Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- The market construction remained bearish on a each day.

- A transfer above the breaker might embolden lower-timeframe consumers.

Dogecoin registered features of 9.4% throughout the 12 hours previous the time of writing. This was a pattern throughout the crypto market, however this transfer introduced many altcoins proper right into a zone of resistance. Dogecoin was one in every of them.

Sensible or not, right here’s DOGE’s market cap in BTC’s phrases

Within the brief time period, the bulls positively have the higher hand- however their push could possibly be exhausted. Bitcoin was additionally in a zone of resistance.

The worry round USDC and stablecoins after the SVB collapse may or may not incite additional panic, however the technical evaluation of Dogecoin painted a bearish image on the upper timeframes.

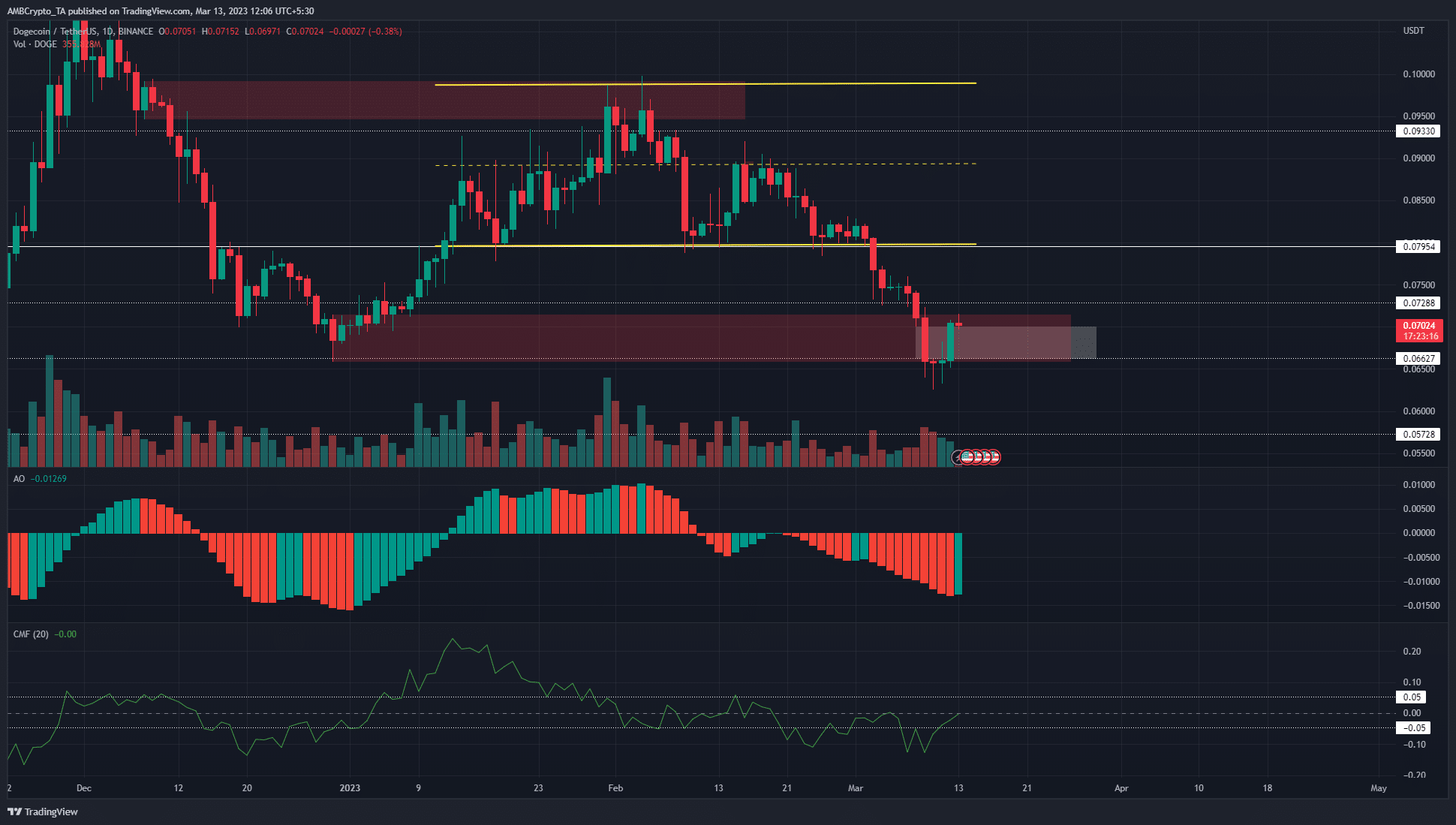

The imbalance was crammed however the breaker stood agency up to now

Supply: DOGE/USDT on TradingView

Dogecoin fell sharply beneath the vary lows of $0.08 on 3 March and has been on a pointy downward transfer since then. It briefly halted on the $0.073 assist stage earlier than crashing to the $0.065 mark. In doing so, it broke beneath the bullish order block at $0.066 and flipped it to a bearish breaker (purple).

