- Key sharks and whales have grown their ETH holdings within the final month.

- Even after a worth decline, ETH sees fewer sell-offs.

Regardless of the continued decline in Ethereum’s [ETH] worth because of the collapse of FTX, sharks, and whales (holders of 100 to 1 million ETH tokens) on the community exhibit no indicators of slowing down accumulation, knowledge from Santiment confirmed.

Learn Ethereum’s [ETH] Worth Prediction 2023-2024

FTX’s sudden collapse pushed ETH’s worth under its pre-merge ranges as FUD overran the market. Nonetheless, the cohort of ETH buyers that maintain between 100 to 100 million tokens remained resilient.

Knowledge from the on-chain analytics platform confirmed that they grew their ETH holdings by 2.1% within the final month. Between 5 and 6 December, they added 561,000 ETH tokens to their baggage, the very best every day accumulation within the final three months. For context, the massive accumulation brought about the cumulative shark and whale holdings to return to pre-merge ranges.

Supply: Santiment

Consumers proceed to purchase

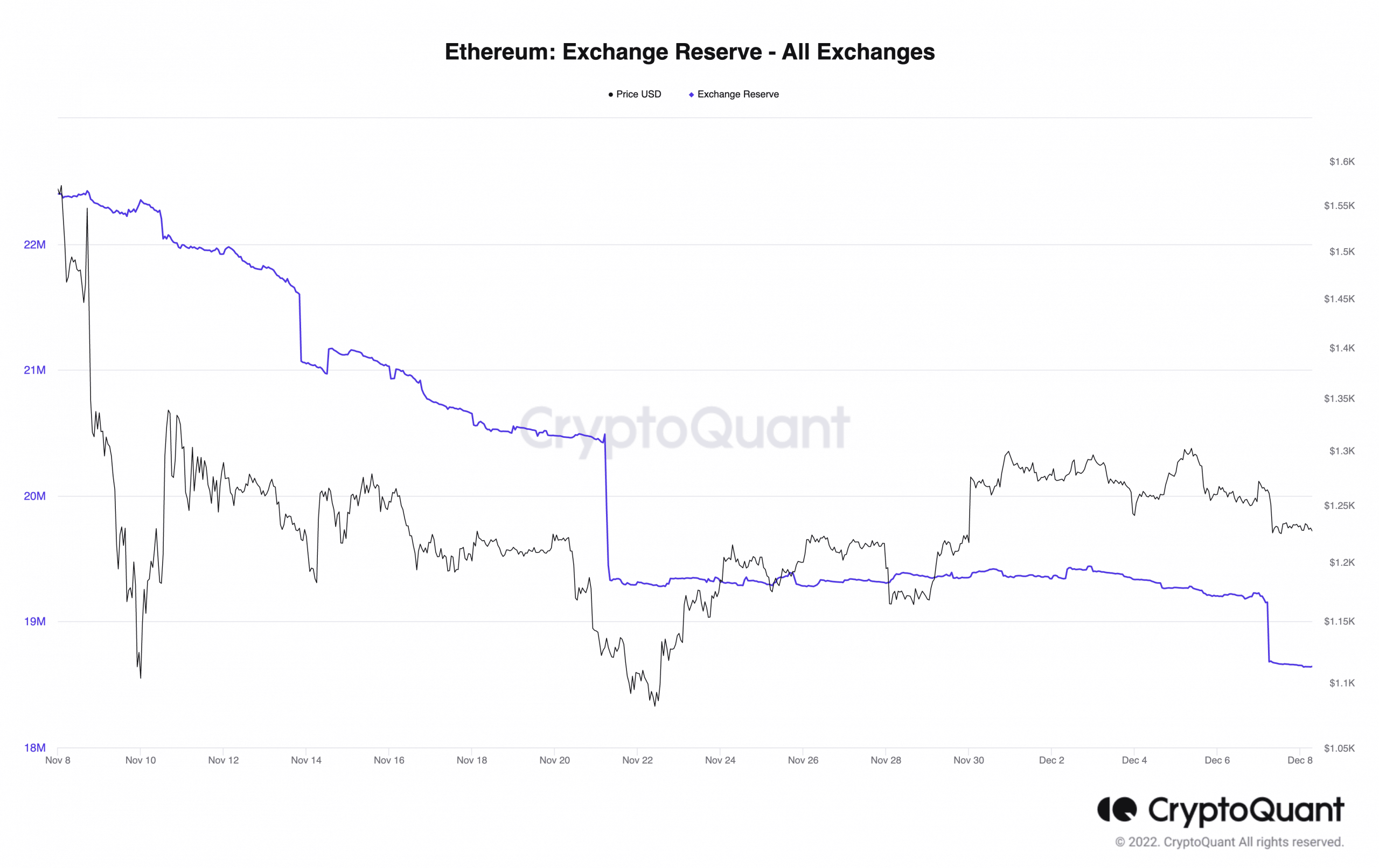

At the same time as ETH’s worth dwindled within the final month, it nonetheless recorded few sell-offs. In keeping with knowledge from CryptoQuant, ETH’s trade reserve fell by 17%. This decline confirmed that the quantity of ETH cash held on exchanges fell.

Sometimes, buyers ship their belongings to exchanges to promote them, and this is able to normally develop such an asset’s trade reserve. Subsequently, a decline in an asset’s trade reserve signifies that fewer sell-offs have taken place.

Supply: CryptoQuant

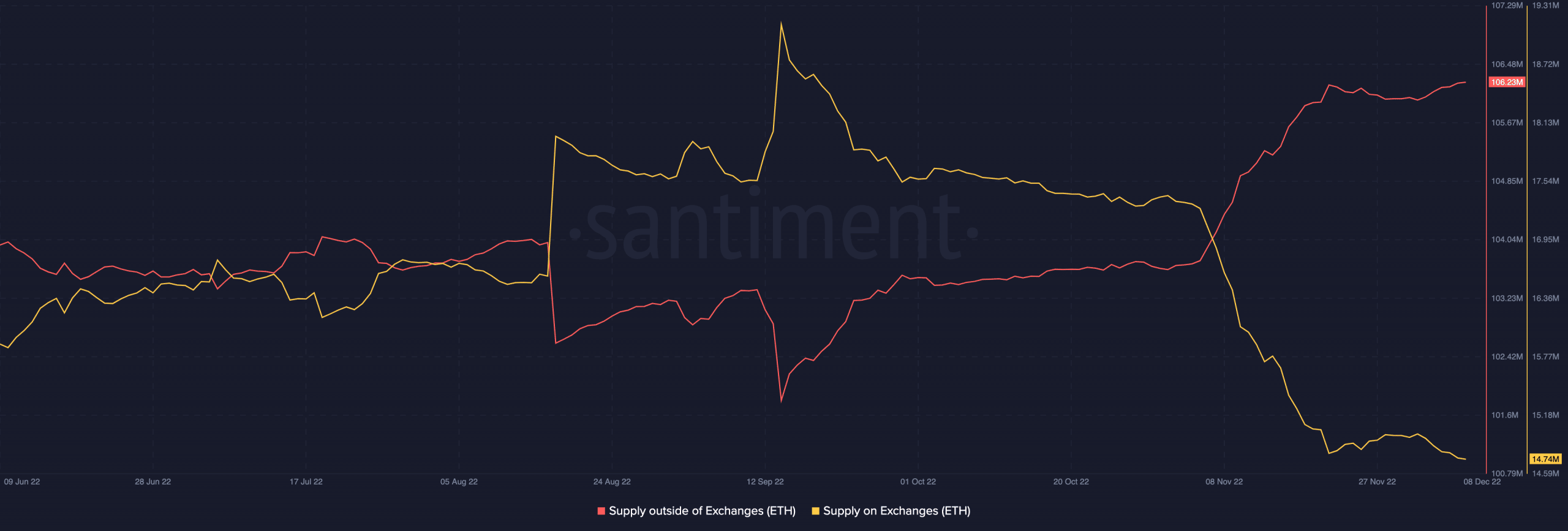

ETH’s provide outdoors of exchanges rallied by 3% inside the identical interval.

