Fundstrat International Advisors’ managing accomplice Tom Lee thinks the horrible macroeconomic circumstances of 2022 are “unlikely to persist” subsequent yr.

In a brand new Twitter thread, Lee says that he thinks inflation is falling quicker than the markets and the Federal Reserve count on.

The CNBC contributor additionally notes the Fed likes to see a powerful labor market.

“Reminder, many inflation drivers have actually imploded and down/flat for 2022 after surging mid-year. One doesn’t need to look far to see progress.

Whereas wages matter, the Fed doesn’t need to crush the financial system and doesn’t essentially need to crush jobs.”

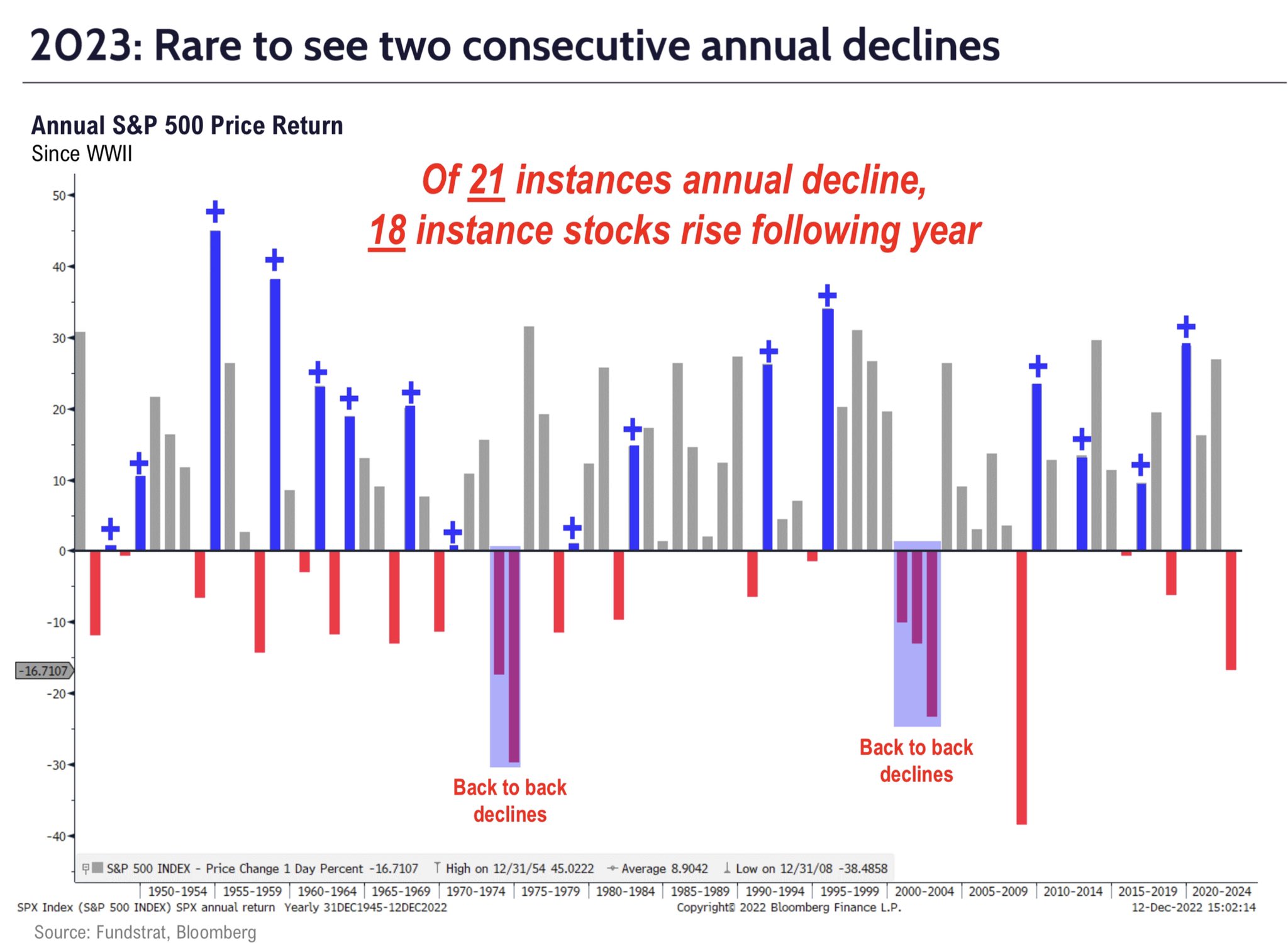

Lee additionally says shares are inclined to bounce again after down years.

“Until the inflation disaster persists, monetary circumstances will ease. This implies shares rise, and shares hardly ever put up back-to-back annual declines In actual fact, three of the 5 best-ever annual beneficial properties got here after a ‘damaging’ yr…

And it nonetheless puzzles me why the US is the worst-performing world inventory market in 2022 outdoors of China-zone-ish nations. Why is Europe outperforming when Europe is within the tooth of an power crunch/inflation spiral?”

Lee factors to a stat shared by Matt Cerminaro, a analysis affiliate at Fundstrat. Cerminaro notes that there have been solely three years up to now 50 (1974, 2002 and 2008) when the S&P 500 has had as many -1% days as 2022.

The years following 1974, 2002 and 2008 all witnessed a minimum of 23% beneficial properties, according to Cerminaro.

“Buyers have had a painful yr.

S&P 500 in 2022 has had 63 -1% days. Ouch.

Up to now 50 years, there have solely been 3 years with as many days down -1%:

1974: n= 67

2002: n= 73

2008: n= 75

Returns in following 12 months:

1975: 32%

2003: 26%

2009: 23%

2023: ?”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney