Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought-about funding recommendation

- Ethereum has a bullish market construction

- But, shopping for stress and momentum weren’t robust sufficient to point a rally was imminent

The Ethereum merge occurred nearly three months in the past on 15 September. Since then ETH was unable to interrupt above the $1,650 resistance. The on-chain metrics didn’t favor the bulls both. The previous month noticed losses amounting to round 20% at press time, from $1646 to $1264.

Learn Ethereum’s Value Prediction 2023-2024

Ethereum bulls would should be cautious within the coming days. Robust shopping for stress was not but evident, and Bitcoin additionally confronted resistance close to $17.3k and $17.6k. A transfer above $1360 can be wanted earlier than patrons can justify their conviction within the coming weeks.

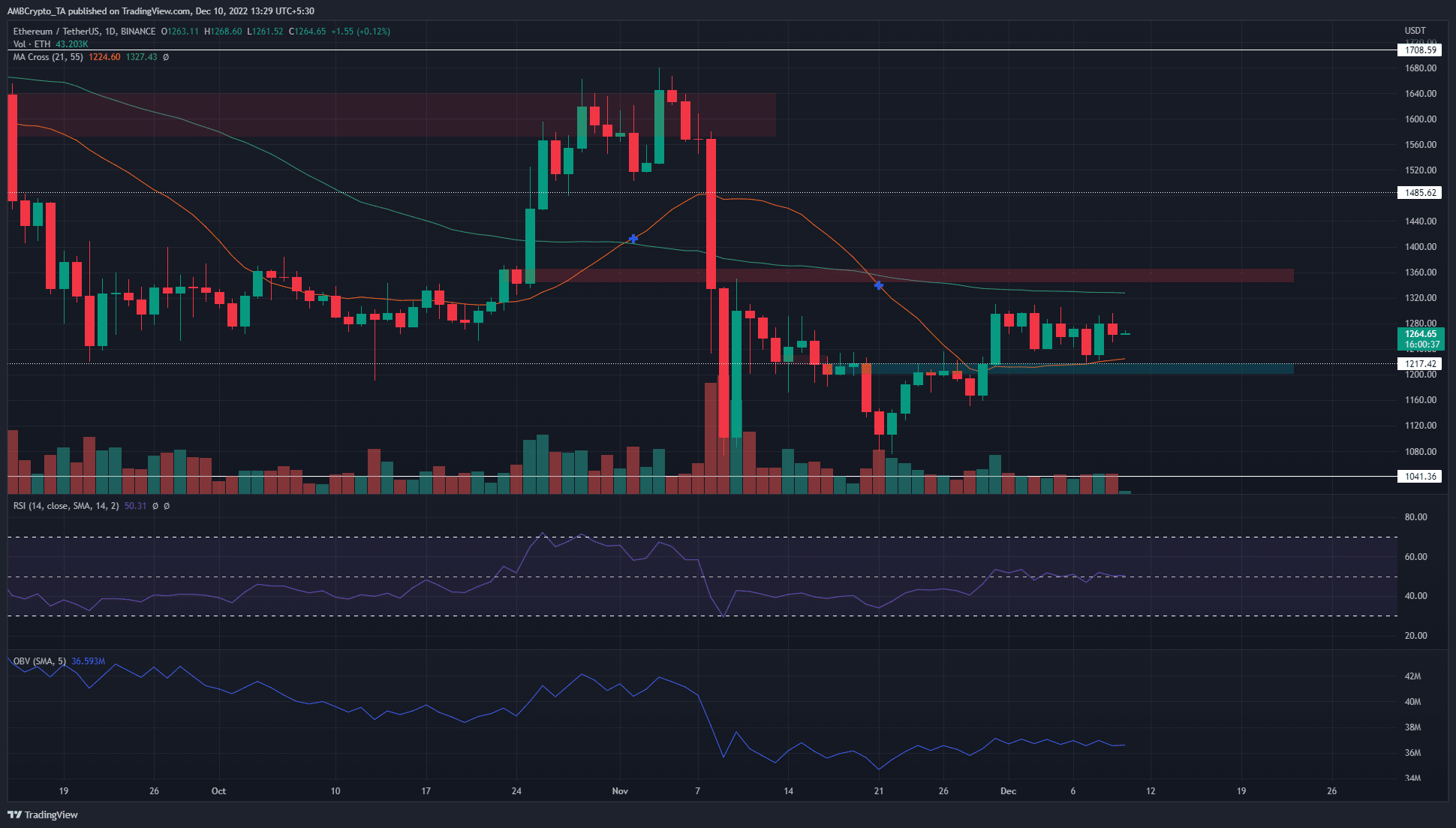

Breakers on both aspect give hints of the place Ethereum can discover a big quantity of patrons and sellers

Supply: ETH/USDT on TradingView

Two breakers had been fashioned over the previous six weeks within the $1,360 and the $1,200 zone. Highlighted in cyan and purple, they’re bullish and bearish breakers respectively. They’d previously been bearish and bullish order blocks however the value has damaged previous them since then.