Supply: Santiment

Situating ETH’s trade exercise inside the context of occasions within the final month, the decline within the quantity of ETH held on exchanges, and the corresponding development within the quantity held off exchanges following FTX’s collapse was because of the fears and doubts that buyers had regarding the security of their belongings on centralized exchanges.

Therefore, the choice to ship them to self-custody and to commerce them on decentralized exchanges. Some have additionally held on to them to appreciate revenue as soon as the worth picks up later.

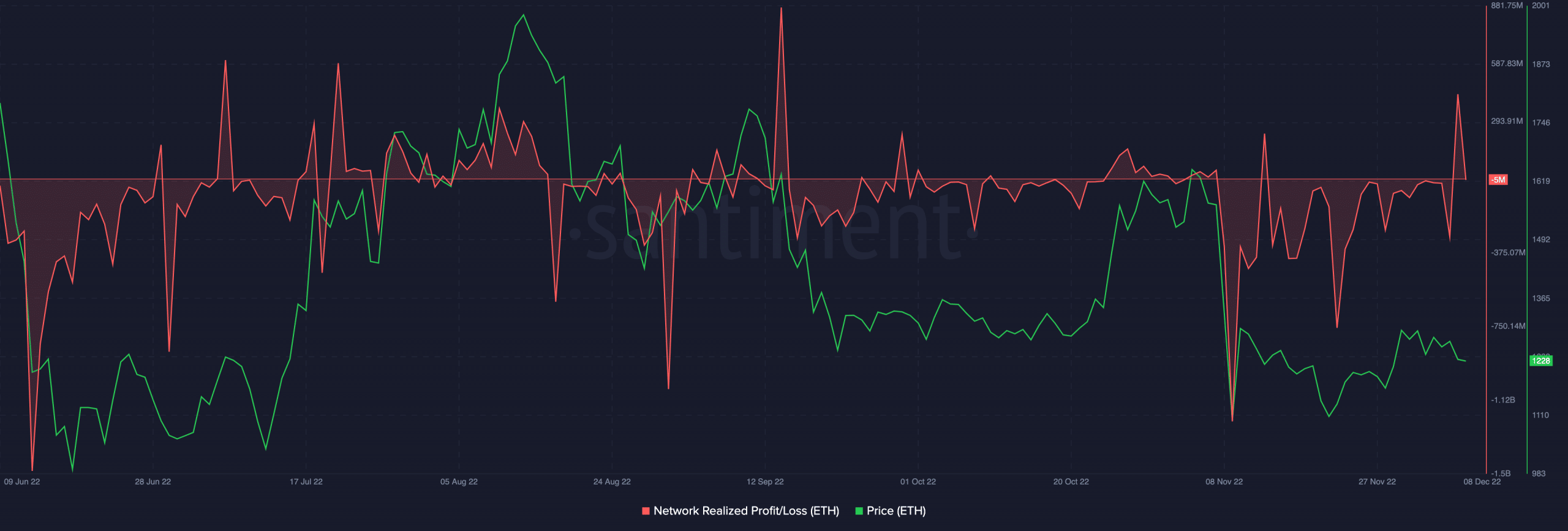

Blame the “weak arms”

Per knowledge from Santiment, an evaluation of ETH’s Community Revenue/Loss (NPL) when FTX collapsed confirmed an enormous fall within the metric on 9 November. This indicated that many buyers, in an try to save lots of their investments, offered at vital losses, a traditional case of the short-term capitulation of “weak arms.”

As new cash tried to enter the market to prop up the asset’s worth, the FUD that plagued the market was too vital to beat, and after a one-day bounce in ETH’s worth, it plummeted.

In the direction of the top of November, when the overall market started to recuperate, ETH’s NPL dipped once more, displaying the exit of “weak arms” and the re-entry of “the good cash,” marking the graduation of an area bounce again.

Supply: Santiment

Even so, since 22 November, ETH’s worth has climbed by 10%, knowledge from CoinMarketCap confirmed.