This breaker block had confluence with an imbalance (white) that DOGE left on the charts over the previous few days. On the time of writing, this hole had been crammed however the value was but to shut a each day buying and selling session above the breaker.

Even when it does transfer previous the breaker, the construction on the each day timeframe would stay bearish till Dogecoin can beat the current decrease excessive at $0.076.

If DOGE noticed a rejection close to the $0.0715 mark, dipped decrease to kind a better low, and transfer previous the $0.073 resistance stage, bulls can take coronary heart.

How a lot are 1, 10, or 100 DOGE value right now?

This was one of many many situations that may unfold. One other was that DOGE bulls have been exhausted over the current decrease timeframe rally, and bears seize the initiative once more.

This might pressure costs to drop as soon as extra and kind new lows within the downtrend.

The AO confirmed bearish momentum remained robust, and the CMF didn’t present important capital influx into the market regardless of the current features.

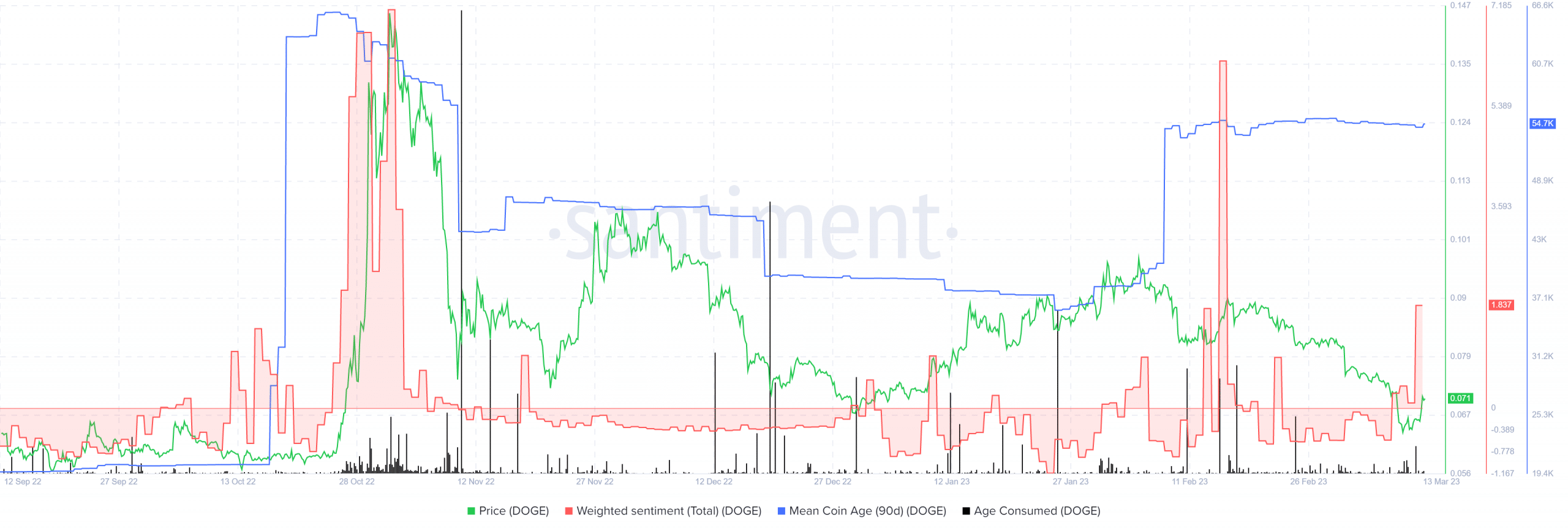

The weighted sentiment noticed a rally as costs went increased

Supply: Santiment

The rally of the previous few hours probably contributed to the robust constructive weighted sentiment seen behind Dogecoin on social media. The imply coin age remained on its flat trajectory. This confirmed there wasn’t an elevated motion of the coin throughout addresses.

Equally, the age-consumed metric didn’t see an especially giant spike. Nevertheless, it did see an even bigger surge over the weekend than it has in two weeks. This underlined the chance of promoting stress just lately. This reality was corroborated by the big quantity bars on the value chart.