On the time of writing, ETH possessed impartial momentum on the each day timeframe. The Relative Power Index (RSI) was at a impartial 50 whereas the 21 and 55-period shifting averages confirmed bearish momentum for ETH. Nonetheless, the market construction was bullish. This occurred on 30 November when the worth broke above the $1217 stage. In doing so it breached the collection of decrease highs the worth has set since 9 November.

The On-Stability Quantity (OBV) was additionally flat since mid-November and confirmed shopping for stress was not but behind Ethereum. Till this modifications, merchants can look to promote ETH at $1360 and purchase it on a retest of $1217. The $1300-$1315 space additionally gives resistance on the decrease timeframes.

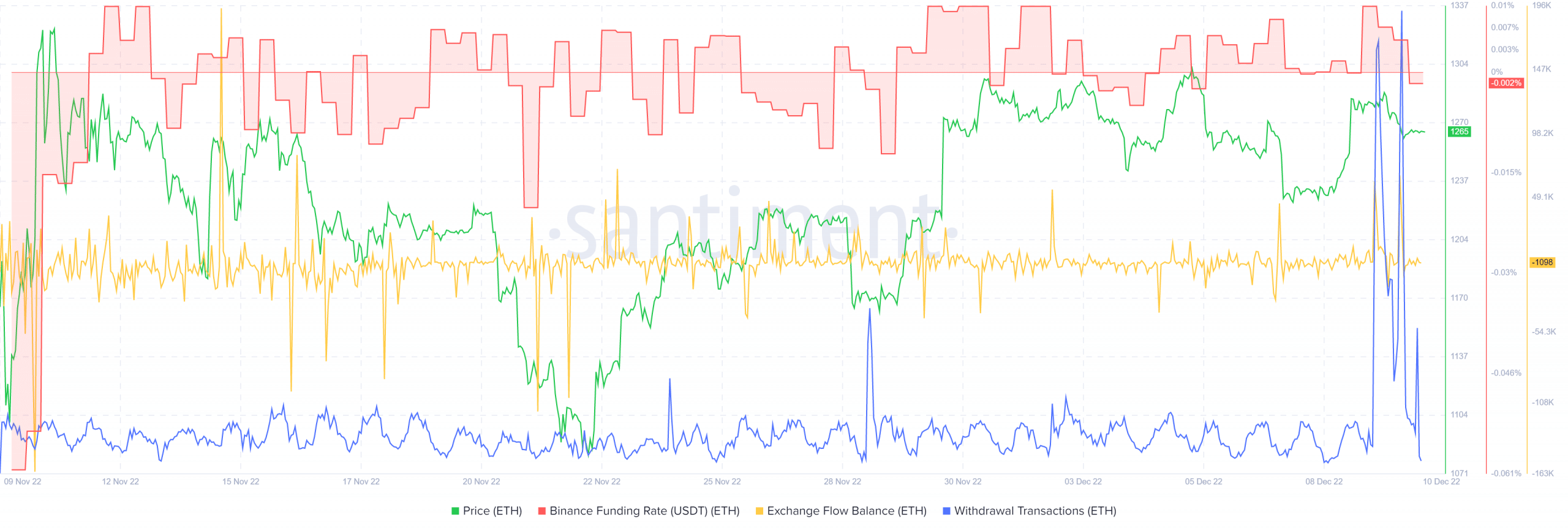

The funding fee slips beneath 0 however withdrawal transactions present accumulation

Supply: Santiment

Previously few days, the funding fee was optimistic on Binance. This meant that futures market contributors had been bullishly positioned, however that took a shift in current hours. Ethereum’s failure to interrupt above $1300 swayed the sentiment of decrease timeframe merchants.

But, the dramatic spike in withdrawal transactions meant that buyers had been probably accumulating ETH. These addresses are used to withdraw the asset from centralized exchanges and will have been moved into chilly storage. On the identical time, the alternate circulation steadiness didn’t present a big outflow, which was one thing that was witnessed on November 21. Again then it marked a neighborhood backside for ETH.