by Marimer Cruz-Nieves, aka Crypto Rican Queen

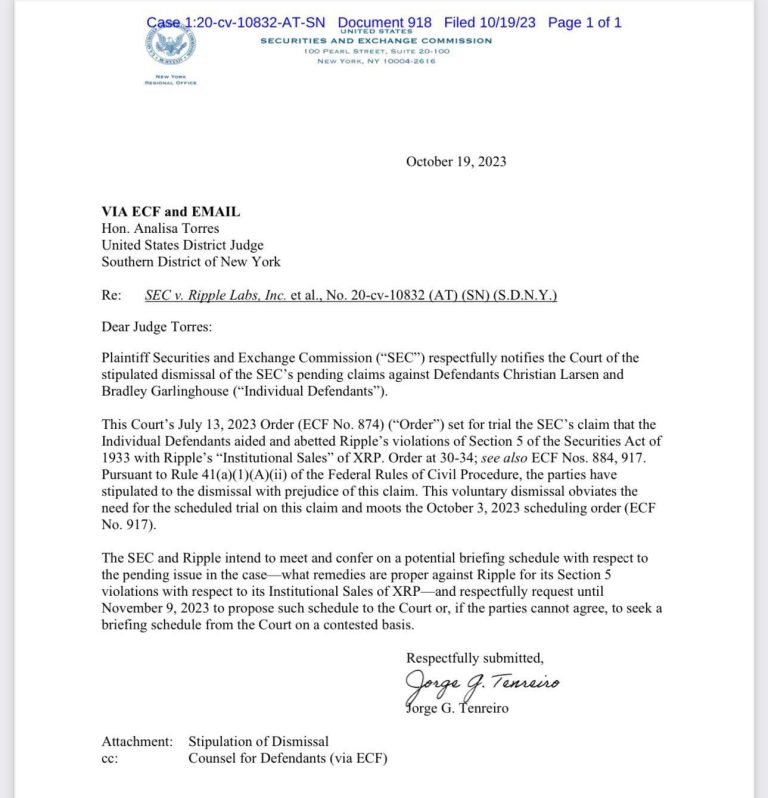

The cryptocurrency industry is celebrating a major victory after the Securities and Exchange Commission (SEC) on Thursday said it would drop its lawsuit against two cryptocurrency executives who oversaw $1.5 billion in sales of a digital coin known as XRP.

The move is seen as a major win for the industry, which has been battling against traditional regulation. The SEC had accused Ripple Labs and its executives, Brad Garlinghouse and Chris Larsen, of selling XRP as unregistered securities. However, the SEC has been facing legal challenges to its authority over cryptocurrencies, and a recent court ruling found that the SEC had not adequately demonstrated that XRP was a security.

The SEC’s decision to drop the lawsuit is a sign that the agency is finally listening to the industry’s concerns about regulation. Cryptocurrency leaders have long argued that the SEC’s regulations are stifling innovation and preventing the United States from becoming a leader in the global cryptocurrency market.

The SEC’s decision is also a boost for Ripple Labs, which has been struggling to gain traction in the cryptocurrency market since the SEC filed its lawsuit in 2020. Ripple Labs has said that it plans to use the money it raised from XRP sales to fund its development of new blockchain products and services.

The SEC’s decision to drop the lawsuit is likely to have a ripple effect on the rest of the cryptocurrency industry. It is a sign that the SEC is willing to back down from its regulatory efforts when faced with legal challenges. This could lead to a more relaxed regulatory environment for cryptocurrencies in the United States.

Industry Leaders React to SEC’s Decision

Cryptocurrency industry leaders have welcomed the SEC’s decision to drop the lawsuit against Ripple Labs and its executives. They say that the decision is a sign that the SEC is finally listening to the industry’s concerns about regulation.

“Today is the day we have been waiting for. The xrp community’s belief never wavered” said Crypto Rican Queen. “The SEC’s decision to drop the XRP lawsuit solidifies that they had no case. It shows that the SEC needs to stop using an antiquated law like the Howey test.”

“In all seriousness, Chris and I were targeted by the SEC in a ruthless attempt to personally ruin us and the company so many have worked hard to build for over a decade,” said Garlinghouse in a tweet responding to the charges being dropped.”

What’s Next for Cryptocurrency Regulation?

The SEC’s decision to drop the lawsuit against Ripple Labs is a positive development for the cryptocurrency industry. However, it remains to be seen how the SEC will regulate cryptocurrencies in the future.

The SEC has said that it is committed to protecting investors from fraud in the cryptocurrency market. However, the agency has also said that it wants to promote innovation in the industry.

It is likely that the SEC will continue to take a case-by-case approach to regulating cryptocurrencies. The agency will need to balance its need to protect investors with its desire to promote innovation.

The cryptocurrency industry is still relatively new, and the regulatory landscape is still evolving. The SEC’s decision to drop the lawsuit against Ripple Labs is a sign that the agency is willing to be flexible in its approach to regulation. However, it remains to be seen how the SEC will regulate cryptocurrencies in the long term.

Conclusion

The SEC’s decision to drop the lawsuit against Ripple Labs is a major victory for the cryptocurrency industry. It is a sign that the SEC is finally listening to the industry’s concerns about regulation and is willing to take a more reasonable approach.

The decision is also a boost for Ripple Labs and the rest of the cryptocurrency industry. It is a sign that the SEC is willing to back down from its regulatory efforts when faced with legal challenges and that the agency is recognizing that cryptocurrencies are a new asset class that deserves to be treated fairly.

The decision is a positive development for the cryptocurrency industry and is likely to lead to a more relaxed regulatory environment for cryptocurrencies in the United States.tunesharemore_vert