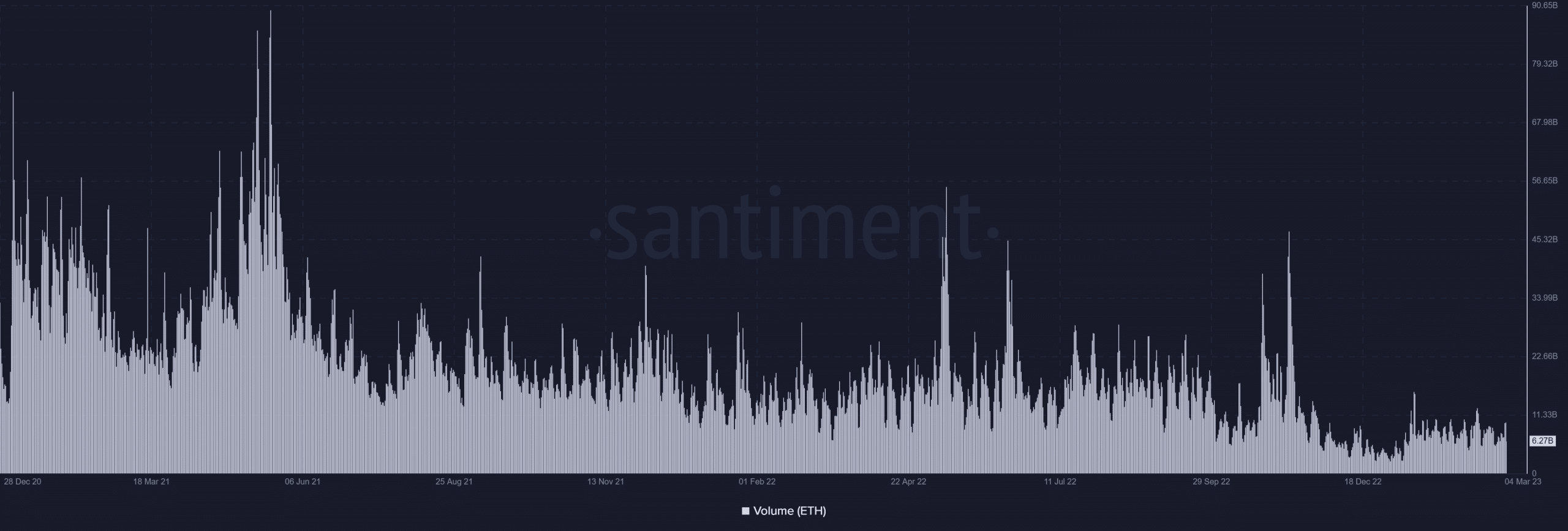

Moreover, the quantity indicator additionally supplied data on how Ethereum behaved over the earlier weeks. In accordance with what could possibly be seen on the quantity measure, there was a low quantity lately.

The low quantity that has been seen contrasts what was initially attainable concerning the exercise the metric had seen. Combining all of the metrics suggests a panic sell-off of ETH is not going to occur quickly. As an alternative, most buyers are demonstrating a need to carry and climate the autumn.

Supply: Santiment

![Ethereum [ETH] investors’ reaction to the recent price swings](https://cryptonitenews.io/wp-content/uploads/2023/03/ethereum-6286124_1920-1000x600-768x461.jpg)