After a weeklong rally that pushed Bitcoin (BTC) worth above $23,000, the crypto market skilled a major sell-off within the final 12 hours that liquidated $183.99 million, based on Coinglass information.

Whole liquidations over the past 24 hours stood at $223.43 million as of press time. Of those liquidations, 90.29% occurred on merchants who took lengthy positions in the marketplace, based on Coinglass data.

Throughout this era, 63,210 merchants have been liquidated — probably the most vital liquidation being a $4.64 million lengthy place on BTC.

Bitcoin tumbles under $23k as traders take revenue

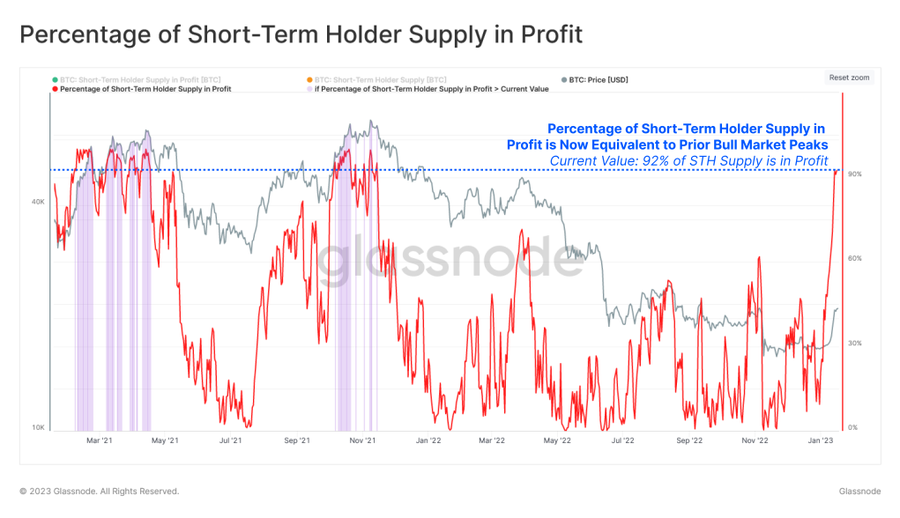

Brief-term BTC traders seem like taking revenue after the cohort noticed a dramatic enhance within the variety of their cash held in revenue.

Glassnode said that this group’s provide in revenue reached 92% — final seen in Could 2021 and when BTC traded at its all-time excessive in November 2021.

“Given this substantial spike in profitability, the chance of promote strain sourced from short-term holders is prone to develop accordingly.”

Glassnode additional pointed out that the profitability spike has pushed the cohort’s spending quantity above the long-term declining development.

High 10 property common a 5% loss

Apart from stablecoins, different digital property on the highest 10 crypto property checklist posted a median of a 5% loss within the final 24 hours, based on CryptoSlate information.

Throughout the reporting interval, Ethereum (ETH) fell 5.20% to $1,552, whereas BNB declined 5.14% to $302. Cardano (ADA), Solana (SOL), and Dogecoin (DOGE) plunged by 6.88%, 6.53 and 5.40%, respectively.